7% Drop In Amsterdam Stocks: Trade War Uncertainty Shakes Market

Table of Contents

The Amsterdam stock market experienced a dramatic 7% drop today, sending shockwaves through the financial world. This significant decline is largely attributed to growing uncertainty surrounding the escalating global trade war. This article delves into the factors contributing to this sharp fall, analyzes the impacted sectors, and explores potential future implications for investors in the Amsterdam exchange (AEX).

Trade War Uncertainty as the Primary Culprit

The current global trade landscape is fraught with tension, largely fueled by escalating tariffs and protectionist policies. This uncertainty directly impacts the Dutch economy, heavily reliant on international trade and export-oriented industries. The Netherlands, a key player in global supply chains, is particularly vulnerable to disruptions caused by trade wars.

- Rising tariffs impacting Dutch exports: Increased tariffs on Dutch agricultural products (like flowers and dairy) and high-tech exports are significantly reducing competitiveness in global markets.

- Reduced consumer confidence due to trade war anxieties: The ongoing uncertainty surrounding trade policies is impacting consumer confidence, leading to decreased spending and impacting domestic demand.

- Uncertainty affecting investment decisions and business growth in the Netherlands: Businesses are delaying investments and expansion plans due to the unpredictable nature of the trade environment, hindering economic growth.

- Geopolitical risks linked to the trade war impacting investor sentiment: The broader geopolitical implications of the trade war, including potential retaliatory measures and escalation, further contribute to negative investor sentiment.

For example, [link to relevant news article about tariff impact on Dutch flower exports] details the impact of tariffs on Dutch flower exporters, a crucial sector of the Dutch economy. Similarly, [link to relevant news article about tariff impact on Dutch tech companies] highlights the challenges faced by Dutch tech companies due to increased trade barriers.

Sectors Most Affected by the Amsterdam Stock Market Drop

The 7% drop in Amsterdam stocks wasn't uniform across all sectors. Some industries felt the impact more acutely than others.

- Technology: The technology sector, highly reliant on global supply chains and international trade, experienced a significant downturn, with a reported [Insert Percentage]% drop. Companies heavily involved in semiconductor manufacturing and software exports were particularly hard hit. For instance, [Company Name] saw its stock price fall by [Percentage]%. [Link to relevant stock performance data].

- Agriculture: The agricultural sector, a cornerstone of the Dutch economy, faced a substantial [Insert Percentage]% decline. Increased tariffs on agricultural exports and disrupted supply chains contributed to this drop. [Company Name], a major player in [Specific agricultural product], saw a [Percentage]% decrease in its stock value. [Link to relevant stock performance data].

- Manufacturing: The manufacturing sector, also heavily reliant on international trade, experienced a [Insert Percentage]% decline, reflecting the challenges posed by trade barriers and reduced global demand. Companies specializing in export-oriented manufacturing were particularly vulnerable.

Investor Reactions and Market Volatility

The sharp decline in Amsterdam stocks triggered a wave of selling amongst investors, leading to increased market volatility. Investors are reacting by:

- Increased volatility in the AEX index: The AEX index, a key indicator of the Amsterdam stock market, experienced heightened volatility, reflecting the uncertainty and anxiety in the market.

- Shifts in investment strategies: Investors are shifting their portfolios towards less volatile assets, seeking to minimize risk in this uncertain environment.

- Potential flight to safety: Many investors are seeking safety in assets like gold and government bonds, considered safe havens during times of economic uncertainty.

- Analyst comments and predictions about future market behavior: Analysts are divided on the future trajectory of the Amsterdam stock market, with some predicting a further decline while others anticipate a recovery, contingent on the resolution of trade tensions.

Potential Long-Term Implications for the Dutch Economy

The ongoing trade war uncertainty poses significant long-term risks for the Dutch economy. Depending on the duration and intensity of the trade conflict, several scenarios are possible:

- Impacts on GDP growth: Continued trade disruptions could lead to a slowdown in GDP growth, potentially impacting job creation and overall economic prosperity.

- Unemployment concerns: Reduced business activity and decreased exports could lead to job losses across various sectors, particularly those heavily reliant on international trade.

- Government response and potential policy changes: The Dutch government might implement various policy measures to mitigate the negative impacts of the trade war, such as providing support to affected businesses and investing in diversification strategies.

- Predictions for the recovery of the Amsterdam stock market: The recovery of the Amsterdam stock market will largely depend on the resolution of trade tensions and a return to greater certainty in global markets.

Conclusion:

The 7% drop in Amsterdam stocks underscores the significant impact of global trade war uncertainty on even relatively stable economies like the Netherlands. The decline highlights the vulnerability of specific sectors and the jittery response of investors to geopolitical risks. Understanding these factors is crucial for navigating the current market climate.

Call to Action: Stay informed about the evolving trade war situation and its impact on the Amsterdam stock market. Monitor the AEX index, follow key companies, and consult with financial advisors to make informed investment decisions in the face of this 7% drop in Amsterdam stocks and ongoing trade war uncertainty. #AmsterdamStockMarket #TradeWarImpact #InvestmentStrategy

Featured Posts

-

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 25, 2025

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 25, 2025 -

Is A Us Band Playing Glastonbury Fans Speculate After Online Clues

May 25, 2025

Is A Us Band Playing Glastonbury Fans Speculate After Online Clues

May 25, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 25, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 25, 2025 -

Escape To The Country Balancing Rural Life With Modern Comforts

May 25, 2025

Escape To The Country Balancing Rural Life With Modern Comforts

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Nav Deep Dive

May 25, 2025

Latest Posts

-

The Thames Water Executive Bonus Scandal A Detailed Analysis

May 25, 2025

The Thames Water Executive Bonus Scandal A Detailed Analysis

May 25, 2025 -

Thames Waters Executive Pay Scrutiny And Public Outrage

May 25, 2025

Thames Waters Executive Pay Scrutiny And Public Outrage

May 25, 2025 -

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025

The 3 Billion Question Understanding Sses Spending Reduction Strategy

May 25, 2025 -

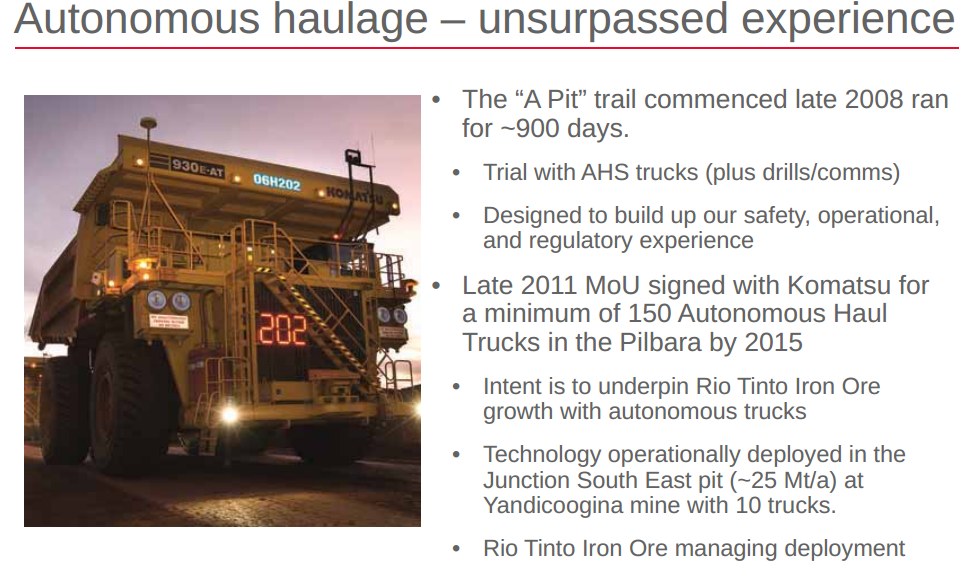

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025

Pilbaras Future Rio Tintos Response To Environmental Concerns Raised By Andrew Forrest

May 25, 2025 -

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025

Andrew Forrests Pilbara Claims Rio Tintos Defence And Environmental Strategy

May 25, 2025