The Shrinking Market Share: Examining The China Problem For BMW And Porsche And Competitors

Table of Contents

Intensifying Domestic Competition

The rise of powerful domestic competitors is a major factor in the shrinking market share of established luxury brands in China. This competition manifests in two key areas: the explosive growth of Chinese electric vehicle (EV) brands and increased price sensitivity among Chinese consumers.

Rise of Chinese Electric Vehicle (EV) Brands

The explosive growth of domestic EV brands like BYD, NIO, and Xpeng is reshaping the luxury car landscape. These brands are aggressively targeting the market share once dominated by foreign players like BMW and Porsche.

- Lower prices and advanced technology: Chinese EVs often offer comparable, and sometimes superior, technology at significantly lower prices than their luxury counterparts. This value proposition is particularly appealing to younger, tech-savvy consumers.

- Government subsidies and supportive policies: The Chinese government actively promotes the domestic EV industry through generous subsidies and supportive policies, further enhancing their competitiveness. This creates a significant advantage for local brands.

- Increasing sophistication and brand recognition: Chinese EV brands are rapidly improving their build quality, design, and brand image. Their increasing sophistication is eroding the perception of foreign brands as inherently superior.

Increased Price Sensitivity

While Chinese consumers are increasingly affluent, they remain price-conscious. This price sensitivity directly challenges the premium pricing strategies employed by BMW and Porsche.

- Challenging premium pricing: The value proposition offered by domestic alternatives makes it increasingly difficult for luxury brands to justify their higher price tags. Consumers are more likely to compare features and technology across price points.

- Feature comparison across price points: Chinese consumers are actively comparing features and technological advancements across various price brackets, forcing luxury brands to offer more competitive features at similar price points. This makes it harder to maintain profit margins.

Shifting Consumer Preferences

Beyond the intensifying competition, shifting consumer preferences in China are also impacting the market share of traditional luxury brands. These shifts center around the demand for electric and hybrid vehicles and a strong focus on technology and digital features.

Demand for Electric and Hybrid Vehicles

The Chinese government's strong push for electrification is driving substantial demand for EVs and hybrid vehicles. This presents a significant challenge for BMW and Porsche, who need to significantly accelerate their own EV rollout to keep up.

- Accelerated EV rollout: BMW and Porsche must rapidly expand their range of electric vehicles specifically tailored for the Chinese market to maintain relevance and competitiveness.

- Adapting to technological advancements: The Chinese EV market is characterized by rapid technological innovation. Staying ahead of the curve in battery technology, charging infrastructure, and autonomous driving features is crucial.

Focus on Technology and Digital Features

Chinese consumers, particularly younger generations, place a premium on advanced technology and digital features in their vehicles. This necessitates a significant investment in cutting-edge technology integration.

- Connectivity, autonomous driving, and personalized infotainment: Integrating advanced connectivity features, autonomous driving capabilities, and highly personalized infotainment systems is essential for attracting and retaining customers.

- Meeting consumer expectations: Failure to meet these technology expectations will lead to lost sales to competitors who are willing to offer more advanced features.

Geopolitical and Economic Factors

Beyond the competitive and consumer-driven factors, broader geopolitical and economic factors further complicate the "China problem" for luxury automakers.

Trade Tensions and Tariffs

Trade disputes between China and the West have created uncertainty and negatively impacted the profitability of luxury car imports. Navigating the complexities of this trade environment is a constant challenge.

- Complex trade regulations and tariffs: Foreign automakers face significant challenges in navigating complex trade regulations and tariff structures in China.

- Mitigating the impact of trade tensions: Developing effective strategies to mitigate the impact of trade disputes and tariffs is vital for maintaining profitability and long-term success.

Economic Slowdown

Concerns about economic growth in China create uncertainty in consumer spending. A slowdown in the economy could lead to a significant decrease in demand for luxury goods.

- Decreased demand for luxury goods: A slowing economy could directly impact the demand for premium vehicles, forcing automakers to reconsider their strategies.

- Adapting to economic fluctuations: Luxury automakers need to develop strategies that are resilient to potential economic fluctuations and downturns in consumer spending.

Conclusion

The "China problem" presents significant challenges for BMW, Porsche, and other luxury automakers. Intensifying domestic competition, evolving consumer preferences, and macroeconomic factors are all contributing to shrinking market share. To overcome this, these brands must adapt quickly, focusing on aggressive electrification strategies, integrating cutting-edge technologies, and tailoring their offerings to the specific demands of the Chinese market. Failure to address these issues could lead to further erosion of market share and long-term difficulties in maintaining a strong presence in this vital market. Understanding and successfully navigating the complexities of the Chinese automotive market is no longer optional; it’s crucial for the continued success of these luxury brands. The future of BMW, Porsche, and their competitors hinges on effectively addressing the evolving dynamics of this increasingly competitive landscape and finding solutions to the China problem. Ignoring the China problem will have dire consequences.

Featured Posts

-

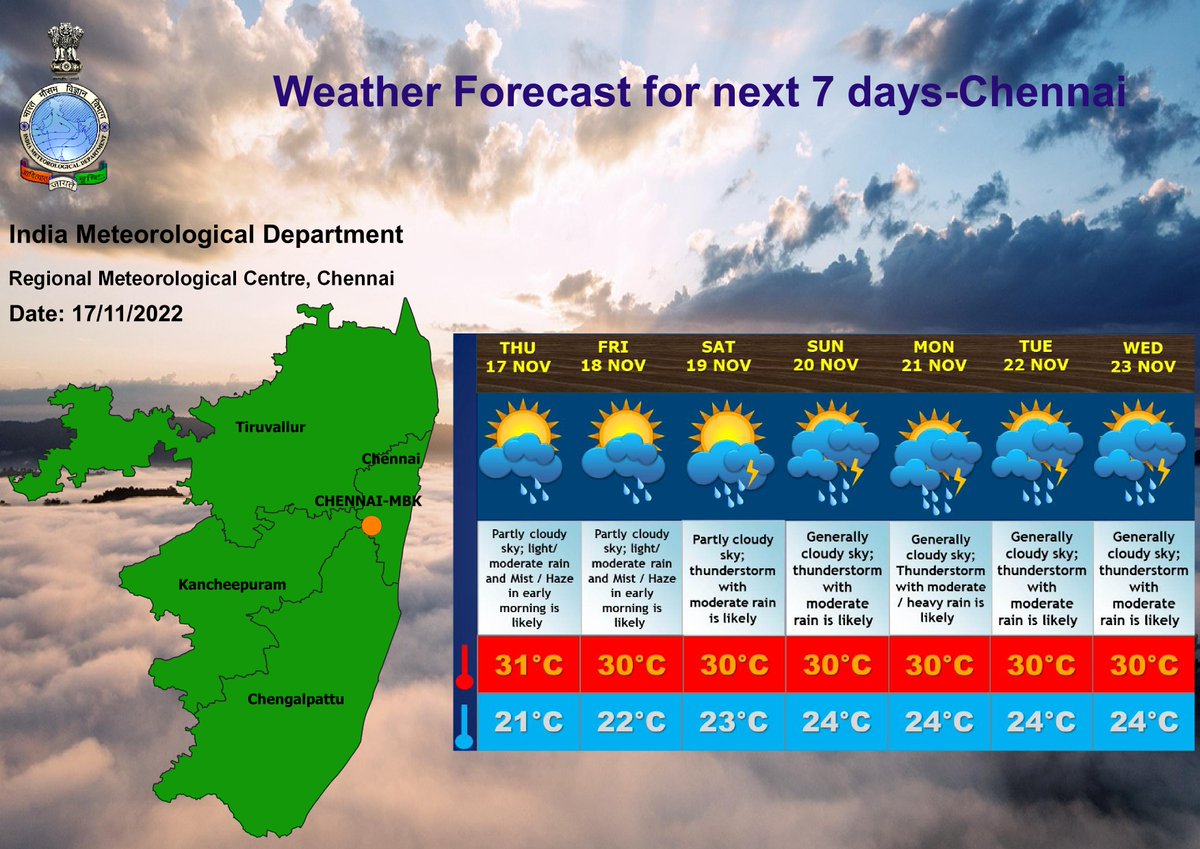

North Bengal Braces For Rain Met Departments Weather Forecast

May 05, 2025

North Bengal Braces For Rain Met Departments Weather Forecast

May 05, 2025 -

Blake Lively And Anna Kendrick Squash Feud Rumors With Premiere Reunion

May 05, 2025

Blake Lively And Anna Kendrick Squash Feud Rumors With Premiere Reunion

May 05, 2025 -

Kentucky Derby 151 Countdown Your Essential Pre Race Guide

May 05, 2025

Kentucky Derby 151 Countdown Your Essential Pre Race Guide

May 05, 2025 -

Bryce Mitchell Vs Jean Silva Heated Exchange At Ufc 314 Press Conference

May 05, 2025

Bryce Mitchell Vs Jean Silva Heated Exchange At Ufc 314 Press Conference

May 05, 2025 -

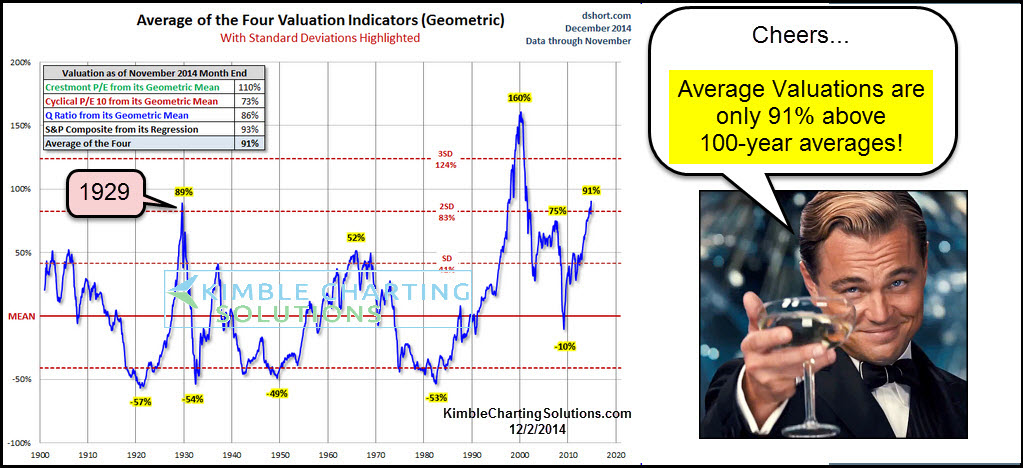

Bof As Reassurance Why High Stock Market Valuations Shouldnt Worry Investors

May 05, 2025

Bof As Reassurance Why High Stock Market Valuations Shouldnt Worry Investors

May 05, 2025

Latest Posts

-

Ufc Announces Fight Card Shuffle For Ufc 314

May 05, 2025

Ufc Announces Fight Card Shuffle For Ufc 314

May 05, 2025 -

Revised Fight Order For Ufc 314 Ppv Event

May 05, 2025

Revised Fight Order For Ufc 314 Ppv Event

May 05, 2025 -

Ufc 314 Pay Per View Fight Order Update

May 05, 2025

Ufc 314 Pay Per View Fight Order Update

May 05, 2025 -

Ufc 314 Fight Card Official Order Change Announced

May 05, 2025

Ufc 314 Fight Card Official Order Change Announced

May 05, 2025 -

Paddy The Baddy Pimbletts Post Ufc 314 Yacht Party Details Revealed

May 05, 2025

Paddy The Baddy Pimbletts Post Ufc 314 Yacht Party Details Revealed

May 05, 2025