This SPAC Stock Is Making Waves: A MicroStrategy Comparison For Investors

Table of Contents

Understanding the Chosen SPAC and its Investment Strategy

Company Overview and Business Model

[SPAC Name] is a SPAC targeting the [Target Industry, e.g., renewable energy, fintech] sector. Its primary investment strategy involves identifying and acquiring a promising company within this industry through a SPAC merger. This acquisition-focused business plan hinges on several key factors:

- Market Opportunity: The [Target Industry] sector is experiencing significant growth, driven by [mention specific market drivers, e.g., increasing demand, technological advancements]. This presents a large market opportunity for the acquisition target.

- Competitive Advantages: The intended acquisition target possesses [mention specific competitive advantages, e.g., proprietary technology, strong brand recognition, experienced management team] which sets it apart from its competitors.

- Synergies: The SPAC's management team believes the acquisition will create significant synergies resulting in increased profitability and market share.

- Investment Thesis: The SPAC's investment thesis rests on the belief that the target company's [mention key value drivers, e.g., innovative technology, strong revenue growth, path to profitability] will deliver substantial returns for investors post-merger.

Management Team and Track Record

The success of any SPAC, and especially the post-merger integration, largely depends on its management team. [SPAC Name]'s executive team boasts considerable industry experience and a proven track record.

- [Name and Title of Key Executive 1]: Extensive experience in [Relevant Industry] with a history of successful mergers and acquisitions at [Previous Company].

- [Name and Title of Key Executive 2]: Expertise in [Relevant Area, e.g., finance, operations, technology] and a proven ability to build and scale businesses.

- [Name and Title of Key Executive 3]: Strong background in [Relevant Field] with a reputation for strategic decision-making and operational efficiency.

This experienced team provides investors with confidence in their ability to successfully identify, acquire, and manage the target company post-merger.

Financial Performance and Projections

While currently a shell company, [SPAC Name] has disclosed its financial statements, showing [mention key financial metrics, e.g., cash on hand, debt levels]. The projections for the post-merger entity are [mention projected revenue growth, profitability targets, and anticipated cash flow]. These projections are based on the target company's [mention the basis for projections, e.g., historical performance, market analysis, management forecasts]. Comparing these projections to industry benchmarks will be crucial for assessing the investment's potential.

The MicroStrategy Comparison: A Bitcoin-Focused Approach

MicroStrategy's Bitcoin Investment Strategy

MicroStrategy's significant investment in Bitcoin has made headlines, demonstrating a bold, long-term investment strategy centered on cryptocurrency. The company's rationale was based on:

- Inflation Hedge: Bitcoin's limited supply and potential for appreciation in the face of inflationary pressures.

- Technological Disruption: Belief in Bitcoin's potential as a disruptive technology and its growing adoption.

- Long-Term Growth: A long-term view of Bitcoin's price appreciation potential.

- Diversification: While highly concentrated, this investment aimed to diversify the company’s assets beyond traditional investments.

Comparing Risk Tolerance and Investment Horizons

Both [SPAC Name] and MicroStrategy's Bitcoin strategy involve substantial risk. However, the nature of these risks differs significantly.

- SPAC Risk: The primary risks associated with [SPAC Name] include the failure to identify and complete a successful acquisition, the underperformance of the acquisition target, and market volatility.

- MicroStrategy Risk: The volatility of the cryptocurrency market is the primary risk for MicroStrategy, with significant price fluctuations being a major concern.

- Investment Horizons: MicroStrategy's Bitcoin investment reflects a longer-term, high-risk, high-reward strategy, while [SPAC Name]'s timeline is shorter, focusing on the acquisition and subsequent integration.

Lessons Learned from MicroStrategy's Experience

MicroStrategy's Bitcoin investment offers several valuable lessons for investors:

- Long-Term Perspective: Successful investing often requires a long-term vision and the ability to withstand short-term market fluctuations.

- Thorough Due Diligence: Extensive research and analysis are crucial before committing to high-risk investments.

- Diversification: Concentrated investments, while potentially rewarding, can also lead to significant losses if the underlying asset performs poorly.

- Risk Management: A clear understanding of the risks involved and implementing appropriate risk management strategies is essential.

Potential Risks and Rewards of Investing in This SPAC

Market Volatility and Economic Uncertainty

The performance of [SPAC Name] is susceptible to market volatility and broader economic conditions.

- Interest Rate Hikes: Rising interest rates can negatively impact valuations of growth stocks, including SPAC targets.

- Inflation: High inflation can erode the value of future cash flows, affecting projected returns.

- Recessionary Fears: A potential recession could severely impact the growth prospects of the target company.

Competitive Landscape and Regulatory Risks

The competitive landscape and potential regulatory hurdles represent significant risks.

- Competition: The target company may face stiff competition from established players in the [Target Industry] sector.

- Regulatory Changes: Changes in regulations could impact the target company's operations and profitability.

- Legal Challenges: Potential lawsuits or legal challenges could also impact the company's performance.

Potential for High Returns and Growth

Despite the inherent risks, the potential for high returns and significant growth remains attractive:

- Successful Acquisition: A successful acquisition and integration could lead to significant gains for investors.

- Market Share Expansion: The target company's expansion into new markets or its growth within the existing market could drive significant growth.

- Technological Innovation: Innovation in the target company's technology could position it for significant market leadership.

This SPAC Stock Is Making Waves: A Final Verdict for Investors

[SPAC Name] presents a compelling investment opportunity, but it's crucial to understand that it shares some similarities to MicroStrategy's Bitcoin strategy in terms of risk and reward. While the potential for high returns exists, the significant volatility and inherent risks associated with both SPAC investments and cryptocurrency markets necessitate a careful evaluation. Investors should conduct their own thorough due diligence, examining the target company's business plan, its management team’s expertise, and the competitive landscape. The lessons learned from MicroStrategy's experience underscore the importance of a long-term perspective, thorough risk assessment, and diversification.

Remember to consult with a qualified financial advisor before making any investment decisions. Investing in this SPAC stock making waves, or any SPAC, requires a keen understanding of the associated risks. Conduct your research, weigh the potential rewards against the inherent volatility, and make informed decisions that align with your investment goals and risk tolerance.

Featured Posts

-

Andor Creator On His Star Wars Series The Most Important Thing I Ll Ever Do

May 08, 2025

Andor Creator On His Star Wars Series The Most Important Thing I Ll Ever Do

May 08, 2025 -

Psg Dominon Por Fiton Vetem Minimalisht

May 08, 2025

Psg Dominon Por Fiton Vetem Minimalisht

May 08, 2025 -

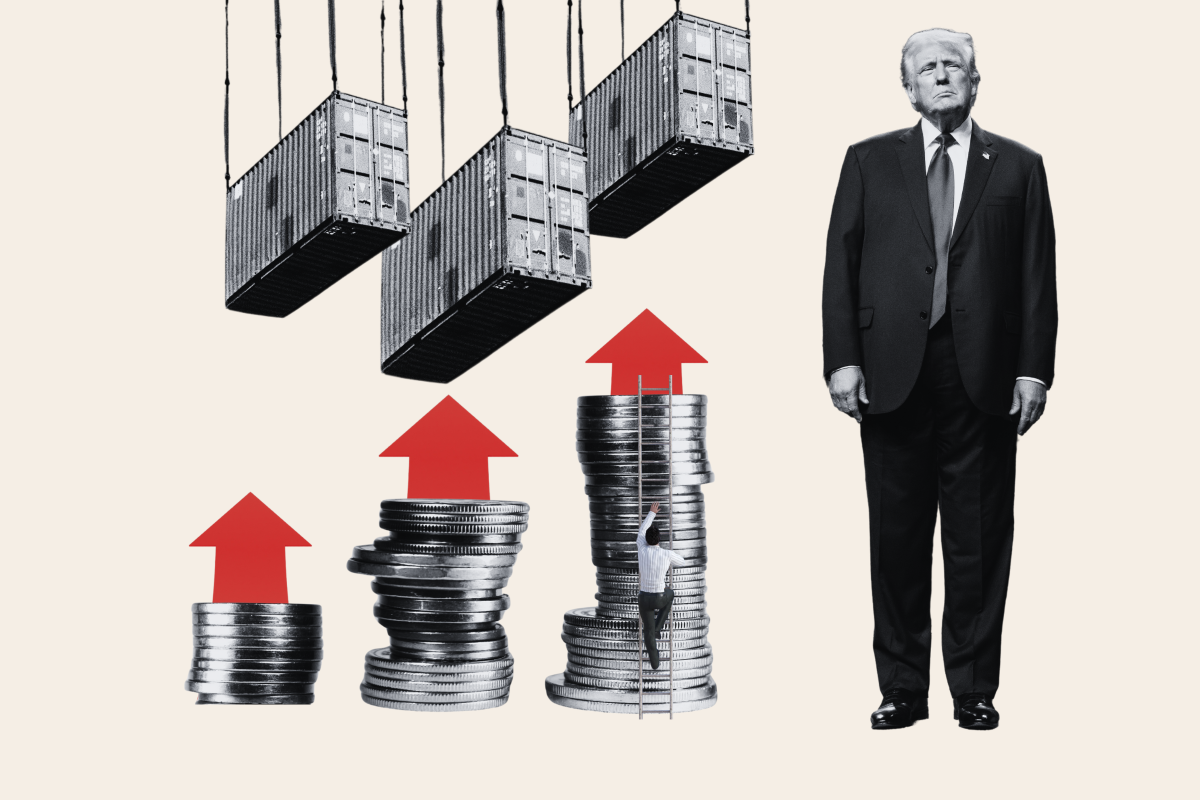

Liberation Day Tariffs And Stock Market Volatility A Detailed Overview

May 08, 2025

Liberation Day Tariffs And Stock Market Volatility A Detailed Overview

May 08, 2025 -

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalov Arsenal Ps Zh Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalov Arsenal Ps Zh Barselona Inter

May 08, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Ruled Invalid

May 08, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Ruled Invalid

May 08, 2025

Latest Posts

-

Flamengo Vence Gremio Com Dois Gols De Arrascaeta No Brasileirao

May 08, 2025

Flamengo Vence Gremio Com Dois Gols De Arrascaeta No Brasileirao

May 08, 2025 -

Liga De Quito Empata Con Flamengo En La Copa Libertadores

May 08, 2025

Liga De Quito Empata Con Flamengo En La Copa Libertadores

May 08, 2025 -

Triunfo De Filipe Luis Nuevo Titulo En Su Carrera

May 08, 2025

Triunfo De Filipe Luis Nuevo Titulo En Su Carrera

May 08, 2025 -

Doblete De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao

May 08, 2025

Doblete De Arrascaeta Garante Triunfo Do Flamengo No Brasileirao

May 08, 2025 -

El Nuevo Titulo De Filipe Luis

May 08, 2025

El Nuevo Titulo De Filipe Luis

May 08, 2025