The Impact Of Tariff Uncertainty On U.S. Company Spending

Table of Contents

The unpredictable nature of tariffs has created significant challenges for U.S. businesses, forcing them to reassess their investment strategies and operational plans. This article explores how tariff uncertainty directly impacts spending decisions among American companies. We’ll examine the effects on capital expenditures, hiring, and overall economic growth, providing insights into how businesses can navigate this complex landscape.

<h2>Reduced Capital Expenditures (CAPEX)</h2>

Tariff uncertainty makes long-term planning extremely difficult for businesses. The constant threat of fluctuating import duties creates significant risk, impacting profitability projections and causing companies to reconsider major investments. This uncertainty directly translates into a reduction in capital expenditures (CAPEX).

<h3>Delayed Investment Decisions</h3>

Uncertainty surrounding import costs makes it nearly impossible to accurately forecast return on investment (ROI). This leads to a significant delay, or even cancellation, of planned investments.

- Uncertainty surrounding import costs makes it hard to accurately forecast return on investment (ROI). Companies need predictable cost structures to justify large capital investments. The volatility introduced by tariff changes undermines this predictability.

- Companies may postpone upgrades to equipment or expansion projects until the tariff landscape clarifies. Rather than risk investing in new equipment only to see import costs skyrocket, many businesses choose to postpone these decisions. This includes delaying vital upgrades to machinery or technology that could increase efficiency and productivity.

- This hesitancy contributes to slower overall economic growth. Delayed CAPEX translates to less investment in infrastructure, innovation, and job creation, all key drivers of economic expansion. This creates a ripple effect throughout the economy, impacting both businesses and consumers.

<h3>Shifting Production and Sourcing</h3>

To mitigate the impact of tariffs and their inherent uncertainty, many companies are actively exploring options to diversify their supply chains and shift production overseas.

- Reshoring and nearshoring initiatives are gaining momentum. Businesses are bringing manufacturing back to the U.S. or moving it to nearby countries to reduce reliance on distant suppliers and minimize tariff exposure.

- This shift can lead to job losses in some sectors and job creation in others. While some industries might see job losses due to offshoring, others will experience growth as reshoring and nearshoring efforts create new opportunities.

- Increased logistical complexities and higher transportation costs add to the financial burden. Shifting production involves significant logistical challenges and increased transportation costs, adding further complexities to already strained budgets.

<h2>Impact on Hiring and Employment</h2>

Tariff uncertainty significantly impacts hiring decisions, leading to a more conservative approach among businesses. This cautiousness can result in hiring freezes, layoffs, and wage stagnation.

<h3>Hiring Freezes and Layoffs</h3>

The unpredictable nature of tariffs creates a climate of uncertainty that discourages companies from expanding their workforce.

- Companies are more likely to rely on existing staff, delaying recruitment for new roles. Companies are less likely to take on the expense of hiring new employees when faced with uncertain future costs.

- Increased labor costs associated with relocating production can also contribute to layoffs. The costs associated with moving production can lead to difficult decisions, potentially resulting in job losses.

- This creates uncertainty in the labor market and impacts consumer confidence. Job insecurity stemming from tariff uncertainty can decrease consumer spending, creating a further negative impact on the economy.

<h3>Wage Stagnation</h3>

A cautious approach to hiring can directly translate into wage stagnation, particularly for workers in sectors heavily impacted by tariffs.

- Reduced competition for labor can suppress wage increases. A decreased demand for labor limits workers' bargaining power, reducing the likelihood of significant wage increases.

- This can negatively impact consumer spending and overall economic activity. Stagnant wages limit consumer spending, further hindering economic growth.

- Workers may face reduced opportunities for career advancement. A lack of new hires can limit opportunities for career progression and advancement within companies.

<h2>Effects on Innovation and Technological Advancement</h2>

The financial strain caused by tariff uncertainty can significantly impact a company's ability to invest in research and development (R&D) and adopt new technologies.

<h3>Reduced R&D Spending</h3>

Facing increased costs and reduced revenue, many companies prioritize cost-cutting measures, often at the expense of R&D.

- Uncertainty makes it harder to justify investments in long-term innovation projects. Long-term R&D projects require substantial upfront investment with uncertain returns, making them less attractive in uncertain economic climates.

- This slows down technological advancements and potentially impacts future competitiveness. Reduced investment in R&D can hinder innovation, making U.S. businesses less competitive in the global market.

- Reduced innovation can hinder economic growth in the long term. Innovation is a vital driver of economic growth, and its stagnation can have long-term negative consequences.

<h3>Delayed Adoption of New Technologies</h3>

The financial burden of tariff uncertainty can discourage companies from adopting new technologies, even when those technologies could increase efficiency and reduce costs.

- Uncertainty makes it difficult to assess the return on investment of new technologies. It is difficult to project the long-term benefits of technological advancements when faced with unpredictable tariff changes.

- This can hinder overall productivity improvements and competitiveness. Delayed adoption of new technologies reduces productivity gains and makes businesses less competitive.

- Falling behind technologically can damage the long-term prospects of American businesses. Failure to embrace technological advancements can place U.S. businesses at a significant disadvantage in the global market.

<h2>Conclusion</h2>

The uncertainty surrounding tariffs significantly impacts U.S. company spending, leading to reduced capital expenditures, cautious hiring practices, and potentially hindering innovation. This ripple effect can negatively influence economic growth, job creation, and the overall competitiveness of American businesses. Understanding the multifaceted impact of tariff uncertainty is crucial for policymakers and businesses alike. For a deeper dive into mitigating the effects of tariff uncertainty on your business, consult with a financial advisor specializing in international trade. Proactive planning and diversification strategies are essential to navigate this complex landscape and ensure long-term success in the face of tariff uncertainty.

Featured Posts

-

Jeff Goldblums Musical Talent New Album Details

Apr 29, 2025

Jeff Goldblums Musical Talent New Album Details

Apr 29, 2025 -

January 29th Dc Air Disaster Assessing The New York Times News Coverage

Apr 29, 2025

January 29th Dc Air Disaster Assessing The New York Times News Coverage

Apr 29, 2025 -

The Limited Thinking Of Ai What We Know Now

Apr 29, 2025

The Limited Thinking Of Ai What We Know Now

Apr 29, 2025 -

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide With Answers And Hints

Apr 29, 2025

Nyt Spelling Bee Puzzle 360 Feb 26th Complete Guide With Answers And Hints

Apr 29, 2025 -

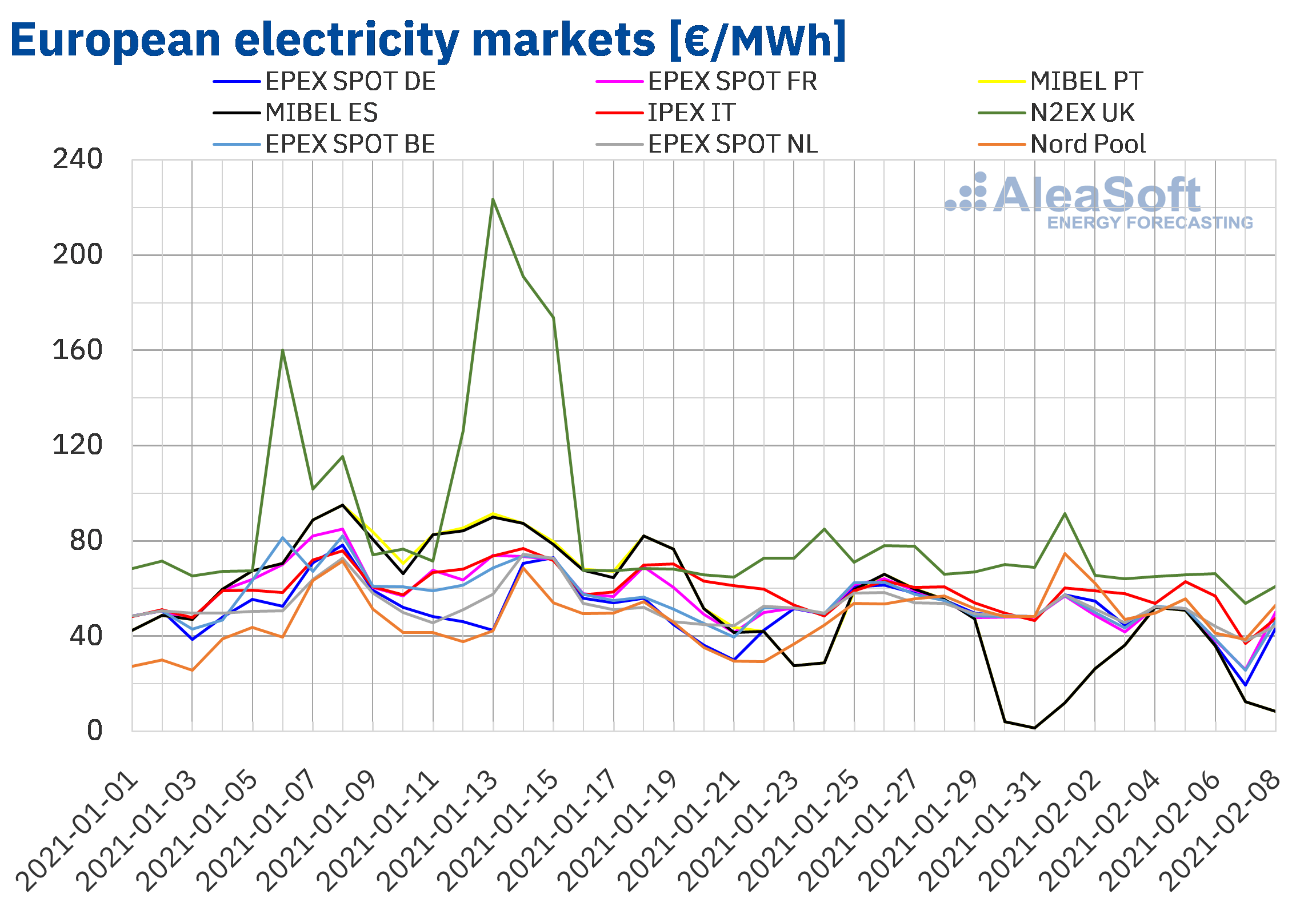

Negative European Power Prices A Solar Success Story

Apr 29, 2025

Negative European Power Prices A Solar Success Story

Apr 29, 2025