Investing In Apple (AAPL): Understanding Key Price Levels For Informed Decisions

Table of Contents

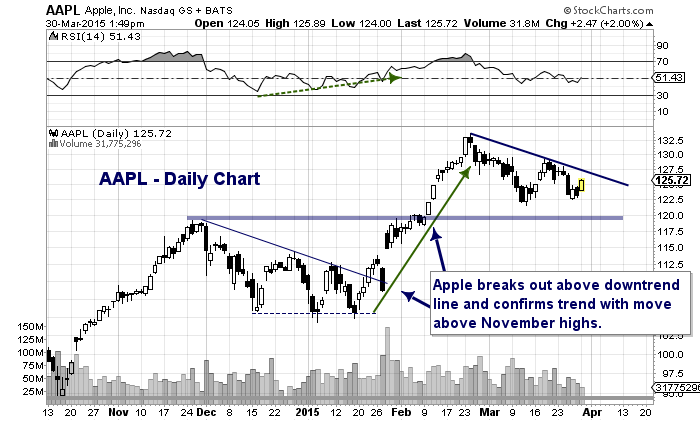

Identifying Key Support and Resistance Levels in AAPL Stock

What are Support and Resistance Levels?

Support and resistance levels are crucial price points in stock trading. Support levels represent a price range where buying pressure is strong enough to prevent further price declines. Conversely, resistance levels indicate price ranges where selling pressure overwhelms buying pressure, hindering further price increases. These levels are formed through the interplay of supply and demand. When the price approaches a support level, buyers tend to step in, preventing a significant drop. Conversely, when the price approaches resistance, sellers become more active, preventing a significant rise.

- Formation: Support and resistance levels are typically formed by observing past price action. Highs and lows create visual boundaries on charts.

- Importance: Identifying these levels allows investors to anticipate potential price reversals and adjust their Apple investment strategies accordingly.

- AAPL Examples: Historically, AAPL has shown strong support around $100 and resistance around $180 (these levels are subject to change and should be validated with current chart analysis).

Technical Analysis for Identifying Key Levels

Technical analysis uses charts and indicators to predict future price movements. For AAPL stock analysis, several tools prove invaluable:

- Charts: Candlestick and line charts visually represent price action, making support and resistance identification easier.

- Trendlines: Drawing trendlines connecting consecutive highs or lows helps visualize the overall trend. Uptrends often encounter resistance at the upper trendline, while downtrends may find support at the lower trendline.

- Moving Averages: Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations, highlighting potential support and resistance zones. Crossovers of moving averages can signal potential trend changes.

- Fibonacci Retracements and Extensions: These tools, based on the Fibonacci sequence, help predict potential price reversal points after a significant price move.

- Indicators: RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) can confirm support and resistance levels by indicating overbought or oversold conditions.

Practical Application: Finding Support and Resistance in AAPL's Current Chart

To find current support and resistance levels for AAPL, follow these steps:

- Access a reliable charting platform (TradingView, Yahoo Finance, etc.).

- Select the AAPL chart and choose a timeframe (daily, weekly, etc.).

- Visually identify significant highs and lows on the chart. These are your potential resistance and support levels.

- Draw trendlines and use moving averages to confirm these levels.

- Apply Fibonacci retracements to gauge potential reversal points.

- Use indicators like RSI and MACD to confirm the strength of support and resistance.

Interpreting the current AAPL chart data requires practice and experience. Consider multiple timeframes to get a comprehensive picture. For example, strong support on a daily chart might be weaker on a weekly chart.

Fundamental Analysis of Apple (AAPL) for Informed Investment Decisions

Fundamental analysis focuses on a company's intrinsic value. For AAPL, this involves examining its financial health and market position.

Evaluating Apple's Financial Health

- Financial Statements: Analyze Apple's income statement, balance sheet, and cash flow statement to assess profitability, liquidity, and solvency.

- Key Ratios: Examine the P/E ratio (Price-to-Earnings), ROE (Return on Equity), and debt-to-equity ratio to understand Apple's financial performance and risk.

- Growth Potential: Analyze Apple's revenue and earnings growth over time to project future performance. Consider the impact of new product releases and technological advancements.

Assessing Market Position and Competitive Landscape

- Market Share: Evaluate Apple's market share in its key markets (smartphones, wearables, etc.).

- Competitive Advantages: Identify Apple's competitive advantages (brand strength, ecosystem, innovation).

- Competitive Landscape: Assess the threats posed by competitors like Samsung, Google, and others. Consider the impact of emerging technologies.

Integrating Fundamental and Technical Analysis for AAPL

Combining fundamental and technical analysis provides a more complete picture. Strong fundamentals support higher price targets, while technical analysis helps time entry and exit points. Discrepancies between the two analyses warrant further investigation. For instance, strong fundamentals might suggest a buy, but bearish technical indicators could suggest waiting for a better entry point.

Risk Management and Investment Strategies for AAPL

Investing in any stock involves risk. Effective risk management is crucial.

Diversification and Portfolio Allocation

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes and stocks.

- Portfolio Allocation: Allocate capital based on your risk tolerance and investment goals. A higher risk tolerance might allow for a larger allocation to AAPL.

Setting Stop-Loss Orders

- Stop-Loss Orders: These orders automatically sell your shares when the price drops to a predetermined level, limiting potential losses.

- Setting Stop-Loss Levels: Set stop-loss levels slightly below support levels, based on your risk tolerance.

Long-Term vs. Short-Term Investment Strategies for AAPL

- Long-Term Investing: This strategy focuses on holding AAPL for several years, benefiting from long-term growth.

- Short-Term Investing: This strategy involves trading AAPL based on short-term price movements, aiming for quicker gains. This strategy carries higher risk.

Conclusion

Understanding key price levels is crucial for successful investing in Apple (AAPL). By combining technical analysis to identify support and resistance levels with fundamental analysis of Apple’s financial health and market position, investors can make more informed buy and sell decisions. Remember to always implement effective risk management strategies, including diversification and stop-loss orders. Start making smarter investment choices today by mastering these key price levels in your Apple (AAPL) investment strategy. Learn more about effectively using AAPL stock price levels for profitable trading.

Featured Posts

-

Snl Afterparty Lady Gagas Romantic Arrival With Michael Polansky

May 25, 2025

Snl Afterparty Lady Gagas Romantic Arrival With Michael Polansky

May 25, 2025 -

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 25, 2025

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 25, 2025 -

Sean Penn Challenges Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025

Sean Penn Challenges Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025 -

Amsterdam Stock Exchange 7 Plunge At Open Reflects Growing Trade War Anxiety

May 25, 2025

Amsterdam Stock Exchange 7 Plunge At Open Reflects Growing Trade War Anxiety

May 25, 2025 -

England Airpark And Alexandria International Airports Ae Xplore Your Gateway To Local And Global Destinations

May 25, 2025

England Airpark And Alexandria International Airports Ae Xplore Your Gateway To Local And Global Destinations

May 25, 2025

Latest Posts

-

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 25, 2025

The Rise And Fall Of Black Lives Matter Plaza A Washington D C Story

May 25, 2025 -

Trumps Legal Fight Against Elite Law Firms Another Court Loss

May 25, 2025

Trumps Legal Fight Against Elite Law Firms Another Court Loss

May 25, 2025 -

Significant Development Trumps Decision On The Nippon U S Steel Deal

May 25, 2025

Significant Development Trumps Decision On The Nippon U S Steel Deal

May 25, 2025 -

Hair Trimmers Used In New Orleans Jail Escape Plot Louisiana Inmate Attempt

May 25, 2025

Hair Trimmers Used In New Orleans Jail Escape Plot Louisiana Inmate Attempt

May 25, 2025 -

Buy And Holds Gut Check A Realistic Look At Long Term Growth

May 25, 2025

Buy And Holds Gut Check A Realistic Look At Long Term Growth

May 25, 2025