5 Do's And Don'ts For Landing A Job In The Private Credit Boom

Table of Contents

5 Do's for Success in the Private Credit Job Market

Do: Network Strategically

Networking is paramount in the private credit world. Building relationships with professionals in the field can significantly increase your chances of landing a job.

- Attend industry events: Conferences and workshops focused on private credit, alternative lending, and investment management offer invaluable networking opportunities. These events allow you to meet potential employers, learn about new trends, and build your professional network.

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords like private credit, credit fund jobs, alternative lending, and financial modeling. Actively connect with professionals in the industry, participate in relevant groups, and engage in discussions.

- Conduct informational interviews: Reach out to professionals working in private credit for informational interviews. These conversations provide insights into the industry, specific firms, and potential career paths, while also establishing valuable connections.

Do: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They must showcase your skills and experience in a way that resonates with potential employers.

- Highlight relevant experience: Emphasize experience in credit analysis, financial modeling, portfolio management, and any other relevant skills. Clearly demonstrate your understanding of different private credit strategies like direct lending and mezzanine financing.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of saying "managed a portfolio," say "managed a $100 million portfolio, resulting in a 15% increase in ROI."

- Use keywords from job descriptions: Carefully review job descriptions and incorporate relevant keywords into your resume and cover letter to improve your chances of getting noticed by applicant tracking systems (ATS).

Do: Master the Technical Skills

Private credit roles demand a strong grasp of technical skills. Demonstrating proficiency in these areas is crucial.

- Develop strong financial modeling skills: Proficiency in Excel and the Bloomberg Terminal is essential. Practice building complex financial models and demonstrate your ability to analyze financial statements and credit metrics.

- Understand credit analysis techniques and methodologies: Master the art of credit risk assessment, including understanding different credit scoring models, covenant analysis, and default probabilities.

- Familiarize yourself with different private credit strategies: Gain a thorough understanding of direct lending, mezzanine financing, distressed debt, and other private credit investment strategies.

Do: Showcase Your Understanding of the Private Credit Landscape

Demonstrate your knowledge of the industry beyond just technical skills.

- Stay updated on market trends and regulations: Keep abreast of current events and regulatory changes affecting the private credit market. Understanding these dynamics will showcase your commitment to the field and your ability to adapt.

- Demonstrate knowledge of different types of private credit investments: Be able to articulate the nuances of different investment strategies and their associated risks and rewards.

- Be prepared to discuss your investment thesis: Develop a well-informed perspective on the current state of the private credit market and be able to discuss your views on promising investment opportunities.

Do: Prepare for Behavioral Interview Questions

Behavioral interviews assess your soft skills and how you've handled past situations.

- Practice the STAR method: Structure your answers using the STAR method (Situation, Task, Action, Result) to clearly and concisely communicate your experiences.

- Anticipate questions about teamwork, problem-solving, and leadership: Reflect on past experiences where you demonstrated these skills and prepare compelling examples.

- Highlight relevant soft skills: Emphasize your communication, collaboration, and problem-solving abilities. These skills are highly valued in the private credit industry.

5 Don'ts to Avoid in Your Private Credit Job Search

Don't: Neglect the Basics

The fundamentals matter. Don't overlook these simple yet crucial aspects.

- Avoid generic resumes and cover letters: Tailor each application to the specific job description and the company's investment strategy.

- Don't ignore grammar and spelling errors: Proofread everything carefully before submitting. Errors reflect poorly on your attention to detail.

- Don't underestimate the importance of professional attire for interviews: Dress professionally and appropriately for each interview.

Don't: Overlook the Importance of Due Diligence

Thorough research is vital for a successful job search.

- Thoroughly research potential employers and the private credit market: Understand their investment strategies, recent deals, and company culture.

- Ask informed questions during interviews: Demonstrate your knowledge of the firm and the industry by asking insightful questions.

- Don't apply for jobs without understanding the firm's investment strategy: Ensure your skills and interests align with the firm's focus.

Don't: Underestimate the Competitive Landscape

The private credit job market is competitive. Be prepared for a challenging search.

- Be prepared for multiple interview rounds: The interview process may involve several rounds with different individuals.

- Network extensively and build relationships: Networking increases your visibility and your chances of landing an interview.

- Don't get discouraged by rejection: Persistence is key. Learn from each setback and continue refining your job search strategy.

Don't: Be Afraid to Negotiate

Know your worth and negotiate your compensation package.

- Research salary ranges for similar roles: Use online resources and your network to understand typical compensation for the position.

- Be prepared to discuss your compensation expectations: Know your minimum and ideal salary range before entering negotiations.

- Know your worth: Highlight your skills and experience to justify your desired compensation.

Don't: Neglect Your Personal Brand

Cultivate a strong personal brand to showcase your expertise.

- Maintain a professional online presence: Ensure your LinkedIn profile is up-to-date and reflects your professional accomplishments.

- Showcase your expertise through publications or presentations: Contribute to industry discussions and share your knowledge.

- Be mindful of your communication style: Maintain professional and clear communication in all interactions.

Conclusion

Landing a job in the booming private credit sector requires a multifaceted approach. By diligently following these "dos" and avoiding the "don'ts," you can significantly increase your chances of success. Remember to hone your technical skills in financial modeling and credit analysis, network strategically within the private debt and alternative lending communities, and prepare thoroughly for interviews. Don't delay – start your private credit job search today and leverage these tips to capitalize on this exciting market opportunity.

Featured Posts

-

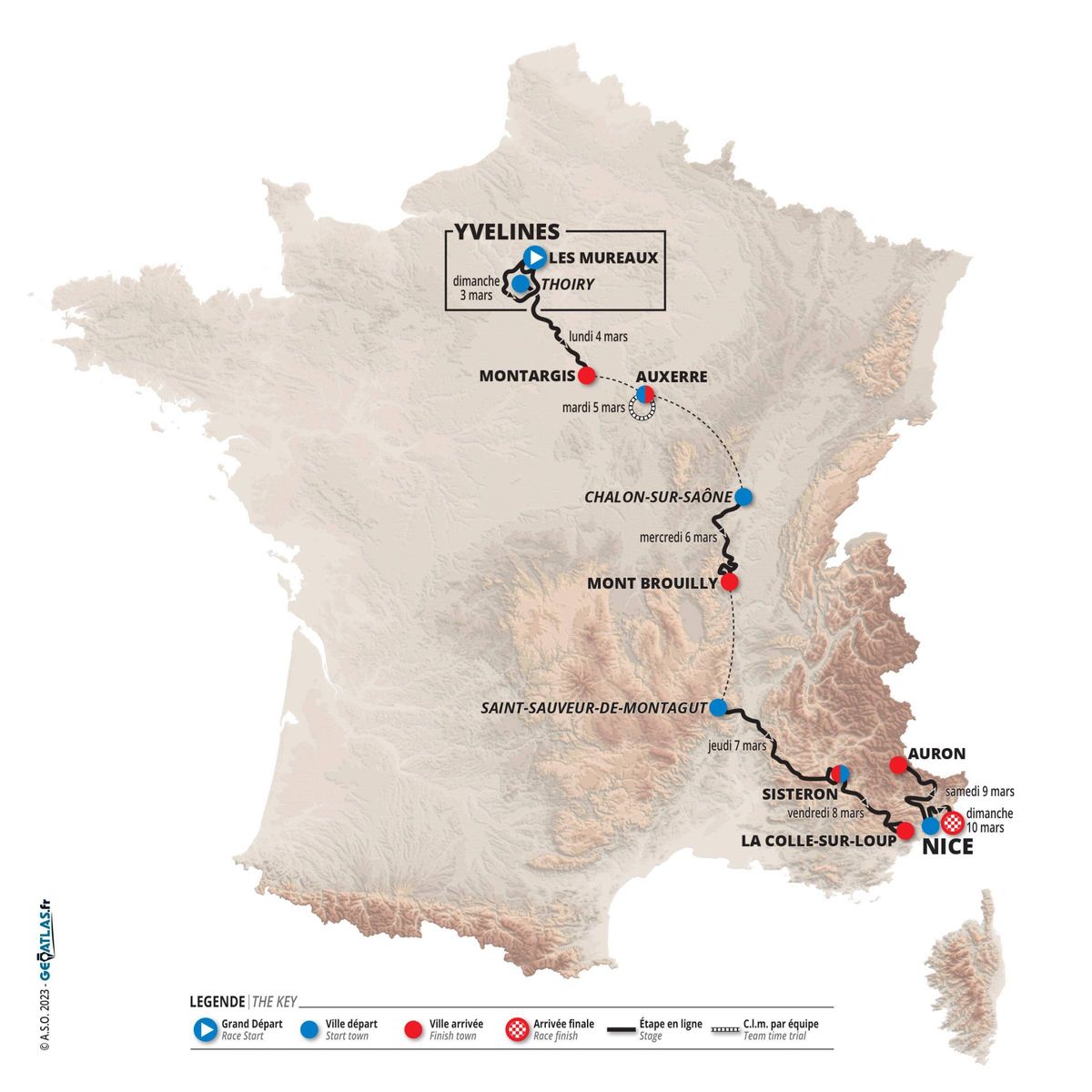

Paris Nice 2024 Jorgensons Successful Title Defense

Apr 26, 2025

Paris Nice 2024 Jorgensons Successful Title Defense

Apr 26, 2025 -

Espn Analyst Expands On Deion Sanders Shedeur Sanders Draft Stock Theory

Apr 26, 2025

Espn Analyst Expands On Deion Sanders Shedeur Sanders Draft Stock Theory

Apr 26, 2025 -

Exploring The Mississippi Delta Through The Lens Of Sinners Cinematographer

Apr 26, 2025

Exploring The Mississippi Delta Through The Lens Of Sinners Cinematographer

Apr 26, 2025 -

Evaluating Gavin Newsoms Leadership In California

Apr 26, 2025

Evaluating Gavin Newsoms Leadership In California

Apr 26, 2025 -

Deion Sanders Son Shedeur Generates Nfl Draft Buzz Giants Connection Explored

Apr 26, 2025

Deion Sanders Son Shedeur Generates Nfl Draft Buzz Giants Connection Explored

Apr 26, 2025

Latest Posts

-

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025 -

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025 -

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025 -

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025 -

Jannik Sinners Doping Case Concludes

Apr 27, 2025

Jannik Sinners Doping Case Concludes

Apr 27, 2025