DAX Falls Below 24,000: Frankfurt Stock Market Losses

Table of Contents

Factors Contributing to the DAX Decline

Several interconnected factors have contributed to the recent DAX decline and the resulting Frankfurt Stock Market losses. Understanding these elements is crucial to grasping the current market volatility.

Rising Inflation and Interest Rates

The persistent rise in inflation across Europe has forced the European Central Bank (ECB) to implement a series of aggressive interest rate hikes. This monetary policy tightening, while aimed at curbing inflation, has significant repercussions for the DAX and the German stock market.

- Higher borrowing costs impacting businesses: Increased interest rates make it more expensive for companies to borrow money, hindering investment in expansion and potentially impacting profitability.

- Reduced consumer spending: Higher interest rates translate to increased borrowing costs for consumers, leading to reduced discretionary spending and dampening demand.

- Decreased corporate profits: A combination of reduced demand and higher borrowing costs squeezes corporate profit margins, impacting stock valuations.

- Investor uncertainty: The uncertainty surrounding future inflation and interest rate movements leads to risk-averse investor behavior, fueling market declines.

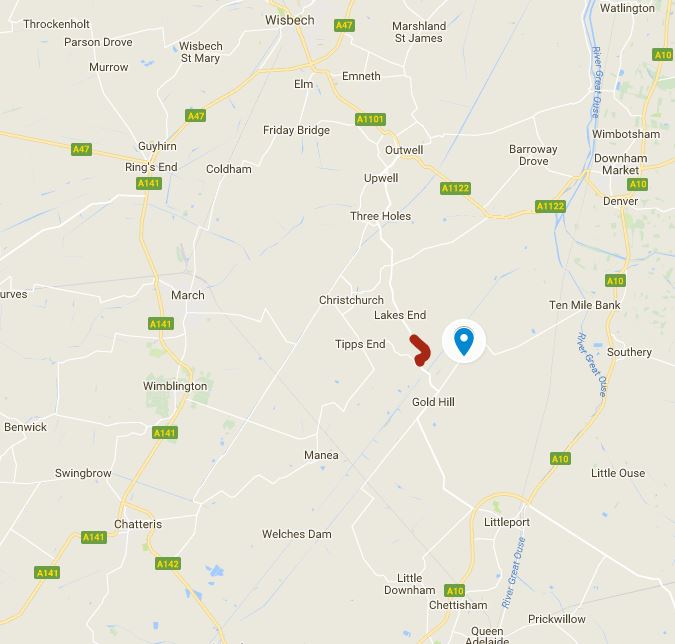

Geopolitical Instability

Ongoing geopolitical tensions, particularly the war in Ukraine and the resulting energy crisis, significantly impact investor sentiment and contribute to market volatility.

- Energy price volatility: The war in Ukraine has created significant uncertainty in global energy markets, leading to volatile energy prices and impacting energy-intensive German industries.

- Supply chain disruptions: The conflict continues to disrupt global supply chains, impacting manufacturing and causing shortages in various sectors.

- Uncertainty about future economic growth: Geopolitical instability creates uncertainty regarding future economic growth, prompting investors to adopt a more cautious approach.

- Risk-averse investor behavior: In times of geopolitical uncertainty, investors tend to move towards safer assets, leading to capital outflows from riskier investments like stocks.

Global Economic Slowdown

Concerns about a potential global recession are further contributing to the DAX decline. A slowdown in global economic activity negatively impacts the export-oriented German economy.

- Reduced export demand: A global recession reduces demand for German goods and services, directly affecting German companies’ performance.

- Decreased industrial production: Weakening global demand leads to reduced industrial production in Germany, impacting employment and corporate profits.

- Weakening consumer confidence: Concerns about a global recession decrease consumer confidence, resulting in reduced spending and impacting domestic demand.

- Negative investor outlook: The prospect of a global recession creates a negative investor outlook, leading to further selling pressure on the DAX.

Impact of the DAX Decline on the German Economy

The fall in the DAX has widespread repercussions for the German economy, impacting businesses, consumers, and ultimately requiring a policy response from the government.

Effects on Businesses and Investments

The falling DAX directly affects corporate valuations, making it more challenging for businesses to secure funding and impacting investment decisions.

- Reduced access to capital: A declining stock market makes it more difficult for companies to raise capital through equity financing.

- Decreased investment in new projects: Uncertainty in the market discourages investment in new projects and expansion plans.

- Potential job losses: Economic slowdowns often lead to cost-cutting measures, potentially resulting in job losses.

- Impact on small and medium-sized enterprises (SMEs): SMEs, which form the backbone of the German economy, are particularly vulnerable to economic downturns.

Consequences for Consumers

The decline in the DAX has a ripple effect on consumers, impacting their purchasing power, savings, and overall economic well-being.

- Decreased purchasing power: Economic uncertainty and potential job losses can decrease consumer purchasing power.

- Potential wage stagnation: Economic downturns often lead to wage stagnation or even wage cuts in some sectors.

- Reduced job security: A weakening economy increases job insecurity, impacting consumer confidence and spending.

- Consumer uncertainty: The overall uncertainty surrounding the economic outlook creates anxiety and reduces consumer spending.

Government Response and Policy Implications

The German government will likely implement measures to mitigate the negative impacts of the DAX fall on the economy.

- Fiscal stimulus packages: The government might introduce fiscal stimulus packages to boost economic activity.

- Monetary policy adjustments: Coordination with the ECB on monetary policy adjustments may be necessary.

- Support for businesses and consumers: Direct support for businesses and consumers through subsidies or tax breaks could be implemented.

- Long-term economic strategies: The government may need to review and adjust long-term economic strategies to address the underlying challenges.

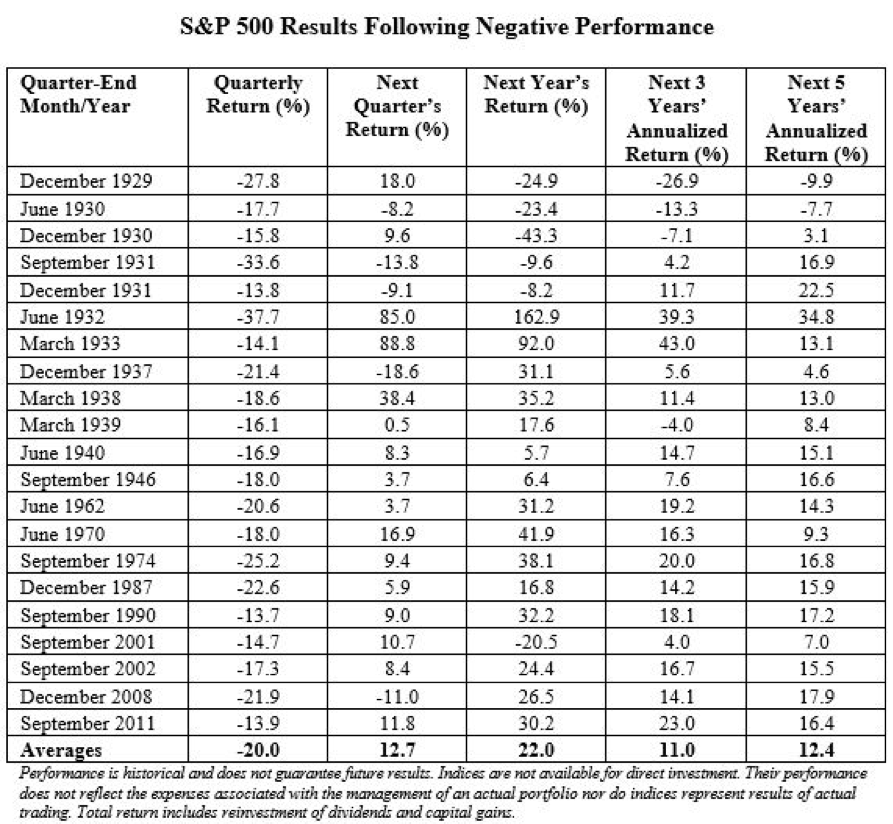

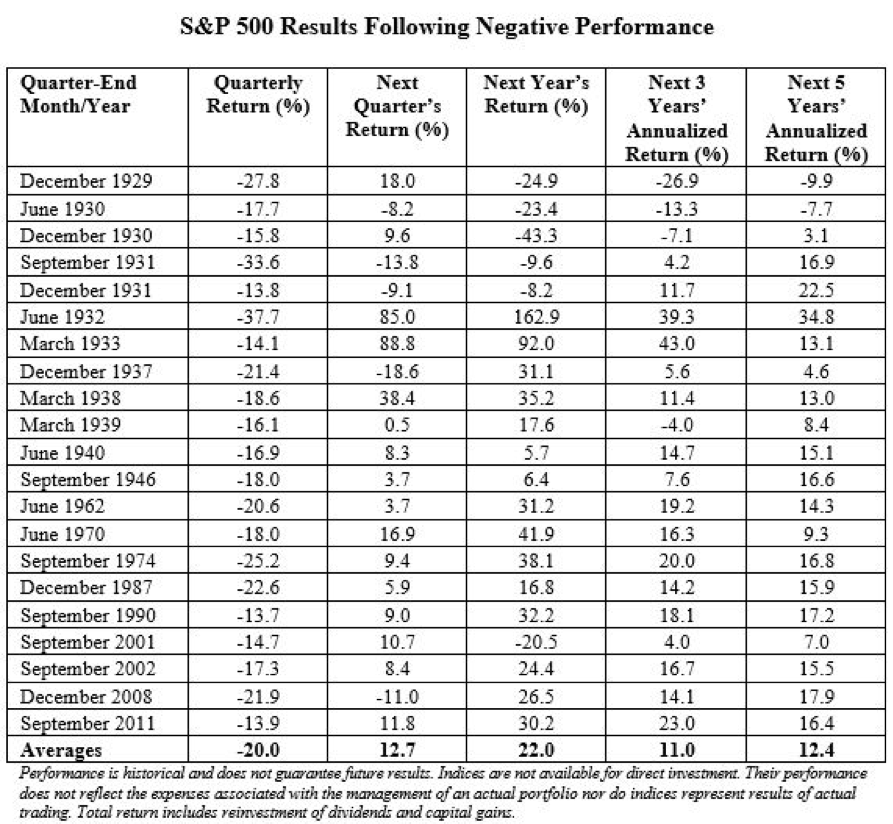

Future Outlook and Market Predictions for the DAX

Predicting the future trajectory of the DAX is challenging, but analyzing analyst forecasts and implementing sound investment strategies is crucial.

Analyst Forecasts and Expert Opinions

Financial analysts offer varied predictions regarding the DAX’s future performance.

- Short-term and long-term forecasts: Short-term forecasts vary widely, reflecting the uncertainty in the market. Long-term forecasts often depend on resolving geopolitical issues and managing inflation.

- Potential recovery scenarios: Several scenarios are possible, ranging from a quick recovery to a prolonged period of low growth.

- Factors influencing future market performance: Key factors influencing future performance include inflation, interest rates, geopolitical stability, and global economic growth.

- Uncertainty levels: High uncertainty levels currently prevail, making precise predictions challenging.

Investment Strategies and Risk Management

Given the current market conditions, investors should adopt prudent investment strategies.

- Diversification: Diversifying investments across different asset classes is crucial to mitigate risk.

- Risk tolerance assessment: Investors should carefully assess their risk tolerance before making any investment decisions.

- Long-term investment horizon: A long-term investment horizon can help mitigate short-term market fluctuations.

- Seeking professional financial advice: Consulting a qualified financial advisor is recommended to develop a personalized investment strategy.

Conclusion

The DAX's fall below 24,000 reflects a confluence of factors, including rising inflation, geopolitical instability, and concerns about a global economic slowdown. This decline has significant implications for the German economy, impacting businesses, consumers, and requiring a policy response from the government. The future outlook for the DAX remains uncertain, highlighting the need for careful risk management and informed investment decisions. Stay informed about the ongoing developments in the DAX and the Frankfurt Stock Exchange. Monitor market trends closely to make informed decisions regarding your investments in the German stock market. Regularly check for updates on the DAX index to understand the fluctuating nature of the market and mitigate potential risks. For comprehensive financial advice, consult a qualified financial advisor to develop a personalized investment strategy suited to your risk tolerance and financial goals.

Featured Posts

-

Porsche 356 Zuffenhausen Riwayat Produksi Dan Warisan

May 25, 2025

Porsche 356 Zuffenhausen Riwayat Produksi Dan Warisan

May 25, 2025 -

M62 Westbound Road Closure Resurfacing Works Manchester To Warrington

May 25, 2025

M62 Westbound Road Closure Resurfacing Works Manchester To Warrington

May 25, 2025 -

Escape To The Country Making The Move From City To Countryside

May 25, 2025

Escape To The Country Making The Move From City To Countryside

May 25, 2025 -

Aex Stijgt Markt Herstelt Na Trumps Uitstel

May 25, 2025

Aex Stijgt Markt Herstelt Na Trumps Uitstel

May 25, 2025 -

Porsche Atidare Nauja Greitojo Ikrovimo Stotele Europoje

May 25, 2025

Porsche Atidare Nauja Greitojo Ikrovimo Stotele Europoje

May 25, 2025

Latest Posts

-

Aex Stijgt Na Trump Uitstel Analyse Van De Marktwinsten

May 25, 2025

Aex Stijgt Na Trump Uitstel Analyse Van De Marktwinsten

May 25, 2025 -

Beurzen Herstellen Na Trump Uitstel Aex Stijging Overal

May 25, 2025

Beurzen Herstellen Na Trump Uitstel Aex Stijging Overal

May 25, 2025 -

11 Drop In Three Days Amsterdam Stock Exchange Faces Significant Losses

May 25, 2025

11 Drop In Three Days Amsterdam Stock Exchange Faces Significant Losses

May 25, 2025 -

Amsterdam Exchange Plunges Three Days Of Heavy Losses Totaling 11

May 25, 2025

Amsterdam Exchange Plunges Three Days Of Heavy Losses Totaling 11

May 25, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Losses Down 11

May 25, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Losses Down 11

May 25, 2025