The Trade War's Impact On Crypto: One Cryptocurrency That Could Still Thrive

Table of Contents

Trade Wars and Market Volatility

Trade wars, characterized by escalating tariffs and trade restrictions between nations, historically correlate with market downturns. The increased friction in global trade leads to several negative consequences:

- Increased investor uncertainty: Uncertainty about future trade policies and economic growth dampens investor confidence.

- Reduced global trade and investment: Higher tariffs make imports more expensive, reducing trade volume and impacting businesses reliant on international commerce.

- Flight to safety: Investors often move their assets into perceived safe havens like gold, US Treasuries, and other low-risk investments.

- Impact on stock markets and traditional assets: Stock markets typically experience volatility and declines during trade wars, reflecting the broader economic uncertainty.

- Ripple effect on cryptocurrency markets: The interconnectedness of global markets means that the volatility in traditional markets often spills over into the cryptocurrency market, affecting the price of Bitcoin and altcoins negatively. A general negative correlation exists between traditional market downturns and cryptocurrency prices. This is largely due to investor sentiment and risk aversion.

This volatility significantly impacts the price of various cryptocurrencies. Bitcoin, often considered a safe haven asset within the crypto world, still experiences price fluctuations during trade war escalations. Altcoins, being generally more speculative, often suffer even more dramatic price drops.

The Appeal of Decentralized Cryptocurrencies During Uncertainty

During economic turmoil, decentralized cryptocurrencies like Monero offer a compelling alternative. Their unique characteristics make them attractive as potential safe havens:

- Resistance to government control and manipulation: Unlike fiat currencies, decentralized cryptocurrencies are not subject to government control or manipulation, making them less vulnerable to geopolitical risks.

- Increased privacy and anonymity in transactions: This feature is particularly attractive during periods of economic instability, when concerns about capital controls and censorship increase.

- Potential for hedging against inflation and currency devaluation: The finite supply of many cryptocurrencies can act as a hedge against inflation, offering a store of value that's less susceptible to devaluation.

- Growing adoption in decentralized finance (DeFi) projects: The DeFi ecosystem offers various financial services without relying on traditional centralized institutions, further enhancing the appeal of decentralized cryptocurrencies.

- Lower susceptibility to geopolitical events compared to centralized assets: Decentralized cryptocurrencies are not tied to any single nation or entity, making them less vulnerable to the effects of trade wars and geopolitical tensions.

The concept of "digital gold" often applies to cryptocurrencies like Monero. While not a perfect analogy, the idea centers on the asset's potential to hold its value during periods of economic instability, similar to how physical gold has historically served as a safe haven asset.

One Cryptocurrency Poised for Growth: Monero

Monero (XMR), a privacy-focused cryptocurrency, is particularly well-positioned to thrive during trade wars. Its key strengths include:

- Strong privacy features: Monero employs advanced cryptographic techniques to ensure the anonymity and confidentiality of transactions, a valuable feature during periods of heightened government scrutiny.

- Decentralized network: The decentralized nature of Monero's network makes it resistant to censorship and control by any single entity.

- Increased demand for privacy and security: During times of uncertainty, the demand for privacy-enhancing technologies often increases, potentially benefiting Monero.

- Growing adoption: Monero's adoption is steadily increasing across various sectors, demonstrating market confidence in its technology and features.

- Active development community: A vibrant community actively supports and develops Monero, ensuring its continued evolution and adaptation to emerging challenges.

[Link to Monero website] [Link to Monero whitepaper]

Investing in cryptocurrencies, including Monero, always carries inherent risks. Market volatility, technological vulnerabilities, and regulatory uncertainty are all factors to consider.

The Role of Blockchain Technology

Monero's resilience during economic uncertainty is underpinned by its blockchain technology:

- Immutability and transparency of the blockchain: Once recorded, transactions on the Monero blockchain are permanent and transparent, fostering trust and accountability.

- Decentralized nature reduces single points of failure: The distributed nature of the network minimizes vulnerability to attacks and censorship.

- Enhanced security features: Monero's cryptographic protocols provide strong security, protecting transactions from unauthorized access.

- Potential for cross-border transactions unaffected by trade restrictions: Because Monero operates independently of any centralized authority, its transactions are largely unaffected by trade restrictions imposed by governments.

Conclusion

Trade wars create economic uncertainty that impacts cryptocurrency markets. However, decentralized cryptocurrencies like Monero, with their inherent privacy features and resistance to centralized control, show potential to thrive during such periods. The underlying blockchain technology further enhances their resilience. The growing adoption of Monero within the DeFi ecosystem also contributes to its potential for growth.

While investing in cryptocurrencies always carries risk, understanding the potential benefits of decentralized options like Monero during times of global instability can be crucial. Conduct thorough research and consider adding Monero to your diversified portfolio as a potential hedge against trade war volatility. Learn more about Monero and its potential today.

Featured Posts

-

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025

Xrp Etf In Brazil Ripple News And Trumps Social Media Activity

May 08, 2025 -

2025 La Angels Games Your Guide To Streaming Without Cable

May 08, 2025

2025 La Angels Games Your Guide To Streaming Without Cable

May 08, 2025 -

Azalan Karlilik Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025

Azalan Karlilik Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025 -

Crypto Market Update Major Xrp Whale Makes 20 M Token Purchase

May 08, 2025

Crypto Market Update Major Xrp Whale Makes 20 M Token Purchase

May 08, 2025 -

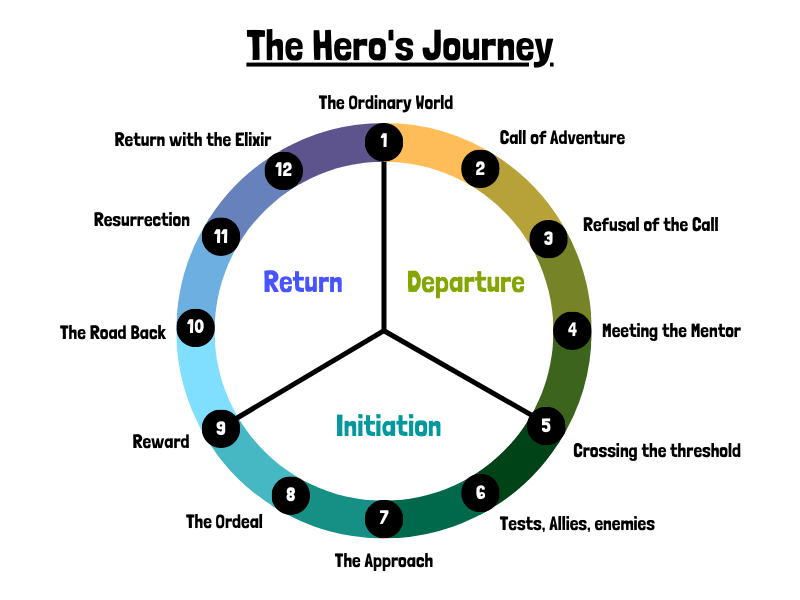

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025

Unveiling The Past A Rogue One Heros Journey In The New Star Wars Series

May 08, 2025

Latest Posts

-

Jayson Tatum Ankle Injury Pain Visible Celtics Face Uncertainty

May 09, 2025

Jayson Tatum Ankle Injury Pain Visible Celtics Face Uncertainty

May 09, 2025 -

The Essence Of Success Jayson Tatum On Grooming And Confidence

May 09, 2025

The Essence Of Success Jayson Tatum On Grooming And Confidence

May 09, 2025 -

Analyzing Colin Cowherds Criticism Of Jayson Tatums Performance

May 09, 2025

Analyzing Colin Cowherds Criticism Of Jayson Tatums Performance

May 09, 2025 -

Jayson Tatum Opens Up Grooming Confidence And His Coach

May 09, 2025

Jayson Tatum Opens Up Grooming Confidence And His Coach

May 09, 2025 -

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Moment

May 09, 2025

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Moment

May 09, 2025