Is The U.S. Dollar Headed For Its Worst 100 Days Since Nixon?

Table of Contents

Inflationary Pressures and the Dollar's Decline

Soaring Inflation: A Threat to Purchasing Power

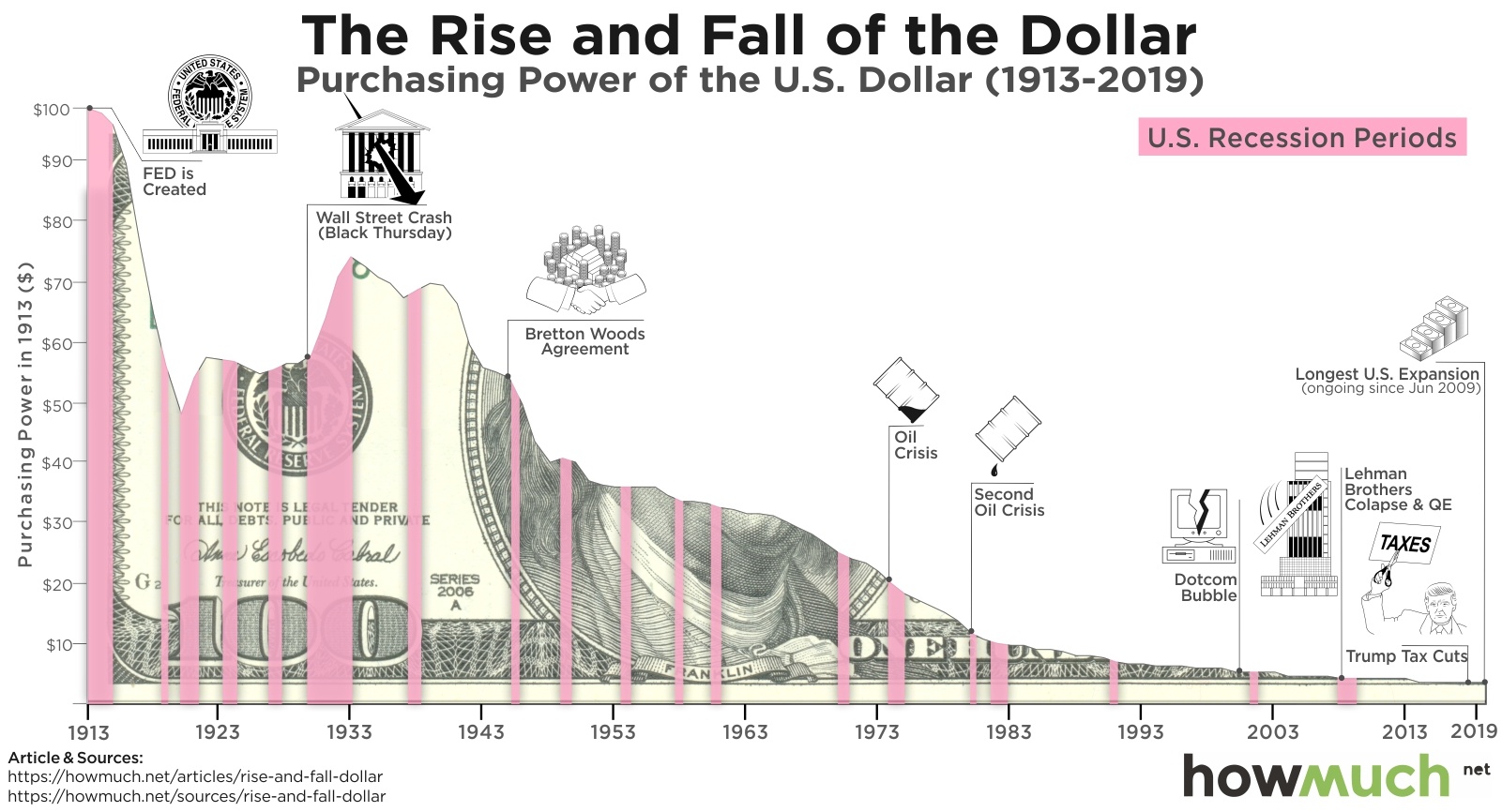

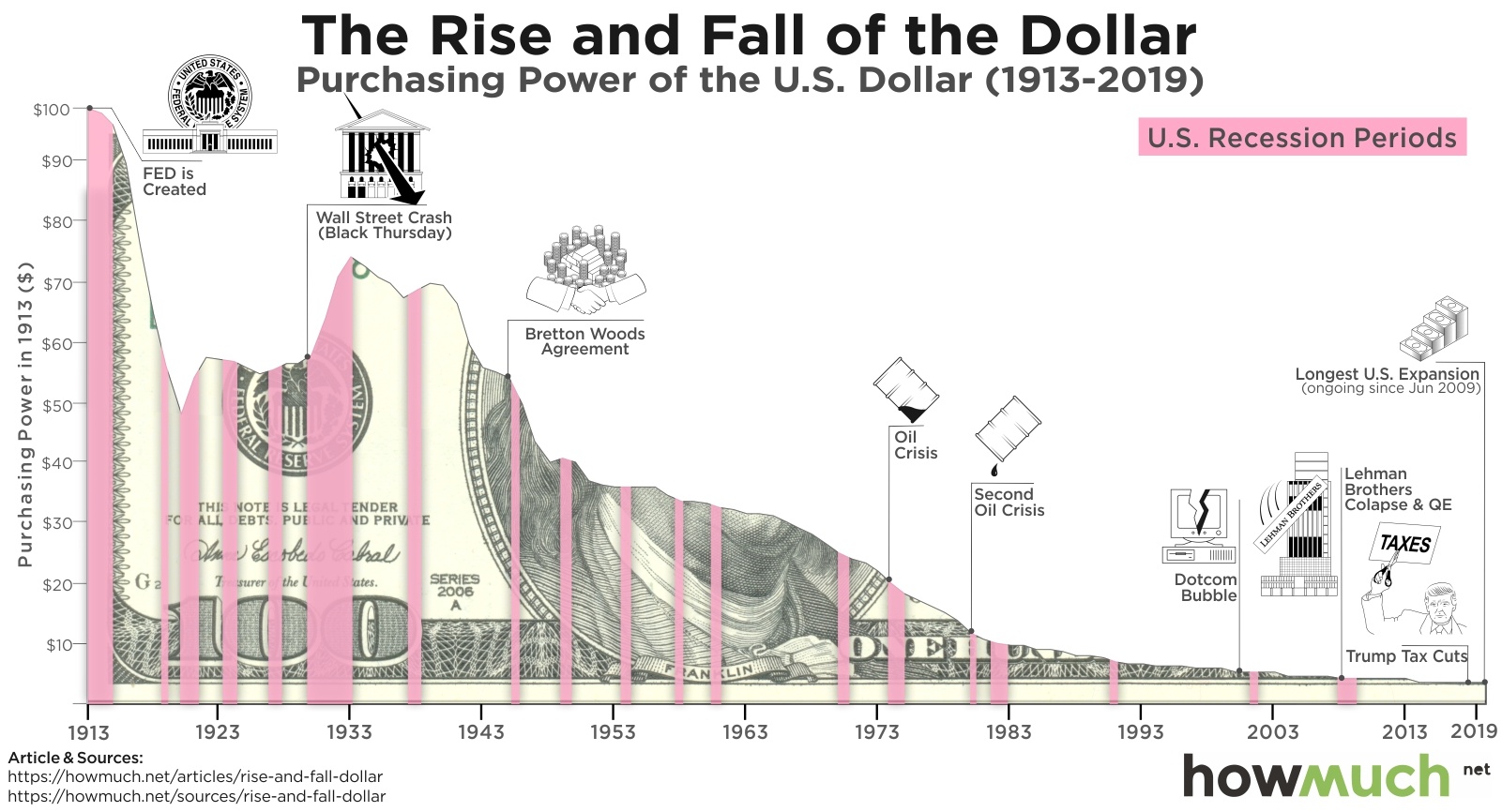

The U.S. is grappling with persistently high inflation. The Consumer Price Index (CPI) has remained stubbornly elevated, significantly eroding the purchasing power of the dollar. For example, in [Insert Month, Year], the CPI rose by [Insert Percentage] compared to the same period last year. This means that goods and services cost considerably more, reducing what your dollar can buy. High inflation directly impacts the value of the dollar, as its purchasing power parity (PPP) decreases. This weakens the dollar's position relative to other currencies.

- Statistic 1: [Insert specific inflation statistic, e.g., "The annual inflation rate reached X% in July 2024."]

- Statistic 2: [Insert another relevant statistic, e.g., "The price of gasoline has increased by Y% since last year."]

- Impact: High inflation reduces consumer confidence and can lead to decreased investment, further impacting the dollar's value.

Federal Reserve Response: A Tightrope Walk

The Federal Reserve (Fed) has responded to inflation with aggressive monetary policy, including significant interest rate hikes and quantitative tightening (QT). While intended to curb inflation, these actions carry risks. Raising interest rates can slow economic growth and potentially trigger a recession, which could negatively impact the dollar. Quantitative tightening, by reducing the money supply, aims to combat inflation but could also lead to market volatility and affect the dollar's value.

- Interest Rate Hikes: [Insert information about recent interest rate hikes and the Fed's projected path.]

- Quantitative Tightening: [Explain the mechanics of QT and its potential effects on the dollar.]

- Consequences: Aggressive monetary policy creates a delicate balance; it risks triggering a recession while aiming to control inflation and maintain the dollar’s stability.

Geopolitical Instability and its Impact on the U.S. Dollar

The War in Ukraine and Global Supply Chains

The war in Ukraine has severely disrupted global supply chains, leading to shortages of essential commodities and surging energy prices. This fuels inflation, directly impacting the dollar’s value. The energy crisis, exacerbated by the war, has driven up prices globally, adding further inflationary pressures. These disruptions create uncertainty in the global economy, negatively affecting investor confidence in the dollar.

- Supply Chain Disruptions: [Cite examples of specific supply chain disruptions and their impact on prices.]

- Energy Crisis: [Discuss the impact of high energy prices on inflation and the dollar.]

- Geopolitical Risk Premium: Increased geopolitical risk often leads to a "risk premium" built into the value of the dollar, making it less attractive to investors seeking stability.

International Relations and Currency Wars

The dollar’s status as the world's reserve currency is being challenged. The rise of alternative currencies, coupled with increasing geopolitical tensions, fuels speculation about a potential "de-dollarization" – a shift away from the dollar's dominance in international trade and finance. This could weaken the dollar significantly. Emerging currency wars, where nations compete to devalue their currencies for trade advantages, add further uncertainty.

- De-dollarization: [Discuss efforts by countries to reduce their reliance on the dollar.]

- Rise of Alternative Currencies: [Mention the increasing use of the Euro, Yuan, and other currencies in international trade.]

- Petrodollar System: The future of the petrodollar system (the pricing of oil in US dollars) is also a factor impacting the dollar's long-term dominance.

Other Factors Contributing to Dollar Weakness

National Debt and Fiscal Policy

The U.S. national debt is substantial and growing. Unsustainable fiscal policies contribute to inflationary pressures and can weaken investor confidence in the dollar. High government spending and borrowing increase demand for capital, potentially driving up interest rates and negatively impacting the dollar's value.

- National Debt Levels: [Provide data on the current national debt and its trajectory.]

- Fiscal Deficit: [Explain the implications of a large fiscal deficit for the dollar.]

- Impact on Investor Confidence: High national debt can lead investors to perceive increased risk and seek safer haven assets, potentially leading to capital flight away from the dollar.

Investor Sentiment and Capital Flight

Investor sentiment plays a crucial role in the dollar's value. Negative news, economic uncertainty, and geopolitical risks can trigger capital flight – investors moving their money out of the dollar and into perceived safer assets. This outflow reduces demand for the dollar, putting downward pressure on its value.

- Safe Haven Assets: [Discuss alternative investments that investors may favor during times of uncertainty, such as gold or other currencies.]

- Risk Aversion: [Explain how risk aversion among investors affects the dollar's value.]

- Market Volatility: Changes in investor sentiment can cause significant volatility in the foreign exchange market, impacting the dollar’s value in the short-term.

Conclusion: Is a Dollar Crisis Imminent?

The U.S. dollar faces significant challenges. Soaring inflation, geopolitical instability, unsustainable fiscal policies, and weakening investor sentiment all contribute to the potential for a substantial downturn. While the dollar has historically shown resilience, the confluence of these factors raises serious concerns, echoing the unprecedented changes following Nixon's 1971 decision. The question "Is the U.S. dollar headed for its worst 100 days since Nixon?" is a complex one, with no simple answer. However, understanding these critical factors is crucial. Stay informed about the future of the U.S. dollar and the economic factors influencing its value. Is the U.S. dollar headed for a crisis? Only time will tell, but understanding the forces at play is essential to navigating this potentially volatile period. Understanding the factors that affect the U.S. dollar is crucial for making informed financial decisions.

Featured Posts

-

Dont Miss Hudsons Bay Closing Sale With Huge Markdowns

Apr 28, 2025

Dont Miss Hudsons Bay Closing Sale With Huge Markdowns

Apr 28, 2025 -

The Great Sell Off How Retail Investors Profited From Market Swings

Apr 28, 2025

The Great Sell Off How Retail Investors Profited From Market Swings

Apr 28, 2025 -

Trumps Gaza Remarks As Hamas Leaders Arrive In Cairo For Peace Negotiations

Apr 28, 2025

Trumps Gaza Remarks As Hamas Leaders Arrive In Cairo For Peace Negotiations

Apr 28, 2025 -

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025 -

Ohio Train Derailment Persistent Toxic Chemical Contamination In Buildings

Apr 28, 2025

Ohio Train Derailment Persistent Toxic Chemical Contamination In Buildings

Apr 28, 2025

Latest Posts

-

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025 -

Universal Tone

Apr 28, 2025

Universal Tone

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Red Sox Manager Cora Alters Lineup For Doubleheaders First Game

Apr 28, 2025

Red Sox Manager Cora Alters Lineup For Doubleheaders First Game

Apr 28, 2025