Two Stocks Poised To Surpass Palantir's Value In 3 Years

Table of Contents

Stock #1: Datadog – Disrupting Cloud Monitoring with AI-Powered Observability

Exceptional Growth Potential:

Datadog (DDOG) is a leading provider of cloud monitoring and observability solutions. Its platform utilizes artificial intelligence (AI) to provide real-time insights into application performance, security, and infrastructure. This sophisticated approach makes it a clear leader in a rapidly expanding market.

- Projected 30% YoY revenue growth for the next three years: Analyst estimates consistently point towards strong revenue growth for Datadog, driven by increasing cloud adoption and the expanding need for comprehensive observability solutions. (Source: [Insert link to reputable analyst report])

- Strategic partnerships expanding into the enterprise market: Datadog is actively forging partnerships with major cloud providers and enterprise software vendors, expanding its reach and reinforcing its position within the market. (Source: [Insert link to Datadog press release or news article])

- First-mover advantage in AI-driven observability: Datadog's early adoption of AI and machine learning sets it apart from competitors, enhancing its ability to deliver superior value and insights.

Datadog's competitive advantage lies in its comprehensive, AI-powered platform that offers a single pane of glass view across an entire tech stack, simplifying operations and improving efficiency for its clients.

Strong Financial Foundation:

Datadog boasts a robust financial foundation, underpinning its impressive growth trajectory.

- Consistent profitability for the past two quarters: The company has demonstrated consistent profitability, showcasing its ability to generate strong cash flow and manage expenses effectively. (Source: [Insert link to Datadog financial reports])

- Strong cash reserves to fund future growth: Datadog has substantial cash reserves, allowing it to invest in research and development, acquisitions, and expansion into new markets. (Source: [Insert link to Datadog financial reports])

- Increasing operating margins: Datadog is experiencing improving operating margins, indicating increasing efficiency and scalability of its business model. (Source: [Insert link to Datadog financial reports])

Key financial metrics like a healthy P/E ratio and consistent revenue growth further solidify its position as a strong investment prospect.

Risks and Mitigation Strategies:

While Datadog presents a compelling investment opportunity, it's essential to acknowledge potential risks.

- Competition from established players: The cloud monitoring market is competitive, with established players like Splunk and New Relic vying for market share. Datadog's competitive advantage lies in its superior AI-powered platform and a strong focus on innovation.

- Dependence on key clients: Concentration risk among a few large clients could potentially impact revenue. Datadog actively diversifies its client base to mitigate this risk.

- Regulatory hurdles: Changes in data privacy regulations could impact its operations. Datadog proactively addresses compliance requirements.

Stock #2: CrowdStrike – Leading the Charge in Cybersecurity with AI-Powered Endpoint Protection

Innovation and Market Leadership:

CrowdStrike (CRWD) is a leading cybersecurity company specializing in cloud-delivered endpoint protection. Its platform leverages AI to proactively detect and respond to threats, offering superior protection compared to traditional antivirus solutions.

- Patent-protected technology with significant competitive moat: CrowdStrike's cutting-edge technology is protected by patents, creating a strong barrier to entry for competitors. (Source: [Insert link to CrowdStrike patents or press releases])

- Market share leader in a high-growth segment: CrowdStrike enjoys a significant market share in the endpoint detection and response (EDR) market, a rapidly expanding segment within the cybersecurity industry. (Source: [Insert link to market research report])

- Strong brand recognition and customer loyalty: CrowdStrike has built a reputation for excellence, attracting and retaining high-profile clients.

Strategic Partnerships and Acquisitions:

CrowdStrike's strategic approach includes partnerships and acquisitions to accelerate its growth.

- Recent acquisition of a complementary technology company: Acquisitions enhance its product offerings and expand its capabilities. (Source: [Insert link to press release announcing acquisitions])

- Strategic partnership with a major industry player: These alliances broaden its reach and market access. (Source: [Insert link to relevant press releases or news articles])

- Expansion into new geographical markets through strategic alliances: CrowdStrike's global expansion strategy increases market reach and diversification.

Robust Scalability and Expansion Plans:

CrowdStrike has demonstrated a strong ability to scale its operations and expand into new markets.

- Significant investment in R&D: Consistent investment in research and development maintains its technological leadership. (Source: [Insert link to CrowdStrike financial reports])

- Expansion into international markets: Global expansion drives revenue diversification and growth opportunities. (Source: [Insert link to CrowdStrike's investor presentations or annual reports])

- Plans to build new infrastructure: This ensures that the company can handle increasing workloads and continue to provide high-quality services.

Potential Downsides and Risk Assessment:

While CrowdStrike's future looks promising, potential risks need to be considered.

- Supply chain disruptions: Dependencies on third-party suppliers could impact its operations.

- Dependence on a limited number of suppliers: Diversifying suppliers can mitigate this risk.

- Economic downturn impact: A significant economic downturn could affect customer spending on cybersecurity solutions. CrowdStrike's strong position in the market should help mitigate this.

Conclusion:

In summary, while Palantir remains a notable player in the technology sector, Datadog and CrowdStrike, with their strong financial foundations, innovative technologies, and robust growth strategies, present compelling alternatives for investors seeking potentially higher returns. Their combined strengths—exceptional growth potential, financial stability, and cutting-edge technologies—position them to surpass Palantir's market capitalization within the next three years.

While Palantir remains a strong player, investors seeking potentially higher returns should consider diversifying their portfolios with high-growth stocks like Datadog and CrowdStrike. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions. Research these stocks and discover the potential for exceeding Palantir's market capitalization in the coming years. Remember, this is a data-driven analysis, and future performance is not guaranteed.

Featured Posts

-

How Bert Kreischers Wife Feels About His Netflix Stand Ups Sex Jokes

May 10, 2025

How Bert Kreischers Wife Feels About His Netflix Stand Ups Sex Jokes

May 10, 2025 -

Exploring The Implications Of Figmas Ai For Designers

May 10, 2025

Exploring The Implications Of Figmas Ai For Designers

May 10, 2025 -

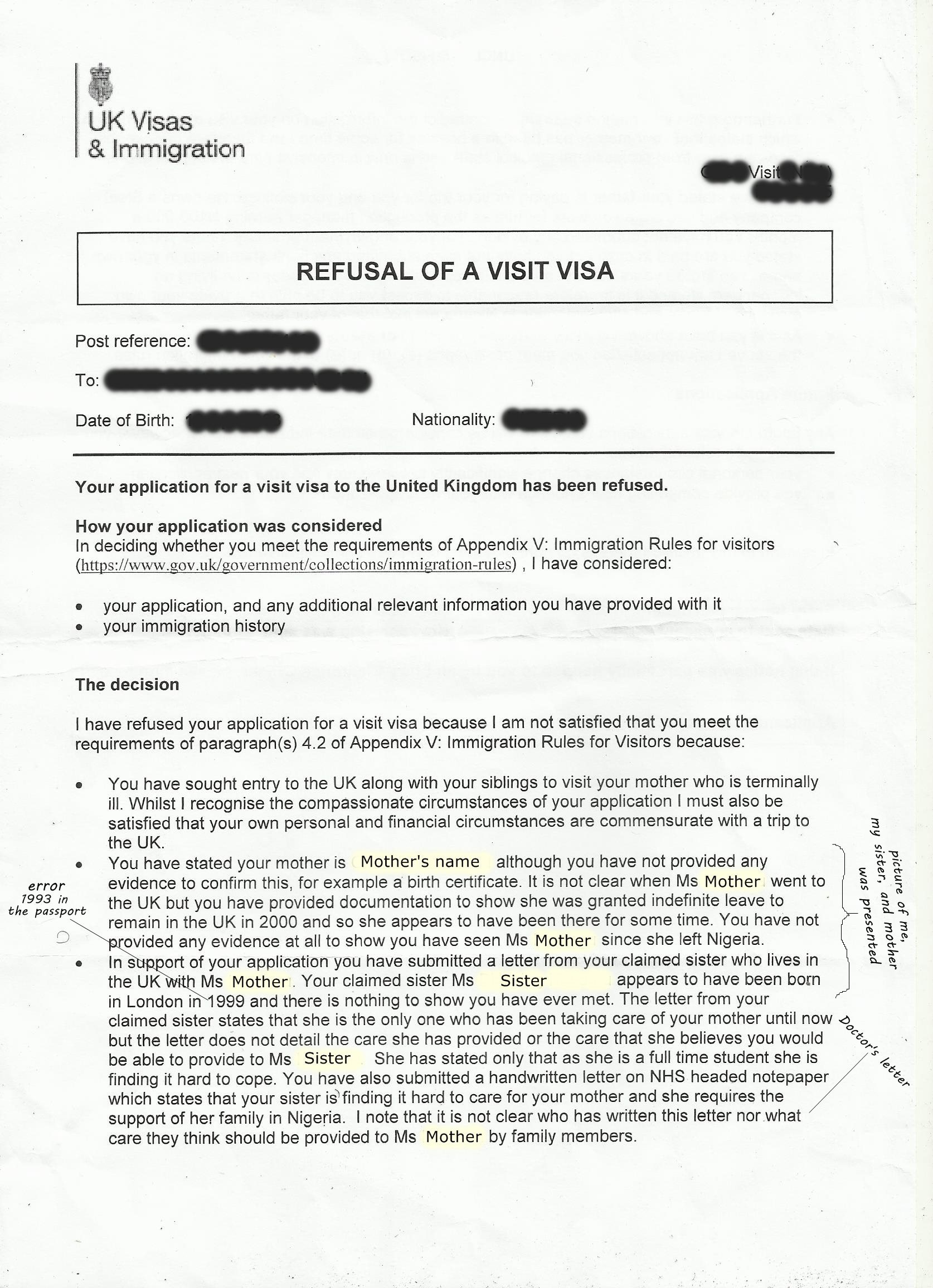

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025 -

Vozvraschenie Stivena Kinga V X Oskorblenie Ilona Maska

May 10, 2025

Vozvraschenie Stivena Kinga V X Oskorblenie Ilona Maska

May 10, 2025 -

Elliott Eyes Exclusive Bet On Russian Gas Pipeline

May 10, 2025

Elliott Eyes Exclusive Bet On Russian Gas Pipeline

May 10, 2025