Trump's Tariffs: CEOs Detail Negative Impact On Economy And Consumer Confidence

Table of Contents

Increased Costs and Reduced Profitability

Trump's tariffs dramatically increased costs and reduced profitability for numerous businesses. This was felt across multiple sectors, significantly impacting the US economy.

Supply Chain Disruptions

The complexities and increased costs associated with sourcing materials internationally due to tariffs were substantial. Businesses faced numerous challenges:

- Increased import costs: Tariffs directly increased the price of imported raw materials and components.

- Delays in shipments: Navigating new trade regulations led to significant delays in receiving essential goods.

- Search for alternative suppliers: Companies were forced to seek out alternative suppliers, often at a higher cost and with longer lead times. This disrupted established supply chains and impacted production timelines.

- Increased administrative burden: Dealing with the increased paperwork and complexities surrounding tariffs added significant administrative overhead.

For example, the CEO of [Insert Example Company Name], a manufacturer of [Insert Product Type], publicly stated, "The tariffs added a significant, unpredictable cost to our raw materials, directly impacting our bottom line and forcing us to raise prices for consumers." This illustrates the direct impact of tariffs on businesses' ability to remain competitive.

Reduced Consumer Spending

The tariff-induced price increases directly decreased consumer purchasing power and spending. This had a ripple effect throughout the economy:

- Higher prices on imported goods: Consumers faced higher prices on a wide range of goods, from electronics to clothing.

- Reduced disposable income: Higher prices for essential goods reduced consumers' disposable income, limiting their spending on non-essential items.

- Decreased demand: Reduced consumer purchasing power led to decreased demand for goods and services across the board.

- Impact on retail sales: Retail sales figures showed a noticeable decline correlated with the implementation of Trump's tariffs.

Data from [Insert Source of Statistics, e.g., Bureau of Economic Analysis] showed a [Insert Percentage]% decline in consumer spending in [Insert Time Period] following the implementation of specific tariffs, highlighting the direct link between trade policies and consumer behavior.

Damage to International Trade Relations

Trump's tariffs severely damaged international trade relations, triggering retaliatory measures and weakening global partnerships.

Retaliatory Tariffs

Other countries responded to Trump's tariffs by imposing their own retaliatory tariffs on US exports. This created a damaging trade war:

- Examples of retaliatory tariffs: [List specific examples, e.g., China's tariffs on soybeans, the EU's tariffs on steel].

- Decreased US exports: Retaliatory tariffs significantly reduced US exports to key markets, hurting American businesses and farmers.

- Loss of market share: US companies lost market share to competitors in countries unaffected by the tariffs.

- Damage to international trade relationships: The trade war significantly damaged trust and cooperation between the US and its major trading partners.

For instance, the retaliatory tariffs imposed by China on US soybeans resulted in significant losses for American farmers, illustrating the unintended consequences of protectionist trade policies.

Weakened Global Trade Partnerships

The atmosphere of trade war created by Trump's tariffs damaged existing trade agreements and weakened global trade alliances:

- Erosion of trust: The unpredictable nature of Trump's tariff policies eroded trust among international trading partners.

- Disruption of supply chains: Retaliatory tariffs and trade disputes disrupted global supply chains, causing delays and increased costs.

- Impact on international collaborations: The trade war hindered international collaboration on trade-related issues.

- Loss of economic opportunities: The strained relationships resulted in a loss of potential economic opportunities for US businesses.

The renegotiation of NAFTA into USMCA, while ultimately avoiding a complete collapse of the agreement, demonstrated the significant challenges and uncertainties caused by the administration’s trade policies.

Decline in Consumer Confidence and Investment

Trump's tariffs created uncertainty in the market, leading to a decline in consumer confidence and investment.

Uncertainty in the Market

The unpredictability of Trump's tariff policies significantly affected business investment and long-term planning:

- Hesitation in investment decisions: Businesses hesitated to make long-term investments due to the uncertainty surrounding future trade policies.

- Postponement of expansion plans: Many companies postponed expansion plans due to fears of increased costs and trade disruptions.

- Negative impact on job creation: The hesitation in investment led to a decrease in job creation.

- General uncertainty among businesses: Businesses across various sectors expressed concern about the long-term implications of Trump's tariffs.

One CEO commented, "The uncertainty created by the tariffs made it impossible for us to make sound long-term investment decisions. We had to put many projects on hold." This reflects the broader sentiment among businesses facing an unpredictable trade environment.

Negative Impact on Employment

The decreased production and business closures resulting from Trump's tariffs led to potential job losses:

- Plant closures: Some companies were forced to close plants or facilities due to increased costs and reduced demand.

- Layoffs: Many companies implemented layoffs to cut costs in the face of tariff-induced economic hardship.

- Reduction in workforce: Businesses across multiple sectors reduced their workforce to adapt to the changing economic environment.

- Impact on specific industries: Industries heavily reliant on imported materials or exports were particularly hard hit.

Data from [Insert Source of Employment Data, e.g., Bureau of Labor Statistics] showed [Insert Statistic on Job Losses] in sectors directly impacted by Trump's tariffs, highlighting the social costs of protectionist trade policies.

Conclusion

The accounts shared by numerous CEOs paint a stark picture of the negative impacts of Trump's tariffs on the US economy and consumer confidence. The key findings underscore significant increases in costs, widespread supply chain disruptions, severe damage to international trade relations, and a substantial decline in both consumer spending and investment. The resulting market uncertainty significantly hampered business growth and job creation.

Understanding the long-term effects of Trump's tariffs is crucial for informed policymaking. Further research and analysis of the economic consequences are essential to avoid repeating similar mistakes. By carefully considering the perspectives of CEOs and other key stakeholders, we can work towards creating a more stable and predictable trade environment that fosters economic growth and strengthens consumer confidence, avoiding the pitfalls of protectionist policies like Trump's tariffs.

Featured Posts

-

Chat Gpt Maker Open Ai Faces Ftc Investigation Key Questions And Concerns

Apr 26, 2025

Chat Gpt Maker Open Ai Faces Ftc Investigation Key Questions And Concerns

Apr 26, 2025 -

The Deion Sanders Factor Assessing Shedeur Sanders Nfl Draft Stock Objectively

Apr 26, 2025

The Deion Sanders Factor Assessing Shedeur Sanders Nfl Draft Stock Objectively

Apr 26, 2025 -

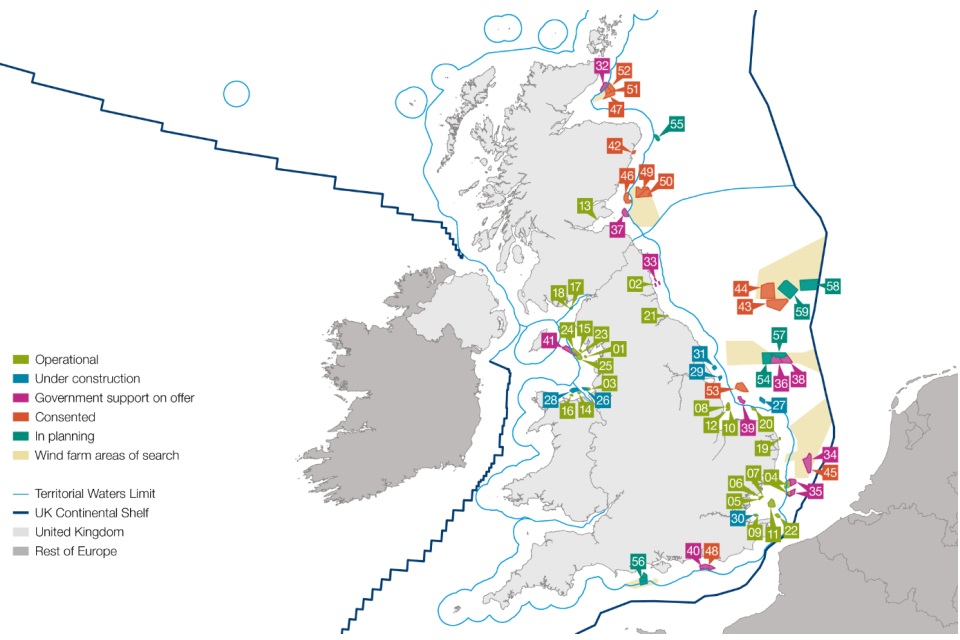

Vestas Investment Warning Proposed Uk Wind Auction Changes Cause Concern

Apr 26, 2025

Vestas Investment Warning Proposed Uk Wind Auction Changes Cause Concern

Apr 26, 2025 -

Citizen Confrontations Lawmakers Face Backlash At Town Hall Meetings

Apr 26, 2025

Citizen Confrontations Lawmakers Face Backlash At Town Hall Meetings

Apr 26, 2025 -

High Stock Valuations Bof As Case For A Relaxed Investment Strategy

Apr 26, 2025

High Stock Valuations Bof As Case For A Relaxed Investment Strategy

Apr 26, 2025

Latest Posts

-

Patrick Schwarzenegger From Ariana Grande Video To White Lotus A Career Retrospective

Apr 27, 2025

Patrick Schwarzenegger From Ariana Grande Video To White Lotus A Career Retrospective

Apr 27, 2025 -

Patrick Schwarzeneggers Forgotten Ariana Grande Music Video Role A White Lotus Connection

Apr 27, 2025

Patrick Schwarzeneggers Forgotten Ariana Grande Music Video Role A White Lotus Connection

Apr 27, 2025 -

Romantic Alaskan Escape Ariana Biermanns Adventure

Apr 27, 2025

Romantic Alaskan Escape Ariana Biermanns Adventure

Apr 27, 2025 -

Ariana Biermanns Chill Alaskan Vacation With Her Partner

Apr 27, 2025

Ariana Biermanns Chill Alaskan Vacation With Her Partner

Apr 27, 2025 -

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025

Alaska Adventure Ariana Biermanns Romantic Trip

Apr 27, 2025