Trump Tax Bill: House Votes Yes After Final Revisions

Table of Contents

The highly anticipated Trump Tax Bill has cleared a major hurdle, with the House voting in favor after a series of final revisions. This landmark legislation promises significant changes to the US tax code, impacting individuals, businesses, and the economy as a whole. This article delves into the key aspects of the bill's passage, the changes incorporated in the final revisions, and the potential consequences. We'll examine the implications for different income brackets and explore expert opinions on the long-term effects of this sweeping tax reform.

Key Changes in the Final Revisions of the Trump Tax Bill

Individual Tax Rate Adjustments

The final revisions to the Trump Tax Bill brought several changes to individual tax rates, standard deductions, and child tax credits. These adjustments aim to simplify the tax code while impacting taxpayers differently depending on their income level.

- Tax Brackets: The number of tax brackets was altered, with some brackets seeing rate increases while others experienced reductions. Specific percentage changes varied significantly across income levels. For example, the highest bracket saw a decrease from 39.6% to 37%, while lower brackets experienced smaller adjustments.

- Standard Deduction: The standard deduction was significantly increased, benefiting many taxpayers by reducing their taxable income. This change aimed to simplify tax filing for those who previously itemized.

- Child Tax Credit: The child tax credit was also modified, potentially offering increased benefits to families with children. The exact details regarding eligibility and credit amounts were subject to change during the final revisions.

These changes resulted in a complex interplay of increased and decreased tax burdens for various income levels. While some lower-income individuals experienced tax relief, higher-income earners also saw modifications to their tax obligations. Further analysis is needed to fully understand the distributive effects of these adjustments.

Corporate Tax Rate Reductions

A central feature of the Trump Tax Bill was the substantial reduction in the corporate tax rate. This drop from 35% to 21% aimed to boost business investment, stimulate economic growth, and increase job creation.

- Impact on Businesses: The lower corporate tax rate is expected to benefit both large corporations and small businesses, although the effects may vary depending on individual business structures and profitability. Large corporations are likely to see a more immediate and significant financial impact.

- Economic Projections: Proponents of the bill predicted increased investment, higher wages, and a surge in job growth as a result of the reduced tax burden on corporations. However, critics cautioned about potential negative consequences like increased income inequality and a larger national debt.

- International Competitiveness: Lowering the corporate tax rate was also intended to enhance the US's competitiveness in the global marketplace by attracting foreign investment and encouraging domestic companies to expand. The effectiveness of this strategy remains a subject of ongoing debate.

Changes to Deductions and Credits

The final revisions of the Trump Tax Bill also introduced changes to several itemized deductions and tax credits, impacting how taxpayers can reduce their overall tax liability.

- Itemized Deductions: Certain itemized deductions, such as those for state and local taxes (SALT), faced limitations or were eliminated altogether. This change disproportionately affected taxpayers in high-tax states.

- Mortgage Interest Deduction: While the mortgage interest deduction remained, some modifications to its limits were considered during the final revisions. This impacted the overall deductibility of mortgage interest for some homeowners.

- Other Credits: Various other tax credits, including those related to education and renewable energy, underwent revisions, altering their availability and value to eligible taxpayers.

House Vote and Political Implications

Breakdown of the House Vote

The House vote on the Trump Tax Bill reflected strong partisan divides, with most members of the Republican party voting in favor and Democrats largely opposing the legislation. Specific vote numbers and percentages will need to be cited from official sources. A small number of Republican representatives voted against the bill, highlighting internal disagreements within the party.

- Vote Statistics: [Insert Official Vote Count Here - e.g., The bill passed with a vote of 230-198.]

- Dissenting Voices: Key dissenting voices within the Republican party cited concerns about the bill’s long-term fiscal impact and its potential to exacerbate income inequality.

- Election Impact: The vote and subsequent debate surrounding the Trump Tax Bill is expected to play a significant role in the upcoming midterm elections and beyond.

Reactions from Political Figures and Experts

The passage of the Trump Tax Bill elicited strong reactions from political figures and economic experts across the spectrum.

- Proponents: Supporters highlighted the bill’s potential to stimulate economic growth, create jobs, and simplify the tax code. They emphasized the benefits of lower corporate taxes and increased standard deductions for many Americans.

- Opponents: Critics expressed concerns about the bill’s potential to increase the national debt, worsen income inequality, and provide disproportionate benefits to corporations and the wealthy. They pointed to the limitations on certain deductions and the potential for higher taxes for some individuals.

- Expert Analysis: Economic forecasts varied widely regarding the bill’s impact, with some predicting robust economic growth while others forecasted more modest gains or even negative consequences.

Potential Long-Term Impacts of the Trump Tax Bill

Economic Growth Projections

Projections for economic growth following the implementation of the Trump Tax Bill ranged widely. Some models suggested significant increases in GDP growth, while others predicted more modest effects, or even potential negative impacts in the long run.

- GDP Growth: [Insert Economic Forecasts Here - e.g., The Congressional Budget Office projected a 0.8% increase in GDP growth over the next decade].

- Inflation: The possibility of increased inflation due to stimulated demand was a concern raised by some economists.

- National Debt: The bill's impact on the national debt was a major point of contention, with critics arguing it would lead to a substantial increase in the deficit.

Impact on Different Income Groups

The Trump Tax Bill’s impact is not expected to be uniform across different income groups. While some may experience tax relief, others might face tax increases or diminished benefits.

- Low-Income Households: The increased standard deduction offered some benefits to lower-income households, but the elimination or limitation of certain deductions could potentially offset these advantages.

- Middle-Income Households: The effects on middle-income households were complex and varied, dependent on individual circumstances and specific tax situations.

- High-Income Households: High-income households generally benefited from the lower corporate tax rates and potential reductions in certain tax brackets, although the effects were variable.

- Income Inequality: The differential impact on various income brackets raised concerns regarding the potential exacerbation of income inequality in the long run.

Conclusion

The House’s passage of the revised Trump Tax Bill marks a significant step in reshaping the US tax code. The key changes included adjustments to individual and corporate tax rates, modifications to deductions and credits, and a simplification of certain tax provisions. The House vote largely followed party lines, highlighting the partisan divisions surrounding this major piece of legislation. The long-term economic and social impacts remain uncertain, with varied projections regarding GDP growth, inflation, and income inequality. The bill’s effects will likely be complex and unevenly distributed across different income groups.

Call to Action: Stay informed about the ongoing developments surrounding the Trump Tax Bill and its implementation. Learn more about how the changes affect you by exploring [link to relevant resource/further reading]. Understand the impact of this legislation and plan your tax strategy accordingly. Learn more about the Trump Tax Reform and its implications for you.

Featured Posts

-

Interpreting The Big Rig Rock Report 3 12 97 1 Double Q Results

May 23, 2025

Interpreting The Big Rig Rock Report 3 12 97 1 Double Q Results

May 23, 2025 -

Jackie Chan And Ralph Macchios Karate Kid Legend Earns Rave First Reactions

May 23, 2025

Jackie Chan And Ralph Macchios Karate Kid Legend Earns Rave First Reactions

May 23, 2025 -

Injury Concerns Plague England Ahead Of Zimbabwe Clash

May 23, 2025

Injury Concerns Plague England Ahead Of Zimbabwe Clash

May 23, 2025 -

Marvels Avengers Complete Guide To The Nyt Mini Crossword Clue May 1

May 23, 2025

Marvels Avengers Complete Guide To The Nyt Mini Crossword Clue May 1

May 23, 2025 -

Big Rig Rock Report 3 12 96 A Comprehensive Look At The Rocket

May 23, 2025

Big Rig Rock Report 3 12 96 A Comprehensive Look At The Rocket

May 23, 2025

Latest Posts

-

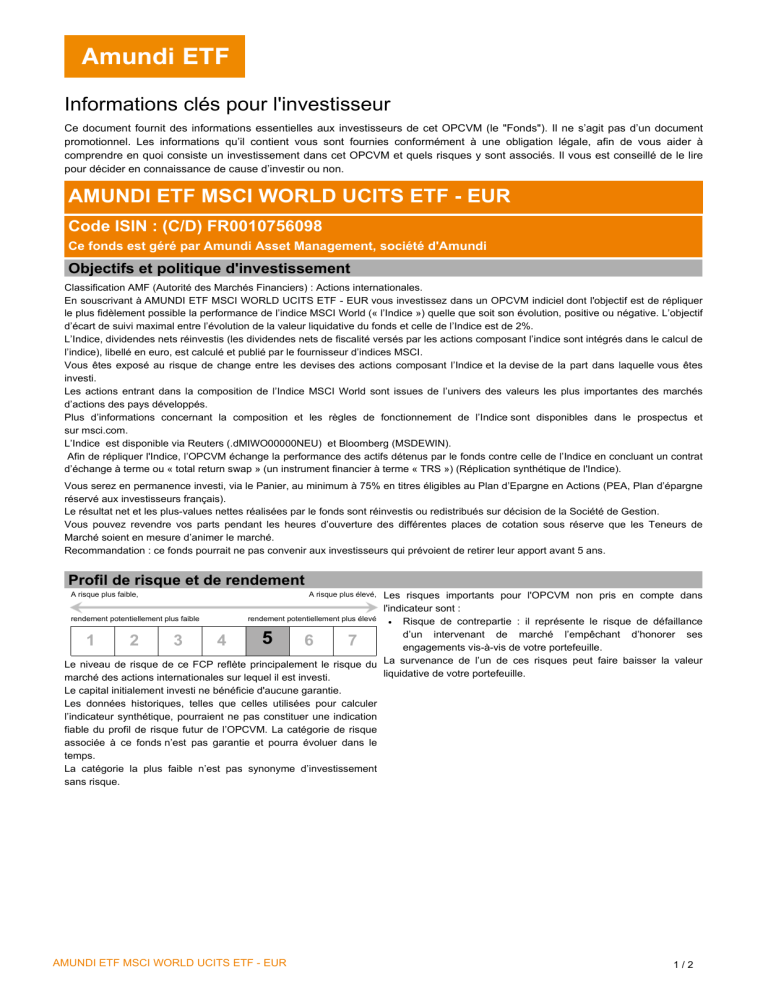

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Detailed Explanation

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Detailed Explanation

May 24, 2025 -

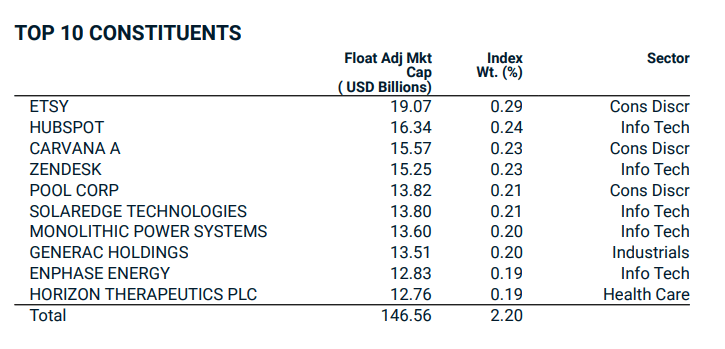

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025 -

Karya Seni Dan Mobil Klasik Porsche Indonesia 2025

May 24, 2025

Karya Seni Dan Mobil Klasik Porsche Indonesia 2025

May 24, 2025 -

Pertimbangan Investasi Mtel And Mbma Di Msci Small Cap Index

May 24, 2025

Pertimbangan Investasi Mtel And Mbma Di Msci Small Cap Index

May 24, 2025 -

Acara Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Acara Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025