U.S. Fed Holds Rates Amid Inflation And Unemployment Concerns

Table of Contents

Persistent Inflation Remains a Key Concern

Inflation remains a significant headwind for the U.S. economy. Despite previous interest rate hikes aimed at cooling inflation, price increases persist, posing a challenge to the Fed's mandate of price stability. The Consumer Price Index (CPI) and Producer Price Index (PPI) continue to reflect elevated price pressures across various sectors. Core inflation, which excludes volatile food and energy prices, also remains stubbornly high.

- Analysis of recent inflation reports (CPI and PPI): Recent data shows CPI remaining above the Fed's 2% target, indicating persistent inflationary pressures. PPI data suggests these pressures are not solely confined to consumer goods, but also impacting businesses' input costs.

- Discussion of the impact of supply chain disruptions on inflation: Lingering supply chain bottlenecks, while easing, continue to contribute to higher prices for certain goods. This adds to the complexity of the Fed's efforts to control inflation.

- Examination of wage growth and its contribution to inflationary pressures: Robust wage growth, while positive for workers, can fuel inflation if it outpaces productivity gains. The Fed is closely monitoring wage increases to assess their impact on overall price levels.

- Mention of the Fed's inflation target and how far the current rate is from that target: The Fed's 2% inflation target remains significantly above the current inflation rate, highlighting the need for continued vigilance and potential future policy adjustments.

Unemployment Figures Present a Complicated Picture

The unemployment rate, while historically low, presents a mixed picture. While the labor market shows strength in certain sectors, there are concerns about potential job losses in others as interest rate increases filter through the economy. The possibility of a recession, and its impact on unemployment, heavily influences the Fed's decision-making process.

- Review of recent unemployment data and its trends: Recent jobless claims data offers insights into the health of the labor market. Fluctuations in these figures provide valuable information about the potential for future economic growth or contraction.

- Discussion of the labor market's health and its potential impact on inflation: A strong labor market can contribute to upward wage pressures and potentially fuel further inflation. However, a weakening labor market could signify an impending recession.

- Analysis of the relationship between inflation and unemployment (Phillips Curve): The traditional inverse relationship between inflation and unemployment, as depicted by the Phillips Curve, is currently being debated amidst the complexities of the current economic environment.

- Mention the impact of potential job losses on consumer spending: A significant increase in unemployment could lead to reduced consumer spending, potentially slowing economic growth and impacting inflation indirectly.

The Fed's Balancing Act: Navigating Inflation and Unemployment

The Fed faces the challenging task of balancing its dual mandate: achieving maximum employment while maintaining price stability. Raising interest rates further risks triggering a recession, while leaving rates unchanged risks allowing inflation to become entrenched. The decision to hold rates steady reflects this complex balancing act and a cautious approach to managing the economic risks.

- Explanation of the Fed's dual mandate (price stability and maximum employment): The Fed's mandate necessitates careful consideration of both inflation and unemployment when determining monetary policy. Finding the optimal balance between these two critical objectives is a constant challenge.

- Analysis of the potential risks of further interest rate hikes: Further interest rate hikes could stifle economic growth, potentially leading to a recession and significantly increasing unemployment.

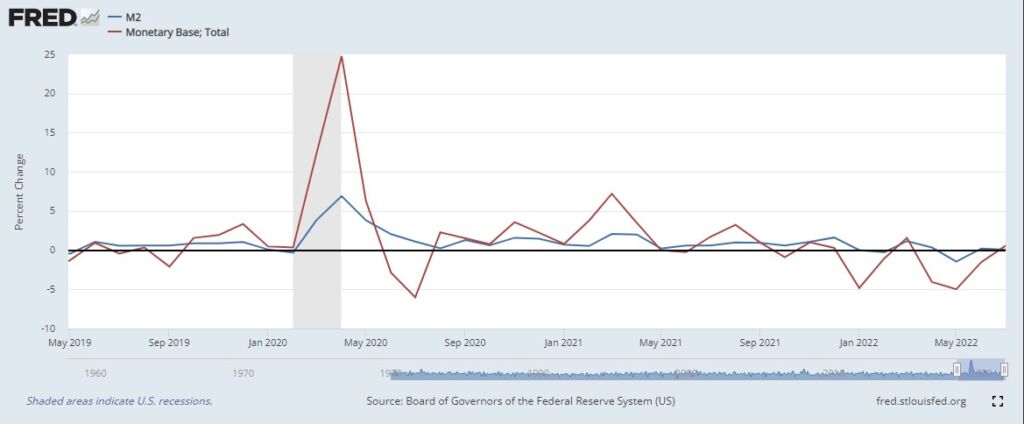

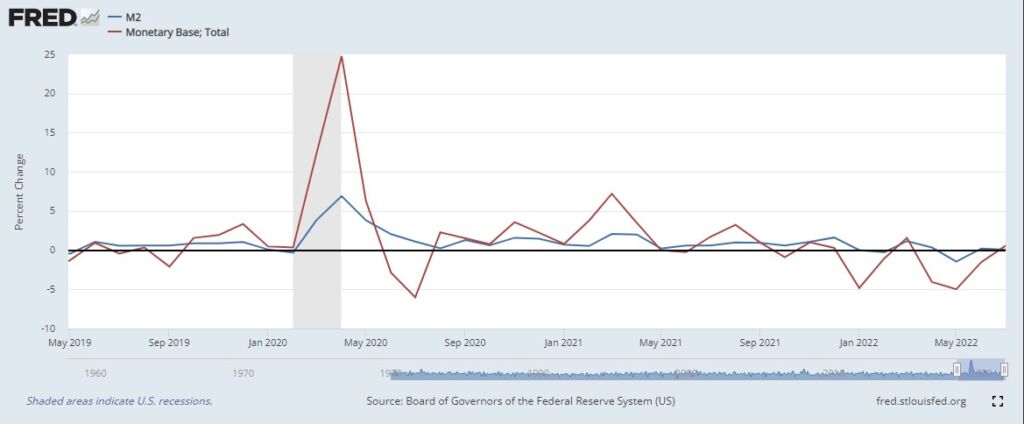

- Discussion of the tools available to the Fed beyond interest rate adjustments: The Fed has other tools at its disposal, including quantitative easing, to influence the economy. These tools may be deployed in conjunction with or as an alternative to interest rate adjustments.

- Mention of the Fed's forward guidance and its implications for future policy decisions: The Fed's statements and projections provide insights into its likely future actions, helping shape market expectations and influencing investor behavior.

Market Reactions and Future Outlook

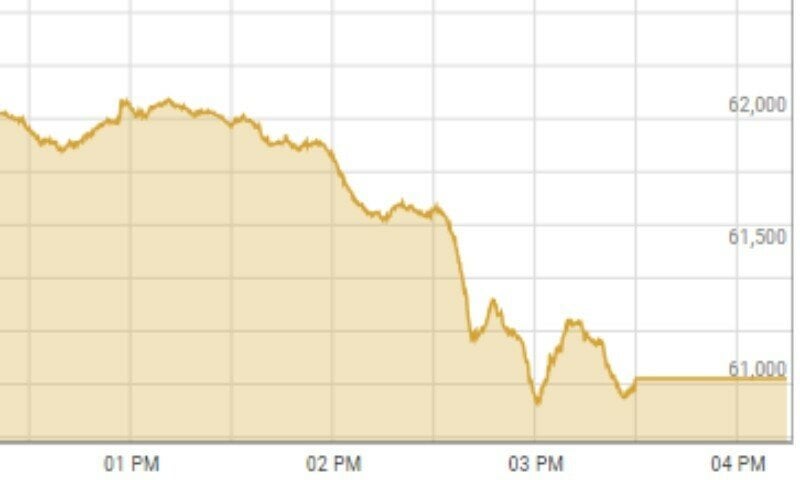

The market's reaction to the Fed's decision to hold interest rates was mixed, reflecting the uncertainty surrounding the future economic outlook. Stock market performance, bond yields, and the value of the dollar all reflect investor sentiment and expectations for future interest rate movements and the overall economic landscape.

- Analysis of stock market and bond market reactions: Initial reactions might show some volatility, reflecting the market's interpretation of the Fed's message. Long-term effects on the stock and bond markets depend on future economic indicators and Fed decisions.

- Discussion of the impact on the dollar's value: Interest rate decisions can influence the relative value of the dollar compared to other currencies. A stronger dollar could impact trade balances and international investment flows.

- Presentation of expert opinions and forecasts on future interest rate movements: Economists offer varying forecasts, considering the persistence of inflation and the resilience of the labor market. These differing opinions illustrate the complexity of predicting future policy decisions.

- Discussion of potential risks and opportunities for investors: The uncertainty surrounding inflation and future interest rate changes presents both risks and opportunities for investors depending on their portfolios and risk tolerance.

Conclusion

The U.S. Federal Reserve's decision to hold interest rates steady reflects the delicate balance between tackling persistent inflation and avoiding a potential recession. The ongoing interplay between inflation and unemployment continues to shape the economic landscape, requiring careful monitoring and strategic adjustments in monetary policy. The Fed's future decisions will depend heavily on incoming economic data, particularly inflation and unemployment figures, and their assessment of the overall economic outlook.

Call to Action: Stay informed on the latest developments concerning U.S. Federal Reserve interest rates and their impact on the economy. Continue to follow our updates on the evolving situation and the implications of U.S. Fed interest rate decisions for your financial planning. Understanding these crucial policy decisions is key to making informed financial choices.

Featured Posts

-

Harry Styles Responds To Awful Snl Impression His Reaction

May 09, 2025

Harry Styles Responds To Awful Snl Impression His Reaction

May 09, 2025 -

Meet Your Nl Federal Election Candidates A Comprehensive Guide

May 09, 2025

Meet Your Nl Federal Election Candidates A Comprehensive Guide

May 09, 2025 -

Investigacao Madeleine Mc Cann Mulher Que Afirma Ser A Menina E Presa

May 09, 2025

Investigacao Madeleine Mc Cann Mulher Que Afirma Ser A Menina E Presa

May 09, 2025 -

Polaca Detida No Reino Unido Alega Ser Maddie Mc Cann

May 09, 2025

Polaca Detida No Reino Unido Alega Ser Maddie Mc Cann

May 09, 2025 -

Operation Sindoor Pakistan Stock Market Plunges Kse 100 Halted

May 09, 2025

Operation Sindoor Pakistan Stock Market Plunges Kse 100 Halted

May 09, 2025