U.S. Federal Reserve Maintains Interest Rates: Inflation, Unemployment Weigh Heavily

Table of Contents

Inflationary Pressures Remain a Key Concern

The Federal Reserve's decision to hold interest rates steady is largely a response to persistent inflationary pressures. While some positive signs exist, inflation remains stubbornly above the Fed's target rate, necessitating a cautious approach to monetary policy.

CPI and Inflation Expectations

The Consumer Price Index (CPI) remains a key metric for gauging inflation. Recent CPI figures show a continued, albeit slowing, increase in prices across various sectors. This signals that inflationary pressures haven't fully subsided. Furthermore, market expectations regarding future inflation play a significant role in the Fed's decision-making process. If consumers and businesses anticipate higher inflation, they may adjust their spending and pricing behaviors accordingly, potentially fueling a self-fulfilling prophecy.

- Latest CPI Figures: The most recent CPI report showed a [insert latest CPI data and percentage change] increase compared to the previous month and a [insert year-over-year percentage change] increase compared to the same period last year.

- Core Inflation: Excluding volatile food and energy prices, core inflation remains [insert latest core inflation data and percentage change], indicating underlying inflationary pressures.

- Inflation Expectations: Surveys of consumer and business sentiment reveal [insert data on consumer and business inflation expectations], indicating a degree of concern about future price increases.

Impact of Supply Chain Issues and Energy Prices

Global supply chain disruptions and fluctuating energy prices continue to exert significant upward pressure on inflation. These factors are largely beyond the direct control of the Federal Reserve, yet they significantly influence its policy decisions.

- Supply Chain Bottlenecks: Lingering supply chain bottlenecks in various sectors contribute to shortages and higher prices for many goods.

- Energy Price Volatility: Fluctuations in oil and natural gas prices directly impact transportation costs and energy bills, contributing to broader inflationary pressures.

- Past Policy Effectiveness: The effectiveness of past Fed policies in mitigating the effects of supply chain issues and energy price shocks remains a subject of ongoing debate and analysis.

Unemployment Remains Low, but Wage Growth is a Factor

The current low unemployment rate presents a complex challenge for the Federal Reserve. While a low unemployment rate is generally positive for the economy, it also contributes to upward pressure on wages, potentially exacerbating inflation.

The Tight Labor Market

The persistent labor shortage and historically low unemployment rates are driving significant wage growth. This presents a dilemma for the Fed, as rapid wage increases can contribute to a wage-price spiral.

- Unemployment Rate: The current unemployment rate stands at [insert current unemployment rate], significantly below the natural rate of unemployment.

- Labor Market Participation: Labor market participation rates remain [insert data on labor market participation], suggesting a tight labor market.

- Wage Growth Trends: Wage growth has accelerated in recent months, reaching [insert data on wage growth], a factor that the Fed closely monitors.

Potential for Wage-Price Spiral

The Fed is carefully considering the risk of a wage-price spiral, a vicious cycle where rising wages lead to higher prices, which in turn lead to further wage increases. This scenario can be difficult to control once it takes hold.

- Wage-Price Spiral Mechanism: A wage-price spiral occurs when rising wages increase production costs, leading businesses to raise prices, which then necessitates further wage increases to maintain purchasing power.

- Risks and Consequences: A wage-price spiral can lead to persistent and potentially uncontrollable inflation, potentially requiring aggressive intervention by the Federal Reserve.

- Managing Wage Growth: The Fed's tools for managing wage growth are limited, primarily focusing on influencing overall economic activity through interest rate adjustments.

The Fed's Balancing Act: Monetary Policy Considerations

The Federal Reserve faces the challenge of balancing the need to control inflation with the risk of triggering a recession by raising interest rates too aggressively. This delicate balancing act requires careful consideration of various economic indicators and potential future scenarios.

The Risk of Recession

Aggressive interest rate hikes to combat inflation could potentially trigger a recession by slowing economic growth too sharply. This risk necessitates a cautious and data-dependent approach to monetary policy.

- Recession Indicators: Economic indicators like [list relevant economic indicators, e.g., GDP growth, consumer confidence, manufacturing output] are being closely monitored for signs of a potential slowdown.

- Impact of Recession: A recession would likely lead to job losses, reduced consumer spending, and a decline in overall economic activity.

- Historical Relationship: Historically, there's a correlation between interest rate hikes and subsequent economic downturns, though the lag time and severity can vary.

Data Dependency and Future Policy Decisions

The Federal Reserve has emphasized its data-dependent approach to monetary policy. Future interest rate decisions will hinge on incoming economic data and the evolving inflation and unemployment landscape.

- Key Economic Indicators: The Fed closely monitors a range of economic indicators, including CPI, unemployment figures, GDP growth, and consumer and business sentiment.

- Potential for Future Adjustments: Depending on upcoming economic data, the Fed may choose to adjust interest rates in the future, either raising or lowering them depending on the prevailing economic conditions.

- Forward Guidance: The Fed employs forward guidance – communicating its intentions and assessment of the economic outlook – to help manage market expectations.

Conclusion

The Federal Reserve's decision to maintain interest rates reflects a cautious and data-driven approach to navigating the complex interplay of inflation and unemployment. The current economic climate requires a careful balancing act, prioritizing the control of inflation while mitigating the risk of a recession. Staying abreast of Federal Reserve interest rates and their impact on the U.S. economy is crucial for everyone – from individual consumers making financial decisions to businesses strategizing for the future. Continue monitoring the latest developments regarding Federal Reserve interest rates and their impact on the U.S. economy to make informed decisions.

Featured Posts

-

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 10, 2025

Did The Fentanyl Crisis Open Doors For Us China Trade Talks

May 10, 2025 -

Anger Erupts In Nottingham After A And E Records Of Stabbing Victims Accessed Without Consent

May 10, 2025

Anger Erupts In Nottingham After A And E Records Of Stabbing Victims Accessed Without Consent

May 10, 2025 -

Us Economic Factors And Their Influence On Elon Musks Net Worth

May 10, 2025

Us Economic Factors And Their Influence On Elon Musks Net Worth

May 10, 2025 -

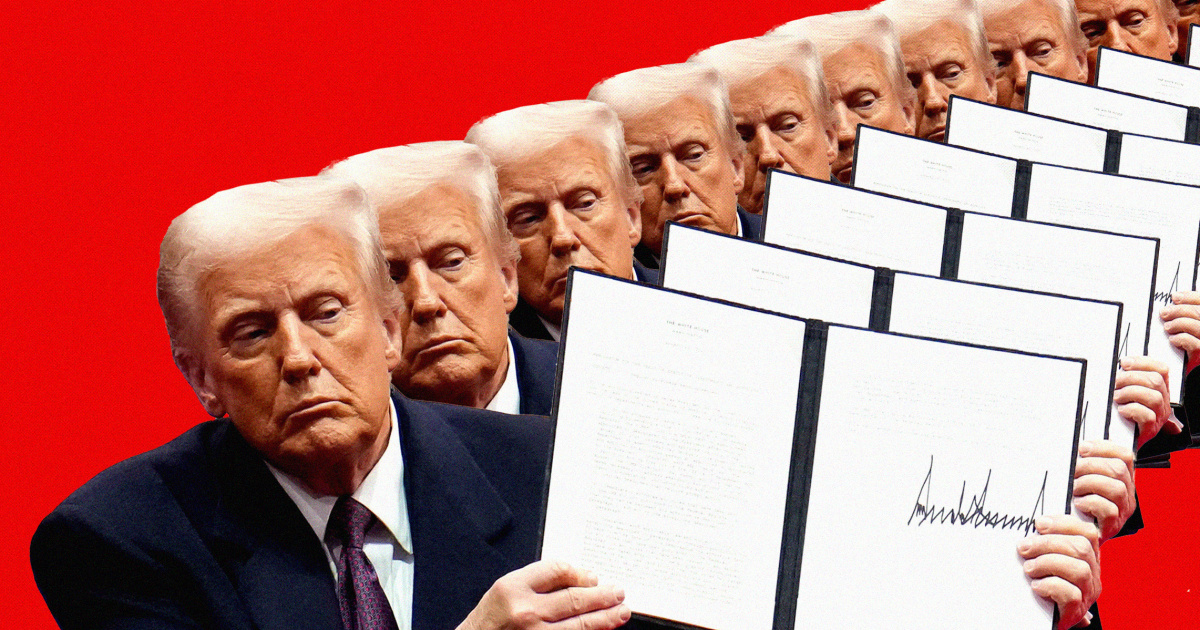

The Impact Of Trumps Executive Orders On The Transgender Community Personal Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community Personal Stories

May 10, 2025 -

Ihsaa Bans Transgender Athletes Following Trump Administration Order

May 10, 2025

Ihsaa Bans Transgender Athletes Following Trump Administration Order

May 10, 2025