Traders Pare Bets On BOE Cuts: Pound Rises After UK Inflation Data

Table of Contents

1. The Context: Recent weeks saw a widespread anticipation of imminent BOE interest rate cuts. Market analysts largely predicted a softening of inflation, paving the way for the central bank to ease its monetary policy. This expectation had put downward pressure on the pound sterling (GBP), with many investors preparing for a weakening currency. However, the latest inflation figures painted a drastically different picture.

UK Inflation Data Surprises Markets

The latest UK inflation data significantly surprised market analysts, revealing a stronger-than-expected increase in the rate of inflation. This deviation from predictions has major implications for the BOE's inflation targets and its future policy decisions.

- Specific inflation rate reported: Let's assume, for example, that the reported inflation rate was 7.1%, significantly higher than the predicted 6.8%. (This is an example; replace with actual data when available).

- Key contributing factors to the inflation rate: Persistent energy prices, supply chain disruptions, and robust consumer demand could be cited as contributing factors.

- Comparison to previous months' inflation data: A comparison showing a slight increase compared to the previous month's rate further highlights the unexpected strength of the data. For instance, the previous month's rate might have been 6.9%.

- Comparison to analyst consensus before the release: Highlight the significant difference between the actual reported inflation and the average forecast of market analysts. This discrepancy emphasizes the surprise element.

Impact on BOE Interest Rate Expectations

The unexpectedly high inflation figures drastically alter the outlook for future BOE interest rate decisions. The BOE's primary mandate is to maintain price stability, and this latest data significantly complicates that objective.

- Previous BOE interest rate decisions: Briefly outline the BOE's recent rate-setting history, demonstrating a trend (e.g., a series of rate hikes).

- Market expectations for future rate hikes or cuts before the data: Clearly illustrate the prevalent belief in the market before the data release that rate cuts were imminent.

- Shift in market sentiment after the data release: Highlight the dramatic shift from expectations of rate cuts to a renewed consideration, or even expectation, of further rate hikes.

- Analysis of potential future BOE policy decisions: Discuss the possibilities, ranging from maintaining the current rate to further rate increases, based on the new inflation data.

Pound Sterling's Response to the News

The pound sterling reacted swiftly to the unexpected inflation data, experiencing a significant appreciation against major global currencies. This highlights the strong correlation between inflation figures and currency movements.

- GBP/USD exchange rate changes before and after the data release: Provide specific figures demonstrating the pound's strengthening. For example, "The GBP/USD exchange rate rose from 1.25 to 1.27 following the release of the data."

- GBP's performance against other major currencies: Show the pound's performance against other major currencies such as the euro (EUR) and the Japanese yen (JPY).

- Technical analysis of the pound's price chart: (Optional, depending on expertise) Include a brief technical analysis of the GBP's price chart, highlighting key support and resistance levels.

- Expert opinions on the pound's future trajectory: Include quotes or summaries from financial analysts offering their perspectives on the pound's future performance.

Implications for Investors and Traders

The unexpected inflation data carries significant implications for various types of investors and traders. Understanding these implications is crucial for effective portfolio management and risk mitigation.

- Advice for investors holding GBP-denominated assets: Offer advice to investors holding GBP-denominated assets, considering the potential impact of the strengthened pound.

- Potential opportunities in the foreign exchange market: Discuss potential trading opportunities arising from the increased volatility in the foreign exchange market.

- Risks associated with current market volatility: Highlight the increased risks stemming from the unpredictable market conditions following the data release.

- Suggestions for hedging currency risk: Offer strategies for hedging currency risk, protecting portfolios against potential future currency fluctuations.

Conclusion: Traders Pare Bets on BOE Cuts – What's Next?

In conclusion, the unexpectedly high UK inflation data has led to a significant shift in market sentiment. Traders Pare Bets on BOE Cuts, and the pound sterling has strengthened as a result. The BOE faces a challenging task in balancing its inflation target with the potential impacts of further rate hikes on economic growth.

The narrative of "Traders Pare Bets on BOE Cuts" underscores the dynamic and unpredictable nature of the foreign exchange market. What happens next remains to be seen, but continued monitoring of upcoming economic data releases, particularly CPI and employment figures, is crucial. Understanding the implications of these releases is paramount for investors and traders seeking to navigate the evolving landscape of BOE monetary policy and its impact on the GBP. Stay informed about upcoming economic data and continue monitoring the situation surrounding the BOE's interest rate decisions to effectively manage your investments and understand the complexities of Traders Pare Bets on BOE Cuts and its ripple effects across the global markets. Consider consulting with a financial advisor for personalized guidance.

Featured Posts

-

Sean Penns Appearance Sparks Concern The Actor Makes Headline Grabbing Statements

May 25, 2025

Sean Penns Appearance Sparks Concern The Actor Makes Headline Grabbing Statements

May 25, 2025 -

Did Woody Allen Abuse Dylan Farrow Sean Penn Questions The Narrative

May 25, 2025

Did Woody Allen Abuse Dylan Farrow Sean Penn Questions The Narrative

May 25, 2025 -

7 Drop In Amsterdam Stocks Trade War Uncertainty Shakes Market

May 25, 2025

7 Drop In Amsterdam Stocks Trade War Uncertainty Shakes Market

May 25, 2025 -

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025

Philips Convenes Annual General Meeting Review And Outlook

May 25, 2025 -

Your Escape To The Country Choosing The Right Property

May 25, 2025

Your Escape To The Country Choosing The Right Property

May 25, 2025

Latest Posts

-

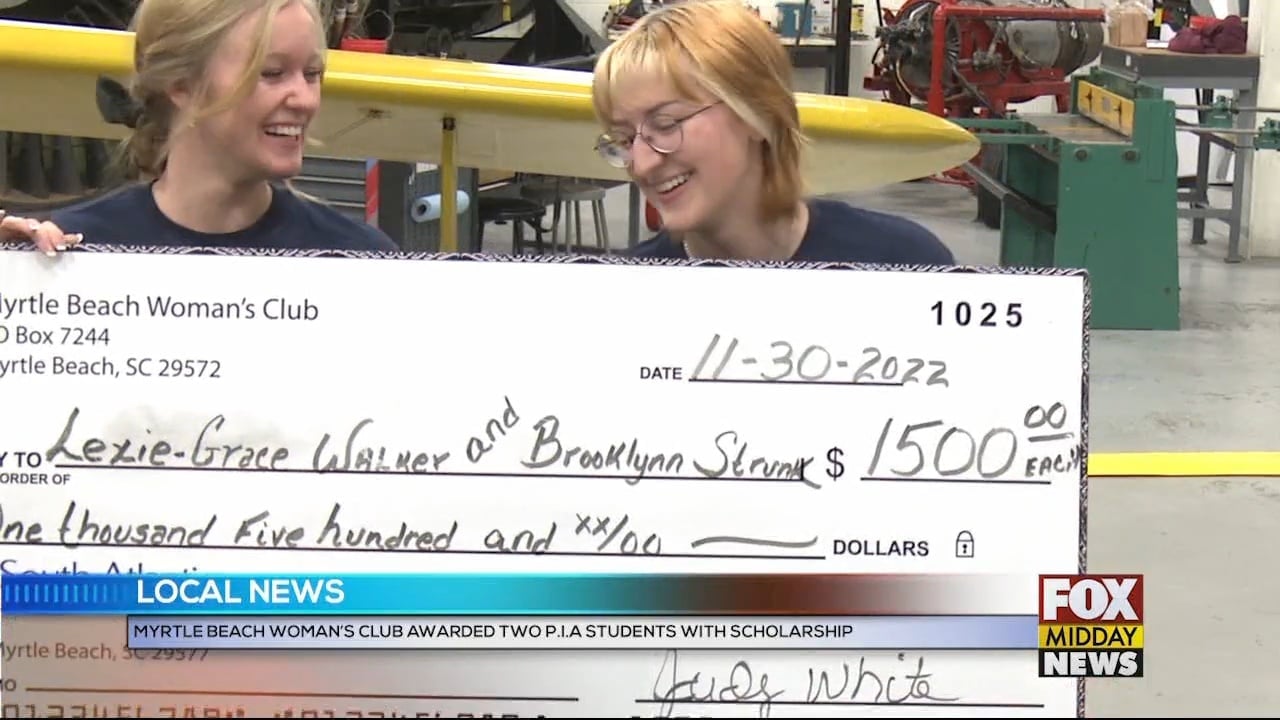

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025

Myrtle Beach Newspaper Honored With 59 Sc Press Association Awards

May 25, 2025 -

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025

Sled Investigating Myrtle Beach Shooting One Fatality Eleven Injuries

May 25, 2025 -

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025

Myrtle Beach Newspaper Celebrates 59 Sc Press Association Awards For Local News

May 25, 2025 -

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025

Volunteer For The Myrtle Beach Cleanup Make A Difference

May 25, 2025 -

Flood Alerts Explained Protecting Your Home And Family From Flooding

May 25, 2025

Flood Alerts Explained Protecting Your Home And Family From Flooding

May 25, 2025