The Changing Face Of X: A Look At The New Financials After The Debt Sale

Table of Contents

Improved Liquidity Post-Debt Sale

The debt sale has had a profoundly positive impact on X's liquidity, both short-term and long-term. By significantly reducing its debt burden, X has freed up considerable financial resources. This improved liquidity position strengthens X's resilience and provides a solid foundation for future growth.

-

Reduction in debt burden leading to improved credit rating: The successful debt sale has resulted in a [Insert Percentage]% decrease in X's total debt, leading to an upgrade in its credit rating from [Insert Previous Rating] to [Insert Current Rating]. This improved creditworthiness allows X to access more favorable financing terms in the future.

-

Increased cash flow available for investments and operational expenses: With less money allocated to debt servicing, X now has a greater cash flow available for strategic investments, operational improvements, and research and development. This enhanced financial flexibility is a crucial driver of future growth.

-

Enhanced ability to weather economic downturns: The improved liquidity provides a crucial buffer against economic uncertainty. X is now better positioned to withstand potential economic downturns or market fluctuations without compromising its operational stability.

-

Lower interest expense improving net income: The reduction in debt directly translates to lower interest expense, significantly boosting X's net income. This positive impact on the bottom line is a key indicator of the success of the debt sale strategy. The current ratio, a key indicator of short-term liquidity, has improved from [Insert previous ratio] to [Insert current ratio], demonstrating a strengthened financial position. Similarly, the quick ratio, another measure of short-term liquidity, shows a positive change from [Insert previous ratio] to [Insert current ratio].

Impact on X's Profitability: A Detailed Analysis

The impact of the debt sale on X's profitability is multifaceted, with both short-term and long-term implications. While the initial repayment of debt might have temporarily reduced net income, the long-term benefits are substantial.

-

Initial impact of debt repayment on net income: The immediate impact on net income might have been slightly negative due to the one-time expense of debt repayment. However, this short-term effect is significantly outweighed by the long-term advantages.

-

Long-term effects on profitability due to reduced interest expense and increased investment opportunities: The most significant long-term benefit is the substantial reduction in interest expense. This allows for a considerable increase in net income, contributing to improved profit margins. Furthermore, the increased financial flexibility allows X to pursue strategic investments that drive future profitability.

-

Analysis of profit margins before and after the debt sale: Pre-debt sale, X's profit margin stood at [Insert Percentage]%. Post-debt sale, the profit margin has shown an increase to [Insert Percentage]%, reflecting the positive impact of the debt restructuring. (Illustrate with a graph showing profit margin change).

-

Potential increased operational efficiency due to restructuring following the debt sale: The debt sale often triggers operational restructuring initiatives. These initiatives, aimed at streamlining processes and improving efficiency, can further enhance profitability.

Future Growth Prospects and Investment Strategies

The new financial structure positions X for substantial future growth. The improved liquidity and reduced debt burden create an environment conducive to expansion and strategic investment.

-

Opportunities for expansion and acquisition due to improved financial flexibility: X now has the financial firepower to pursue strategic acquisitions or expand into new markets. This enhanced flexibility opens exciting opportunities for growth and diversification.

-

Potential for strategic investments in new technologies or markets: X can now allocate significant resources to research and development, leading to innovation and the development of new products or services. Furthermore, it can explore new market segments, further driving growth.

-

Long-term sustainability and growth potential post-debt sale: The debt sale has set the stage for sustainable long-term growth. X's stronger financial foundation provides the stability and flexibility needed to navigate future challenges and capitalize on emerging opportunities.

-

Discussion of investor confidence and potential impact on stock price: The positive impact of the debt sale on X's financials is expected to boost investor confidence, potentially leading to a positive impact on the stock price. Analysts predict [Insert Analyst Prediction/Market Analysis].

Addressing Investor Concerns and Stakeholder Analysis

Transparency and open communication with investors are crucial following a major financial transaction like a debt sale. Addressing potential concerns proactively builds trust and confidence.

-

Transparency and communication with investors regarding the debt sale and its implications: X has been proactive in communicating the details of the debt sale and its financial implications to investors through press releases, investor calls, and other channels.

-

Addressing concerns about long-term debt and financial risk: While the debt sale reduces the immediate debt burden, addressing any remaining long-term debt concerns and mitigating financial risk is vital to maintain investor confidence. [Explain X's strategy to manage remaining debt].

-

Highlighting the positive aspects of the debt sale and its benefits to stakeholders: The positive impacts on liquidity, profitability, and future growth prospects are key aspects to emphasize to investors and stakeholders.

-

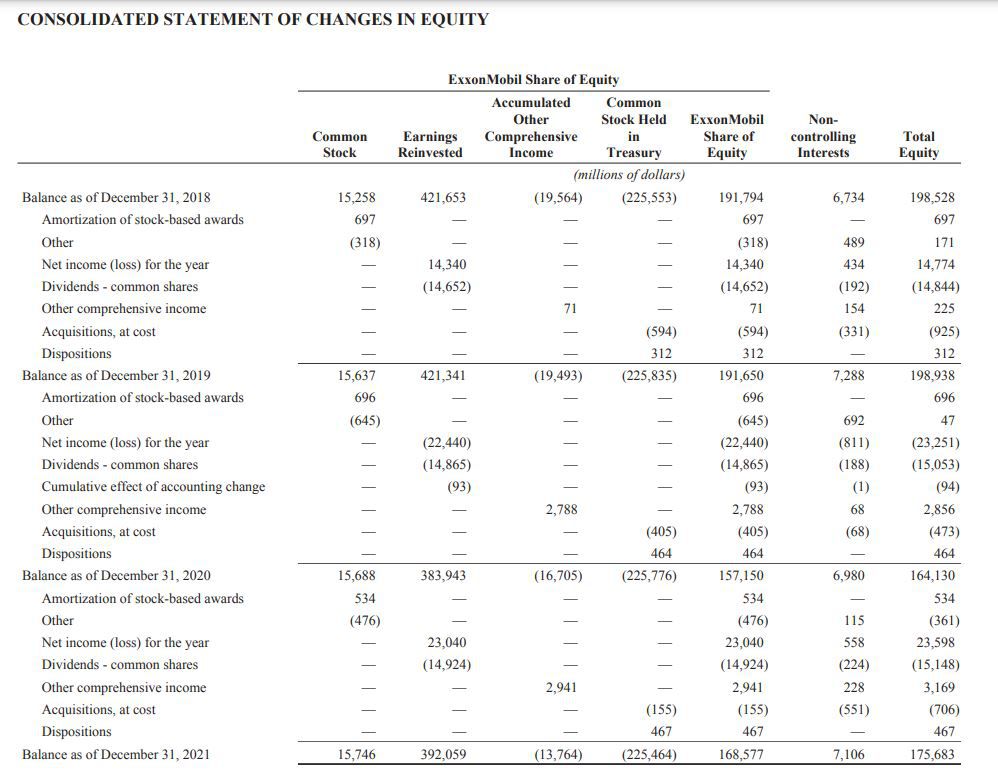

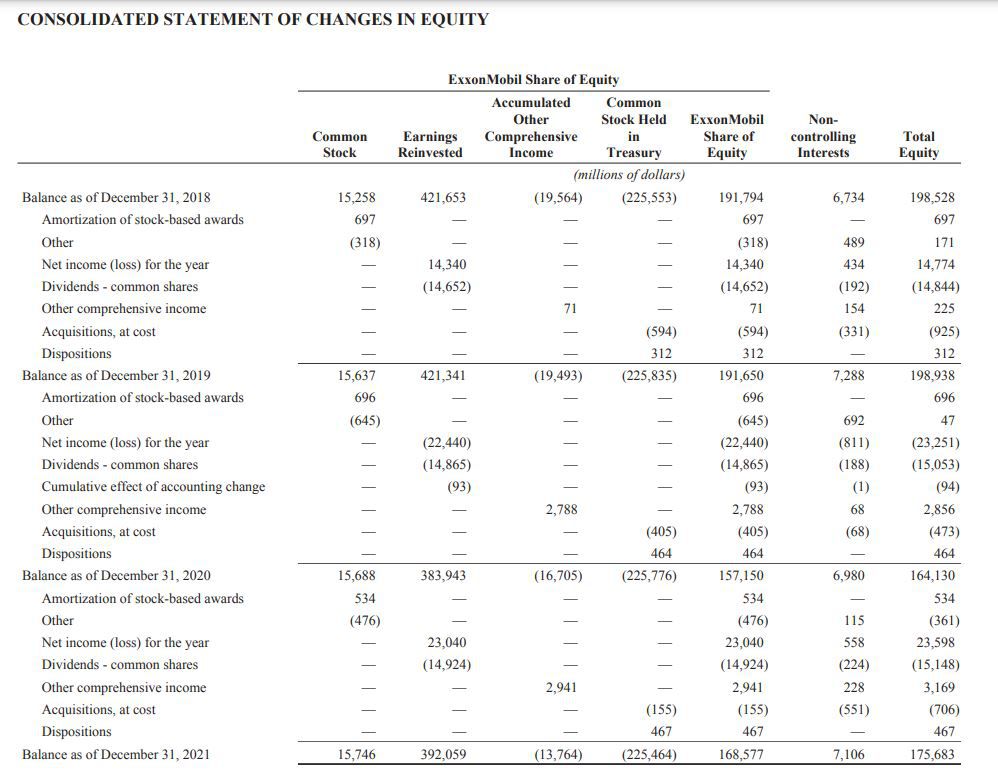

Mention any changes in shareholder equity and their significance: The debt sale may have resulted in changes to shareholder equity, which should be clearly communicated and explained to investors. [Explain the impact on shareholder equity and its significance].

Conclusion

The debt sale has profoundly impacted X's financials, leading to improved liquidity, long-term profitability potential, and enhanced opportunities for future growth. The restructuring provides a more stable foundation for the company. While short-term effects might have presented some challenges, the long-term outlook for X is positive. The improved X financials after debt sale demonstrate a clear path to sustainable success.

Call to Action: Stay informed about the evolving financial landscape of X by following our updates on the company’s performance. Understanding the intricacies of X's financials after this debt sale is crucial for making informed investment decisions and assessing the future of X. Continue learning about X financials after debt sale by subscribing to our newsletter.

Featured Posts

-

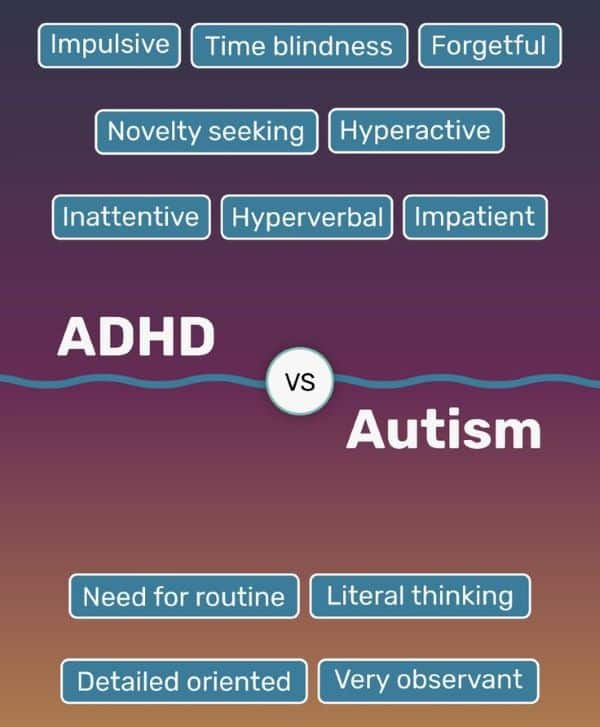

Study Shows Significant Overlap Of Adhd Autism And Intellectual Disability

Apr 29, 2025

Study Shows Significant Overlap Of Adhd Autism And Intellectual Disability

Apr 29, 2025 -

Adhd And Aging The Role Of Brain Iron In Cognitive Function

Apr 29, 2025

Adhd And Aging The Role Of Brain Iron In Cognitive Function

Apr 29, 2025 -

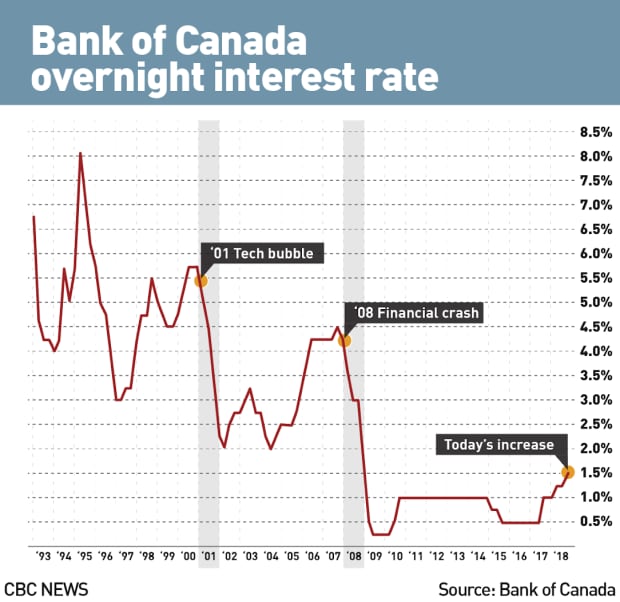

Falling Retail Sales A Harbinger Of Bank Of Canada Rate Cuts

Apr 29, 2025

Falling Retail Sales A Harbinger Of Bank Of Canada Rate Cuts

Apr 29, 2025 -

What We Learned About Treasuries On April 8th A Market Recap

Apr 29, 2025

What We Learned About Treasuries On April 8th A Market Recap

Apr 29, 2025 -

One Plus 13 R Review A Detailed Look At Performance And Features Compared To Pixel 9a

Apr 29, 2025

One Plus 13 R Review A Detailed Look At Performance And Features Compared To Pixel 9a

Apr 29, 2025