Today's Stock Market: Analyzing Dow Futures And China's Economic Policies

Table of Contents

Understanding Dow Futures and Their Impact

What are Dow Futures?

Dow Futures contracts are derivative instruments that track the predicted performance of the Dow Jones Industrial Average (DJIA). They act as a barometer of market sentiment, offering insights into investors' expectations for the future direction of this major stock market index. Trading Dow Futures allows investors to speculate on the DJIA's price movements without directly owning the underlying stocks.

- Mechanics of Trading: Dow Futures contracts are standardized agreements to buy or sell a specific number of DJIA shares at a predetermined price on a future date.

- Contract Types: Various contract sizes and expiration dates cater to different trading strategies and risk tolerances.

- Leverage Potential: Dow Futures trading offers leverage, amplifying both potential profits and losses. This means a smaller investment can control a larger position in the DJIA.

Dow Futures movements often precede broader market trends, providing valuable predictive power for discerning investors. For instance, a significant upward movement in Dow Futures may signal a bullish outlook for the overall stock market.

Analyzing Current Dow Futures Trends

Currently, Dow Futures are exhibiting [Insert current trend: e.g., a period of consolidation following a recent dip, showing signs of bullish recovery, etc.]. [Insert relevant data and charts here showcasing recent price movements, trading volume, and open interest]. The recent increase/decrease in trading volume suggests [Insert analysis based on volume changes]. The open interest indicates [Insert analysis based on open interest trends].

- Recent Price Movements: [Describe the recent price action, e.g., a sustained upward trend, a series of lower lows, etc.]

- Trading Volume: High trading volume often indicates strong conviction in the market's direction, whereas low volume might signal indecision.

- Open Interest: Open interest reflects the total number of outstanding contracts, which can provide insights into the overall market sentiment.

Significant news events, such as [mention specific recent events, e.g., Federal Reserve announcements, geopolitical events, corporate earnings reports], have significantly impacted Dow Futures prices.

Dow Futures and Investor Sentiment

Dow Futures trading provides a powerful window into investor confidence and risk appetite. A surge in buying activity, for example, indicates optimism about the future performance of the DJIA.

- Options Trading Insights: Options contracts on Dow Futures offer additional insights into market sentiment. High call option volume (the right to buy) suggests bullish expectations, while high put option volume (the right to sell) suggests bearish sentiment.

- Correlation with Other Indices: Analyzing the correlation between Dow Futures and other key market indices, such as the S&P 500 and Nasdaq, helps provide a more comprehensive view of market trends and sentiment. A divergence between the DJIA and these other indices might point to sector-specific factors at play.

China's Economic Policies and Global Market Influence

Key Aspects of China's Economy

China's economy remains a significant force in global markets. Its current state, characterized by [Describe current state: e.g., slowing growth, increased inflation, etc.], profoundly affects worldwide investment strategies.

- Major Economic Sectors: The manufacturing, technology, and consumer goods sectors play a critical role in China's economy and influence global supply chains.

- Global Trade Impact: China's massive export capacity and its growing middle class significantly impact global trade flows and commodity prices. China's influence on global supply chains is undeniable and needs careful consideration when analyzing Dow Futures and broader market trends.

Analyzing Recent Policy Changes

Recent economic policy decisions from the Chinese government, such as [Mention specific policies: e.g., infrastructure spending, regulatory changes, monetary policy adjustments], have considerable implications for global markets.

- New Regulations: Regulations targeting specific sectors can have significant repercussions on related companies and global supply chains.

- Stimulus Packages: Government spending aimed at boosting economic activity can influence commodity prices and global market sentiment.

- Trade Agreements: New trade deals with other countries can affect the flow of goods and services, impacting global economic growth. The ripple effect of these policies can significantly impact the Dow Futures market, necessitating careful analysis.

China's Economic Policies and Dow Futures Correlation

The correlation between China's economic performance and Dow Futures trading activity is [Describe correlation: e.g., generally positive, indicating that strong economic data in China tends to support higher Dow Futures prices; or negative, suggesting that negative news from China can lead to a decline in Dow Futures].

- Historical Examples: [Provide examples of past economic events in China, like the 2008 financial crisis or the trade war with the US, and their impact on Dow Futures].

- Geopolitical Factors: Geopolitical tensions involving China can significantly affect investor sentiment and influence Dow Futures trading.

Integrating Dow Futures Analysis and China's Economic Policies for Investment Strategies

Diversification and Risk Management

Diversification is crucial for mitigating the risks associated with both Dow Futures and China's economic policies. Holding a diversified portfolio helps reduce the impact of negative events in either area.

- Risk Mitigation Techniques: Hedging strategies using options or other derivatives can help limit potential losses from unexpected market movements.

- Investment Strategies: Careful analysis of Dow Futures and China's economic indicators allows for informed investment decisions across various asset classes.

Opportunities and Challenges

The interaction between Dow Futures and China's economic policies presents both opportunities and challenges for investors.

- Investment Opportunities: Understanding these dynamics can allow investors to identify undervalued assets or sectors poised for growth.

- Challenges: Market volatility stemming from unexpected policy changes or geopolitical events needs to be carefully considered. A proactive approach is crucial for navigating these complexities.

Conclusion

Analyzing both Dow Futures and China's economic policies is crucial for informed investment decisions. The interconnected nature of global markets necessitates a comprehensive understanding of these factors to make effective trading and investment choices. By staying updated on Dow Futures trends and closely monitoring China's economic policies, investors can navigate the complexities of the global stock market and potentially improve their investment outcomes. Master Dow Futures analysis and understand the impact of China's economic policies to stay ahead in the stock market. Continue your research and utilize the available resources to sharpen your understanding of these powerful market influencers.

Featured Posts

-

Southern Olive Oils Cultivating Quality And Flavor

Apr 26, 2025

Southern Olive Oils Cultivating Quality And Flavor

Apr 26, 2025 -

Escape Disney 7 Must Try Orlando Restaurants For 2025

Apr 26, 2025

Escape Disney 7 Must Try Orlando Restaurants For 2025

Apr 26, 2025 -

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 26, 2025

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

Apr 26, 2025 -

Anna Wongs Warning Impending Food Shortages

Apr 26, 2025

Anna Wongs Warning Impending Food Shortages

Apr 26, 2025 -

Benson Boones I Heart Radio Music Awards 2025 Outfit Photo 5137815

Apr 26, 2025

Benson Boones I Heart Radio Music Awards 2025 Outfit Photo 5137815

Apr 26, 2025

Latest Posts

-

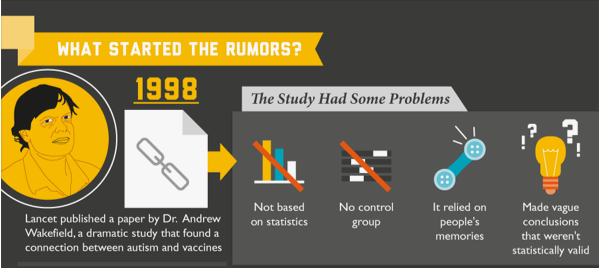

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025

Controversial Appointment Hhs And The Debunked Autism Vaccine Connection

Apr 27, 2025 -

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

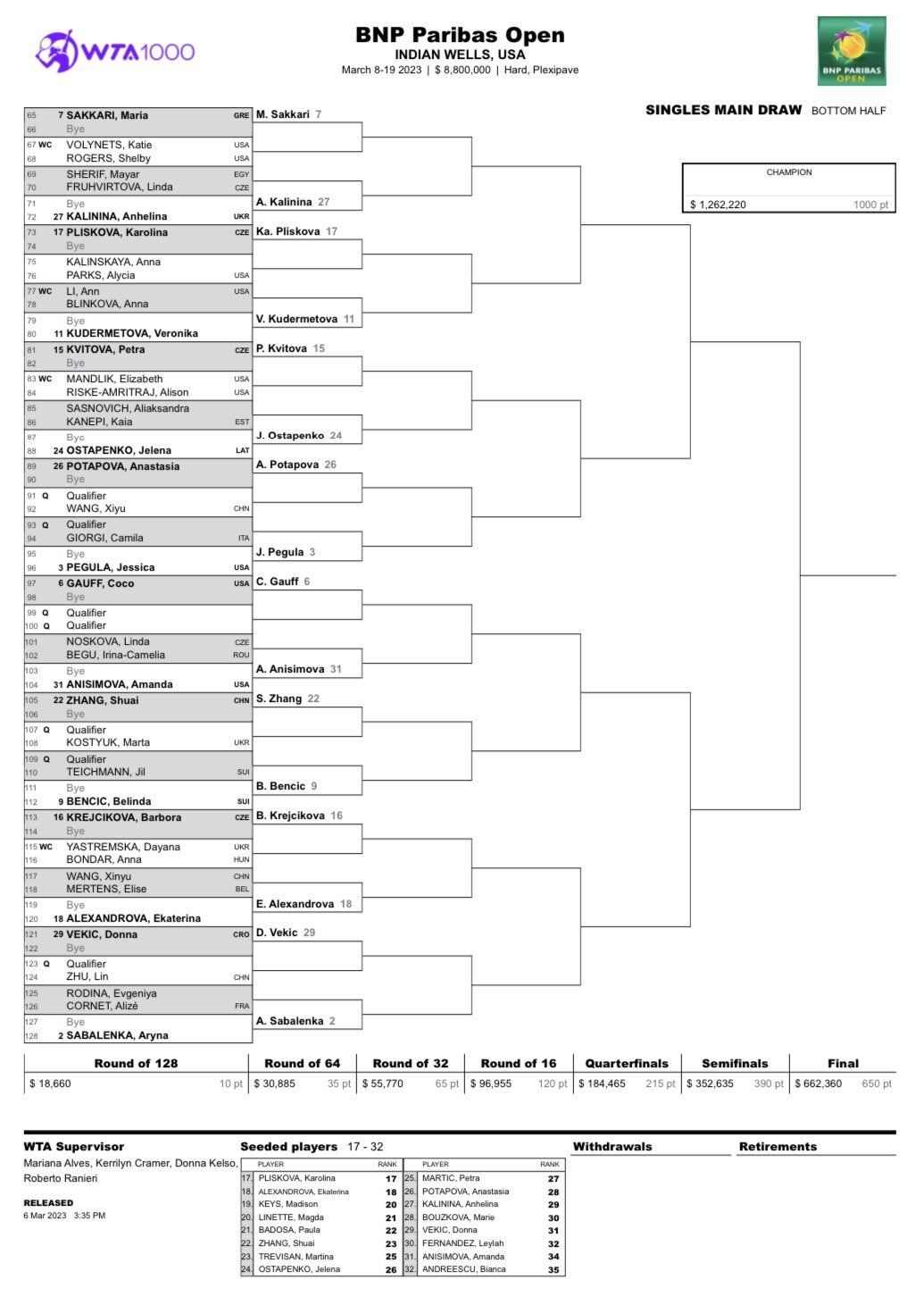

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025