Should You Buy This Cryptocurrency? VanEck's 185% Prediction Explained

Table of Contents

Understanding VanEck's 185% Prediction

VanEck's prediction, while ambitious, isn't made in a vacuum. It's based on a complex interplay of factors, considered within a specific timeframe (which needs to be explicitly stated by VanEck if available, otherwise this needs to be removed or edited to reflect the available information). While the exact methodology remains proprietary, we can speculate on the key elements contributing to their bullish forecast.

-

Market analysis: VanEck likely considered the cryptocurrency's adoption rate, noting a significant increase in user base and transaction volume. Technological advancements, such as scalability improvements and enhanced security features, could also contribute to this positive outlook. Furthermore, any positive regulatory changes influencing the cryptocurrency's legal standing would certainly be factored in.

-

Competitive landscape: A comparative analysis with other cryptocurrencies in the same sector is likely included. VanEck would likely have considered the cryptocurrency's unique selling propositions and advantages over its competitors, identifying areas of potential dominance.

-

Economic indicators: Macroeconomic conditions like inflation and interest rates would indirectly influence the prediction. A period of high inflation could potentially drive investors towards alternative assets like cryptocurrencies, impacting the cryptocurrency's price.

It's crucial to acknowledge that any prediction carries caveats. VanEck's forecast is not a guarantee; it's a projection based on current trends and assumptions, which could be influenced by unforeseen market events or changes in regulatory landscapes.

Analyzing the Cryptocurrency's Fundamentals

Let's analyze the fundamentals of the cryptocurrency in question (replace "[Cryptocurrency Name]" and "[Ticker Symbol]" with the actual names): [Cryptocurrency Name] ([Ticker Symbol]). A thorough assessment should involve:

-

Technology: Understanding the blockchain technology powering [Cryptocurrency Name] is crucial. Is it a proof-of-work or proof-of-stake system? What is its transaction speed and security level? Are there any novel technological advancements or features that provide a competitive edge?

-

Team and Development: The experience and track record of the development team are key indicators of long-term success. A strong, transparent, and active team inspires confidence.

-

Use Cases and Adoption: Real-world applications are critical for sustainable growth. The broader the adoption, the more resilient the cryptocurrency's value tends to be. The number of users, businesses accepting it as payment, and the overall engagement within the ecosystem are all crucial metrics.

-

Tokenomics: The total supply of [Ticker Symbol] tokens and their distribution mechanism are important considerations. A deflationary model, for instance, can impact price positively over time.

Investing in [Cryptocurrency Name] presents both potential rewards and significant risks. While the potential for significant returns is alluring, it's essential to remain grounded in reality.

Assessing the Investment Risk

The cryptocurrency market is inherently volatile. While VanEck's prediction is optimistic, several factors could negatively impact [Ticker Symbol]'s price:

-

Market manipulation: The cryptocurrency market is susceptible to manipulation, with large players potentially influencing price movements.

-

Regulatory uncertainty: Changes in regulations could significantly impact the cryptocurrency's value and accessibility.

-

Technological vulnerabilities: Any security breaches or unforeseen technical issues could lead to a price drop.

-

Competition: The emergence of competing cryptocurrencies could dilute [Ticker Symbol]'s market share and affect its price.

Effective risk management is crucial. Strategies like diversification (spreading your investments across different assets), and dollar-cost averaging (investing a fixed amount at regular intervals) can help mitigate risks.

Alternative Investment Options

Before investing solely in [Cryptocurrency Name], consider alternative investment avenues. The crypto market offers many diverse options, each with its own risk/reward profile. Traditional investments, such as stocks and bonds, also deserve consideration, offering different levels of risk and potential returns.

Remember, thorough research is non-negotiable. Never invest more than you can afford to lose.

Conclusion

VanEck's 185% prediction for [Cryptocurrency Name] is intriguing, but it's crucial to approach it with caution. The potential for substantial returns is undeniable, but the inherent volatility and various risks associated with cryptocurrency investments cannot be overlooked. Conduct your own thorough research, understand the fundamentals of [Cryptocurrency Name], and assess your risk tolerance before making any investment decisions. Only invest what you can afford to lose. Learn more about [Cryptocurrency Name] and make your own informed decision.

Featured Posts

-

Cassidy Hutchinsons Fall Memoir Details On The January 6th Hearings

May 08, 2025

Cassidy Hutchinsons Fall Memoir Details On The January 6th Hearings

May 08, 2025 -

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

May 08, 2025

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

May 08, 2025 -

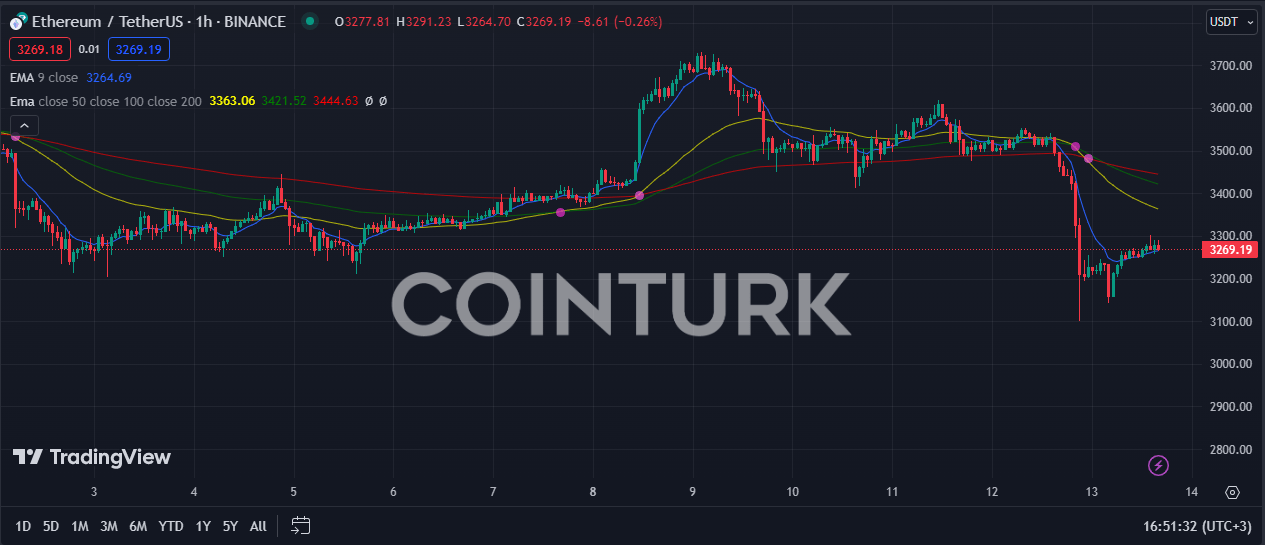

Ethereum Price Plunge 67 M In Liquidations Spark Concerns

May 08, 2025

Ethereum Price Plunge 67 M In Liquidations Spark Concerns

May 08, 2025 -

Ethereum Activity Surges Nearly 10 Address Increase In 48 Hours

May 08, 2025

Ethereum Activity Surges Nearly 10 Address Increase In 48 Hours

May 08, 2025 -

Inters Road To The Champions League Final Conquering Barcelona

May 08, 2025

Inters Road To The Champions League Final Conquering Barcelona

May 08, 2025

Latest Posts

-

Krypto The Super Dog Steals The Show In New Superman Footage

May 08, 2025

Krypto The Super Dog Steals The Show In New Superman Footage

May 08, 2025 -

Xrp Gains Momentum Institutional Investments Driven By Trumps Endorsement

May 08, 2025

Xrp Gains Momentum Institutional Investments Driven By Trumps Endorsement

May 08, 2025 -

Xrps Stalled Recovery A Look At The Derivatives Market

May 08, 2025

Xrps Stalled Recovery A Look At The Derivatives Market

May 08, 2025 -

New Superman Footage Shows Kryptos Adorable Side

May 08, 2025

New Superman Footage Shows Kryptos Adorable Side

May 08, 2025 -

Institutional Investors Show Interest In Xrp After Trumps Public Support

May 08, 2025

Institutional Investors Show Interest In Xrp After Trumps Public Support

May 08, 2025