The BofA Take On Stretched Stock Market Valuations: Reasons For Confidence

Table of Contents

BofA's Rationale: Why They Believe in Continued Market Growth Despite High Valuations

BofA's confidence in continued market growth, even with high valuations, rests on several pillars. Their core argument hinges on the belief that robust corporate earnings growth and a supportive macroeconomic environment will outweigh current valuation concerns in the long run. This positive outlook isn't blind optimism; it's based on a careful analysis of several key factors:

-

Strong corporate earnings growth projections: BofA projects continued strong earnings growth for many sectors, driven by factors such as technological innovation, increasing consumer spending, and global economic recovery. This expected growth is seen as justifying, at least partially, the current elevated valuations.

-

Sustained low interest rates (or specific interest rate expectations): Low interest rates, or at least the expectation that rates will remain relatively low for an extended period, provide a supportive environment for equity markets. This reduces borrowing costs for companies and encourages investment. BofA's specific interest rate projections (if publicly available) would strengthen this point.

-

Positive economic indicators: Several key economic indicators support BofA's positive view. Strong consumer spending, steady GDP growth (mention specific projected GDP figures if available from BofA's reports), and a robust labor market all contribute to a healthy economic backdrop.

-

Strategic investment opportunities: BofA identifies specific sectors, likely mentioning specific examples (e.g., technology, renewable energy, healthcare) where they see compelling investment opportunities despite seemingly high valuations. They likely argue that these sectors possess significant long-term growth potential that justifies premium valuations.

-

Expected future inflation rates and their impact: BofA's analysis likely incorporates expected inflation rates and their potential impact on earnings and valuations. A moderate inflation rate could be considered beneficial, whereas high inflation could pose a significant risk.

Addressing the "Stretched Valuations" Concern: Counterarguments from BofA

The obvious counterargument to BofA's bullishness is the concern over stretched stock market valuations. BofA addresses this by employing several strategies:

-

Discussion of specific valuation metrics: BofA likely analyzes various valuation metrics, such as the Price-to-Earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE), providing context and explaining why current levels, while high, are not necessarily unsustainable given the projected earnings growth.

-

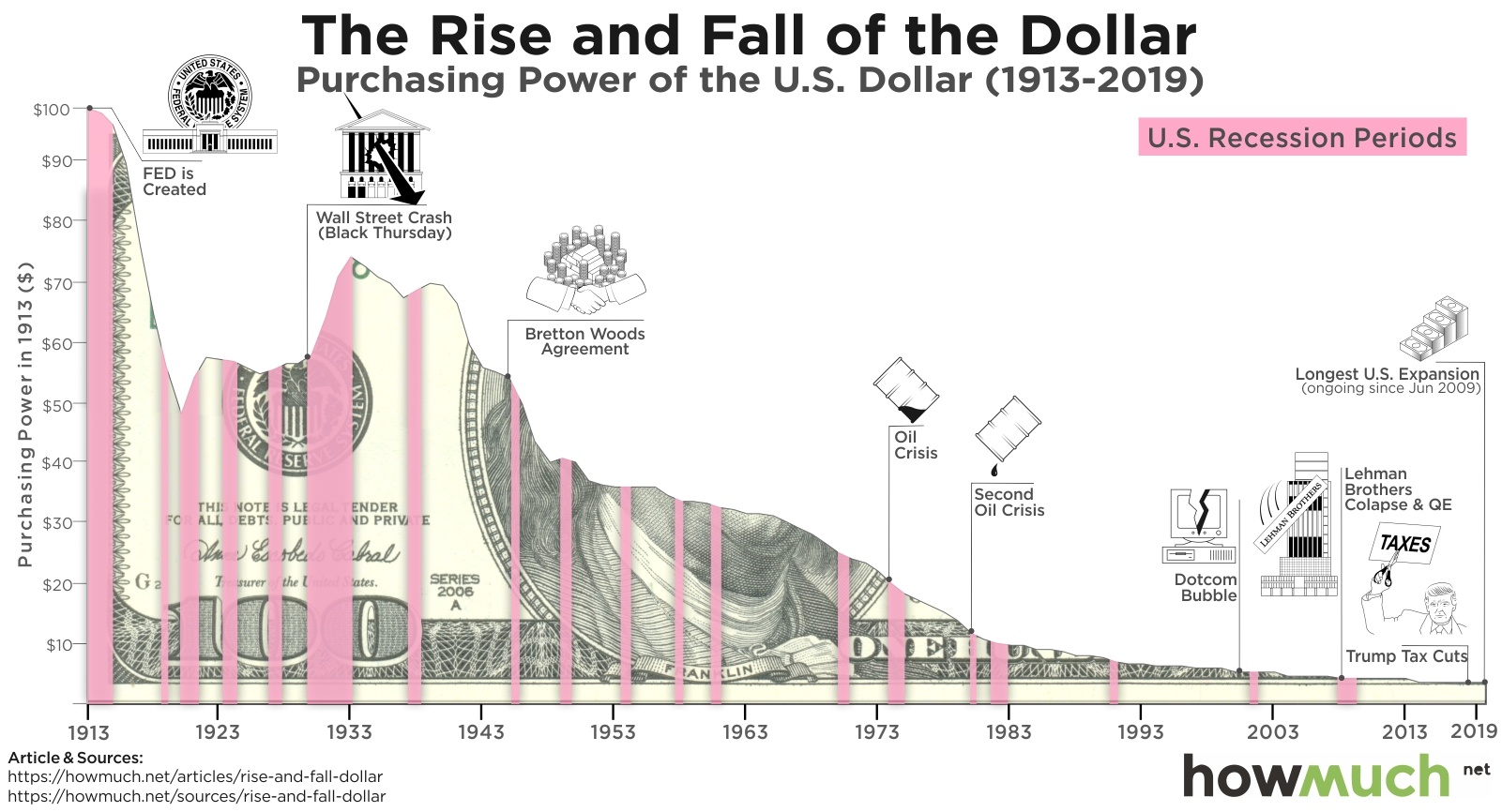

Comparison to historical valuations: They likely compare current valuations to historical precedents, highlighting periods of similarly high valuations that were followed by further market growth. This demonstrates that high valuations alone are not necessarily a harbinger of an imminent market crash.

-

Emphasis on long-term growth potential: BofA emphasizes that the long-term growth potential of many companies and sectors outweighs concerns about current valuation levels. The focus is on long-term value creation, not short-term price fluctuations.

-

Mention of specific sectors showing better relative value: BofA likely highlights specific sectors where they see relatively better value despite the overall market's high valuation. This allows investors to focus on opportunities within a seemingly overvalued market.

Risks and Potential Downsides: A Balanced Perspective

While BofA maintains a positive outlook, they acknowledge several potential risks:

-

Inflationary pressures: Significant inflationary pressures could erode corporate earnings and negatively impact stock valuations. High inflation could lead to interest rate hikes, further impacting market sentiment.

-

Geopolitical risks: Geopolitical instability, including trade wars, conflicts, or unexpected global events, can significantly impact market sentiment and trigger volatility.

-

Potential for interest rate hikes: Increased interest rates by central banks, aimed at controlling inflation, could lead to a decline in stock valuations. Higher interest rates make borrowing more expensive, impacting corporate investment and profitability.

-

Unexpected economic slowdowns or recessions: An unexpected economic slowdown or recession could dramatically impact corporate earnings and investor confidence, leading to a market correction.

BofA's Suggested Investment Strategies for Navigating "Stretched Stock Market Valuations"

Based on their analysis, BofA likely suggests a cautious but optimistic investment approach:

-

Sector-specific recommendations: They'll likely recommend focusing on specific sectors they believe are best positioned for future growth, despite the overall market's valuation.

-

Advice on diversification strategies: Diversification across different asset classes and sectors is crucial to mitigate risk in a potentially volatile market.

-

Recommendations on asset allocation: BofA may suggest an optimal asset allocation strategy tailored to individual investor risk tolerance and investment goals.

-

Importance of long-term investment horizons: The firm likely emphasizes the importance of maintaining a long-term investment horizon to weather short-term market volatility and capture the potential for long-term growth.

Conclusion

BofA's analysis presents a compelling case for maintaining a cautiously optimistic outlook despite stretched stock market valuations. Their counterarguments to valuation concerns, based on projected earnings growth and favorable economic indicators, are significant. However, the acknowledgment of potential risks, such as inflation and geopolitical instability, demonstrates a balanced perspective. Understanding their reasoning, particularly concerning strong earnings growth projections and identified undervalued sectors, is crucial for informed investment decisions. Learn more about navigating stretched stock market valuations and developing your own informed strategy by [link to relevant BofA resources or further research].

Featured Posts

-

Yukon Politicians Issue Contempt Threat Amidst Mining Investigation

Apr 28, 2025

Yukon Politicians Issue Contempt Threat Amidst Mining Investigation

Apr 28, 2025 -

Podcast Creation How Ai Simplifies The Processing Of Repetitive Scatological Documents

Apr 28, 2025

Podcast Creation How Ai Simplifies The Processing Of Repetitive Scatological Documents

Apr 28, 2025 -

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025 -

Car Dealers Double Down On Opposition To Ev Requirements

Apr 28, 2025

Car Dealers Double Down On Opposition To Ev Requirements

Apr 28, 2025 -

Lab Owner Admits To Faking Covid 19 Test Results

Apr 28, 2025

Lab Owner Admits To Faking Covid 19 Test Results

Apr 28, 2025

Latest Posts

-

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025

Is The U S Dollar Headed For Its Worst 100 Days Since Nixon

Apr 28, 2025 -

U S Dollars Bleak Outlook Worst Start Since Nixon

Apr 28, 2025

U S Dollars Bleak Outlook Worst Start Since Nixon

Apr 28, 2025 -

Yukon Politicians Issue Contempt Threat Amidst Mining Investigation

Apr 28, 2025

Yukon Politicians Issue Contempt Threat Amidst Mining Investigation

Apr 28, 2025 -

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025

U S Stock Market Rally Driven By Tech Giants Tesla In The Lead

Apr 28, 2025 -

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025

Tesla And Tech Stocks Power U S Market Surge

Apr 28, 2025