Hong Kong Intervenes In FX Market To Defend US Dollar Peg

Table of Contents

Understanding the Hong Kong Dollar's Peg to the US Dollar

Hong Kong's linked exchange rate system maintains the HKD within a narrow band against the USD (7.75-7.85 HKD per USD). This peg, implemented in 1983, functions as a cornerstone of Hong Kong's financial stability. The HKMA acts as the primary player, intervening in the FX market to ensure the HKD remains within this predetermined range.

The benefits of this peg are undeniable:

- Stability of the currency: The peg provides a stable and predictable exchange rate, benefiting both businesses and consumers.

- Reduced exchange rate risk: Businesses engaged in international trade are shielded from the uncertainties associated with fluctuating exchange rates.

- Attracting foreign investment: A stable currency fosters confidence and attracts significant foreign direct investment (FDI).

However, maintaining the peg also presents significant challenges:

- Potential loss of monetary policy independence: The need to maintain the peg limits the HKMA's ability to independently set interest rates to address domestic economic conditions.

- Vulnerability to external shocks: Global economic turmoil, particularly fluctuations in the USD, can put immense pressure on the HKD peg, requiring intervention.

The HKMA's Response to Recent Market Pressures

In response to recent market pressures, the HKMA has employed various measures to defend the HKD peg. These interventions usually involve the HKMA buying HKD in the open market, thus increasing demand and supporting its value. This is often accompanied by adjustments to the base rate, mirroring US interest rate changes to prevent significant capital outflows.

For example, during [insert specific date range], the HKMA intervened [insert details about interventions, amounts, etc.]. The rationale behind these actions was to counteract speculative attacks and maintain the HKD within the acceptable band. The effectiveness of these interventions is evident in the relative stability of the HKD/USD exchange rate following the intervention.

- Specific dates and amounts of interventions: [Insert specific data points if available]

- Changes in interest rates: [Insert specific data points if available]

- Impact on the HKD/USD exchange rate: [Insert specific data points if available]

- Market response to the HKMA's actions: [Insert analysis of market response]

Economic Implications and Future Outlook for the HKD Peg

The HKMA's interventions have short-term and long-term implications for Hong Kong's economy. Short-term effects can include adjustments in interest rates and inflation. Long-term effects, however, depend on the sustainability of the peg and the broader global economic environment.

- Impact on inflation: [Analyze the potential impact]

- Effect on interest rates: [Analyze the potential impact]

- Influence on foreign investment: [Analyze the potential impact]

- Potential challenges to the peg's future: [Discuss potential challenges]

- Long-term implications for Hong Kong's economy: [Discuss long-term implications]

The sustainability of the HKD peg depends on various factors, including the stability of the USD, global economic conditions, and the effectiveness of the HKMA's interventions. Alternatives to the current system, such as a managed float, have been discussed but are not currently under serious consideration given the benefits of the current stability.

Global Market Context and Related Currency Dynamics

The pressure on the HKD peg is heavily influenced by global events and the performance of other currencies. A strong USD, for example, can put upward pressure on the HKD, requiring HKMA intervention to prevent it from breaching the upper bound of the band. Conversely, a weak USD could necessitate interventions to support the HKD.

- Impact of US interest rate changes: [Analyze the impact]

- Influence of the Chinese Yuan (CNY): [Analyze the impact]

- Global economic factors influencing the HKD: [Discuss relevant factors]

The correlation between the HKD and other major Asian currencies is also a critical factor. The strength or weakness of these currencies can indirectly influence the pressure on the HKD peg.

Conclusion: The Ongoing Importance of Hong Kong's Intervention to Maintain the US Dollar Peg

The HKMA's consistent interventions in the FX market are crucial for maintaining Hong Kong's economic stability. The actions taken to defend the HKD's peg to the USD, while having short-term economic consequences, ultimately serve to safeguard Hong Kong's financial system. The long-term sustainability of the peg remains a subject of ongoing debate and requires continuous monitoring of global economic conditions and the effectiveness of HKMA interventions. Staying informed about these developments is paramount for understanding Hong Kong's economic future. For further reading, explore resources on Hong Kong's monetary policy and currency peg from reputable financial institutions and academic sources. Understanding Hong Kong's proactive approach to managing its currency peg is key to understanding the city's resilience in the face of global economic volatility.

Featured Posts

-

Review Honjo Modern Japanese Restaurant In Hong Kongs Sheung Wan

May 04, 2025

Review Honjo Modern Japanese Restaurant In Hong Kongs Sheung Wan

May 04, 2025 -

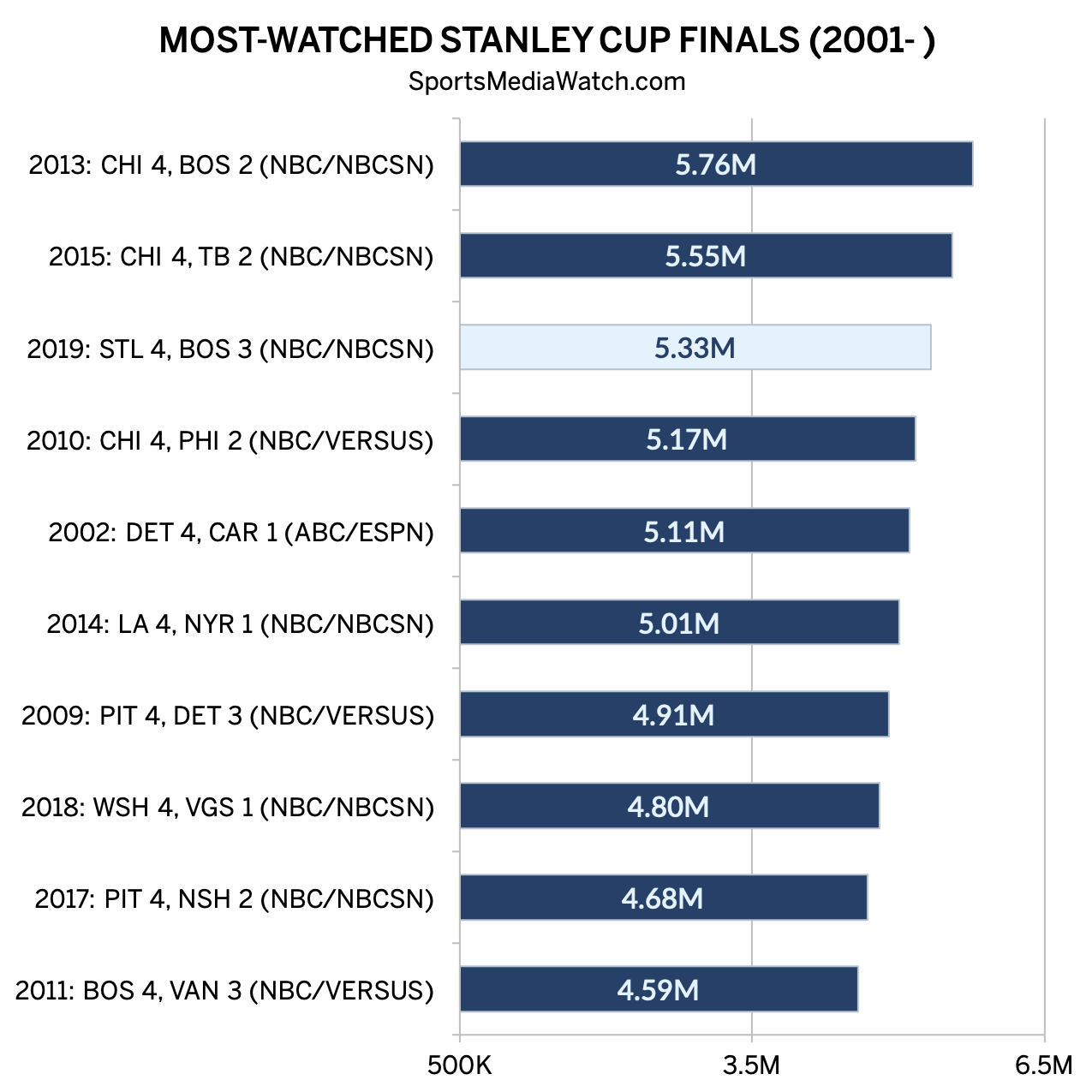

Lower Stanley Cup Playoff Ratings In The Us A Detailed Look

May 04, 2025

Lower Stanley Cup Playoff Ratings In The Us A Detailed Look

May 04, 2025 -

Nyc Late Night Shoot Bradley Cooper Directing Will Arnett For Is This Thing On

May 04, 2025

Nyc Late Night Shoot Bradley Cooper Directing Will Arnett For Is This Thing On

May 04, 2025 -

2025 Kentucky Derby Chunk Of Golds Profile And Betting Odds

May 04, 2025

2025 Kentucky Derby Chunk Of Golds Profile And Betting Odds

May 04, 2025 -

Esc 2024 Wiener Duo Abor And Tynna Vertreten Deutschland

May 04, 2025

Esc 2024 Wiener Duo Abor And Tynna Vertreten Deutschland

May 04, 2025