High Stock Valuations: BofA's Case For A Relaxed Investment Strategy

Table of Contents

BofA's Rationale Behind the Relaxed Investment Strategy

BofA's core argument centers on the premise that high stock valuations suggest reduced potential for significant short-term gains, making aggressive, high-growth strategies less appealing and potentially riskier. Their analysis points to a market environment where rapid, substantial returns are less likely, emphasizing the need for a more measured approach.

-

Elevated Price-to-Earnings (P/E) ratios across various sectors: Many sectors are trading at historically high P/E ratios, indicating that investors are paying a premium for earnings. This suggests the market may be overvalued, increasing the risk of a correction. Recent reports show P/E ratios exceeding historical averages by a significant margin in several key sectors, including technology and consumer discretionary.

-

Increased market volatility due to macroeconomic uncertainties: Global economic uncertainty, including inflation, interest rate hikes, and geopolitical instability, contributes to increased market volatility. High stock valuations amplify the impact of these uncertainties, making short-term predictions unreliable and increasing the risk of significant losses.

-

Potential for slower growth in the near future: BofA's forecasts suggest that economic growth may slow in the coming quarters. This translates to potentially slower earnings growth for companies, making high-valuation stocks less attractive in the short term.

-

Higher risk of corrections or market downturns: High stock valuations often precede market corrections or downturns. A relaxed strategy helps mitigate the potential losses associated with such events by reducing exposure to riskier assets. Historical data clearly demonstrates the correlation between high valuations and subsequent market corrections.

Key Implications for Investors Facing High Stock Valuations

BofA's assessment has significant implications for investors, particularly depending on their investment timeline and risk tolerance.

-

Long-term investors: For those with a long-term investment horizon (10+ years), maintaining a diversified portfolio focused on long-term growth potential remains crucial. While short-term fluctuations are expected, the long-term outlook for the market generally remains positive.

-

Short-term investors: Short-term investors should consider reducing exposure to riskier assets and potentially shifting towards more conservative investments with lower volatility. The potential for short-term losses in a high-valuation market is significantly higher.

-

Importance of rebalancing portfolios: Rebalancing your portfolio to align with a more conservative risk profile is vital. This involves selling some overvalued assets and reinvesting in undervalued sectors or asset classes. Regular portfolio rebalancing helps manage risk and maintain a desired asset allocation.

-

Explore alternative investment options: Diversifying beyond stocks is advisable. Consider allocating a portion of your portfolio to alternative investments like bonds, real estate, or commodities to reduce overall portfolio risk and potentially improve risk-adjusted returns.

Strategies for Navigating High Stock Valuations

Based on BofA's advice, investors can adopt several strategies to navigate the current market environment.

-

Focus on quality companies: Prioritize investments in high-quality companies with strong fundamentals, sustainable earnings growth, and a history of consistent performance. These companies are generally less susceptible to market fluctuations.

-

Emphasize value investing: Value investing principles – focusing on identifying undervalued assets with strong potential for future growth – become even more crucial in a high-valuation market.

-

Disciplined asset allocation and diversification: Maintain a disciplined approach to asset allocation and diversification across various asset classes and sectors to mitigate risk.

-

Regular portfolio review and adjustment: Regularly review your portfolio and adjust your asset allocation based on market conditions, your risk tolerance, and your financial goals.

-

Consider dollar-cost averaging: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, helps mitigate the risk of investing a lump sum at a market peak.

Addressing Concerns: Is a Relaxed Strategy Too Passive?

Some may argue that a relaxed strategy is too passive and could lead to missing significant market opportunities. However, this perspective overlooks the critical importance of balancing risk and reward.

-

Balancing risk and reward: While aggressive strategies may offer the potential for higher returns, they also carry significantly higher risk in a high-valuation market. A relaxed strategy prioritizes capital preservation and minimizes potential losses.

-

Downsides of chasing high returns: Chasing high returns in an overvalued market can lead to substantial losses if the market corrects. A more measured approach protects capital while still aiming for long-term growth.

-

Long-term perspective: A relaxed strategy emphasizes the importance of patience and discipline. Long-term investors understand that market cycles occur and that short-term fluctuations are normal.

-

Active management within a relaxed strategy: A relaxed approach doesn't equate to passive investing. It involves active management focused on strategic adjustments rather than frequent, reactive trading. Regular monitoring and rebalancing remain essential components.

Conclusion

BofA's analysis suggests that a relaxed investment strategy is prudent in the face of high stock valuations. This involves a focus on long-term growth, diversification across various asset classes, and robust risk management. By prioritizing quality companies, employing value investing principles, and maintaining a disciplined approach to portfolio management, investors can navigate these challenging times effectively.

Given the current climate of high stock valuations, consider adapting your investment strategy to reflect a more relaxed and disciplined approach. Carefully review your portfolio and consult with a financial advisor to determine the best course of action for your individual circumstances and risk tolerance. Remember, navigating high stock valuations requires a thoughtful and patient strategy.

Featured Posts

-

Amanda Holden And Tess Dalys Daughters On A Desert Island Tv Show

Apr 26, 2025

Amanda Holden And Tess Dalys Daughters On A Desert Island Tv Show

Apr 26, 2025 -

53

Apr 26, 2025

53

Apr 26, 2025 -

Nepotism On Tv How Connected Kids Are Shaping The Screen

Apr 26, 2025

Nepotism On Tv How Connected Kids Are Shaping The Screen

Apr 26, 2025 -

Amanda Seyfrieds Raw Defense Of Nepotism In The Entertainment Industry

Apr 26, 2025

Amanda Seyfrieds Raw Defense Of Nepotism In The Entertainment Industry

Apr 26, 2025 -

Mission Impossible 8 Tom Cruises Daring Biplane Stunt Explained

Apr 26, 2025

Mission Impossible 8 Tom Cruises Daring Biplane Stunt Explained

Apr 26, 2025

Latest Posts

-

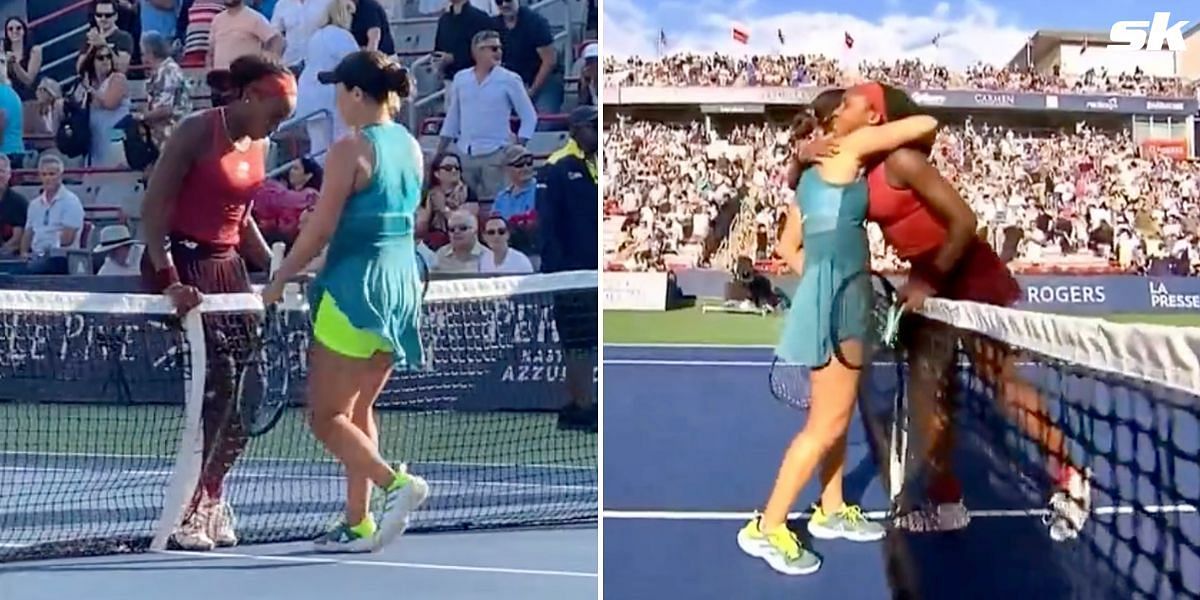

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025 -

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025 -

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025