U.S. Federal Reserve Rate Decision: Balancing Inflation And Economic Growth

Table of Contents

Understanding the Current Economic Landscape

The U.S. Federal Reserve's recent rate decision was made against a backdrop of complex and evolving economic conditions. Analyzing both inflationary pressures and economic growth indicators is vital to understanding the rationale behind the Fed's actions.

Inflationary Pressures

Inflation remains a significant concern for the U.S. economy. Current inflation rates, as measured by key metrics like the Consumer Price Index (CPI) and the Producer Price Index (PPI), remain elevated. Several factors contribute to these persistent inflationary pressures:

- Elevated energy prices: Fluctuations in global energy markets significantly impact inflation, affecting transportation costs and overall consumer prices.

- Supply chain bottlenecks: Disruptions to global supply chains continue to constrain the availability of goods, driving up prices.

- Strong consumer spending: Robust consumer demand, fueled by factors such as pent-up demand and government stimulus, adds to inflationary pressures.

- Wage growth: Increased wage growth, while positive for workers, can also contribute to inflationary pressures if it outpaces productivity gains.

Economic Growth Indicators

While inflation is a concern, the U.S. economy continues to show signs of growth, albeit at a potentially slower pace. Key economic growth indicators provide insights into the overall health of the economy:

- GDP growth rate: The Gross Domestic Product (GDP) growth rate, reflecting the overall output of the economy, provides a measure of economic expansion or contraction.

- Unemployment rate: The unemployment rate, a key indicator of labor market health, offers insights into the availability of jobs and the overall state of the economy. Low unemployment often signifies a strong economy, but it can also contribute to wage inflation.

- Job creation numbers: The number of jobs created each month provides valuable information about the health of the labor market and its impact on economic growth.

- Consumer confidence index: Consumer confidence surveys gauge consumer sentiment and expectations about the future economy, which can influence spending patterns and overall economic growth.

The Federal Reserve's Response: The Recent Rate Decision

The Federal Reserve's recent meeting resulted in a [Insert specific rate change, e.g., 0.25% increase/decrease/pause] to the federal funds rate.

The Rate Hike (or Pause/Cut)

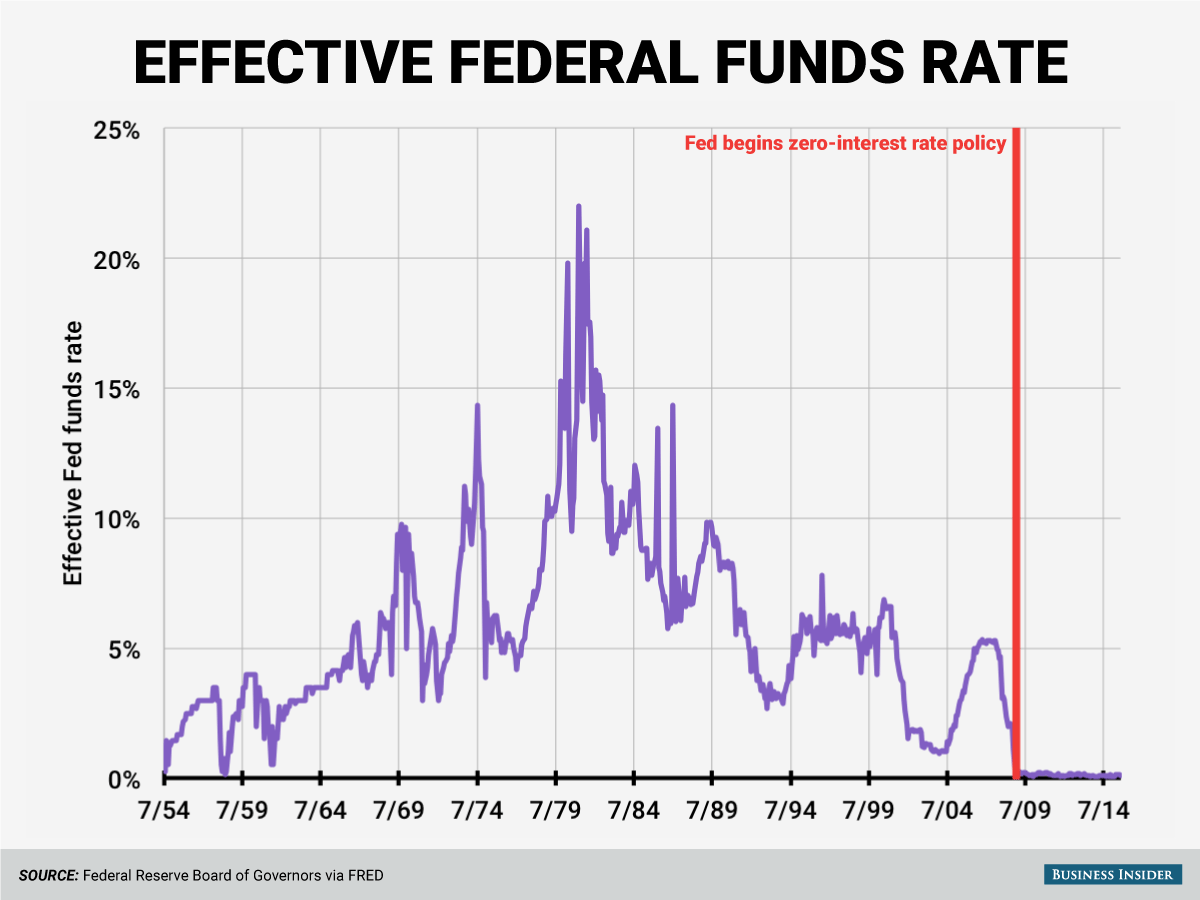

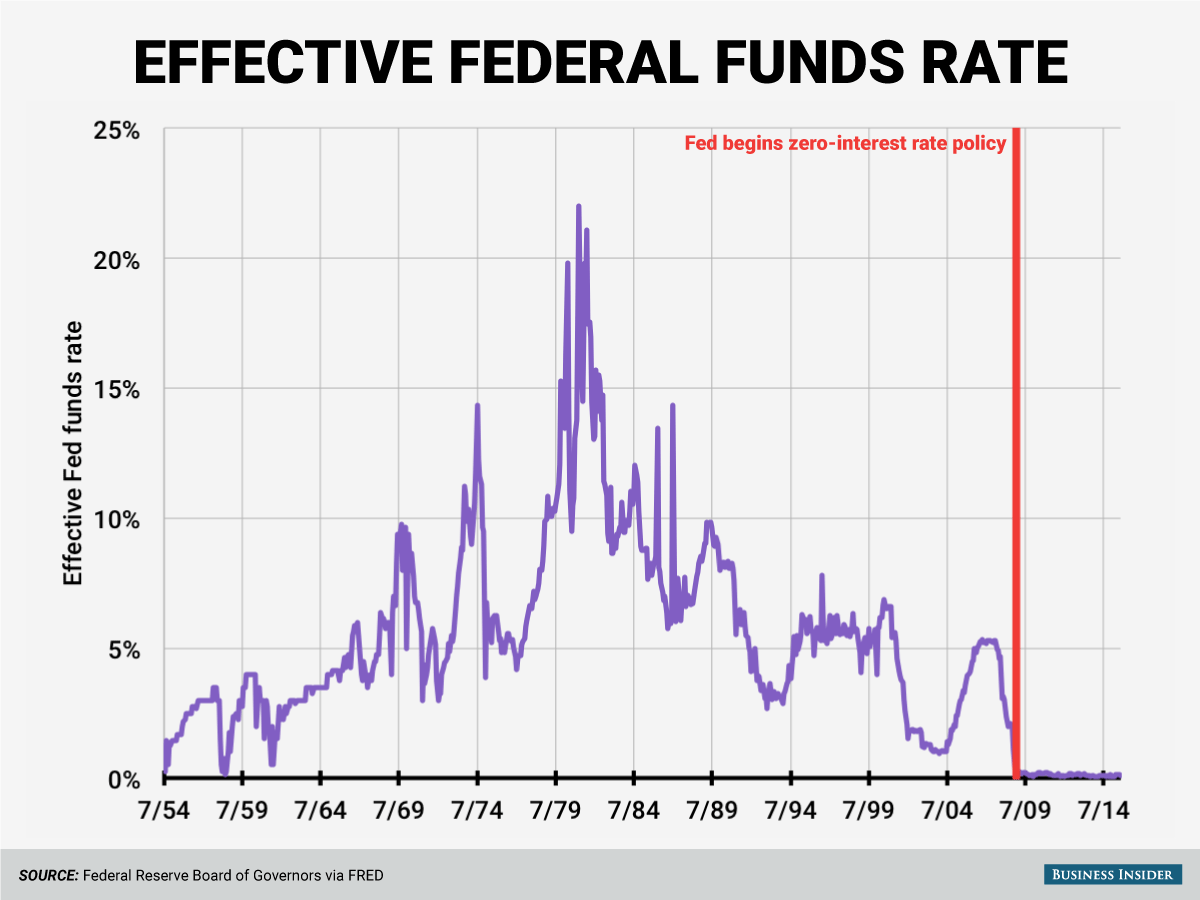

[Explain the specific rate change announced by the Fed. For example: "The Fed raised the federal funds rate by 0.25%, bringing it to a target range of X% to Y%."] This decision was based on the Federal Open Market Committee (FOMC)'s assessment of the current economic situation, weighing the risks of persistent inflation against the potential for slowing economic growth. The rationale behind the decision was outlined in the committee's statement, emphasizing [mention specific concerns cited by the FOMC, e.g., "the need to maintain price stability" or "concerns about persistent inflationary pressures"]. The change in the federal funds rate directly impacts other interest rates throughout the economy.

Forward Guidance and Future Expectations

The Fed's communication regarding future rate adjustments, also known as forward guidance, is crucial for market participants. [Analyze the Fed's communication – were they hawkish or dovish? Did they provide a clear path forward or remain vague?]. Potential scenarios for future rate adjustments depend on upcoming economic data releases, particularly inflation figures and employment reports. The Fed may also utilize other monetary policy tools, such as quantitative easing or tightening, to influence economic conditions.

Potential Impacts of the Rate Decision

The Fed's rate decision has far-reaching consequences across the economy, impacting borrowing costs, inflation, and economic growth.

Impact on Borrowing Costs

The rate decision directly affects borrowing costs across the economy. An increase in the federal funds rate generally leads to:

- Higher mortgage rates: Making home purchases more expensive.

- Higher business loan rates: Potentially slowing investment and expansion.

- Higher consumer credit rates: Affecting credit card interest and auto loan payments.

Impact on Inflation

The intended effect of a rate hike is to curb inflation by reducing consumer spending and business investment. However, the impact on inflation is complex and can take time to materialize. The effectiveness of the rate change in controlling inflation depends on various factors, and there's a risk of over-tightening, leading to a recession.

Impact on Economic Growth

Raising interest rates can slow economic growth by reducing investment and consumer spending. The risk of a recession or a significant slowdown in economic expansion is a key consideration for the Fed. The delicate balance lies in finding a rate that curbs inflation without triggering a recession.

Conclusion

The U.S. Federal Reserve's recent rate decision reflects the ongoing challenge of balancing inflation and economic growth. The Fed's actions are carefully calibrated to navigate this complex economic landscape, but uncertainty remains about the ultimate impact of these decisions. The interplay between inflation, employment, and economic growth makes predicting the future trajectory of the economy difficult.

Call to Action: Stay informed on future U.S. Federal Reserve rate decisions and their impact on the economy. Follow reputable financial news sources for regular updates on the U.S. Federal Reserve rate decision and its implications. Understanding these decisions is crucial for making informed financial decisions, whether you're an individual investor, a business owner, or simply interested in understanding the dynamics of the American economy.

Featured Posts

-

Elizabeth Hurleys Most Daring Cleavage Displays

May 09, 2025

Elizabeth Hurleys Most Daring Cleavage Displays

May 09, 2025 -

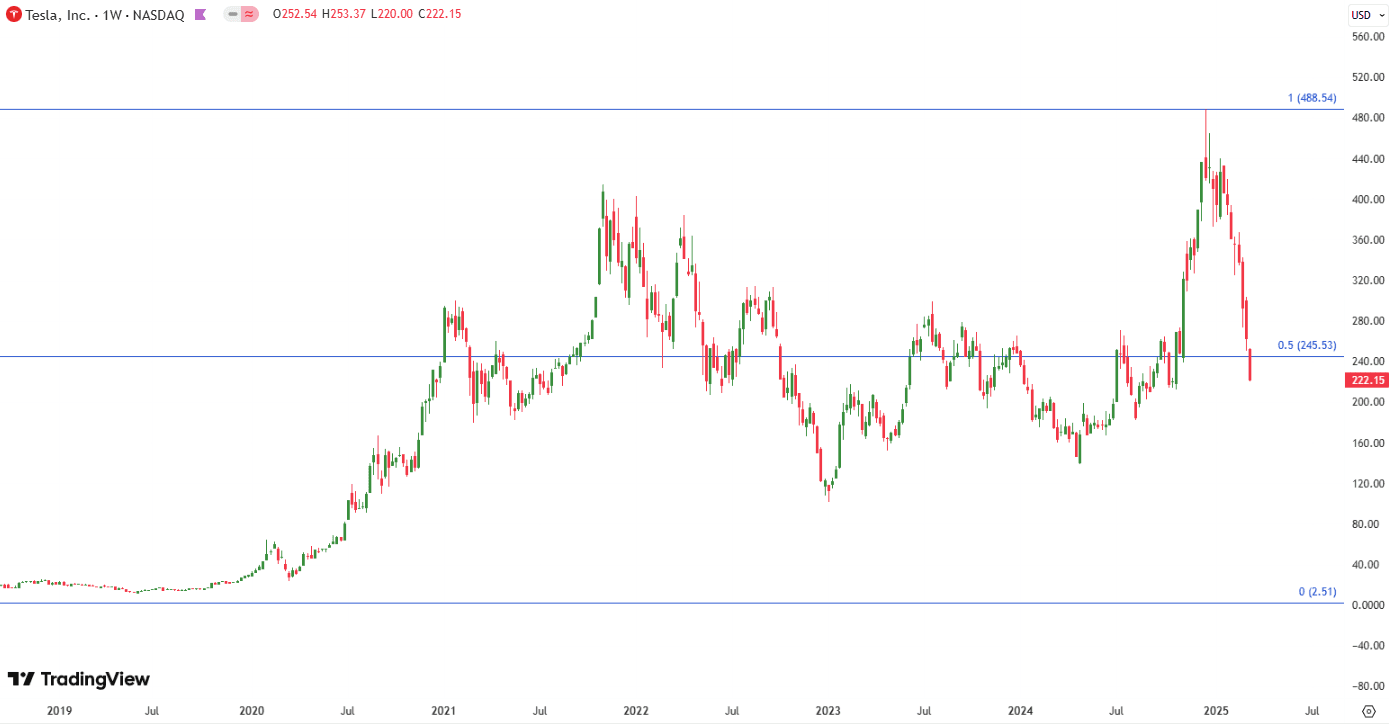

Elon Musks Time Tesla Stock Plummets Impacting Dogecoin

May 09, 2025

Elon Musks Time Tesla Stock Plummets Impacting Dogecoin

May 09, 2025 -

Dakota Johnson With Family At Materialist La Screening

May 09, 2025

Dakota Johnson With Family At Materialist La Screening

May 09, 2025 -

Binge Watch This Top Stephen King Show In Under 5 Hours

May 09, 2025

Binge Watch This Top Stephen King Show In Under 5 Hours

May 09, 2025 -

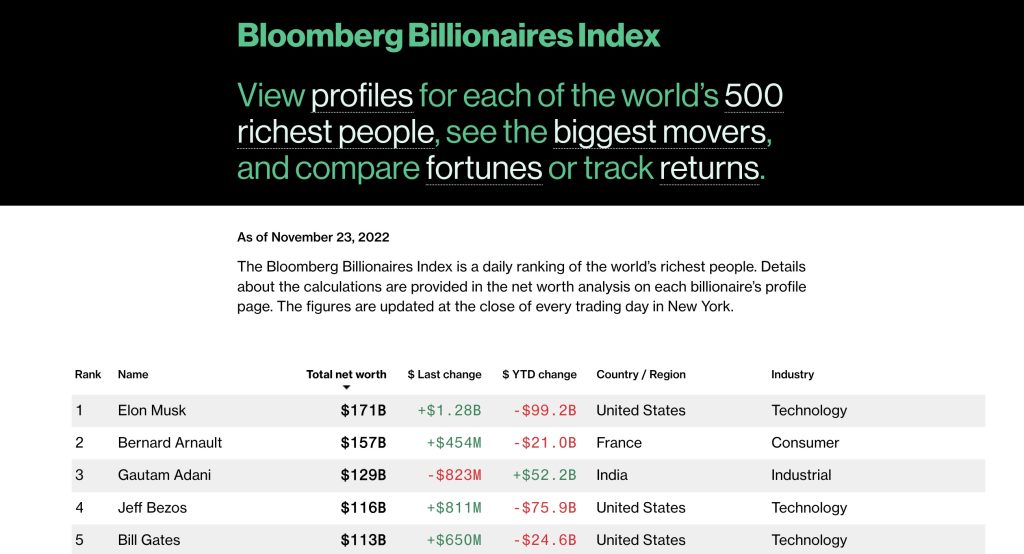

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 09, 2025

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 09, 2025