Elon Musk's Time: Tesla Stock Plummets, Impacting Dogecoin

Table of Contents

Tesla Stock's Sharp Decline: Causes and Consequences

Analyzing the Factors Behind Tesla's Stock Fall:

Tesla's stock has experienced a considerable downturn in recent times. Several factors contribute to this decline:

- Elon Musk's Twitter Activities: Musk's controversial tweets and actions on Twitter have frequently influenced Tesla's stock price. His unpredictable behavior and sometimes erratic pronouncements create uncertainty among investors.

- Broader Market Trends: The overall economic climate and broader stock market trends also play a significant role. Concerns about inflation, rising interest rates, and potential recessions can negatively impact even strong companies like Tesla.

- Concerns about Tesla's Financial Performance: Analysts' concerns about Tesla's profitability and growth projections can lead to sell-offs. Any perceived weakness in financial performance can trigger a stock price decline.

- Competition in the EV Market: The electric vehicle (EV) market is becoming increasingly competitive. The emergence of new players and aggressive competition from established automakers puts pressure on Tesla's market share and profitability.

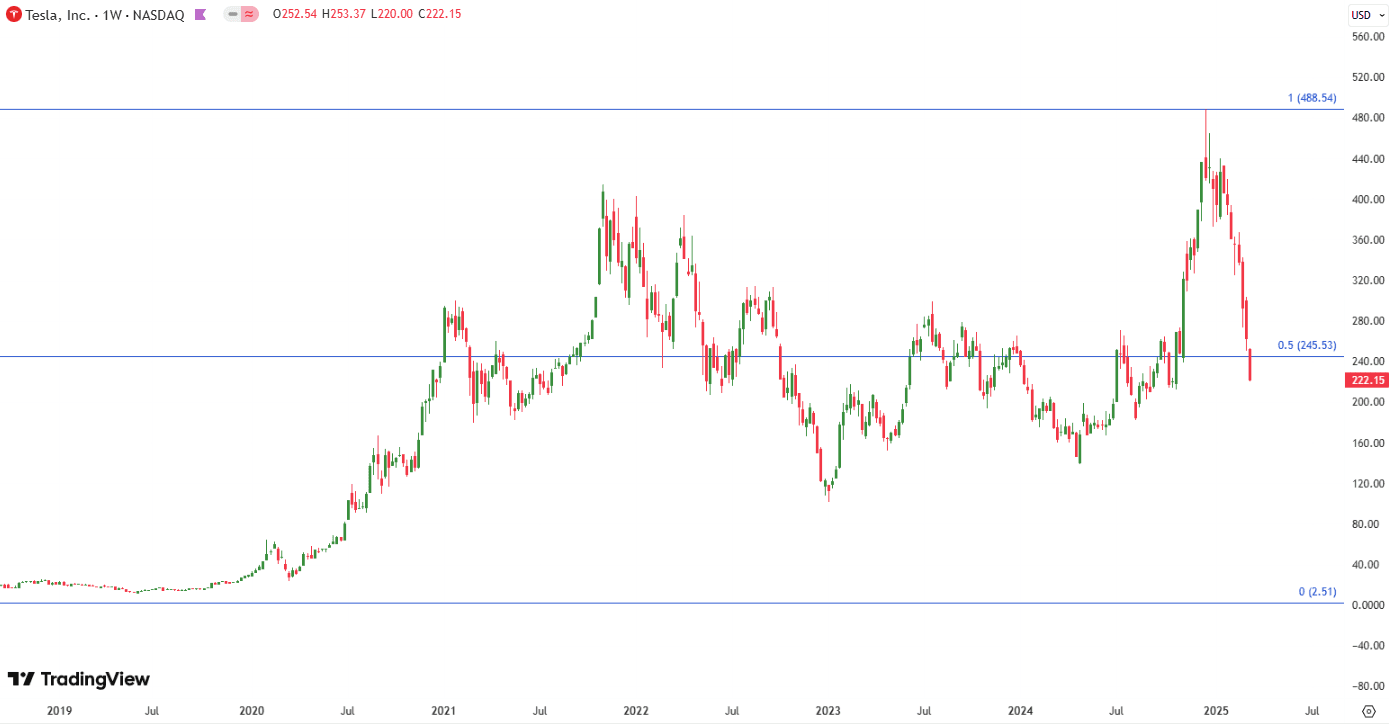

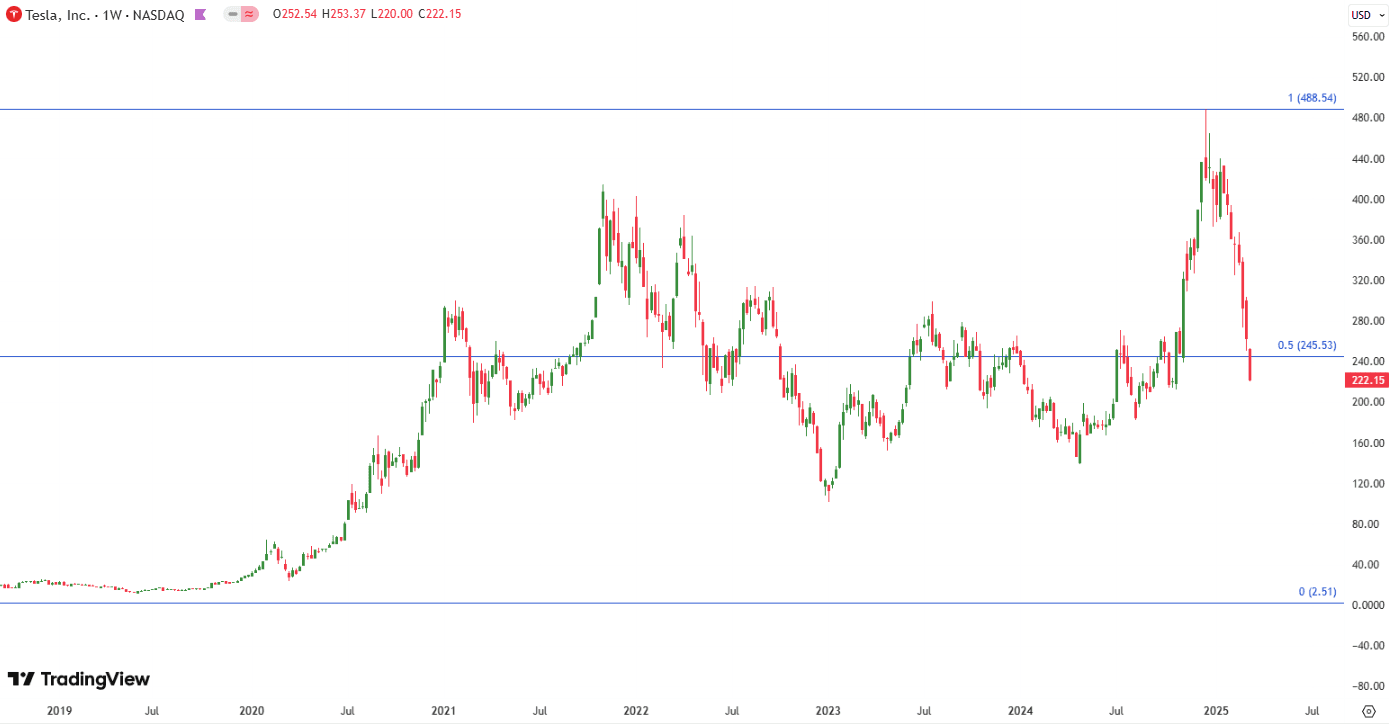

Tesla's stock price has fallen by [Insert Percentage]% in the last [Time Period], resulting in a [Dollar Amount] decrease in market capitalization. This significant drop has shaken investor confidence and created uncertainty about the company's future trajectory.

The Ripple Effect on the EV Market:

Tesla's stock performance acts as a barometer for the broader EV sector. A significant decline in Tesla's stock price can create a ripple effect, impacting investor sentiment towards other electric vehicle companies. Investors might become hesitant to invest in the EV sector as a whole, fearing a potential downturn across the board. Companies like Rivian, Lucid Motors, and Nio could experience a decline in their stock valuations as a consequence of Tesla's struggles. This demonstrates the interconnectedness and vulnerability of the burgeoning EV market.

Dogecoin's Correlation with Tesla and Elon Musk

Elon Musk's Influence on Dogecoin's Price:

Elon Musk's influence on Dogecoin's price is undeniable. His past tweets endorsing or mentioning Dogecoin have led to dramatic price swings, highlighting the speculative and meme-driven nature of this cryptocurrency. Musk's pronouncements act as powerful catalysts, driving significant price volatility.

- Example 1: [Insert specific example of a tweet from Musk and its impact on Dogecoin's price].

- Example 2: [Insert another example highlighting Musk's influence].

Dogecoin's price is largely driven by speculation and sentiment, making it highly susceptible to the whims of its most prominent proponent.

The Impact of Tesla's Stock Drop on Dogecoin:

There's a clear correlation between Tesla's stock performance and Dogecoin's price. When Tesla's stock falls, investor sentiment often negatively impacts Dogecoin's value as well, demonstrating a shared susceptibility to market fluctuations and the influence of Elon Musk. [Insert data points or charts illustrating the correlation between Tesla stock and Dogecoin's price, if available]. The recent downturn in Tesla's stock is likely to have contributed to a decline in Dogecoin's value, although the exact degree of influence can be difficult to isolate due to the cryptocurrency's inherently volatile nature.

Investor Sentiment and Market Volatility

Assessing Investor Confidence in Tesla and Dogecoin:

The recent events have significantly impacted investor confidence in both Tesla and Dogecoin. The high volatility of Tesla's stock and the speculative nature of Dogecoin make them risky investments. Expert opinions and market analyses indicate a cautious outlook for both assets in the short term.

Navigating the Volatility of the Stock and Crypto Markets:

Investing in volatile markets requires careful risk management. Diversification is crucial to mitigate risk. Investors should only allocate a small portion of their portfolio to high-risk assets like Tesla and Dogecoin. Thorough research and understanding of the underlying fundamentals before making any investment decisions are paramount.

Conclusion

The recent plummet in Tesla's stock price has underscored the significant influence of Elon Musk and the interconnectedness of the stock market and cryptocurrency markets. The causes are multifaceted, encompassing Musk's actions, broader market trends, and competition within the EV sector. This decline has had a ripple effect, influencing investor sentiment and impacting the value of Dogecoin, highlighting the speculative nature of cryptocurrencies heavily influenced by a single individual's pronouncements. The volatility of both Tesla stock and Dogecoin serves as a stark reminder of the inherent risks associated with investing in these markets. To effectively navigate this landscape, understanding the Elon Musk effect on Tesla and Dogecoin, and staying updated on the latest Tesla stock and Dogecoin news is crucial. Stay informed and make prudent investment decisions.

Featured Posts

-

Exploring The World Of Celebrity Antiques Road Trip A Comprehensive Overview

May 09, 2025

Exploring The World Of Celebrity Antiques Road Trip A Comprehensive Overview

May 09, 2025 -

Jayson Tatums Bone Bruise Latest Updates And Game 2 Outlook

May 09, 2025

Jayson Tatums Bone Bruise Latest Updates And Game 2 Outlook

May 09, 2025 -

Snegopad V Permi Aeroport Zakryt

May 09, 2025

Snegopad V Permi Aeroport Zakryt

May 09, 2025 -

Sta Xamilotera Epipeda 23 Eton I Krisimi Meiosi Ton Xionion Sta Imalaia

May 09, 2025

Sta Xamilotera Epipeda 23 Eton I Krisimi Meiosi Ton Xionion Sta Imalaia

May 09, 2025 -

Nhl News Leon Draisaitls Injury Casts Shadow On Oilers Season

May 09, 2025

Nhl News Leon Draisaitls Injury Casts Shadow On Oilers Season

May 09, 2025