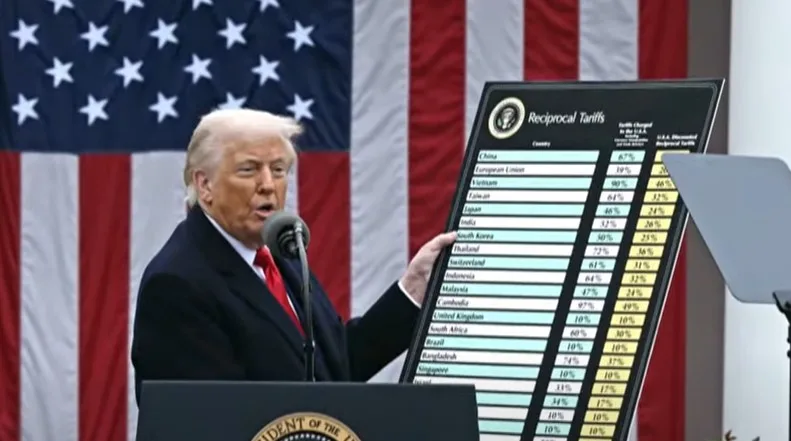

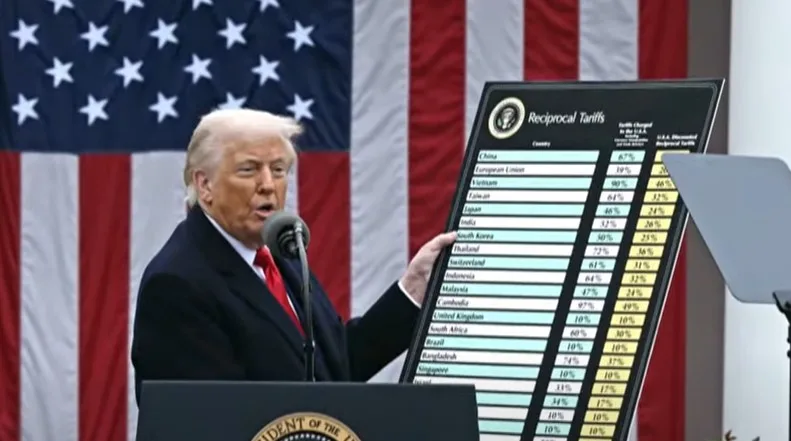

The Stock Market's Struggle With 'Liberation Day' Tariffs: Challenges And Opportunities

Table of Contents

Challenges Posed by 'Liberation Day' Tariffs

Increased Import Costs and Inflation

"Liberation Day" tariffs directly increase the cost of imported goods, triggering a ripple effect throughout the economy. This translates to:

- Higher prices for consumers: Increased import costs are often passed on to consumers, leading to reduced purchasing power and potentially dampening overall economic growth. This can negatively impact consumer confidence and spending habits.

- Reduced consumer spending: As prices rise, consumers may cut back on discretionary spending, impacting businesses reliant on consumer demand. This decreased demand can lead to lower corporate profits and slower economic growth.

- Potential for decreased corporate profits due to higher input costs: Businesses that rely on imported materials or components will face higher production costs, potentially squeezing profit margins. This can lead to reduced investment and slower job growth.

- Increased inflationary pressures: The rise in import prices contributes to overall inflation, potentially eroding the value of savings and impacting the purchasing power of consumers. This inflationary pressure can force central banks to raise interest rates, further impacting the stock market.

Supply Chain Disruptions

The imposition of "Liberation Day" tariffs creates significant disruptions to established global supply chains. This can manifest in several ways:

- Delays in production and delivery: Tariffs can add significant delays to the import process, impacting production schedules and potentially leading to shortages. This can disrupt just-in-time manufacturing systems and increase inventory costs.

- Increased reliance on domestic suppliers (potential benefits and drawbacks): Businesses might shift to domestic suppliers to avoid tariffs, but this may involve higher costs or reduced quality if domestic alternatives aren't readily available or as efficient.

- Potential for shortages of certain goods: Disruptions to global supply chains can result in shortages of specific goods, impacting both businesses and consumers. This can lead to price increases and potentially create opportunities for businesses that can provide alternatives.

- Increased logistics and transportation costs: Navigating the complexities of tariffs can lead to increased costs associated with logistics, transportation, and customs processing. These added costs contribute to higher overall prices.

Negative Impact on Specific Sectors

Certain sectors are disproportionately vulnerable to the impacts of "Liberation Day" tariffs. These include:

- Technology: The tech sector, heavily reliant on imported components and global supply chains, faces significant challenges from increased costs and disruptions.

- Manufacturing: Manufacturing companies utilizing imported materials will experience increased input costs, impacting profitability and competitiveness.

- Agriculture: Agricultural products, subject to international trade, are directly affected by tariffs, potentially leading to reduced exports and market instability.

Examples: [Insert specific examples of companies or sectors negatively impacted, referencing stock performance data where possible. E.g., "Company X, a major importer of [product], saw its stock price decline by Y% following the implementation of the tariffs."] This impact could potentially lead to job losses in affected sectors, creating further economic uncertainty.

Opportunities Presented by 'Liberation Day' Tariffs

While presenting significant challenges, "Liberation Day" tariffs also create opportunities for businesses and investors:

Growth of Domestic Industries

Tariffs can inadvertently protect and stimulate domestic industries by:

- Increased domestic production: Higher import costs can incentivize businesses to shift production to domestic sources, creating jobs and boosting economic activity within the country.

- Job creation in protected sectors: The increased demand for domestically produced goods can lead to job creation in protected sectors, mitigating some of the negative impacts in other areas.

- Potential for increased innovation and competitiveness: The increased competition fostered by tariffs can drive innovation and efficiency improvements among domestic businesses, leading to greater competitiveness in the long run.

- Opportunities for investment in domestic companies: Investors can seek opportunities in companies that are well-positioned to benefit from increased domestic demand and reduced reliance on imports.

Investment in Diversification and Resilience

"Liberation Day" tariffs highlight the importance of portfolio diversification and investing in resilient companies:

- Shifting investments towards less tariff-sensitive sectors: Investors can mitigate risk by shifting investments towards sectors less exposed to the impact of tariffs, such as services or domestically focused industries.

- Investing in companies that have successfully adapted to trade barriers: Companies that have demonstrated adaptability and resilience to previous trade barriers represent attractive investment opportunities.

- Exploring emerging markets less affected by the tariffs: Diversification into emerging markets less susceptible to the tariffs can offer growth potential and reduce overall portfolio risk.

Strategic Repositioning and Innovation

Companies can use "Liberation Day" tariffs as a catalyst for innovation and strategic repositioning:

- Development of new technologies or processes to reduce reliance on imports: The increased cost of imports incentivizes companies to invest in research and development, leading to innovation and reduced dependence on foreign suppliers.

- Exploration of new markets and supply chains: Companies may explore new markets and supply chain partners to reduce their exposure to tariff-related disruptions. This can create new opportunities for growth and expansion.

- Investment in research and development to create competitive advantages: Companies can invest in R&D to create new products or processes that reduce their reliance on imported components and gain a competitive edge.

Conclusion

"Liberation Day" tariffs present a complex interplay of challenges and opportunities for the stock market. Understanding the potential impacts on various sectors and adjusting investment strategies accordingly is crucial. The increased import costs and supply chain disruptions pose significant headwinds, while the potential for growth in domestic industries and the need for diversification offer strategic advantages. Understanding the complexities of "Liberation Day" tariffs and their impact on the stock market is crucial for informed investment decisions. Conduct thorough research and consider diversifying your portfolio to mitigate potential risks and capitalize on emerging opportunities presented by these tariffs.

Featured Posts

-

Xrp On The Brink Of A Record High The Role Of The Grayscale Etf

May 08, 2025

Xrp On The Brink Of A Record High The Role Of The Grayscale Etf

May 08, 2025 -

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025 -

Ps 5 Pro Disassembly A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025

Ps 5 Pro Disassembly A Deep Dive Into Its Liquid Metal Cooling

May 08, 2025 -

New Gambit Weapon Honors Rogues Sacrifice

May 08, 2025

New Gambit Weapon Honors Rogues Sacrifice

May 08, 2025 -

New Ps 5 Pro Enhanced Exclusives What To Play Now

May 08, 2025

New Ps 5 Pro Enhanced Exclusives What To Play Now

May 08, 2025

Latest Posts

-

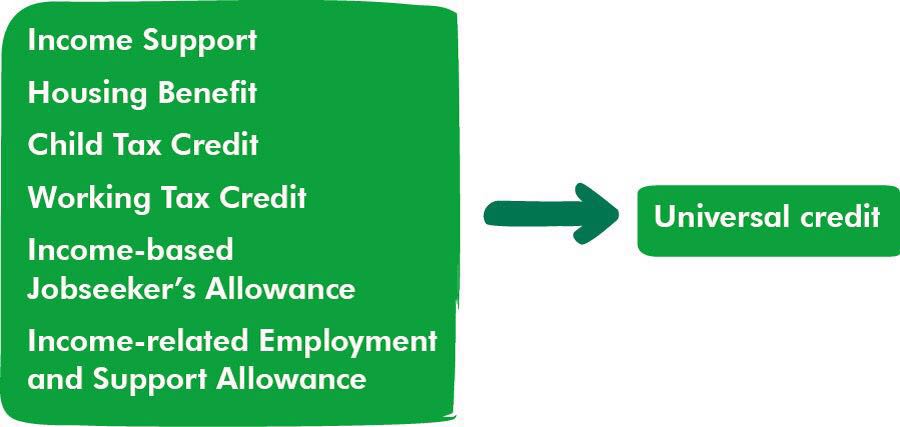

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Money

May 08, 2025 -

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025

Universal Credit Overpayment Reclaiming Money From The Dwp

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025 -

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025

Jayson Tatum Injury His Status For The Celtics Vs Nets Game

May 08, 2025 -

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025

Celtics Vs Nets Jayson Tatum Playing Status And Injury Update

May 08, 2025