The XRP Commodity Debate: Implications For Investors And The Crypto Market

Table of Contents

SEC vs. Ripple: Understanding the Core Dispute

At the center of the XRP commodity debate is the SEC's lawsuit against Ripple, alleging that XRP is an unregistered security offered and sold in violation of federal securities laws. The SEC's argument hinges on the application of the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security. Ripple, on the other hand, vehemently argues that XRP is a decentralized, functional cryptocurrency, akin to Bitcoin or Ethereum, and therefore a commodity, not a security.

-

SEC's Argument: The SEC claims that Ripple's sale of XRP constituted an investment contract, fulfilling the Howey Test criteria: an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. They point to Ripple's control over XRP's distribution and its perceived influence on its price.

-

Ripple's Defense: Ripple counters that XRP operates as a decentralized digital asset, traded on numerous exchanges independent of Ripple's influence. They emphasize XRP's utility in facilitating cross-border payments and its established network of users and developers. They cite legal precedents arguing for a functional, rather than investment-contract, based classification of cryptocurrencies.

-

Key Legal Precedents: Both sides are referencing various legal precedents related to securities law and digital assets, making this case a landmark legal battle that could set a critical precedent for the future of cryptocurrency regulation. The outcome will significantly shape how future crypto projects navigate regulatory compliance.

Potential Outcomes and Their Impact on XRP's Price

The outcome of the SEC vs. Ripple case will dramatically affect XRP's price and the cryptocurrency market as a whole. Let's consider three possible scenarios:

-

Scenario 1: SEC Wins: An SEC victory could lead to a significant drop in XRP's price, potentially delisting from major exchanges in the US and severely impacting its trading volume and liquidity. This could also create a chilling effect on other crypto projects.

-

Scenario 2: Ripple Wins: A Ripple victory would likely send XRP's price soaring, boosting investor confidence and potentially attracting significant institutional investment. This would solidify XRP's position in the crypto market and could lead to increased adoption.

-

Scenario 3: Settlement: A negotiated settlement could result in a mixed outcome. It might involve Ripple agreeing to certain regulatory stipulations, potentially impacting XRP's future development and market perception. The price impact would likely depend on the specific terms of the settlement.

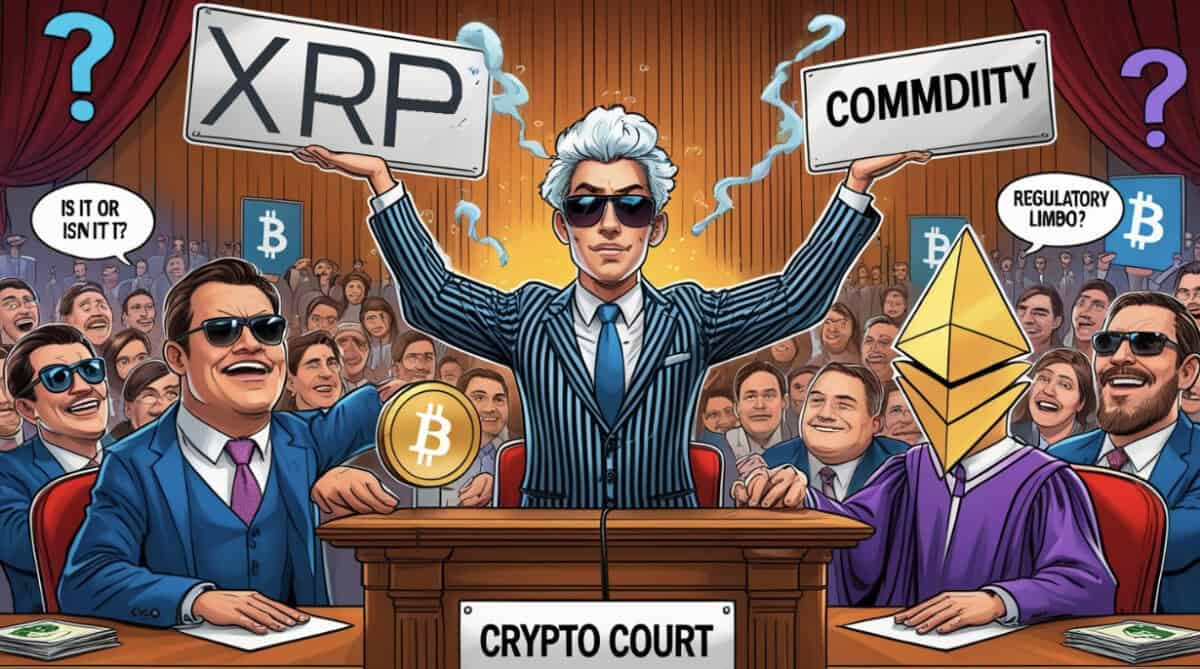

(Insert Chart/Graph illustrating potential price movements under each scenario here)

- Price Impact Summary:

- Short-term: High volatility is expected regardless of the outcome.

- Long-term: A Ripple victory would likely lead to long-term price stability and growth, while an SEC victory could lead to prolonged instability or even a decline.

- Trading Volume: Significant fluctuations in trading volume are anticipated across all scenarios.

Regulatory Uncertainty and its Effect on the Crypto Market

The XRP commodity debate extends far beyond the immediate impact on XRP. The case's outcome will create a ripple effect across the entire cryptocurrency market. The regulatory uncertainty it generates could:

-

Increased Scrutiny: The SEC's actions suggest a broader push for increased regulatory scrutiny of all cryptocurrencies, leading to a potential crackdown on projects deemed securities.

-

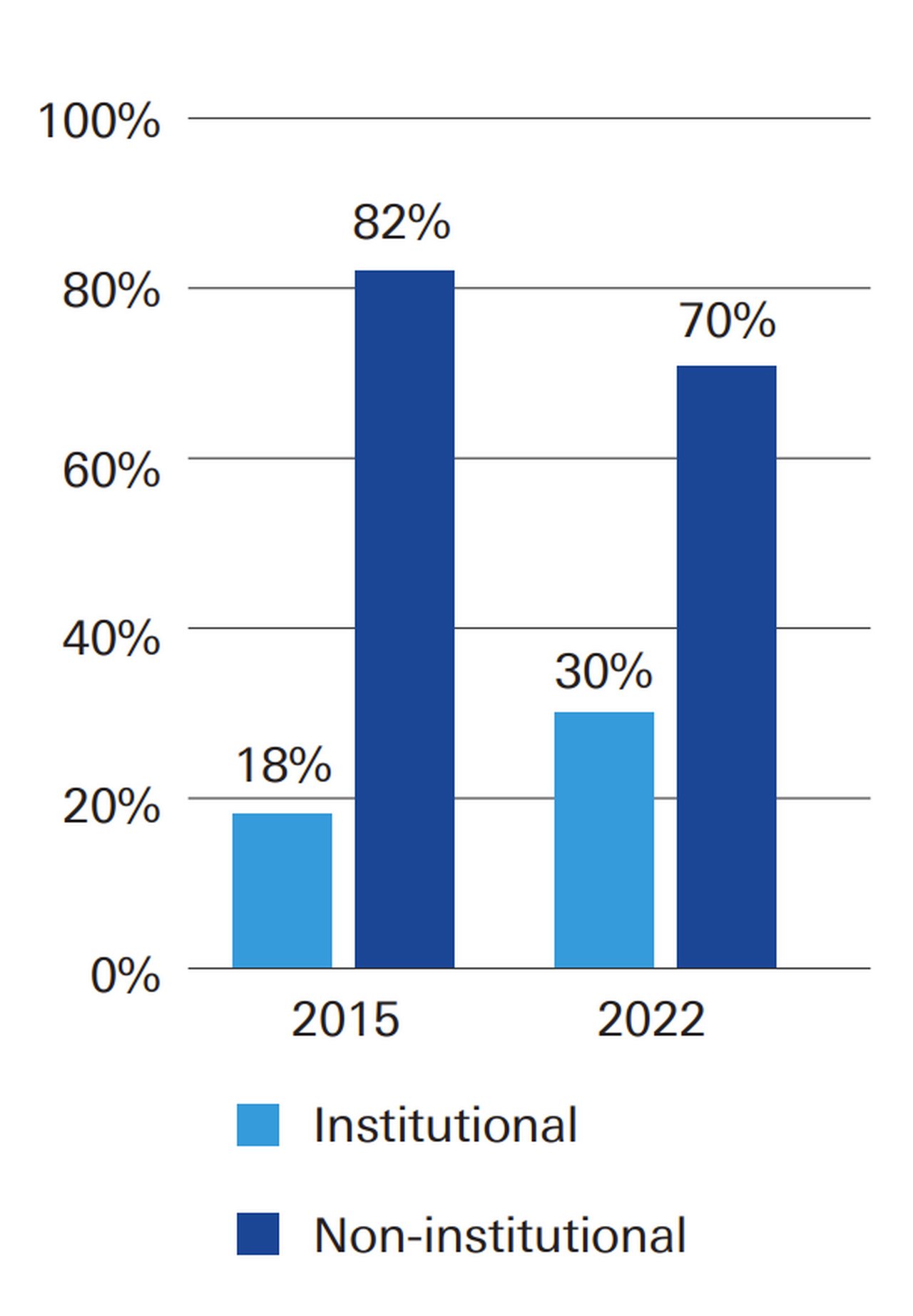

Investor Confidence: Regulatory uncertainty inevitably erodes investor confidence, impacting market stability and potentially discouraging institutional investment.

-

Ripple Effect on Other Crypto Assets: The legal precedent set by this case will influence how other crypto projects are classified and regulated, potentially impacting the viability and growth of the entire industry. This includes:

- Increased regulatory pressure on other tokens that might be considered securities.

- A more cautious approach to Initial Coin Offerings (ICOs).

- A dampening effect on institutional investment in cryptocurrencies until clarity emerges.

Investing in XRP: Strategies for Navigating Uncertainty

Investing in XRP during this period of uncertainty requires a cautious approach. Risk management is paramount. Consider the following:

-

Diversification: Diversify your crypto portfolio to mitigate risk. Don't put all your eggs in one basket.

-

Risk Tolerance: Understand your personal risk tolerance before investing in any cryptocurrency, especially one facing significant regulatory challenges.

-

Alternative Options: Explore alternative cryptocurrencies with clearer regulatory landscapes and established market positions.

-

Stay Informed: Stay updated on legal developments and regulatory changes affecting the crypto market. This is crucial for informed decision-making.

Conclusion: Navigating the Future of the XRP Commodity Debate

The XRP commodity debate is a pivotal moment in the history of cryptocurrency regulation. Its outcome will have far-reaching consequences for investors and the entire crypto market. Understanding the potential scenarios, their price impacts, and the broader regulatory implications is critical for navigating this complex landscape. The uncertainty surrounding XRP highlights the need for cautious investment strategies, thorough due diligence, and a keen awareness of ongoing legal developments. Stay informed, conduct thorough research, and always practice responsible investment principles when considering XRP or any other cryptocurrency. For further information, refer to [link to SEC website] and [link to Ripple website]. Remember, the future of cryptocurrency is intertwined with the resolution of the XRP commodity debate.

Featured Posts

-

Tesla Board Denies Plans To Replace Elon Musk

May 02, 2025

Tesla Board Denies Plans To Replace Elon Musk

May 02, 2025 -

Analyzing Frances Six Nations 2025 Prospects

May 02, 2025

Analyzing Frances Six Nations 2025 Prospects

May 02, 2025 -

The Impact Of Saudi Arabias Abs Market Deregulation

May 02, 2025

The Impact Of Saudi Arabias Abs Market Deregulation

May 02, 2025 -

School Desegregation Order Ended Implications For Schools Nationwide

May 02, 2025

School Desegregation Order Ended Implications For Schools Nationwide

May 02, 2025 -

Effective Strategies For Mental Health Literacy Education Programs

May 02, 2025

Effective Strategies For Mental Health Literacy Education Programs

May 02, 2025