The Trump Effect: How His XRP Endorsement Impacts Institutional Investors

Table of Contents

Increased Public Awareness and Speculation

A Trump endorsement, whether explicit or implied through social media pronouncements, would instantly catapult XRP into the mainstream spotlight. The resulting publicity would be massive, creating a ripple effect across traditional and social media channels. This heightened visibility would dramatically increase public awareness and speculation surrounding XRP, potentially leading to a surge in retail demand.

- Increased media coverage and social media discussions: News outlets worldwide would cover the story extensively, driving organic search traffic and social media engagement, potentially making XRP a trending topic.

- Potential surge in retail investor interest and trading volume: Driven by FOMO (fear of missing out) and the perceived endorsement's legitimacy, retail investors might flock to XRP, leading to significant increases in trading volume on major exchanges.

- Increased price volatility in the short term: The sudden influx of retail investors could create substantial price volatility, with potential for both dramatic price increases and equally sharp corrections.

- Psychological impact of celebrity endorsements on market behavior: The psychology of celebrity endorsements is well-documented. Trump's endorsement would tap into this powerful dynamic, influencing investor sentiment and potentially overriding fundamental analysis for some traders.

Shifting Institutional Perception of XRP

For institutional investors, a Trump endorsement could significantly alter their perception of XRP's risk profile. While previously wary due to regulatory uncertainty and market volatility inherent to cryptocurrencies, the perceived backing of a high-profile figure like Trump might reduce their perceived risk.

- Potential for increased legitimacy and reduced perceived risk: Institutional investors often prioritize perceived legitimacy. A Trump endorsement could lend a veneer of respectability, mitigating concerns about XRP's relative newness and volatility.

- Attracting attention from larger investment firms previously hesitant to invest in crypto: The endorsement might act as a catalyst, encouraging larger, more risk-averse investment firms to consider allocating assets to XRP, increasing institutional adoption.

- Impact on due diligence processes undertaken by institutional investors: While due diligence would still be crucial, the Trump effect might shorten the timeline for certain institutions, accelerating their consideration of XRP as a viable investment.

- Whether the endorsement would outweigh existing concerns about XRP's regulatory landscape: This is a crucial factor. Even with a Trump endorsement, regulatory uncertainty and the ongoing legal battles faced by Ripple could still deter some institutional investors.

Impact on Regulatory Scrutiny and Legal Landscape

A Trump endorsement could ironically increase regulatory scrutiny of XRP. Government agencies might view the increased public interest and potential for market manipulation as requiring greater oversight.

- Increased regulatory scrutiny from government agencies: Regulators might initiate investigations into market manipulation or potential violations of securities laws, spurred by the increased trading volume and public attention.

- Potential for new regulations impacting XRP adoption: The increased scrutiny could result in new regulations specifically targeting XRP or the broader cryptocurrency market, potentially hindering its adoption.

- Discussion of legal ramifications for Ripple and XRP related to ongoing lawsuits: The endorsement's impact on the ongoing legal battles faced by Ripple would be significant. A positive outcome might be perceived as less likely due to increased governmental scrutiny, even with a favorable Trump endorsement.

- Comparison to the regulatory impact on other cryptocurrencies following celebrity endorsements: Examining historical precedents of celebrity endorsements in the crypto space and their subsequent regulatory implications could offer valuable insights into potential outcomes.

Strategic Implications for Ripple and XRP

For Ripple, the company behind XRP, a Trump endorsement presents a complex scenario with both advantages and disadvantages.

- Potential increase in XRP adoption by financial institutions: The increased legitimacy and reduced perceived risk could drive greater adoption by financial institutions, accelerating Ripple's goal of becoming a global payments network.

- Improved brand image and enhanced trust among investors: A Trump endorsement, however controversial, could boost Ripple's brand image and build trust among investors who might associate it with success and influence.

- Potential challenges related to managing increased market demand and volatility: A sudden surge in demand could strain Ripple's infrastructure and create challenges in managing price volatility.

- Impact on Ripple's long-term strategy and partnerships: The endorsement might necessitate adjustments to Ripple's long-term strategy and partnerships, potentially requiring it to navigate complex regulatory landscapes and address investor concerns related to the volatility and scalability of XRP.

The Trump Effect on XRP and Institutional Investment – A Call to Action

The potential "Trump Effect" on XRP and institutional investment is a complex issue with significant uncertainties. While a Trump endorsement could boost XRP's price and attract institutional investment, it also carries the risk of increased regulatory scrutiny and heightened market volatility. Careful analysis and informed decision-making are crucial. Stay informed about developments in the XRP market and the implications of any significant events by subscribing to reputable newsletters, following relevant news sources, and conducting your own thorough research on the "Trump Effect" on XRP and institutional investment strategies. Further reading on XRP, institutional investment in crypto, and the impact of political endorsements on financial markets is highly recommended.

Featured Posts

-

How Saturday Night Live Propelled Counting Crows To Fame In 1995

May 08, 2025

How Saturday Night Live Propelled Counting Crows To Fame In 1995

May 08, 2025 -

Arsenal Vs Psg Key Battles In The Champions League Semi Final

May 08, 2025

Arsenal Vs Psg Key Battles In The Champions League Semi Final

May 08, 2025 -

This Spac Stock Is Making Waves A Micro Strategy Comparison For Investors

May 08, 2025

This Spac Stock Is Making Waves A Micro Strategy Comparison For Investors

May 08, 2025 -

Long Term Effects Toxic Chemicals From Ohio Train Derailment Remain In Buildings

May 08, 2025

Long Term Effects Toxic Chemicals From Ohio Train Derailment Remain In Buildings

May 08, 2025 -

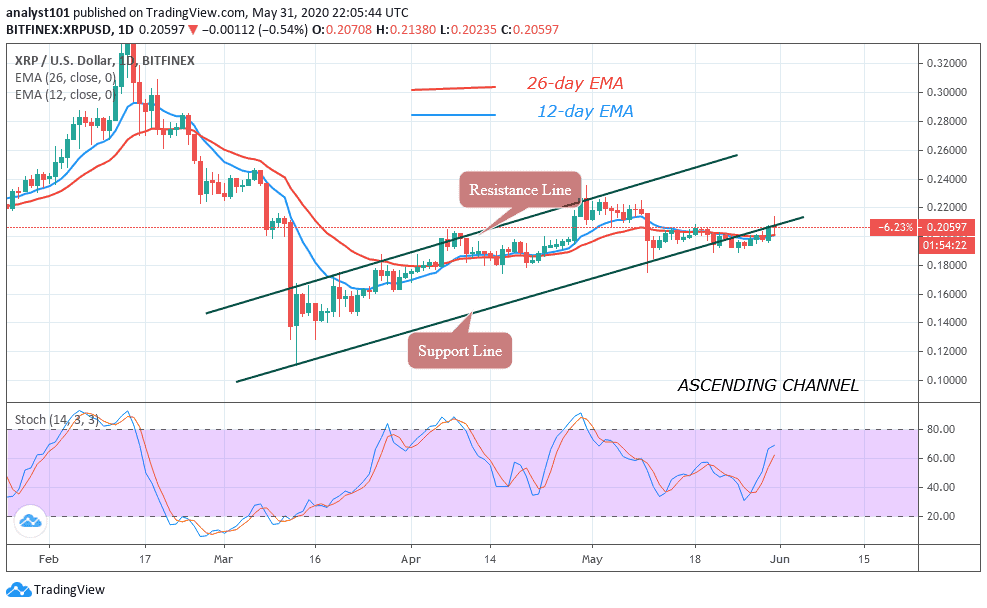

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025

Xrp Ripple Price Prediction And Investment Strategy

May 08, 2025

Latest Posts

-

Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025

Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025 -

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Byan

May 08, 2025

Krachy Pwlys Ky Naahly Jawyd Ealm Awdhw Ka Byan

May 08, 2025 -

Armghan Kys Krachy Pwlys Chyf Ka Naahly Ka Aetraf

May 08, 2025

Armghan Kys Krachy Pwlys Chyf Ka Naahly Ka Aetraf

May 08, 2025 -

Jawyd Ealm Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025

Jawyd Ealm Awdhw Ka Armghan Kys Myn Pwlys Ky Karkrdgy Pr Aetraf

May 08, 2025 -

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025

Krachy Pwlys Srbrah Ka Armghan Kys Myn Naahly Ka Aetraf

May 08, 2025