Trade War Uncertainty: Amsterdam Stock Market Falls 7% At Open

Table of Contents

Causes of the Amsterdam Stock Market Fall

The sharp decline in the Amsterdam Stock Market is attributable to a confluence of factors, primarily stemming from escalating trade tensions and broader global market anxieties.

Escalating Trade Tensions

The ongoing US-China trade war, coupled with the lingering uncertainties surrounding Brexit, are major drivers of the market's downturn. These trade disputes create significant ripple effects, impacting global supply chains and investor confidence.

- Specific Trade Actions: The imposition of tariffs on various goods between the US and China, along with the retaliatory measures taken by both sides, has led to increased costs for businesses and reduced consumer demand. Brexit, despite its completion, continues to create uncertainty for businesses trading between the UK and the Netherlands.

- Impact on Dutch Businesses: Dutch businesses, particularly those in the technology and agricultural sectors, are significantly impacted. The Netherlands, a major trading hub, is heavily reliant on international trade. Statistics reveal a substantial decrease in trade volume between the Netherlands and key trading partners involved in these conflicts. For example, exports of Dutch agricultural products to China have fallen by X% in the last quarter.

- Global Economic Impact: The trade war uncertainty is not limited to bilateral relationships. It undermines global economic growth, leading to decreased investment and reduced consumer spending worldwide.

Global Market Sentiment

The Amsterdam Stock Market's fall is not an isolated incident. Similar declines have been observed in other major stock markets, including the Dow Jones and FTSE. This reflects a broader global market sentiment characterized by increasing fear and risk aversion.

- Contagion Effect: Market declines in one major economy often trigger a contagion effect, impacting other markets globally. The uncertainty surrounding trade policies increases volatility and makes investors hesitant to commit capital.

- Investor Fear and Risk Aversion: Investors are increasingly moving towards safer assets, like government bonds, thereby reducing investment in riskier assets, such as stocks. This flight to safety further exacerbates the market downturn.

- Expert Opinion: [Insert quote from a financial expert on the current market sentiment and its impact on the Amsterdam Stock Market].

Impact of Brexit Uncertainty

While Brexit is technically complete, its lingering effects continue to ripple through the Amsterdam Stock Market. The shift of trading activity from London to Amsterdam, while initially beneficial, presents new challenges and uncertainties.

- Shift in Trading Activity: Amsterdam benefited from a significant influx of trading activity after Brexit, but this shift created new regulatory and infrastructural demands.

- Uncertain Future: The long-term implications of Brexit on the EU-UK relationship remain unclear, potentially impacting trade flows and investor sentiment regarding the Amsterdam Stock Market.

Consequences of the Drop for the Amsterdam Stock Market

The 7% drop in the Amsterdam Stock Market has far-reaching consequences, impacting investor confidence, the Dutch economy, and necessitating government intervention.

Investor Confidence and Volatility

The market fall has significantly eroded investor confidence, leading to increased market volatility. This makes it harder for businesses to raise capital and increases uncertainty for both long-term and short-term investors.

- Short-Term Effects: Short-term investors are likely to withdraw their investments, leading to further price drops.

- Long-Term Effects: Prolonged uncertainty may deter long-term investors and reduce foreign direct investment (FDI) in the Netherlands.

- Impact on FDI: Reduced investor confidence can lead to a decrease in foreign direct investment, negatively impacting economic growth.

Economic Impact on the Netherlands

The Amsterdam Stock Market decline reflects broader economic concerns impacting the Netherlands. The ripple effects can be felt across various sectors, affecting GDP, employment, and consumer confidence.

- GDP Impact: The fall can lead to a decrease in GDP growth as business investment slows down and consumer spending declines.

- Employment Concerns: Reduced business activity can lead to job losses in affected sectors.

- Consumer Confidence: Market volatility and economic uncertainty erode consumer confidence, further impacting spending and economic growth.

Government Response and Mitigation Strategies

The Dutch government is likely to take measures to mitigate the negative consequences of the market downturn and bolster investor confidence.

- Economic Stimulus Packages: The government might introduce economic stimulus packages to boost economic activity.

- Supportive Policies: Supportive policies aimed at stimulating business investment and supporting affected sectors are expected.

- Investor Confidence Measures: The government might announce measures to reassure investors about the stability and resilience of the Dutch economy.

Strategies for Navigating the Amsterdam Stock Market Uncertainty

Navigating the current uncertainty requires a cautious yet proactive approach to investing.

Diversification and Risk Management

Diversifying investment portfolios across different asset classes is crucial to mitigate risks.

- Asset Class Diversification: Investing in a mix of assets like stocks, bonds, real estate, and commodities reduces the impact of market volatility on the overall portfolio.

- Risk Management Strategies: Utilizing risk management strategies, such as hedging, can help to protect against potential losses.

Long-Term Investment Approach

Instead of reacting to short-term market fluctuations, adopting a long-term investment approach is recommended.

- Long-Term Perspective: A long-term investment strategy allows investors to ride out short-term market downturns and benefit from long-term growth.

- Fundamental Analysis: Focusing on fundamental analysis helps investors make informed decisions based on a company's intrinsic value, rather than reacting to market sentiment.

Monitoring Economic Indicators

Staying informed about key economic indicators is essential for informed decision-making.

- Key Indicators: Monitor indicators such as inflation, unemployment rates, GDP growth, and consumer confidence.

- Reliable Sources: Utilize reliable sources for economic data, such as the Central Bank of the Netherlands and international organizations.

Conclusion

The 7% fall in the Amsterdam Stock Market at its open, driven by trade war uncertainty, serves as a stark reminder of the interconnectedness of global markets and the significant impact of geopolitical events. While the short-term outlook may be uncertain, focusing on diversification, long-term investment strategies, and careful monitoring of economic indicators will help investors navigate the challenges presented by this period of volatility in the Amsterdam Stock Market. Understanding the factors affecting the Amsterdam Stock Market is crucial for informed decision-making. Stay informed and adapt your investment strategy accordingly to minimize risks and capitalize on opportunities in the ever-changing landscape of the Amsterdam Stock Market. Consult with a financial advisor to create a personalized strategy for navigating the Amsterdam Stock Market effectively.

Featured Posts

-

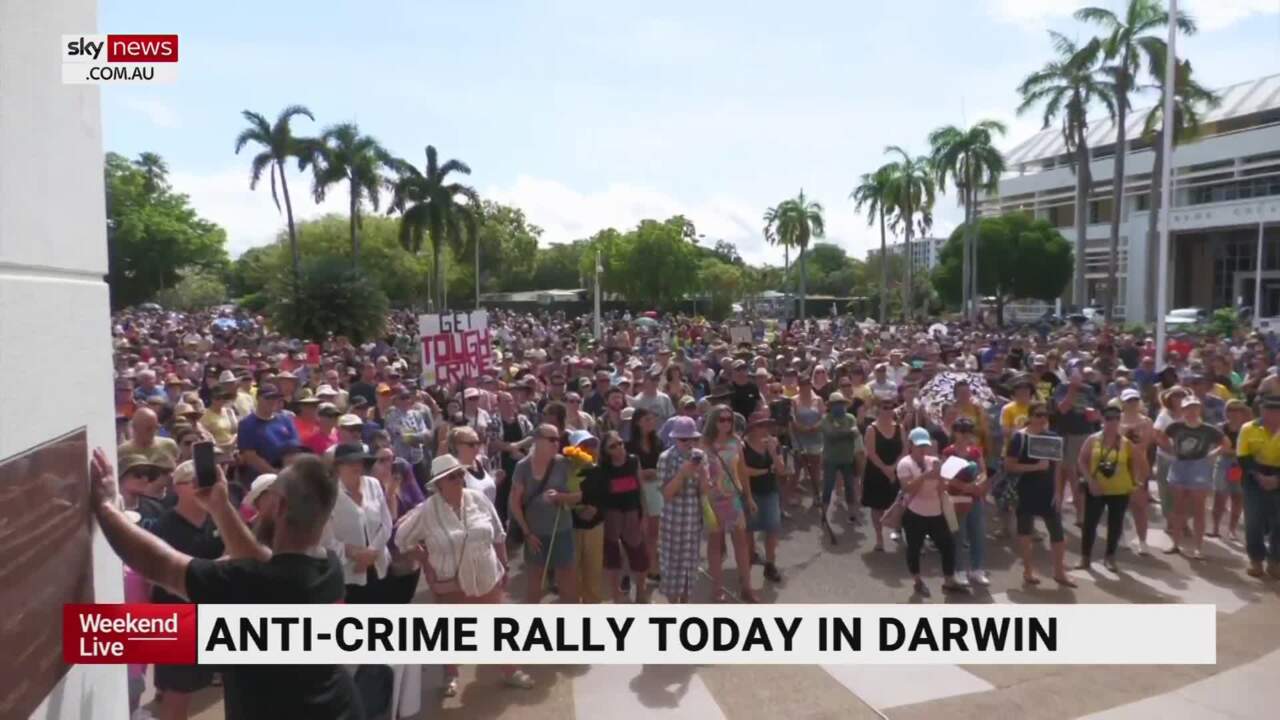

Darwin Shop Owner Stabbed To Death Teenager In Custody Following Nightcliff Incident

May 25, 2025

Darwin Shop Owner Stabbed To Death Teenager In Custody Following Nightcliff Incident

May 25, 2025 -

Demnas Vision Reimagining The Gucci Brand

May 25, 2025

Demnas Vision Reimagining The Gucci Brand

May 25, 2025 -

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 25, 2025

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 25, 2025 -

Frankfurt Stock Market Update Dax Climbs Record Within Reach

May 25, 2025

Frankfurt Stock Market Update Dax Climbs Record Within Reach

May 25, 2025 -

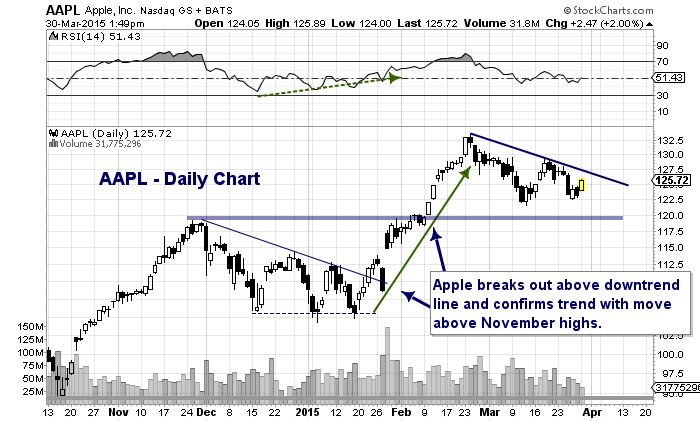

Investing In Apple Aapl Understanding Key Price Levels For Informed Decisions

May 25, 2025

Investing In Apple Aapl Understanding Key Price Levels For Informed Decisions

May 25, 2025

Latest Posts

-

Rising Rental Costs After La Fires Accusations Of Price Gouging

May 25, 2025

Rising Rental Costs After La Fires Accusations Of Price Gouging

May 25, 2025 -

Future Of Activision Blizzard Ftc Challenges Microsoft Merger

May 25, 2025

Future Of Activision Blizzard Ftc Challenges Microsoft Merger

May 25, 2025 -

La Fire Victims Face Price Gouging A Reality Tv Stars Account

May 25, 2025

La Fire Victims Face Price Gouging A Reality Tv Stars Account

May 25, 2025 -

Ftc To Appeal Microsofts Activision Blizzard Acquisition Faces Setback

May 25, 2025

Ftc To Appeal Microsofts Activision Blizzard Acquisition Faces Setback

May 25, 2025 -

Wga And Sag Aftra Strike What It Means For Hollywood

May 25, 2025

Wga And Sag Aftra Strike What It Means For Hollywood

May 25, 2025