Suncor Production: Record High Output, Sales Slowdown Due To Inventory

Table of Contents

Suncor Energy, a leading force in the Canadian oil and gas industry, has recently reported record-high oil production levels. This achievement, however, is overshadowed by a significant slowdown in sales, a discrepancy largely attributed to a substantial build-up of oil inventory. This article dissects the contributing factors to both the record production and the sales slump, analyzing their impact on Suncor's financial performance and exploring potential future implications for the company and the broader energy market. We will examine the complexities of Suncor production and its current challenges.

Record-Breaking Suncor Production Levels

Increased Extraction Capacity and Efficiency

Suncor's record-high oil production is a testament to significant investments in advanced technologies and operational improvements. The company has implemented several initiatives designed to boost extraction capacity and enhance efficiency. These include:

- Enhanced Oil Recovery (EOR) techniques: Suncor has invested heavily in EOR technologies to extract more oil from existing reserves, significantly increasing production yields.

- Automation and digitalization: The adoption of advanced automation and data analytics has streamlined operations, optimized resource allocation, and minimized downtime.

- Investment in new extraction projects: Suncor's ongoing investment in new projects, such as the expansion of its oil sands operations, has contributed directly to increased production capacity.

Key Performance Indicators (KPIs):

- Q[Quarter] 2024: [Insert Suncor's reported daily oil production figure] barrels per day, a [percentage]% increase compared to the same period last year.

- [Year] Annual Production: [Insert Suncor's reported annual oil production figure] barrels, representing a record high for the company.

Favorable Geopolitical Factors

Global demand for oil and favorable pricing have also significantly impacted Suncor's production levels.

- Strong global oil demand: Increased global economic activity, particularly in Asia, has driven up demand for oil, creating incentives for increased production.

- High oil prices: Higher global oil prices have made oil production more profitable, encouraging Suncor and other producers to ramp up output.

- Geopolitical instability: Uncertainties in global oil supply due to geopolitical events have further contributed to high oil prices, benefiting Suncor's production.

Impact of Geopolitical Events:

- The ongoing conflict in [relevant region] has led to supply disruptions, increasing global demand and prices.

- Sanctions imposed on [relevant country] have further tightened the global oil supply, creating opportunities for producers like Suncor.

Sales Slowdown and Inventory Build-up

Pipeline Constraints and Transportation Bottlenecks

Despite record production, Suncor is facing a significant slowdown in sales, largely due to logistical bottlenecks.

- Limited pipeline capacity: Existing pipeline infrastructure is struggling to handle the increased volume of oil produced by Suncor and other Canadian oil producers.

- Transportation costs: The constraints on pipeline capacity have increased transportation costs, impacting the profitability of oil sales.

- Expansion delays: Proposed pipeline expansion projects have faced delays due to regulatory hurdles and environmental concerns, exacerbating the existing capacity constraints.

Key Pipeline Constraints:

- The limited capacity of the [Specific Pipeline Name] pipeline restricts the flow of oil to export terminals.

- Delays in the construction of the [Specific Pipeline Name] pipeline are further impacting transportation capacity.

Weakening Global Demand and Price Volatility

Fluctuating oil prices and softening global demand have also contributed to the inventory build-up.

- Price volatility: Unpredictable oil prices make inventory management challenging, as producers struggle to predict future market conditions.

- Economic slowdown: Concerns about a global economic slowdown have dampened demand for oil, leading to an oversupply in the market.

- Inventory management strategies: Suncor is likely employing strategies like price hedging and strategic storage to mitigate the risks associated with price volatility and fluctuating demand.

Impact of Price Volatility:

- The recent decline in oil prices has reduced the profitability of sales and increased the cost of holding excess inventory.

- The uncertainty surrounding future oil prices is making it difficult for Suncor to make optimal sales decisions.

Refinery Maintenance and Operational Issues

Refinery maintenance and operational challenges can also impact sales volume.

- Scheduled maintenance: Planned refinery maintenance can temporarily reduce refining capacity, impacting the amount of crude oil that can be processed and sold.

- Unforeseen operational issues: Unexpected equipment failures or other operational problems can further disrupt refining activities, leading to sales slowdowns.

- Refining capacity limitations: Existing refinery capacity may not be sufficient to process all the crude oil produced by Suncor, leading to inventory build-up.

Impact of Refinery Operations:

- Planned maintenance at Suncor's refinery in [Location] reduced refining capacity by [Percentage] for [Duration].

- An unexpected equipment failure at the refinery resulted in a temporary halt in processing, further reducing sales.

Impact on Suncor's Financial Performance and Future Outlook

The combination of record production and reduced sales has significant implications for Suncor's financial performance.

- Reduced profitability: The build-up of inventory increases storage costs and reduces overall profitability.

- Pressure on cash flow: The slowdown in sales can negatively impact Suncor's cash flow, potentially affecting its investment plans.

- Strategic responses: Suncor will likely explore strategies to improve logistics, enhance pipeline capacity, and diversify its markets to mitigate the impact of inventory build-up.

Future Outlook:

- Suncor is likely to focus on securing new pipeline capacity to facilitate increased oil sales.

- The company may adjust its production levels to better align with market demand.

- Suncor’s long-term success will depend on its ability to navigate the challenges of pipeline constraints, price volatility, and global demand fluctuations.

Key Financial Implications:

- Reduced profit margins due to increased inventory holding costs.

- Potential impact on dividend payouts due to reduced profitability.

- Need for strategic investments in logistics and infrastructure.

Conclusion

Suncor's record-high oil production underscores its operational efficiency and strategic investments. However, the concurrent sales slowdown, largely stemming from inventory challenges, highlights the critical need for improved logistics and a more proactive approach to market fluctuations. Addressing pipeline constraints and effectively managing inventory levels are paramount to optimizing Suncor's future performance and maintaining profitability. Understanding the intricacies of Suncor production and its response to these challenges is crucial for investors and industry stakeholders alike.

Call to Action: Stay updated on the evolving dynamics of Suncor production and the broader energy sector by regularly checking our website for the latest news and analysis. Further understanding Suncor energy's strategies to overcome these obstacles is essential for informed decision-making.

Featured Posts

-

Chuyen Tinh Dep Cua Lynk Lee Va Ban Trai Sau Khi Chuyen Gioi

May 10, 2025

Chuyen Tinh Dep Cua Lynk Lee Va Ban Trai Sau Khi Chuyen Gioi

May 10, 2025 -

Androids Design Refresh Analyzing Its Appeal To Gen Z

May 10, 2025

Androids Design Refresh Analyzing Its Appeal To Gen Z

May 10, 2025 -

Analysis Of Pam Bondis Statement On Eliminating American Citizens

May 10, 2025

Analysis Of Pam Bondis Statement On Eliminating American Citizens

May 10, 2025 -

Five Theories On Davids Identity In High Potential Exploring The He Morgan Brother Mystery

May 10, 2025

Five Theories On Davids Identity In High Potential Exploring The He Morgan Brother Mystery

May 10, 2025 -

10 Must See Film Noir Movies A Banger List

May 10, 2025

10 Must See Film Noir Movies A Banger List

May 10, 2025

Latest Posts

-

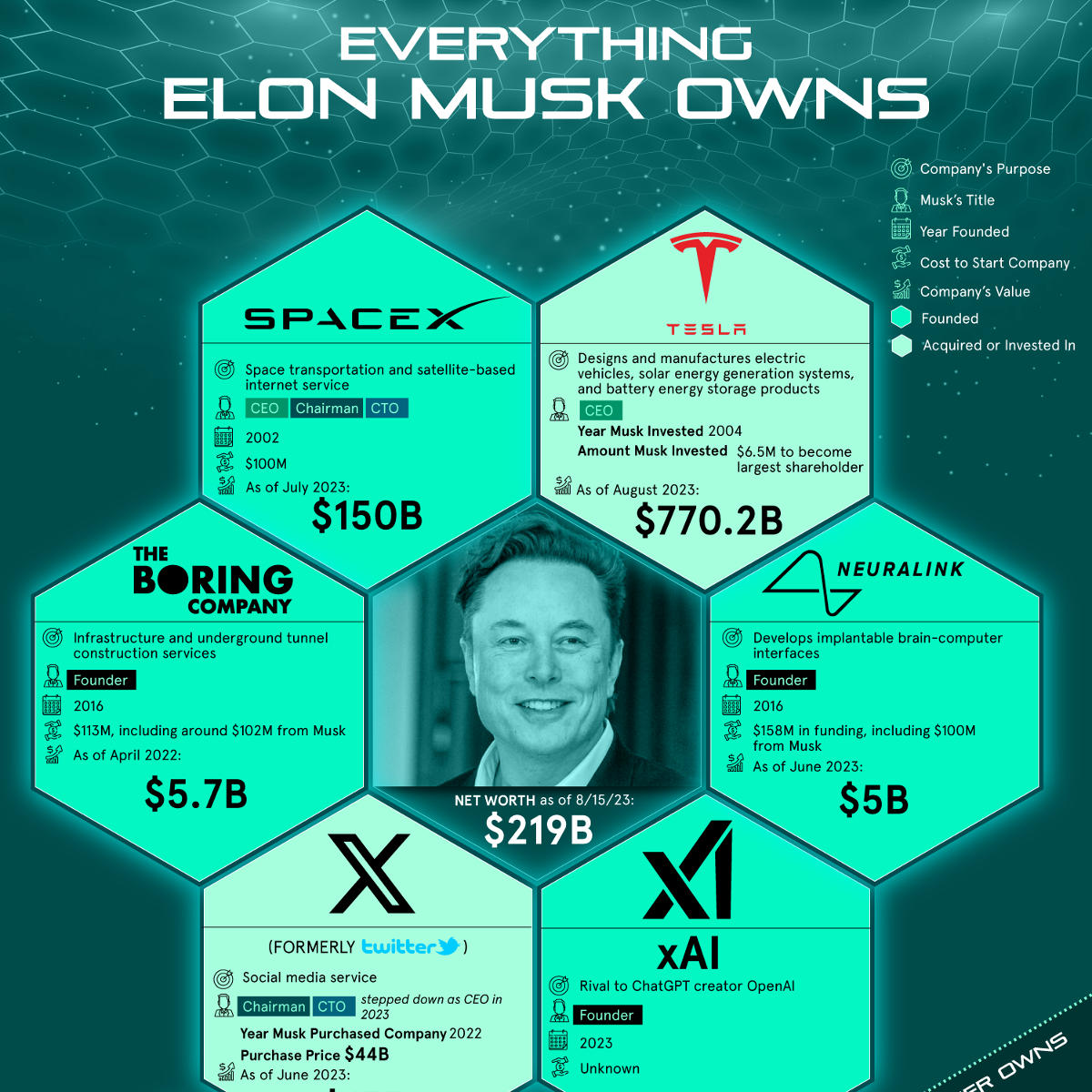

Understanding Elon Musks Wealth Key Strategies And Investments

May 10, 2025

Understanding Elon Musks Wealth Key Strategies And Investments

May 10, 2025 -

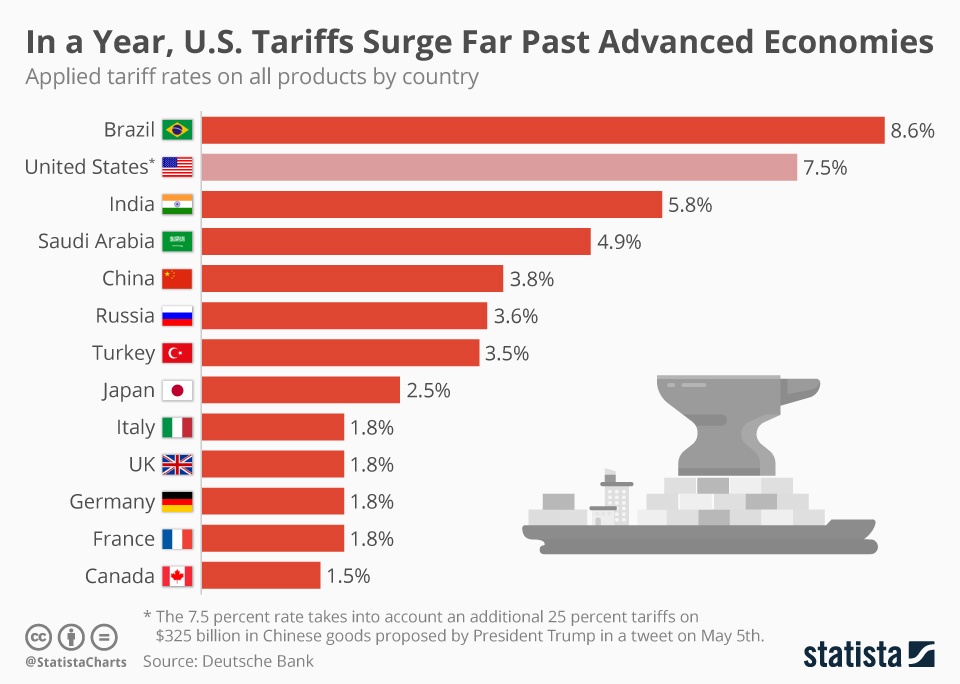

Post Liberation Day Assessing The Financial Losses Of Trumps Billionaire Circle

May 10, 2025

Post Liberation Day Assessing The Financial Losses Of Trumps Billionaire Circle

May 10, 2025 -

The Economic Impact Of Liberation Day Tariffs On Trumps Billionaire Network

May 10, 2025

The Economic Impact Of Liberation Day Tariffs On Trumps Billionaire Network

May 10, 2025 -

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 10, 2025

Elon Musks Net Worth A Comprehensive Look At His Business Ventures

May 10, 2025 -

Liberation Day Tariffs How They Impacted Trumps Wealthy Associates

May 10, 2025

Liberation Day Tariffs How They Impacted Trumps Wealthy Associates

May 10, 2025