'Liberation Day' Tariffs And Stock Market Volatility: A Detailed Overview

Table of Contents

1. The Immediate Impact of 'Liberation Day' Tariffs on Global Markets

The implementation of the Liberation Day tariffs, which primarily affected the import/export of agricultural goods and technological components between the fictional nations of Atheria and Solara, immediately sent ripples through global markets. These tariffs, announced on the symbolic "Liberation Day," were intended to reshape trade relations but resulted in unforeseen economic consequences.

1.1 Initial Market Reactions:

The initial reaction to the Liberation Day tariff announcement was swift and dramatic. Major stock indices experienced significant drops. The Atheria Stock Exchange (ASE) plummeted by 4.2%, while the Solara Equity Index (SEI) saw a 3.8% decline. The impact spread globally, with the Global Composite Index falling 1.5%. The following charts illustrate the immediate volatility:

[Insert Chart 1: Showing the immediate drop in ASE, SEI, and Global Composite Index upon tariff announcement]

[Insert Chart 2: Showing volatility in the days following the tariff announcement]

1.2 Sector-Specific Impacts:

Different sectors felt the impact of the Liberation Day tariffs differently.

- Technology: Technology stocks in Atheria were particularly hard hit, experiencing a sharp 6% decline due to increased import costs for crucial components sourced from Solara. The disruption to supply chains caused significant uncertainty.

- Agriculture: Agricultural stocks in both Atheria and Solara suffered, with retaliatory tariffs from other nations further exacerbating the issue. Farmers faced decreased export demand and higher input costs.

- Energy: The energy sector showed more resilience, though some fluctuation was observed depending on the country's dependence on imported energy sources affected by the tariffs.

1.3 Currency Fluctuations:

The Atheria Dollar (ATD) depreciated against the Solara Krone (SKR) by 2.5% in the immediate aftermath of the tariff announcement, reflecting the economic impact on Atheria. The instability in currency exchange rates added another layer of uncertainty to the already volatile market conditions.

2. Analyzing the Underlying Factors Contributing to Volatility

The market volatility following the Liberation Day tariffs wasn't solely a direct result of the tariffs themselves. Several underlying factors amplified the impact:

2.1 Investor Sentiment and Confidence:

The sudden imposition of the Liberation Day tariffs fueled investor uncertainty and fear. The uncertainty surrounding future trade relations between Atheria and Solara contributed to decreased consumer confidence and reduced business investment. News outlets reported widespread anxiety among investors.

2.2 Geopolitical Implications:

The tariffs triggered fears of a potential trade war between Atheria and Solara, increasing geopolitical tensions and market uncertainty. The lack of clear communication between the two nations further fueled speculation and negative sentiment.

2.3 Inflationary Pressures:

The Liberation Day tariffs increased the cost of imported goods in both countries, contributing to inflationary pressures. This, in turn, caused investors to reassess their investment strategies, moving away from riskier assets in anticipation of higher interest rates.

3. Long-Term Effects of 'Liberation Day' Tariffs on Stock Market Behavior

The long-term implications of the Liberation Day tariffs are still unfolding, but certain trends are already becoming apparent.

3.1 Shifts in Investment Strategies:

Investors responded to the long-term uncertainty by diversifying their portfolios, seeking out more stable investments, and employing hedging strategies to mitigate potential losses. This marked a significant shift away from previously favored investments.

3.2 Structural Changes in Global Trade:

The Liberation Day tariffs have the potential to trigger significant structural changes in global trade patterns, forcing businesses to re-evaluate their supply chains and potentially leading to the relocation of production facilities to lessen tariff impacts.

3.3 Economic Growth and Recovery:

The long-term effect on economic growth and recovery in Atheria and Solara remains uncertain. While some sectors may adapt, the initial negative impact on trade and investor confidence could have lasting consequences.

4. Conclusion: Navigating the Volatility of 'Liberation Day' Tariffs and Beyond

The Liberation Day tariffs served as a stark reminder of the significant impact geopolitical events can have on stock market volatility. The immediate market reactions, amplified by underlying factors like investor sentiment and geopolitical tensions, caused substantial short-term losses. The long-term effects, including shifts in investment strategies and potential structural changes in global trade, highlight the need for a careful and informed approach to managing risk in volatile markets. Understanding Liberation Day tariffs and their ripple effects is crucial for making informed investment decisions. Before making any investment decisions, especially in the wake of significant geopolitical events like the imposition of Liberation Day tariffs, conduct thorough research and consider seeking professional financial advice to mitigate volatility caused by these kinds of events and to manage Liberation Day tariff-related risks effectively.

Featured Posts

-

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025

Dwp Benefit Changes What Claimants Need To Know About April 5th

May 08, 2025 -

Navigating The Stock Market Amidst The Liberation Day Tariffs

May 08, 2025

Navigating The Stock Market Amidst The Liberation Day Tariffs

May 08, 2025 -

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkovikh Turnirakh

May 08, 2025

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkovikh Turnirakh

May 08, 2025 -

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025 -

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025

Superman Vs Darkseids Legion Dc Comics July 2025 Solicitations

May 08, 2025

Latest Posts

-

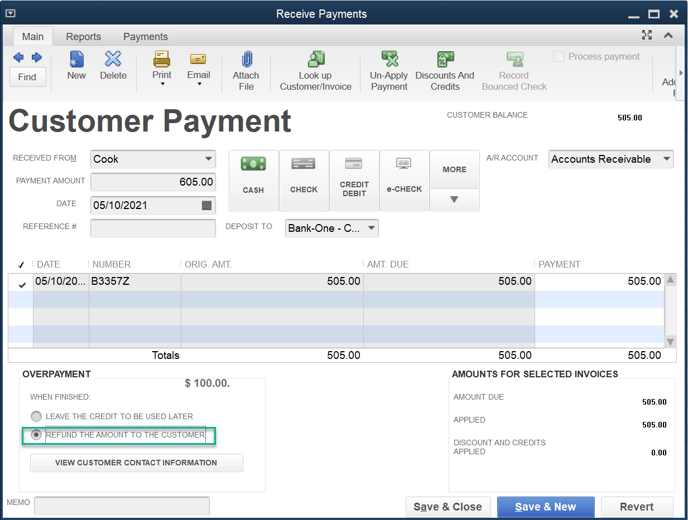

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025

Universal Credit Find Out If You Re Entitled To A Hardship Payment Refund

May 08, 2025 -

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025

Could You Be Due A Universal Credit Refund A Step By Step Guide

May 08, 2025 -

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025

Check For Universal Credit Overpayments Are You Eligible For A Refund

May 08, 2025 -

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025

Claiming Back Money Universal Credit Hardship Payment Entitlement

May 08, 2025 -

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025

Dwp Universal Credit Find Out If You Re Due A Refund

May 08, 2025