The Impact Of Saudi Arabia's ABS Market Deregulation

Table of Contents

Asset-Backed Securities (ABS) are financial instruments backed by a pool of underlying assets, such as mortgages, auto loans, credit card receivables, or other receivables. They allow issuers to efficiently transfer credit risk to investors, unlocking capital and facilitating economic activity. The deregulation of the Saudi Arabia ABS market has opened up significant opportunities for both domestic and international players.

Increased Investment and Market Growth in Saudi Arabia's ABS Market

The deregulation of the Saudi Arabia ABS market has created a more attractive environment for investors, both domestically and internationally. The reduced regulatory burden has streamlined the issuance process, making it easier and more cost-effective for companies to raise capital. This, in turn, has led to a surge in investment and trading volume.

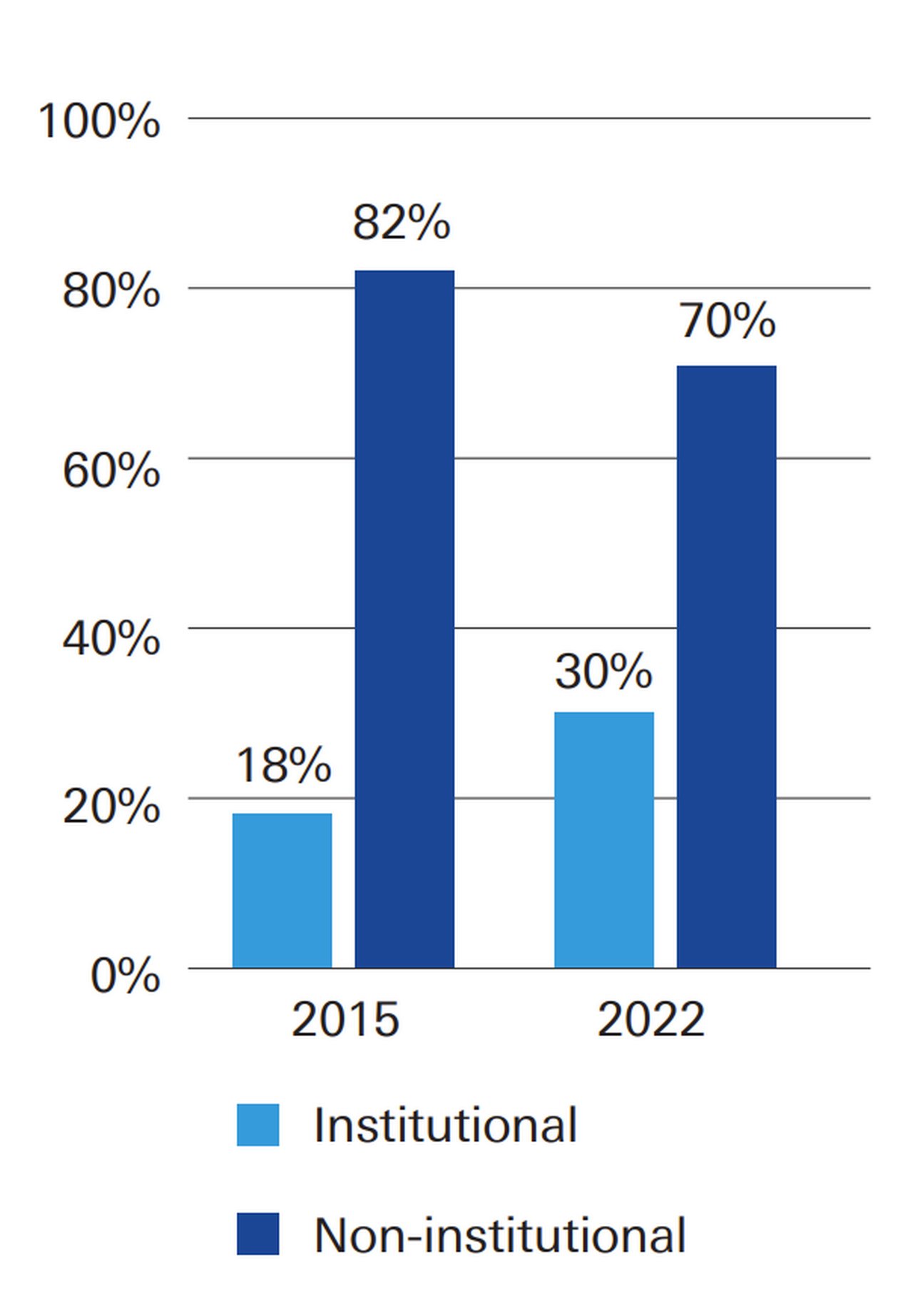

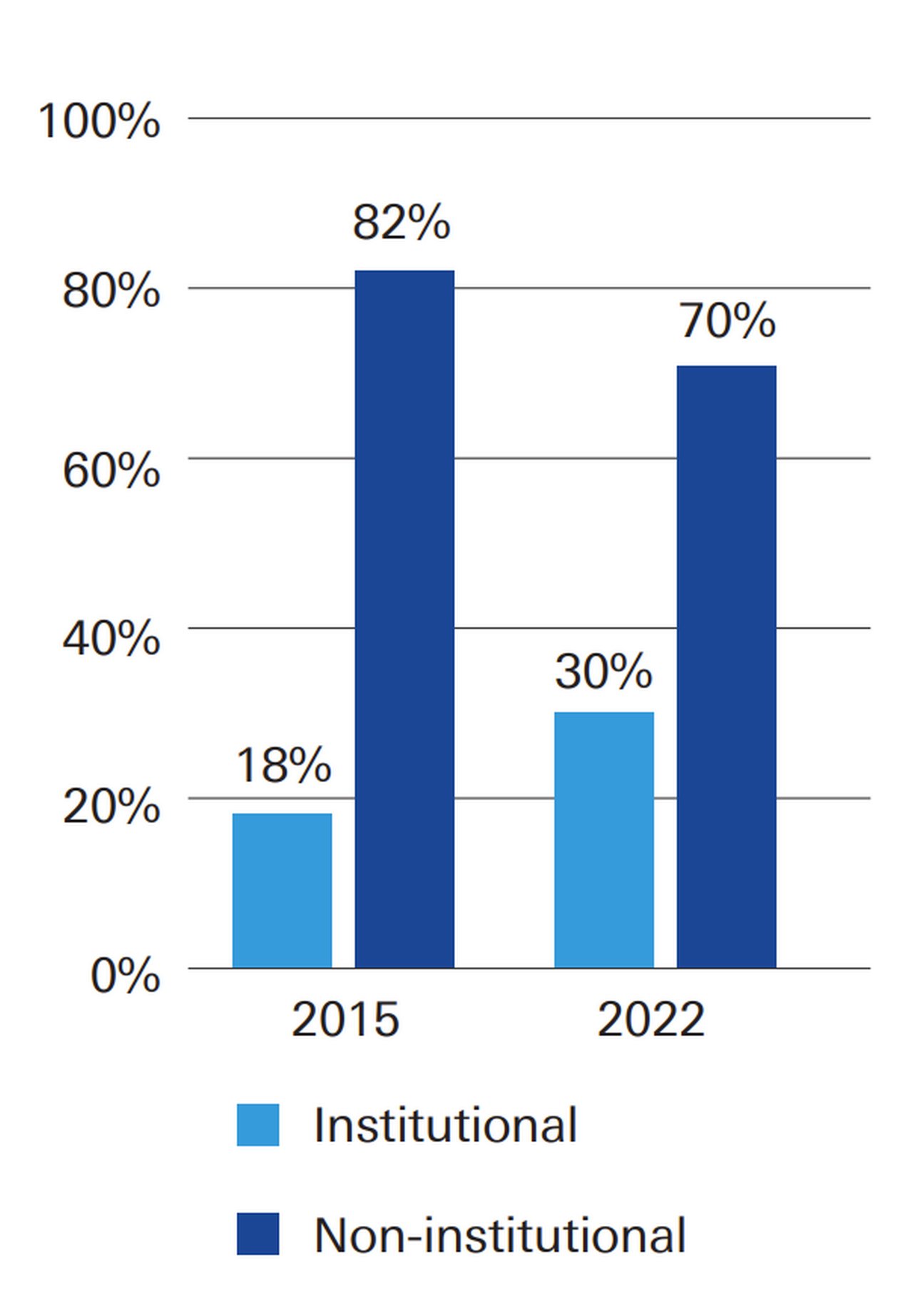

Data from [insert credible source here, e.g., a reputable financial news outlet or government report] shows a significant increase in the issuance of various ABS instruments since the deregulation. For instance, the volume of mortgage-backed securities (MBS) issued has [insert specific data, e.g., "increased by X%"]. Similarly, the market for auto loan ABS has experienced [insert specific data, e.g., "robust growth of Y%"]. This growth indicates a growing confidence in the Saudi Arabia ABS market and its potential for long-term returns.

- Increased foreign direct investment (FDI) in Saudi ABS.

- Higher participation of local banks and financial institutions in the Saudi Arabia ABS market.

- Growth in issuance of various types of ABS, including MBS and auto loan ABS.

- Improved liquidity in the secondary market for Saudi Arabia ABS.

Enhanced Competition and Innovation within the Saudi Financial Sector

Deregulation has fostered a more competitive environment within the Saudi financial sector. This increased competition has spurred innovation in product offerings and service delivery. New players are entering the market, and existing institutions are expanding their ABS-related activities to capture a larger market share. This competition benefits investors by leading to more favorable pricing and improved service quality.

The introduction of new technologies is also transforming the Saudi Arabia ABS market. Technology-driven platforms are streamlining trading processes, improving transparency, and reducing operational costs. The development of sophisticated ABS structuring techniques enables the creation of more tailored and efficient financial products.

- Development of new ABS structuring techniques tailored to specific investor needs.

- Introduction of technology-driven platforms for efficient ABS trading and risk management.

- Increased competition leading to better pricing and more diversified services for investors in the Saudi Arabia ABS market.

- Greater product diversification within the ABS market, catering to a wider range of investor preferences.

Potential Risks and Challenges Associated with Saudi Arabia's ABS Market Deregulation

While the deregulation of the Saudi Arabia ABS market presents numerous opportunities, it also introduces potential risks. Increased market liberalization can lead to greater volatility and potentially increase systemic risk. The emergence of asset bubbles is a potential concern, requiring careful monitoring and proactive risk management strategies.

To mitigate these risks, robust regulatory oversight is crucial. A well-defined regulatory framework, including effective supervision and investor protection measures, is essential to ensure the stability and long-term health of the Saudi Arabia ABS market. Investor education is equally important; investors need to understand the risks associated with ABS investments and implement appropriate risk management strategies.

- Potential for increased market volatility due to increased participation and less regulation.

- Risk of asset bubbles and subsequent market crashes requiring careful oversight.

- Need for strengthened regulatory frameworks and supervisory bodies to monitor the Saudi Arabia ABS market.

- Importance of investor protection measures and transparent disclosure requirements.

The Future Outlook for the Saudi Arabia ABS Market Post-Deregulation

The future of the Saudi Arabia ABS market looks bright. Based on current trends and projections, the market is expected to experience substantial growth in the coming years. [Insert specific growth projections from reputable sources, if available]. The ABS market is poised to play a significant role in achieving Vision 2030's economic diversification goals by providing efficient channels for financing various sectors of the Saudi economy.

However, global economic factors will inevitably impact the Saudi ABS market. International economic slowdowns or financial crises could affect investor sentiment and market activity. Technological advancements will continue to reshape the market, creating both opportunities and challenges for market participants.

- Projected growth rates for the Saudi Arabia ABS market in the coming years.

- Potential for further deregulation and market liberalization to enhance competitiveness.

- Integration with regional and international financial markets, opening up new investment opportunities.

- The transformative impact of technological advancements, such as blockchain and AI, on future growth.

Conclusion: The Future of Saudi Arabia's ABS Market Deregulation

The deregulation of Saudi Arabia's ABS market has ushered in a new era of growth and opportunity. Increased investment, enhanced competition, and the introduction of innovative financial instruments are transforming the financial landscape. However, the potential for increased volatility and systemic risk necessitates a balanced regulatory approach. Robust oversight, investor education, and proactive risk management strategies are crucial for ensuring sustainable growth and mitigating potential downsides. The long-term prospects for the Saudi Arabia ABS market remain positive, contributing significantly to the Kingdom's economic diversification objectives. Stay informed about the dynamic Saudi Arabia ABS market and its future potential. Explore the opportunities presented by the deregulated Saudi ABS market and its potential for growth.

Featured Posts

-

School Desegregation Order Terminated Analysis And Expected Impact On Education

May 02, 2025

School Desegregation Order Terminated Analysis And Expected Impact On Education

May 02, 2025 -

Ekonomik Ve Siyasi Is Birligi Tuerkiye Endonezya Anlasmalari Detaylari

May 02, 2025

Ekonomik Ve Siyasi Is Birligi Tuerkiye Endonezya Anlasmalari Detaylari

May 02, 2025 -

Kshmyr Ka Tnazeh Awr Jnwby Ayshyae Ka Amn Ely Rda Syd Ka Mwqf

May 02, 2025

Kshmyr Ka Tnazeh Awr Jnwby Ayshyae Ka Amn Ely Rda Syd Ka Mwqf

May 02, 2025 -

Maines Groundbreaking Post Election Audit Pilot Project

May 02, 2025

Maines Groundbreaking Post Election Audit Pilot Project

May 02, 2025 -

Directorial Change In Harry Potter Why Columbus Wasnt Involved In Film 3

May 02, 2025

Directorial Change In Harry Potter Why Columbus Wasnt Involved In Film 3

May 02, 2025