The Trump Effect On Nvidia: Assessing Long-Term Geopolitical Impacts

Table of Contents

Trade Wars and Tariffs: Disrupting Nvidia's Supply Chains

The Trump administration's trade war with China, particularly the imposition of tariffs on semiconductors, significantly impacted Nvidia's supply chain.

Impact on Chip Manufacturing and Sourcing

The "China tariffs" and broader "semiconductor tariffs" dramatically increased the cost of manufacturing and sourcing components, primarily from China, a key hub for semiconductor production. This led to several critical adjustments for Nvidia:

- Increased Costs: Tariffs directly increased the price of imported components, squeezing profit margins.

- Relocation of Manufacturing: Nvidia, like many other tech companies, began exploring options to diversify manufacturing locations, reducing reliance on China.

- Diversification of Suppliers: The company actively sought alternative suppliers to mitigate risks associated with relying on a single region.

- Impact on Production Timelines: Supply chain disruptions led to delays in product launches and potentially affected Nvidia’s ability to meet market demand.

The impact on the "Nvidia supply chain" necessitated a proactive response to manage the escalating costs and uncertainties.

Navigating Geopolitical Risks

Nvidia responded to the "trade war impact" and broader "geopolitical risk management" challenges by adopting several key strategies:

- Investment in Domestic Manufacturing: The company increased investments in domestic manufacturing within the US, reducing its reliance on overseas production.

- Strategic Partnerships: Nvidia forged stronger partnerships with suppliers in various regions to create a more resilient supply chain.

- Lobbying Efforts: The company actively engaged in lobbying efforts to influence trade policy and advocate for its interests.

The "Nvidia risk mitigation" strategies demonstrated a clear understanding of the evolving geopolitical landscape and the need for flexibility and adaptability.

Technology Nationalism and AI Development

The Trump administration's focus on technology nationalism and intellectual property rights significantly impacted Nvidia's operations.

The Impact of Restrictions on Technology Transfer

Policies concerning "AI technology transfer" and intellectual property created new challenges for Nvidia, especially in its collaborations with Chinese partners:

- Restrictions on Chinese Partnerships: Increased scrutiny on collaborations with Chinese entities hampered joint research and development efforts.

- Increased Scrutiny of Technology Exports: Export controls and tighter regulations made it more difficult to transfer sensitive technologies across borders.

- Impact on AI Research: Restrictions on technology transfer potentially slowed down the pace of Nvidia’s AI research and development.

The impact of "technology nationalism" and the implications for "Nvidia AI" required a strategic reevaluation of research partnerships and collaborations.

The Rise of Domestic AI Initiatives

The push for "domestic AI initiatives" under the Trump administration positively influenced Nvidia's strategies:

- Increased Investment in US-based AI Initiatives: Nvidia increased its investment in US-based research and development, aligning with the administration's priorities.

- Collaborations with US Research Institutions: The company strengthened collaborations with leading US universities and research institutions to foster innovation within the country.

- Competition with Chinese AI Companies: The focus on domestic AI development intensified competition with Chinese AI companies, creating new challenges and opportunities.

The "Nvidia AI investment" in US-based initiatives reflects a strategic response to shifting geopolitical priorities and intensified "AI competition."

Shifting Global Alliances and International Relations

The strained US-China relations under the Trump administration significantly impacted Nvidia's global market positioning.

Impact of US-China Relations on Nvidia's Global Market Share

The deterioration of "US-China relations" affected Nvidia's market access and competitiveness in both regions:

- Market Share Fluctuations: Nvidia experienced fluctuations in market share in both the US and Chinese markets, reflecting the changing geopolitical dynamics.

- Strategic Alliances: The company had to adjust its strategic alliances, adapting to the changing geopolitical environment.

- Changes in Investment Strategies: Nvidia likely modified its investment strategies, taking into account the uncertainties associated with the strained US-China relationship.

Understanding "Nvidia market share" fluctuations and the impact on "global market access" is vital for assessing the company's long-term performance.

Long-term implications for Nvidia's global positioning

The "Trump effect on Nvidia" has had lasting implications for its "global positioning" and strategic planning:

- Diversification of Geographical Markets: Nvidia has likely accelerated its efforts to diversify its geographical markets, reducing dependence on any single region.

- Adaptation to Changing Geopolitical Landscapes: The company has honed its ability to adapt to rapidly changing geopolitical landscapes and navigate complex regulatory environments.

- Long-term Investment Decisions: The experiences of the Trump era have informed Nvidia's long-term investment decisions, emphasizing resilience and adaptability in the face of geopolitical uncertainty.

The company’s ability to navigate the "geopolitical landscape" and develop a robust "long-term strategy" will be crucial for maintaining its global leadership.

Conclusion: The Enduring Trump Effect on Nvidia's Future

The Trump administration's policies have profoundly impacted Nvidia, influencing its supply chain, AI development, and global positioning. The long-term consequences, including increased costs, supply chain diversification, and a heightened focus on domestic AI initiatives, are significant. Understanding the "Trump effect on Nvidia" is crucial not only for investors analyzing "Nvidia stock" but also for anyone seeking to understand the evolving interplay between geopolitical risk and the tech industry. We encourage further research into the "Trump effect on Nvidia" and the broader implications for geopolitical risk assessment in the tech sector. Follow Nvidia's financial reports and industry news for ongoing analysis, and share your thoughts and analysis on this critical topic.

Featured Posts

-

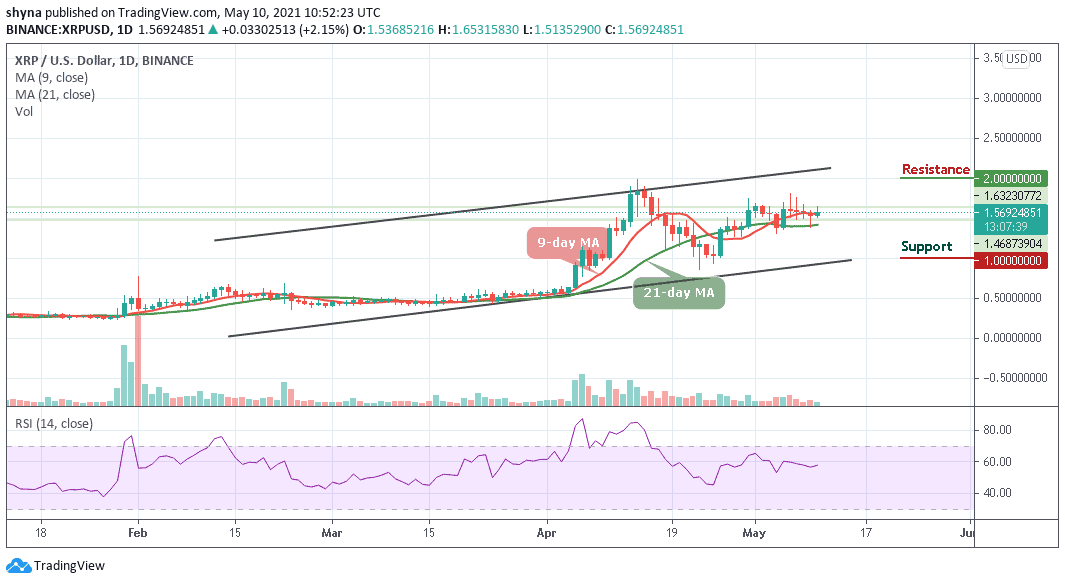

Should I Buy Xrp Ripple While Its Below 3 A Prudent Investors Guide

May 01, 2025

Should I Buy Xrp Ripple While Its Below 3 A Prudent Investors Guide

May 01, 2025 -

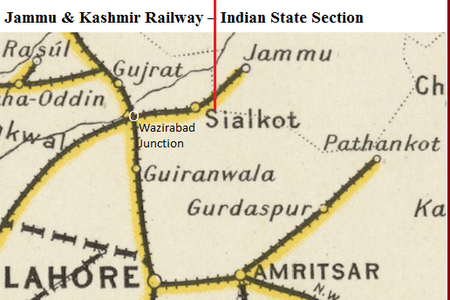

Kashmir Railway A Long Awaited Connection Finally Arrives

May 01, 2025

Kashmir Railway A Long Awaited Connection Finally Arrives

May 01, 2025 -

Simple Recipe For Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025

Simple Recipe For Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025 -

Program Tabung Baitulmal Sarawak Bantu 125 Anak Asnaf Sibu Kembali Ke Sekolah 2025

May 01, 2025

Program Tabung Baitulmal Sarawak Bantu 125 Anak Asnaf Sibu Kembali Ke Sekolah 2025

May 01, 2025 -

Londons Gangs A Look At The Warring Mobs In The Capital

May 01, 2025

Londons Gangs A Look At The Warring Mobs In The Capital

May 01, 2025