Operation Sindoor: Pakistan Stock Market Plunges, KSE 100 Halted

Table of Contents

Understanding the "Operation Sindoor" Trigger

The term "Operation Sindoor" itself remains somewhat opaque, lacking official definition. However, the market crash is widely attributed to a confluence of factors, primarily stemming from escalating political instability and the resulting economic anxieties. The event highlighted existing vulnerabilities in the Pakistani economy, amplifying existing concerns about foreign exchange reserves and sovereign debt.

- Key Political Factors: The pre-existing political turmoil and uncertainty significantly contributed to investor apprehension. [Insert details about specific political events leading up to the crash, citing reputable news sources]. The lack of clear policy direction further exacerbated the situation.

- Economic Indicators: Prior to the crash, several economic indicators painted a concerning picture. [Insert details about relevant economic data, such as inflation rates, currency devaluation, and foreign exchange reserves]. This created a climate of fear among investors.

- Impact of International News and Global Market Trends: The global economic slowdown and tightening monetary policies in several key markets likely played a role in amplifying the negative sentiment already present in the Pakistani market. [Insert details about relevant global economic events and their potential impact].

The Depth of the KSE 100 Crash

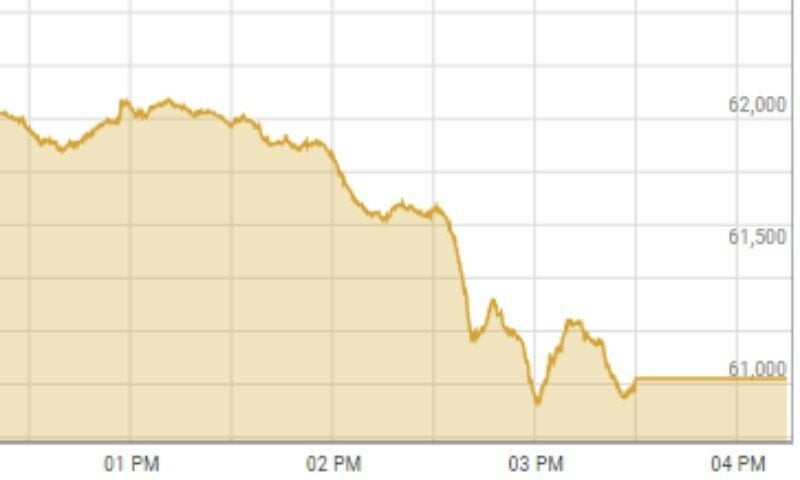

The KSE 100 crash was nothing short of dramatic. The index plummeted by [Insert Percentage]% on [Insert Date], representing one of the sharpest single-day drops in the PSX's history. This compares to [Insert Comparison to historical crashes, e.g., the percentage drop during the 2008 global financial crisis in Pakistan].

- KSE 100 Index Values: The KSE 100 index fell from [Insert pre-crash value] to [Insert post-crash value] within a matter of hours.

- Companies Affected: The crash impacted a broad spectrum of sectors, with significant losses reported across banking, energy, technology, and other industries. [Insert specific examples and data].

- Visualizing the Plunge: [Include charts and graphs visualizing the market’s drastic decline].

The Halt of Trading and its Ramifications

The unprecedented halt of trading on the KSE 100 was a direct response to the severity of the Pakistan Stock Market plunge. This decision was made to prevent further uncontrolled losses and allow authorities to assess the situation.

- Duration of the Halt: Trading was suspended for [Insert Duration] to provide a buffer and prevent panic selling.

- Official Statements: The Pakistan Stock Exchange issued statements [Insert links to official statements] explaining the reasons behind the halt and assuring investors of efforts to stabilize the market.

- Impact on Foreign Investment: The crash undoubtedly damaged investor confidence, potentially deterring future foreign investment in Pakistan.

Government Response and Market Recovery Efforts

The Pakistani government responded to the KSE 100 crash with [Insert details of the government's response, including specific policy measures, economic stimulus packages, or regulatory changes]. However, the effectiveness of these measures remains to be seen.

- Government Policies: [List specific policy announcements and their intended impact on market recovery].

- Official Statements: [Quote relevant statements from government officials regarding their response].

- Expert Opinions: [Include opinions from financial analysts and experts on the adequacy and effectiveness of the government's response].

Conclusion: Navigating the Aftermath of the Pakistan Stock Market Plunge

The "Operation Sindoor" event underscores the fragility of the Pakistan Stock Market and the significant impact of political and economic uncertainty on investor sentiment. The sheer depth of the Pakistan Stock Market plunge and the subsequent KSE 100 crash highlight the need for robust regulatory frameworks and proactive measures to mitigate future crises. The long-term consequences for investor confidence and economic stability remain a key concern. Staying informed about the evolving situation is crucial. Subscribe to our newsletter for updates on the KSE 100 and future market analyses to navigate the complexities of the Pakistan Stock Market and its recovery from this significant downturn. Understanding the intricacies of the KSE 100 crash is vital for future investment strategies.

Featured Posts

-

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 09, 2025

Toddler Choking On Tomato Dramatic Police Rescue Caught On Bodycam

May 09, 2025 -

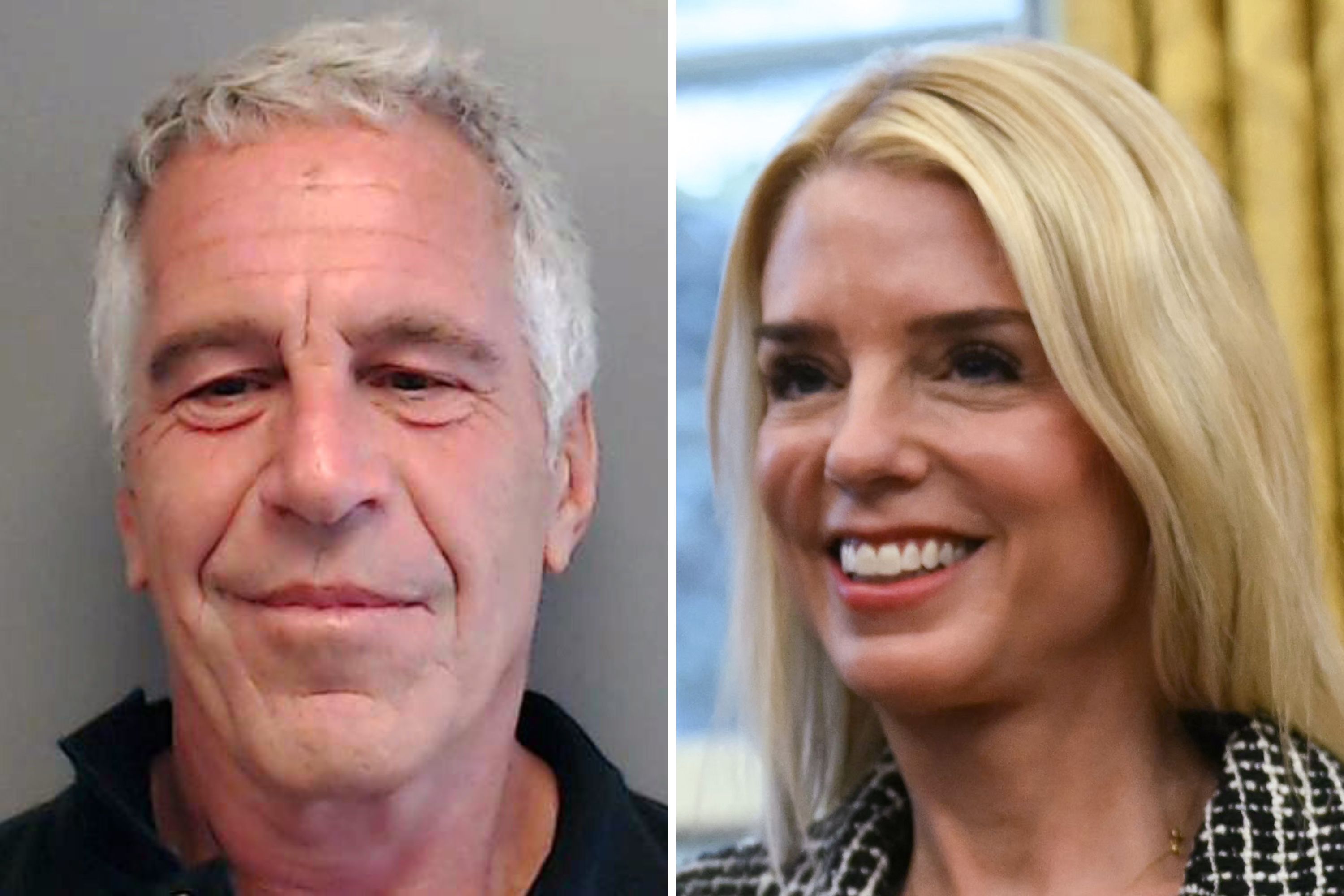

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 09, 2025

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 09, 2025 -

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 09, 2025

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 09, 2025 -

New Totalitarian Threat Lais Warning On Ve Day

May 09, 2025

New Totalitarian Threat Lais Warning On Ve Day

May 09, 2025 -

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya S Sh A I Rossii

May 09, 2025

Frantsiya I Polsha Novoe Oboronnoe Soglashenie Signal Dlya S Sh A I Rossii

May 09, 2025