The Canadian Dollar's Strength: Risks And Opportunities

Table of Contents

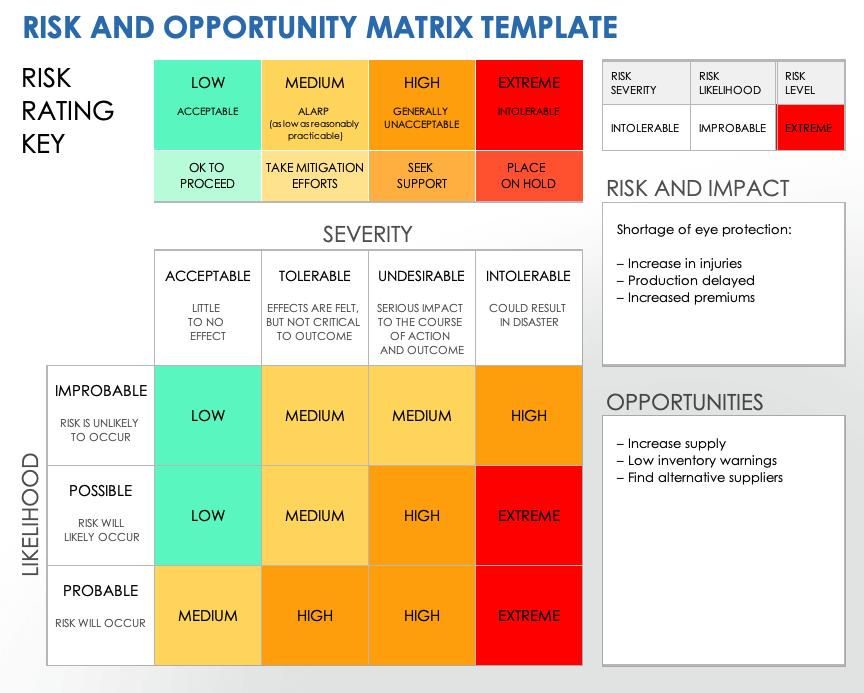

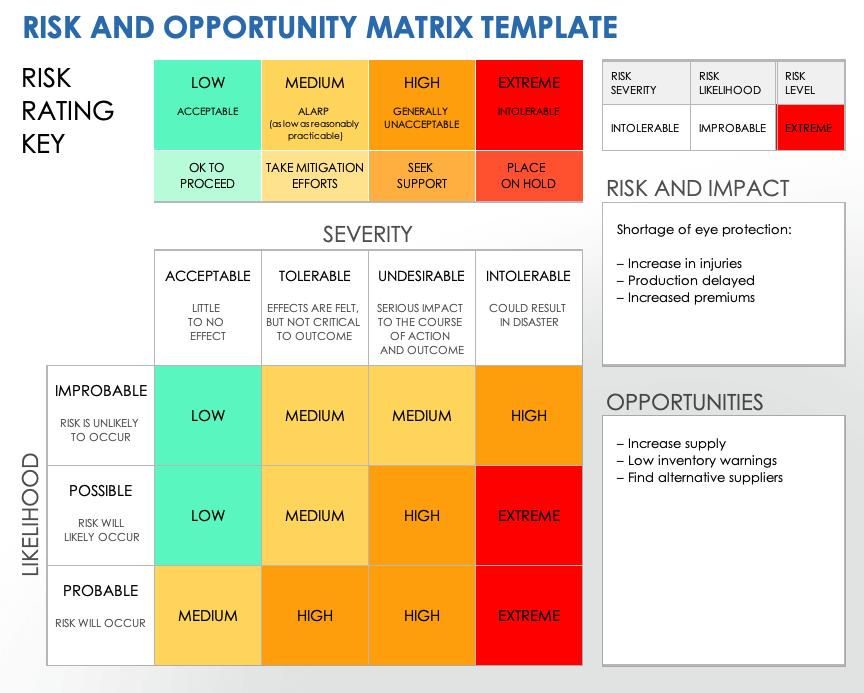

Opportunities Presented by a Strong Canadian Dollar

A strong Canadian dollar, while potentially challenging for some sectors, unlocks several significant opportunities. Understanding these advantages is key to navigating the current economic climate.

Increased Purchasing Power

A robust CAD translates directly into increased purchasing power for Canadians. This is particularly beneficial for those traveling abroad or purchasing imported goods.

- Lower Import Costs: A strong dollar means imported goods, from electronics to clothing, become cheaper. This can lead to lower inflation rates and increased consumer spending power.

- Affordable International Travel: Canadians find their vacations and travel experiences significantly more affordable when the CAD is strong. This boosts tourism spending outside of Canada but can also impact domestic tourism in some areas.

- Examples:

- Lower prices on imported automobiles.

- Reduced costs for international flights and accommodations.

- Cheaper electronics and technology products.

Attractiveness to Foreign Investors

A strong Canadian dollar makes Canadian assets, including stocks, bonds, and real estate, more attractive and affordable to foreign investors.

- Increased Foreign Direct Investment (FDI): A robust CAD can stimulate an influx of foreign direct investment, boosting economic growth and creating new job opportunities. This capital infusion can help fund expansion in various sectors.

- Enhanced Market Competitiveness: The lower cost of acquisition makes Canadian businesses a more appealing investment target.

- Examples of Sectors Benefiting from FDI:

- Technology sector: attracting investment in research and development.

- Natural resources: attracting foreign capital for exploration and development.

- Real estate: attracting international buyers which drive prices up.

Boosted Competitiveness (in specific sectors)

While a strong CAD can negatively impact export-oriented industries, it also boosts the competitiveness of import-competing sectors within the Canadian economy.

- Import-Competing Industries: Businesses that primarily compete with imported goods benefit from a stronger dollar. They can offer more competitive pricing, potentially gaining market share.

- Resilient Sectors: Sectors less reliant on exports, such as domestic services, tend to be more resilient to currency fluctuations.

- Examples:

- Beneficiaries: Domestic retail, construction, and some service industries.

- Sufferers: Energy, agriculture (commodity prices are often denominated in USD), and manufacturing (export-oriented).

Risks Associated with a Strong Canadian Dollar

Despite the opportunities, a strong Canadian dollar also presents several notable risks to the Canadian economy. Careful consideration of these challenges is essential for effective economic planning.

Impact on Exports

A strong CAD makes Canadian exports more expensive on the global market, potentially leading to decreased demand and impacting key sectors.

- Reduced Export Revenue: Canadian businesses exporting goods and services face lower demand due to higher prices in foreign currencies. This can lead to reduced profits and job losses.

- Vulnerable Industries: Industries heavily reliant on exports are particularly vulnerable to the effects of a strong CAD.

- Examples of Vulnerable Industries:

- Energy sector: Oil and gas prices are often denominated in USD, a strong CAD diminishes profits when converted back to Canadian dollars.

- Agricultural products: Canadian wheat and other agricultural exports become more expensive internationally.

- Manufacturing: Canadian manufactured goods face increased competition from lower-priced imports.

Reduced Tourism Revenue

A strong CAD discourages international tourists from visiting Canada, as travel and accommodation become more expensive for them.

- Economic Impact on Tourism-Dependent Regions: Regions relying heavily on tourism revenue, such as Banff, Whistler, and many coastal communities, will experience a downturn in economic activity.

- Reduced Spending: Fewer international tourists translate to less spending on hotels, restaurants, attractions, and other tourism-related services.

- Examples of Regions Heavily Reliant on Tourism:

- Banff National Park and surrounding areas.

- Whistler and other British Columbia ski resorts.

- Various coastal communities in Atlantic Canada and British Columbia.

Potential for Economic Slowdown

While not solely attributable to a strong CAD, a robust dollar, coupled with other economic factors, could contribute to an economic slowdown.

- Weakened Export Sector: The decreased competitiveness of Canadian exports can negatively affect overall economic growth.

- Impact on Employment: Reduced export demand and potential decreased foreign investment may lead to job losses in certain sectors.

- Potential Scenarios:

- A global economic downturn exacerbating the negative effects of a strong CAD.

- Increased interest rates to curb inflation, further slowing down economic activity.

Conclusion

The Canadian dollar's strength presents a complex picture with both significant opportunities and notable risks. While a strong CAD boosts purchasing power and attracts foreign investment, it simultaneously weakens the export sector and can negatively impact tourism. Understanding these intricate dynamics is crucial for navigating the current economic climate. The key takeaways are the importance of understanding the interplay between CAD strength and various economic sectors, and the necessity of adaptive strategies by businesses and investors alike. Understanding the complexities of the Canadian dollar's strength is crucial for making informed financial decisions. Stay updated on Canadian dollar trends, CAD strength outlook, and consult with financial professionals to navigate this dynamic environment and develop a robust strategy for managing your investments in light of Canadian currency strength.

Featured Posts

-

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025

De Andre Jordan Makes Nba History In Thrilling Nuggets Bulls Matchup

May 08, 2025 -

Possible Ps 5 And Ps 4 Game Announcements At The March 2025 Nintendo Direct

May 08, 2025

Possible Ps 5 And Ps 4 Game Announcements At The March 2025 Nintendo Direct

May 08, 2025 -

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Akuzat Dhe Pasojat E Mundshme

May 08, 2025

Arsenali Nen Hetim Te Uefa S Pas Ndeshjes Me Psg Akuzat Dhe Pasojat E Mundshme

May 08, 2025 -

Should You Buy This Cryptocurrency Van Ecks 185 Prediction Explained

May 08, 2025

Should You Buy This Cryptocurrency Van Ecks 185 Prediction Explained

May 08, 2025 -

Counting Crows Slip Into The Shadows An Analysis Of Lyrics And Musical Style From Aurora

May 08, 2025

Counting Crows Slip Into The Shadows An Analysis Of Lyrics And Musical Style From Aurora

May 08, 2025

Latest Posts

-

Analyzing The Success Of Dcs Krypto Movie

May 08, 2025

Analyzing The Success Of Dcs Krypto Movie

May 08, 2025 -

The Method Behind Matt Damons Success Ben Afflecks Perspective

May 08, 2025

The Method Behind Matt Damons Success Ben Afflecks Perspective

May 08, 2025 -

Krypto The Last Dog Of Krypton Characters And Story

May 08, 2025

Krypto The Last Dog Of Krypton Characters And Story

May 08, 2025 -

How Matt Damons Smart Role Choices Impressed Ben Affleck

May 08, 2025

How Matt Damons Smart Role Choices Impressed Ben Affleck

May 08, 2025 -

Unforgettable Oscars Snubs When The Academy Got It Wrong

May 08, 2025

Unforgettable Oscars Snubs When The Academy Got It Wrong

May 08, 2025