BofA's Reassurance: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Necessarily Overblown

BofA's recent reports challenge the notion that current stock market valuations are excessively high. Their analysis takes a nuanced approach, considering various factors often overlooked in knee-jerk reactions to headline numbers. Let's break down their key arguments:

-

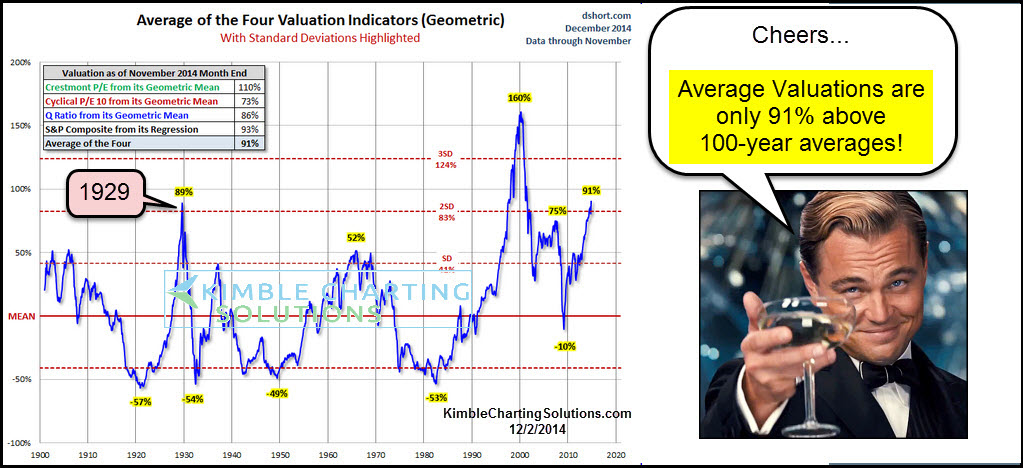

Comparison to Historical Valuations: BofA's analysts compare current valuation metrics, such as the price-to-earnings ratio (P/E), to historical data. This long-term perspective reveals that while valuations are elevated, they are not unprecedented outliers. Periods of similarly high valuations have occurred in the past without resulting in immediate or catastrophic market crashes. Context is key.

-

Analysis of Interest Rate Environments: Interest rates significantly impact stock valuations. BofA's analysis considers the current interest rate environment and its influence on discounted cash flow models, a key method for valuing companies. Lower interest rates can justify higher valuations, as the future cash flows of companies are discounted less heavily.

-

Sector-Specific Performance: BofA's analysis doesn't treat all sectors equally. Certain sectors, driven by technological innovation and strong growth prospects, may justify higher valuations than others. This granular approach highlights the importance of evaluating individual company performance and sector-specific growth trajectories rather than focusing solely on broad market indices.

The Power of Long-Term Growth: Why a Short-Term Perspective is Misleading

Focusing solely on short-term market fluctuations and current valuations can be detrimental to long-term investment success. BofA emphasizes the importance of a long-term investment strategy centered on fundamental analysis.

-

Fundamental Analysis over Market Noise: Instead of panicking over daily market swings, BofA encourages investors to focus on a company's underlying fundamentals: revenue growth, profitability, competitive landscape, and management quality. These factors provide a more accurate picture of a company's long-term value.

-

Examples of Long-Term Success: History is replete with examples of companies that have thrived despite periods of high market valuations. These companies demonstrated strong fundamentals and a clear path to long-term growth, ultimately outperforming the market.

-

Technological Innovation and Future Growth: Technological advancements continually reshape industries, creating new opportunities for growth. BofA recognizes the impact of innovation, suggesting that companies at the forefront of technological disruption can justify higher valuations based on their future growth potential.

Economic Factors Supporting Continued Market Strength: Beyond Valuations

Even with elevated valuations, several economic indicators support BofA's confidence in continued market strength.

-

Robust Corporate Earnings and Profit Growth: Many companies continue to report strong earnings and profit growth, demonstrating the underlying health of the economy. This positive trend directly impacts stock prices and reinforces investor confidence.

-

Positive Employment Data and Consumer Confidence: Strong employment numbers and high consumer confidence point to a healthy economy capable of supporting further market growth. This consumer spending power fuels corporate growth and further justifies current valuations from a macroeconomic perspective.

-

Government Policies Supporting Economic Expansion: Government policies aimed at fostering economic expansion can further bolster market strength. These policies can range from infrastructure investment to tax incentives, creating a positive feedback loop for economic growth.

Managing Risk in a High-Valuation Environment

While BofA's analysis provides reassurance, risk management remains crucial, even in a seemingly bullish market.

-

Diversification: Diversifying your investment portfolio across different asset classes and sectors mitigates risk and reduces exposure to sector-specific downturns.

-

Due Diligence: Thorough research and due diligence before investing in any company are essential. Understanding a company's financials, competitive landscape, and long-term prospects is crucial to making informed investment decisions.

-

Sector-Specific Risks: While the overall market may appear strong, certain sectors might face specific risks. It's important to identify and assess these sector-specific risks before committing capital.

BofA's Reassurance: A Call to Action for Informed Investors

BofA's analysis highlights that while high stock market valuations are a valid concern, they shouldn't necessarily deter long-term investors. The underlying economic strength, coupled with the power of long-term growth and strategic risk management, offers a compelling case for continued investment. However, informed decision-making is paramount. Don't let high stock market valuations deter you from pursuing your financial goals. Learn more about BofA's insights into navigating high stock market valuations and conduct thorough research, consulting with financial advisors to create an investment strategy aligned with your risk tolerance and long-term objectives. Remember, successful investing involves understanding both the current market dynamics and your own individual financial situation.

Featured Posts

-

Blake Lively And Anna Kendricks Relationship Body Language Reveals Potential Feud

May 05, 2025

Blake Lively And Anna Kendricks Relationship Body Language Reveals Potential Feud

May 05, 2025 -

Vegas Golden Knights Stanley Cup Playoffs Predictions And Analysis

May 05, 2025

Vegas Golden Knights Stanley Cup Playoffs Predictions And Analysis

May 05, 2025 -

Is The Mcu Losing Its Way A Critical Analysis Of Recent Projects

May 05, 2025

Is The Mcu Losing Its Way A Critical Analysis Of Recent Projects

May 05, 2025 -

Lizzos Transformation How She Achieved Significant Weight Loss

May 05, 2025

Lizzos Transformation How She Achieved Significant Weight Loss

May 05, 2025 -

Sheung Wans Honjo Review Of A Fun And Modern Japanese Restaurant

May 05, 2025

Sheung Wans Honjo Review Of A Fun And Modern Japanese Restaurant

May 05, 2025

Latest Posts

-

Fallica Criticizes Trumps Actions Towards Putin

May 05, 2025

Fallica Criticizes Trumps Actions Towards Putin

May 05, 2025 -

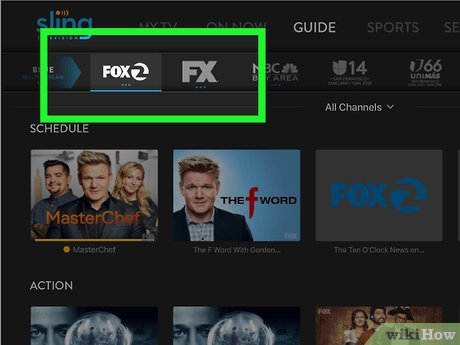

Fox And Espn Standalone Streaming Services Arrive In 2025

May 05, 2025

Fox And Espn Standalone Streaming Services Arrive In 2025

May 05, 2025 -

How To Watch The Chicago Cubs Vs La Dodgers Game In Tokyo Online

May 05, 2025

How To Watch The Chicago Cubs Vs La Dodgers Game In Tokyo Online

May 05, 2025 -

No Cable No Problem How To Stream Fox Live And On Demand

May 05, 2025

No Cable No Problem How To Stream Fox Live And On Demand

May 05, 2025 -

Katie Nolan Addresses Charlie Dixon Allegations Her Full Statement

May 05, 2025

Katie Nolan Addresses Charlie Dixon Allegations Her Full Statement

May 05, 2025