The Impact Of Trump's Tariffs On Norway's Investment Strategy Under Nicolai Tangen

Table of Contents

Trump's Tariffs and Global Market Volatility

Trump's tariffs, implemented between 2018 and 2020, significantly disrupted global trade flows and injected considerable uncertainty into the market. This volatility created ripple effects across various sectors, particularly impacting those heavily reliant on international trade and supply chains. Industries like energy, technology, and manufacturing – key components of NBIM's portfolio – faced considerable headwinds.

- Increased uncertainty for international investors: The unpredictable nature of the tariff policies made it difficult for investors like NBIM to accurately forecast future market conditions.

- Fluctuations in currency exchange rates: Tariffs and trade disputes often lead to currency volatility, adding another layer of complexity to investment decisions.

- Potential for trade wars and reduced global growth: The threat of escalating trade conflicts dampened global economic growth prospects, reducing overall investment returns.

- Impact on supply chains and commodity prices: Disruptions to global supply chains caused price fluctuations in various commodities, affecting companies across numerous sectors.

The introduction of Trump's tariffs created a challenging environment for all global investors, requiring strategic adjustments to mitigate potential losses and capitalize on emerging opportunities.

NBIM's Response to Increased Market Risk

Under Nicolai Tangen's leadership, NBIM adopted a proactive approach to managing the increased market risk presented by Trump's tariffs. The fund's strategy emphasized risk management and diversification, allowing them to navigate the volatile landscape more effectively. NBIM's response included several key adjustments:

- Increased focus on specific geographic regions less affected by tariffs: NBIM likely shifted investment towards regions less embroiled in trade disputes, reducing exposure to tariff-related volatility.

- Shift in sector allocation towards less tariff-sensitive industries: The fund might have reduced its holdings in sectors heavily impacted by tariffs, reallocating resources to more resilient sectors.

- Potential increase in hedging strategies to mitigate risk: NBIM may have employed various hedging techniques to insulate its portfolio from currency fluctuations and other tariff-related risks.

- Emphasis on long-term investment horizons despite short-term volatility: Maintaining a long-term perspective helped NBIM weather the short-term storm created by the tariffs, focusing on the overall long-term growth potential of its investments.

These strategic adjustments demonstrate NBIM's commitment to robust risk management and its ability to adapt to a rapidly changing global economic environment.

The Impact on Specific Sectors within NBIM's Portfolio

Trump's tariffs had a varied impact on different sectors within NBIM's expansive portfolio. Let's examine some key areas:

- Analysis of the impact on specific technology companies reliant on global supply chains: Technology companies reliant on international supply chains faced challenges due to increased costs and logistical complexities stemming from tariffs.

- Evaluation of the energy sector’s performance considering fluctuations in commodity prices: The energy sector, a significant portion of NBIM's holdings, experienced price fluctuations due to tariff-related disruptions in global trade and supply chains.

- Assessment of the impact on manufacturing companies and their reliance on international trade: Manufacturing companies relying heavily on imported components or exporting finished goods faced considerable challenges as a result of the tariffs.

Specific examples of individual companies and their performance during this period would require a deeper, case-by-case analysis, however, the general trends outlined above reveal the widespread nature of the impact.

Long-Term Implications for Norway's Sovereign Wealth Fund

Trump's tariff policies had long-term consequences for Norway's economy and its sovereign wealth fund. The experience provided valuable lessons for NBIM regarding navigating periods of significant market volatility:

- Potential for adjustments in long-term investment strategy: The uncertainty caused by the tariffs likely prompted NBIM to refine its long-term strategy, incorporating lessons learned about global trade risks.

- Re-evaluation of risk management frameworks: The experience highlighted the importance of robust and adaptable risk management frameworks capable of handling unforeseen global events.

- Increased focus on sustainable and ethical investing practices: The period may have reinforced NBIM's commitment to sustainable and ethical investments, emphasizing resilience and long-term value creation.

- Impact on future investment returns and the fund's overall performance: While the precise long-term impact on returns remains to be fully assessed, the tariffs undoubtedly introduced a level of uncertainty and complexity into NBIM's investment calculations.

Conclusion: Navigating Global Trade Uncertainty: The Legacy of Trump's Tariffs on Norway's Investment Strategy

Trump's tariffs significantly impacted NBIM's investment decisions under Nicolai Tangen, forcing the fund to adapt its strategies to manage increased market risk and uncertainty. The experience underscores the vital role of robust risk management and diversification in navigating volatile global trade environments. The long-term implications for Norway's sovereign wealth fund are still unfolding, but the lessons learned from this period will undoubtedly shape NBIM's approach to global investment in the years to come. We encourage further research into the impact of trade tariffs on investment strategies and the importance of adapting to unpredictable market conditions, particularly concerning Norway's sovereign wealth fund and global trade dynamics. Understanding these dynamics is crucial for ensuring the long-term health and stability of national investment strategies in an increasingly interconnected world.

Featured Posts

-

High Costs Jeopardize Offshore Wind Farm Projects

May 04, 2025

High Costs Jeopardize Offshore Wind Farm Projects

May 04, 2025 -

Corinthians E Fred Luz Bastidores Da Polemica Separacao E O Futuro Da Parceria

May 04, 2025

Corinthians E Fred Luz Bastidores Da Polemica Separacao E O Futuro Da Parceria

May 04, 2025 -

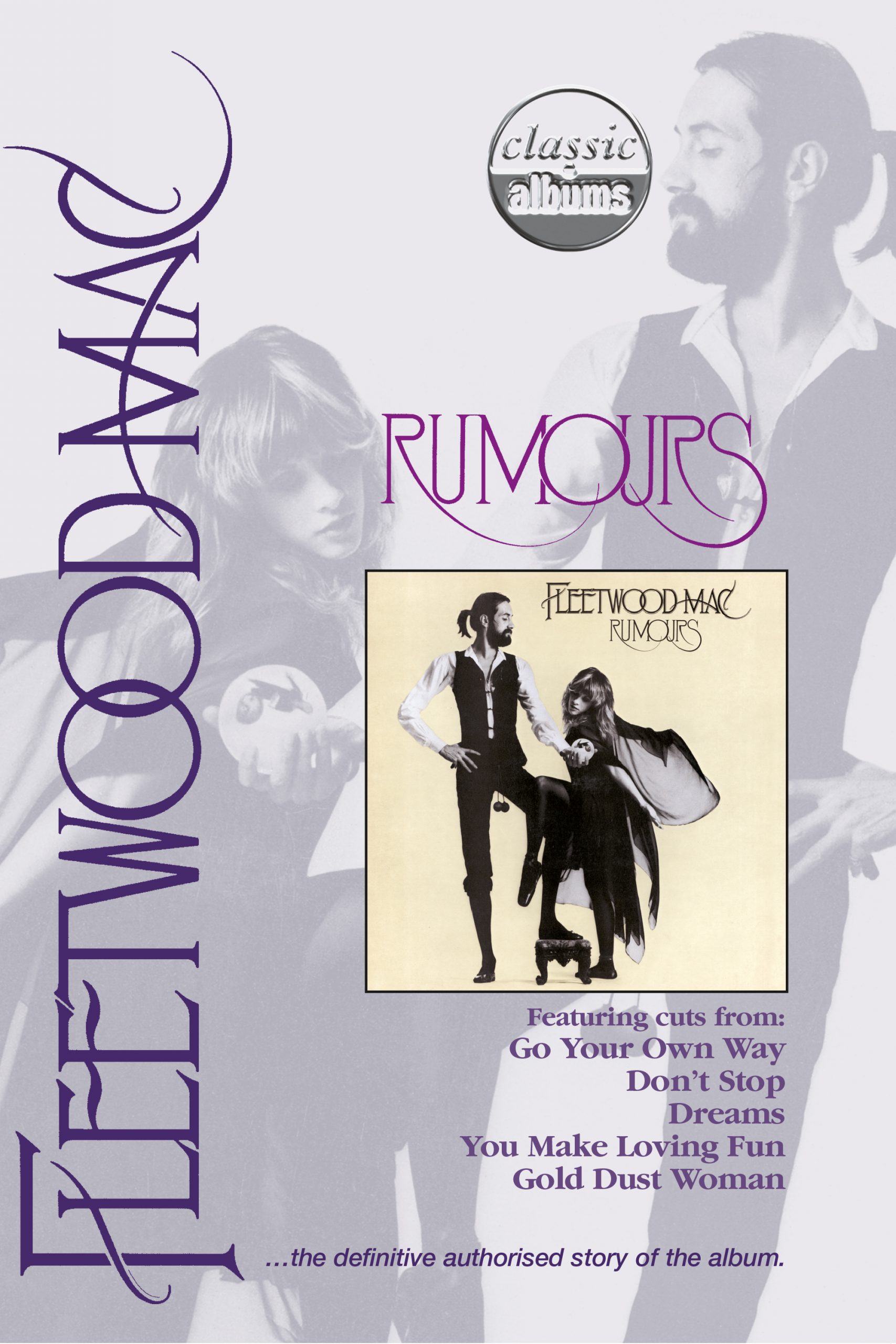

Fleetwood Macs Rumours 48 Years Ago A Broken Band Created A Legendary Album

May 04, 2025

Fleetwood Macs Rumours 48 Years Ago A Broken Band Created A Legendary Album

May 04, 2025 -

Hong Kong Intervenes In Fx Market To Defend Us Dollar Peg

May 04, 2025

Hong Kong Intervenes In Fx Market To Defend Us Dollar Peg

May 04, 2025 -

Dzhidzhi Khadid Rasskazala O Romane S Kuperom

May 04, 2025

Dzhidzhi Khadid Rasskazala O Romane S Kuperom

May 04, 2025