Should I Buy XRP (Ripple) While It's Below $3? A Prudent Investor's Guide

Table of Contents

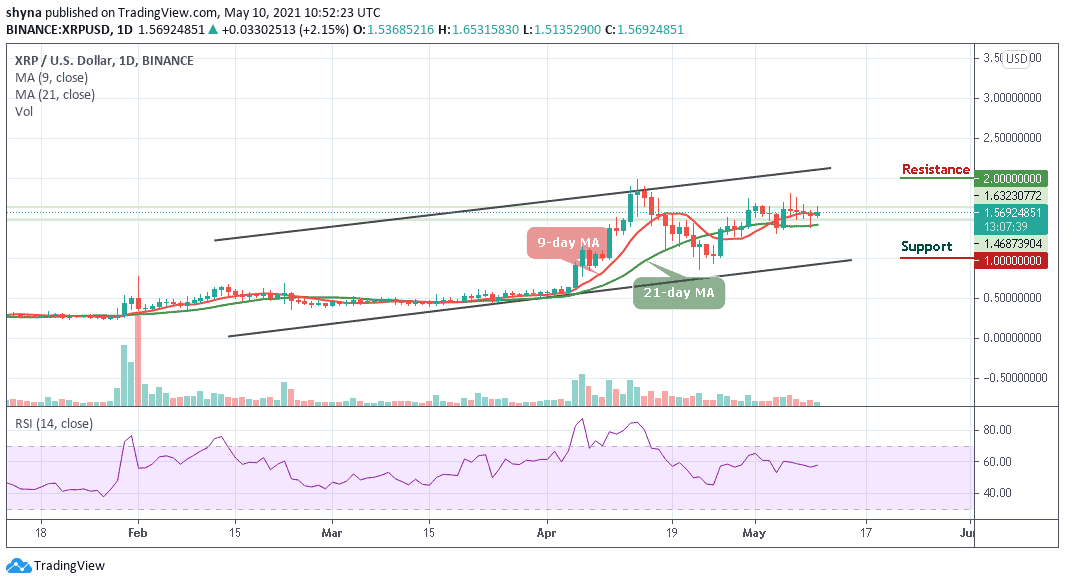

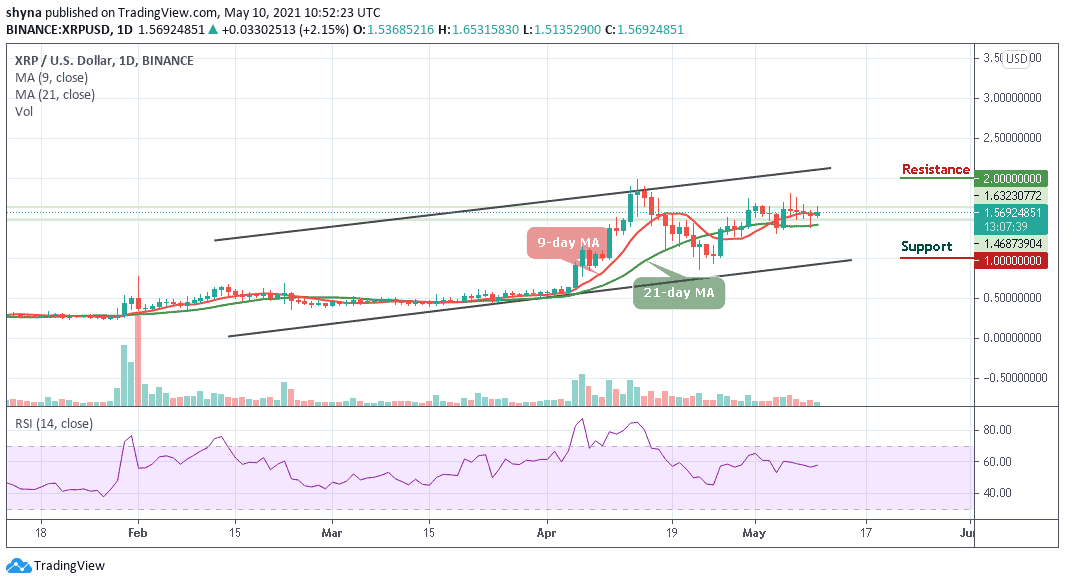

Understanding the Current XRP Market Landscape

XRP, Ripple's native cryptocurrency, has experienced significant price fluctuations. At the time of writing, XRP is trading [insert current price and source]. This price point follows [briefly describe recent market performance – e.g., a period of consolidation, a recent dip, etc.]. Several factors influence XRP's price:

-

Regulatory Developments: The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. Positive developments in the case could lead to price increases, while negative news might trigger further declines. Understanding the legal landscape surrounding XRP is paramount. Follow reputable legal news sources for updates.

-

Market Sentiment: Investor sentiment towards XRP is a key driver of its price. Positive news and increased adoption by financial institutions can boost investor confidence and push the price upward. Conversely, negative news or regulatory uncertainty can lead to sell-offs. Monitoring social media sentiment and news coverage can provide insights.

-

Technological Advancements: Ripple continues to develop its technology, including improvements to its payment network and expansion into new markets. These advancements can attract more users and institutions, potentially increasing demand for XRP. Stay informed about Ripple's technological roadmap.

-

Current XRP price and trading volume: [Insert data, cite source]

-

Recent news impacting XRP price (e.g., SEC lawsuit updates): [Summarize recent key news, cite sources]

-

Comparison to other cryptocurrencies in the same market cap range: [Compare XRP's performance to similar cryptocurrencies]

-

Sentiment analysis from major crypto news outlets: [Summarize sentiment from major outlets, cite sources]

Evaluating the Risks of Investing in XRP

Investing in cryptocurrencies, including XRP, involves significant risk. It's crucial to understand these risks before investing:

-

Volatility: The cryptocurrency market is notoriously volatile. XRP's price can fluctuate dramatically in short periods, leading to potential losses. Be prepared for significant price swings.

-

Potential for Complete Loss of Investment: There's always a possibility of losing your entire investment in XRP. Never invest more than you can afford to lose.

-

Legal and Regulatory Risks: The SEC lawsuit against Ripple creates significant regulatory uncertainty. An unfavorable outcome could severely impact XRP's price and even lead to its delisting from exchanges. This risk is substantial and warrants careful consideration.

-

Risks associated with centralized exchanges: Storing XRP on centralized exchanges exposes your investment to hacking and security breaches. Consider using secure hardware wallets for long-term storage.

-

Security risks of holding XRP: Like all cryptocurrencies, XRP is susceptible to various security threats, including phishing scams and malware. Practice safe cryptocurrency handling.

Assessing the Potential Rewards of Buying XRP Below $3

Despite the risks, investing in XRP below $3 could offer potential rewards:

-

Potential Long-Term Growth: If Ripple wins the SEC lawsuit and gains wider adoption, XRP's price could appreciate significantly in the long term. This is a speculative outlook, however.

-

Ripple's Partnerships and Collaborations: Ripple has established partnerships with several financial institutions globally. Further expansion into new markets could boost XRP demand. Research Ripple's partnerships.

-

Technological Advancements within the Ripple Network: Continuous improvements to Ripple's technology could enhance its efficiency and appeal, driving adoption and potentially increasing XRP's value. Stay updated on RippleNet's progress.

-

Potential for Increased Demand Due to Regulatory Clarity (if achieved): Resolution of the SEC lawsuit could lead to increased regulatory clarity, potentially unlocking greater institutional investment and boosting XRP’s price.

-

Comparison of potential ROI with other investment options: Compare the potential return on investment (ROI) of XRP with other investment options, considering the risks involved.

Developing a Prudent Investment Strategy for XRP

A prudent investment strategy is vital when dealing with XRP's volatility and regulatory uncertainty:

-

Thorough Research: Conduct in-depth research before investing. Understand the technology, the risks, and the potential rewards.

-

Invest Only What You Can Afford to Lose: Never invest more than you can comfortably afford to lose. Cryptocurrency investments are highly speculative.

-

Dollar-Cost Averaging (DCA): Consider using a DCA strategy, which involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak.

-

Risk Assessment and Diversification: Assess your risk tolerance and diversify your investment portfolio to reduce overall risk. Don't put all your eggs in one basket.

-

Realistic Investment Budget: Set a realistic budget and stick to it. Avoid impulsive investment decisions based on short-term price movements.

-

Due Diligence Resources: Use reputable sources for research, such as whitepapers, financial news sites, and analyst reports.

Conclusion

Investing in XRP below $3 presents a potential opportunity, but it also carries significant risks. The ongoing regulatory uncertainty and market volatility must be carefully considered. A prudent approach involves thorough research, risk assessment, and a well-defined investment strategy. Remember, never invest more than you can afford to lose.

Call to Action: Whether or not to buy XRP while it's below $3 is a decision that depends on your individual risk tolerance and investment goals. Before making any decisions about buying XRP, conduct thorough research and consult with a financial advisor to determine if it aligns with your personal financial situation. Remember to approach any XRP investment with a prudent and informed strategy.

Featured Posts

-

Eurovision Village 2025 Basel Grants Funding

May 01, 2025

Eurovision Village 2025 Basel Grants Funding

May 01, 2025 -

Bestu Deildin I Dag Leikjadagskra Og Urslitaspa

May 01, 2025

Bestu Deildin I Dag Leikjadagskra Og Urslitaspa

May 01, 2025 -

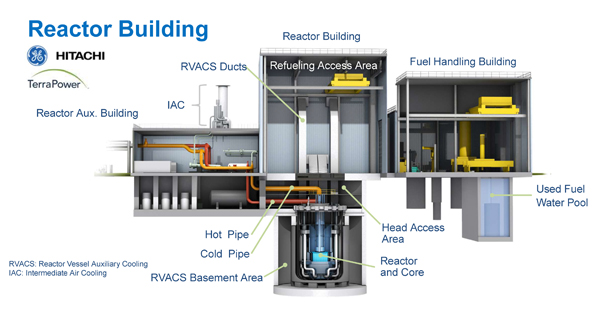

Nrc Reactor Power Uprate Timeline And Key Considerations

May 01, 2025

Nrc Reactor Power Uprate Timeline And Key Considerations

May 01, 2025 -

Juridische Strijd Kampen Eist Aansluiting Op Stroomnet Van Enexis

May 01, 2025

Juridische Strijd Kampen Eist Aansluiting Op Stroomnet Van Enexis

May 01, 2025 -

Kamala Harris Broadway Speech A Word Salad

May 01, 2025

Kamala Harris Broadway Speech A Word Salad

May 01, 2025