Trump's Trade War: A Crushing Blow To Fintech IPOs, Including Affirm (AFRM)

Table of Contents

Increased Economic Uncertainty and Investor Hesitation

Trump's trade war fueled considerable economic uncertainty, significantly impacting investor confidence and risk appetite. The constant threat of escalating tariffs and retaliatory measures created a volatile stock market environment. This volatility directly affected IPO valuations, making it riskier for companies to go public. Investors, faced with heightened uncertainty, demanded higher returns to compensate for the perceived increased risk, further deterring companies from pursuing IPOs.

- Increased market volatility leading to postponed IPOs: The unpredictable nature of the trade war made it difficult for companies to accurately predict future earnings and project long-term growth, leading many to postpone their IPO plans until market conditions stabilized.

- Investors demanding higher returns due to perceived increased risk: Uncertainty breeds risk aversion. Investors demanded higher returns to offset the potential negative impacts of the trade war on Fintech companies' performance.

- Reduced capital available for funding Fintech startups: With investors more cautious, the availability of funding for Fintech startups decreased, making it harder for them to reach the scale necessary for a successful IPO.

- Negative impact on overall market sentiment: The overall gloomy economic outlook dampened market sentiment, making it less attractive for both companies to go public and investors to participate in IPOs.

Tariffs and Supply Chain Disruptions

The tariffs imposed during Trump's trade war significantly disrupted global supply chains, impacting the cost of goods and services for Fintech companies. Many Fintech firms rely on global supply chains for hardware, software components, and even services. The increased tariffs led to higher input costs, squeezing profit margins and making companies less attractive to potential investors considering their IPOs. Supply chain bottlenecks further exacerbated the problem, leading to delayed product launches and impacting growth projections.

- Increased costs of imported components and materials: Tariffs directly increased the cost of imported components, impacting the profitability of Fintech companies.

- Delayed product launches due to supply chain bottlenecks: Disruptions to global supply chains caused delays in acquiring necessary components, pushing back product launch timelines and impacting revenue projections.

- Reduced profit margins impacting IPO valuations: Higher costs and reduced output directly translated into lower profit margins, making the companies less attractive to investors and negatively impacting IPO valuations.

- Examples of specific Fintech companies affected by supply chain issues: While pinpointing specific examples for every Fintech company is difficult due to the sensitive nature of business data, anecdotal evidence suggests many companies faced challenges in securing components and materials on time and at competitive prices.

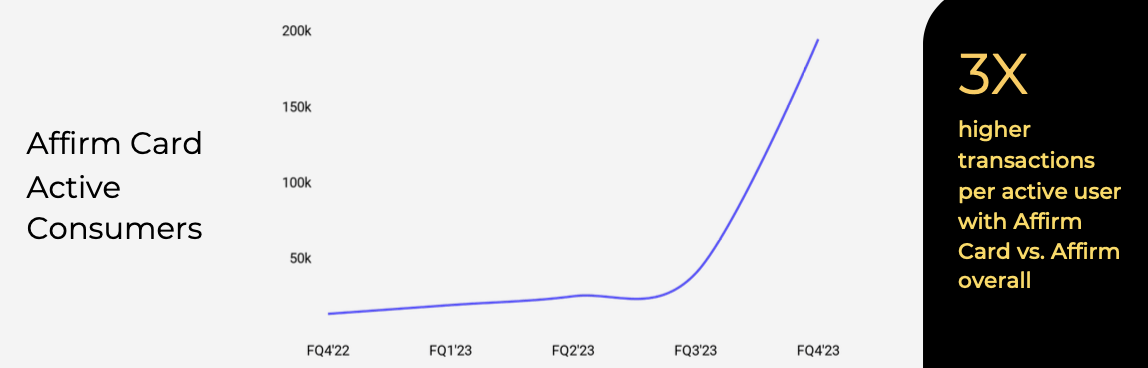

Affirm (AFRM) as a Case Study: Navigating the Trade War's Impact

Affirm, a leading Buy Now, Pay Later (BNPL) company, went public during a period still significantly impacted by the lingering effects of Trump's trade war. While Affirm's business model wasn't directly reliant on global supply chains in the same way as hardware-focused Fintech companies, it still felt the repercussions of the broader economic uncertainty. Its IPO performance needs to be viewed within the context of this challenging environment.

- Affirm's IPO timing relative to the trade war: Affirm's IPO took place during a period of continued economic uncertainty following the trade war.

- Analysis of Affirm's stock performance during and after the trade war: Analyzing Affirm's stock performance requires a detailed examination of its financial reports and market trends during and after the trade war, separating the company’s inherent performance from the external macroeconomic factors.

- Strategies Affirm implemented to mitigate the trade war's effects: Understanding Affirm's internal strategies during this period – cost management, diversification, or perhaps focusing on specific market segments less affected by the trade war – would provide valuable insights.

- Comparison of Affirm's performance to other Fintech IPOs during the same period: Comparing Affirm's performance to other Fintech IPOs during the same period helps contextualize its results, revealing whether it outperformed or underperformed the sector as a whole.

The Long-Term Effects on Fintech Innovation

Trump's trade war had a lasting impact on Fintech innovation and growth. The economic uncertainty and reduced investor confidence led to a decrease in venture capital funding for Fintech startups. This, in turn, slowed the development of new Fintech products and services, potentially leading to market consolidation and reduced competition.

- Reduced venture capital funding for Fintech startups: A decrease in investor confidence led to a reduction in available capital for early-stage Fintech companies, hindering their growth and innovation.

- Slowdown in the development of new Fintech products and services: Less funding and a risk-averse environment stifle innovation and the launch of new products and services.

- Potential for market consolidation and reduced competition: Fewer startups succeed in obtaining funding, increasing market dominance by larger companies and potentially reducing competition.

- Long-term implications for financial inclusion and technological advancement: Slower innovation in Fintech may hinder efforts to promote financial inclusion and limit advancements in financial technology.

Conclusion: Understanding the Lasting Legacy of Trump's Trade War on Fintech

Trump's trade war had a demonstrably negative impact on Fintech IPOs. The increased economic uncertainty, disrupted supply chains, and the overall negative market sentiment significantly affected investor confidence and the viability of many Fintech companies seeking to go public. Affirm (AFRM), while not directly hit by supply chain disruptions, still experienced the headwinds of a volatile market. The long-term effects include reduced investment in the sector and a potential slowdown in Fintech innovation. Learn more about the effects of Trump's trade war on Fintech by investigating the risks associated with investing in Fintech during times of economic uncertainty. Understanding how global trade policies can impact your Fintech investments is crucial for informed decision-making.

Featured Posts

-

Economists Forecast Bank Of Canada Rate Cuts Due To Tariff Related Job Losses

May 14, 2025

Economists Forecast Bank Of Canada Rate Cuts Due To Tariff Related Job Losses

May 14, 2025 -

Hollyoaks Spoilers 9 Big Reveals Coming Next Week

May 14, 2025

Hollyoaks Spoilers 9 Big Reveals Coming Next Week

May 14, 2025 -

Bought Wegmans Braised Beef Check For Recall Notice

May 14, 2025

Bought Wegmans Braised Beef Check For Recall Notice

May 14, 2025 -

Que Ver Y Hacer En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025

Que Ver Y Hacer En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025 -

Captain America Brave New World 4 K Blu Ray Steelbook Pre Orders Open

May 14, 2025

Captain America Brave New World 4 K Blu Ray Steelbook Pre Orders Open

May 14, 2025

Latest Posts

-

Israel Eurovision Boycott Directors Dismissal

May 14, 2025

Israel Eurovision Boycott Directors Dismissal

May 14, 2025 -

Cannonball Your Ultimate Guide To U Tv Showtimes And Episodes

May 14, 2025

Cannonball Your Ultimate Guide To U Tv Showtimes And Episodes

May 14, 2025 -

Maya Jamas Viral Hair Product And Beauty Secrets Revealed

May 14, 2025

Maya Jamas Viral Hair Product And Beauty Secrets Revealed

May 14, 2025 -

Eurovisions Response To Israel Boycott Demands

May 14, 2025

Eurovisions Response To Israel Boycott Demands

May 14, 2025 -

Maya Jamas Beauty Routine Hair Product And More

May 14, 2025

Maya Jamas Beauty Routine Hair Product And More

May 14, 2025