The Future Of XRP: Analyzing The Impact Of ETF Applications And SEC Legal Battles

Table of Contents

The Ripple vs. SEC Lawsuit: A Turning Point for XRP?

The legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) has cast a long shadow over XRP, creating significant uncertainty for investors. Understanding the current legal landscape and potential outcomes is crucial for predicting XRP's future.

The Current Legal Landscape:

The SEC's lawsuit against Ripple alleges that XRP is an unregistered security, claiming its sale constituted an unregistered securities offering. Ripple, on the other hand, argues that XRP is a cryptocurrency and not a security, emphasizing its decentralized nature and use in its payment network. Keywords: Ripple SEC lawsuit, XRP legal battle, Ripple vs SEC updates.

- SEC's Claims: The SEC argues that Ripple knowingly sold unregistered securities, violating federal laws. They point to Ripple's control over XRP distribution and its perceived benefits to investors as key arguments.

- Ripple's Defense: Ripple maintains that XRP is a decentralized digital asset, distinct from traditional securities. They highlight its use in facilitating cross-border payments and its community-driven development.

- Key Legal Arguments: The case hinges on the "Howey Test," which defines what constitutes a security. Both sides present arguments on whether XRP meets the criteria of this test.

- Potential Implications: A favorable ruling for Ripple could significantly boost XRP's price and adoption. Conversely, an unfavorable ruling could severely damage XRP's market position and lead to delisting from major exchanges.

Impact of the Ruling on XRP Price and Adoption:

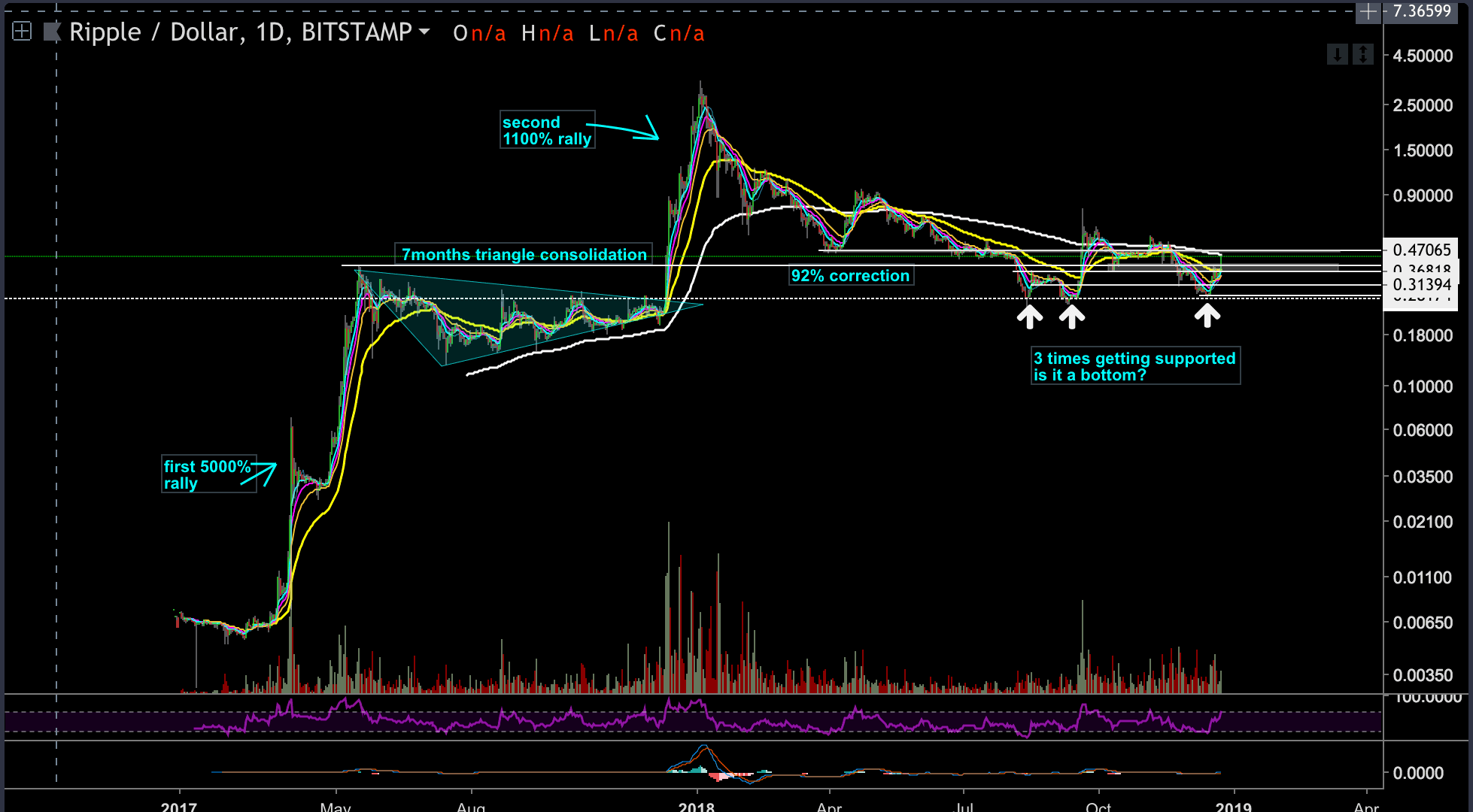

The outcome of the Ripple vs. SEC lawsuit will dramatically impact XRP's price and adoption. Keywords: XRP price prediction, XRP market cap, XRP adoption, regulatory uncertainty.

- Potential Price Scenarios: A victory for Ripple could send XRP's price soaring, while a loss could cause a significant drop. Many XRP price predictions are contingent on the lawsuit's outcome.

- Impact on Exchange Listings: The ruling will influence whether exchanges continue listing XRP, with some potentially delisting it if deemed a security.

- Effect on Institutional Investment: A clear regulatory framework is essential for attracting institutional investors. The lawsuit's resolution will significantly affect investor confidence.

- The Role of Public Perception: Public opinion and media coverage will play a considerable role in shaping XRP's future, regardless of the legal outcome.

The Rise of XRP ETFs: A Catalyst for Mainstream Adoption?

The potential approval of XRP exchange-traded funds (ETFs) could be a game-changer for the cryptocurrency. The process and implications of such approval are worth careful consideration.

The ETF Application Process:

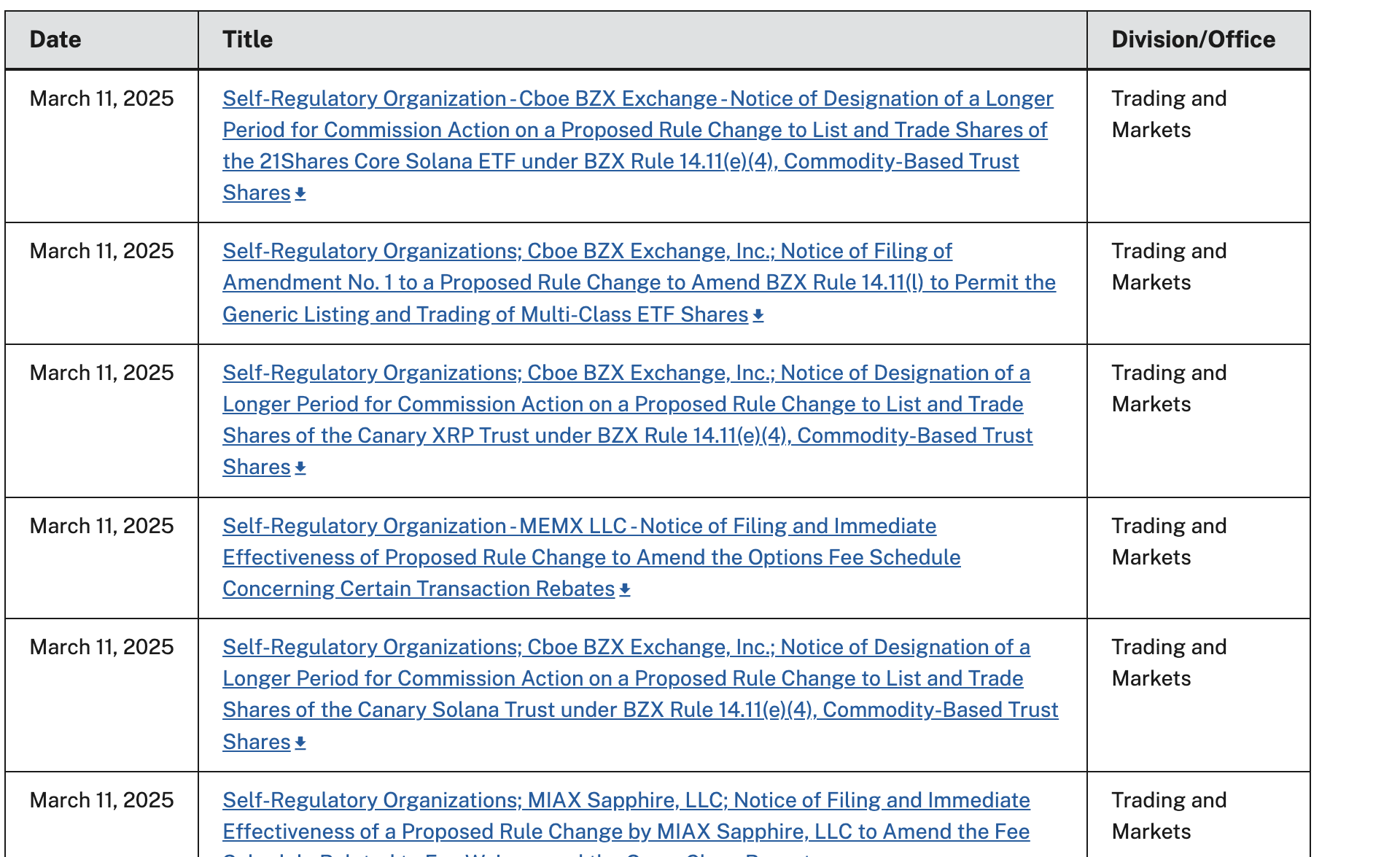

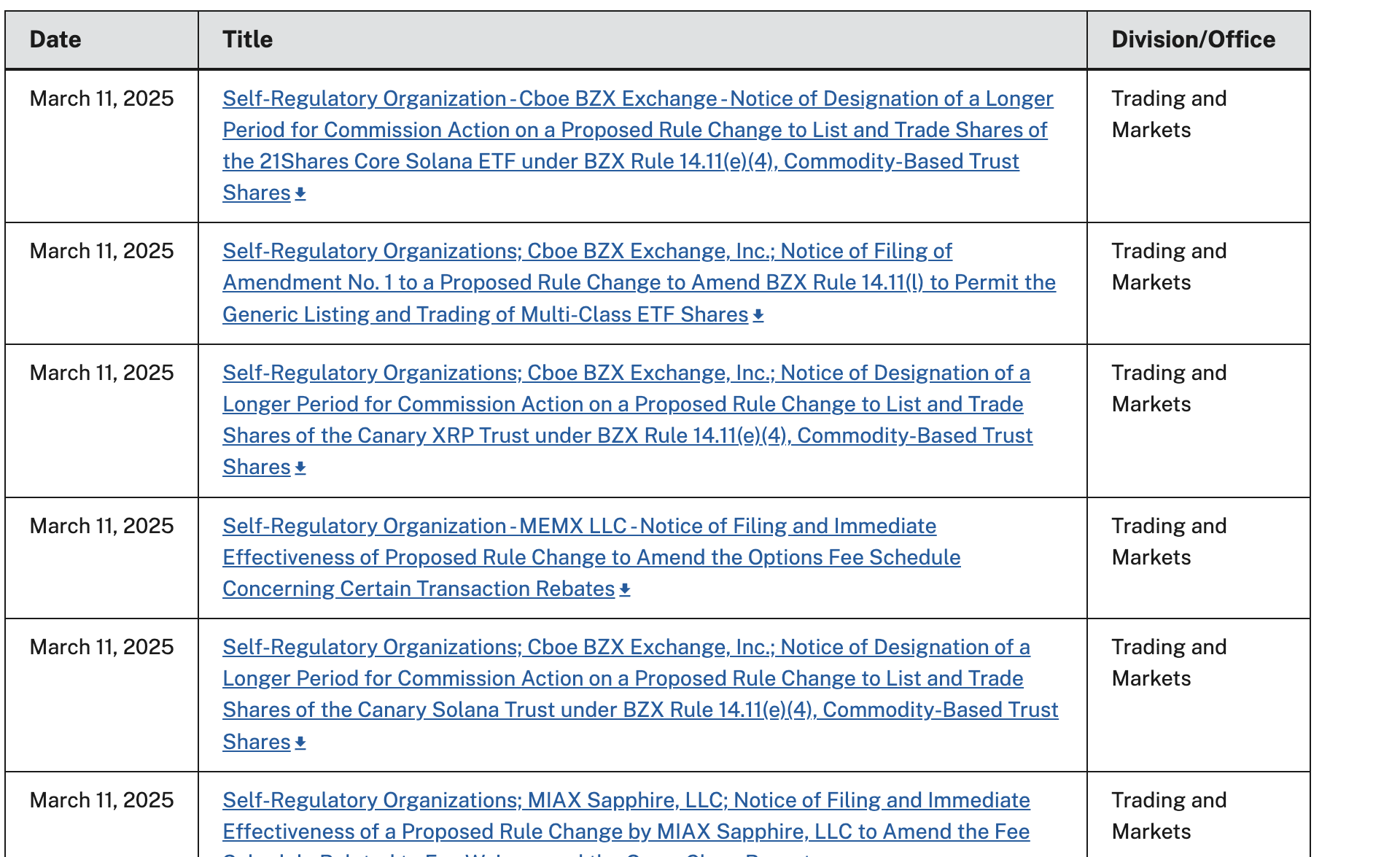

The application process for an XRP ETF involves navigating complex regulatory hurdles, primarily overseen by the SEC. Keywords: XRP ETF application, SEC ETF approval, Bitcoin ETF, Ethereum ETF.

- Key Requirements for ETF Approval: Applicants must meet stringent requirements demonstrating the ETF's safety, liquidity, and compliance with securities regulations.

- The Role of the SEC: The SEC plays a crucial role in reviewing and approving ETF applications, considering potential risks and market impacts.

- Comparison with Other Crypto ETF Applications: The SEC's approach to XRP ETF applications will likely be influenced by its decisions regarding other cryptocurrency ETFs, such as Bitcoin and Ethereum ETFs.

- Timeline for Potential Approval: The timeline for potential approval is uncertain and depends on numerous factors, including the resolution of the Ripple lawsuit.

Potential Benefits of XRP ETF Approval:

Approval of an XRP ETF would likely result in several positive effects on the market. Keywords: XRP liquidity, XRP investment, ETF benefits, institutional investors.

- Increased Trading Volume: ETFs generally lead to increased trading volume and liquidity, making XRP more accessible to a wider range of investors.

- Price Discovery: An ETF can lead to more efficient price discovery, reflecting XRP’s true market value more accurately.

- Reduced Volatility: Increased liquidity can often help reduce volatility in an asset's price.

- Increased Institutional Adoption: ETFs make it easier for institutional investors to participate in the XRP market, potentially leading to significant capital inflows.

- Improved Market Efficiency: The increased trading activity associated with ETFs can improve market efficiency and reduce price manipulation.

Analyzing the Interplay Between Legal Battles and ETF Applications

The Ripple vs. SEC lawsuit and XRP ETF applications are inextricably linked. The outcome of one will heavily influence the other.

The Correlation Between Legal Outcome and ETF Approval:

The SEC's decision on XRP ETF applications will likely depend significantly on the resolution of the Ripple lawsuit. Keywords: XRP regulatory outlook, SEC decision, Ripple lawsuit impact on ETF.

- Scenarios Where a Favorable Ruling Boosts ETF Approval Chances: A clear victory for Ripple, establishing XRP as a non-security, would significantly increase the likelihood of ETF approval.

- Scenarios Where an Unfavorable Ruling Delays or Prevents ETF Approval: Conversely, a ruling against Ripple could delay or even prevent ETF approval indefinitely.

- Impact of Public Opinion and Media Coverage: Public and media perception of the legal case and its outcome will heavily influence the SEC's decision-making and public support for XRP ETFs.

Long-Term Implications for XRP's Future:

The interplay of legal battles and ETF applications will shape XRP’s long-term prospects. Keywords: XRP long-term outlook, XRP future price, cryptocurrency investment.

- Potential Scenarios for XRP's Market Position in 5 Years, 10 Years: Several scenarios are possible, ranging from mainstream adoption and substantial price appreciation to continued uncertainty and limited growth.

- Factors Driving Growth or Decline: Factors like technological advancements, regulatory clarity, and overall market sentiment will significantly influence XRP’s future.

- Impact of Technological Advancements: Ripple's ongoing development of its technology and its integration into payment systems will play a crucial role in XRP's success.

Conclusion:

The future of XRP remains uncertain, intricately tied to the outcome of the ongoing SEC lawsuit and the success of potential ETF applications. A favorable ruling and subsequent ETF approval could propel XRP into the mainstream, unlocking significant growth potential. Conversely, an unfavorable outcome could hinder adoption and limit its upside. Staying informed about the legal proceedings and the progress of ETF applications is crucial for anyone interested in investing in or understanding the future of XRP. Continue researching the latest developments surrounding the XRP market to make informed decisions about your investments and your understanding of this evolving cryptocurrency.

Featured Posts

-

Saturday Night Live And Counting Crows How A Single Performance Launched A Career

May 08, 2025

Saturday Night Live And Counting Crows How A Single Performance Launched A Career

May 08, 2025 -

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025

1 500 Ethereum Price Target Is The Crucial Support Level About To Break

May 08, 2025 -

Cusma Trump Declares It Beneficial Yet Leaves Open The Possibility Of Termination

May 08, 2025

Cusma Trump Declares It Beneficial Yet Leaves Open The Possibility Of Termination

May 08, 2025 -

Lotto Jackpot Numbers Saturday April 12th Winning Numbers Revealed

May 08, 2025

Lotto Jackpot Numbers Saturday April 12th Winning Numbers Revealed

May 08, 2025 -

Xrps 400 Surge How High Can It Climb

May 08, 2025

Xrps 400 Surge How High Can It Climb

May 08, 2025

Latest Posts

-

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025

Trumps Influence And The Ripple Xrp Price Jump

May 08, 2025 -

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025

Ripple Xrp Price Increase Is Trumps Influence A Contributing Factor

May 08, 2025 -

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025

Why Is Xrp Up Today A Look At The Trump Factor

May 08, 2025 -

Xrp Rising The Impact Of Recent Trump News

May 08, 2025

Xrp Rising The Impact Of Recent Trump News

May 08, 2025 -

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025

Xrp Price Surge Is Donald Trump The Reason

May 08, 2025