Liberation Day Tariffs: How They Impacted Trump's Wealthy Associates

Table of Contents

Identifying Trump's Key Wealthy Associates Affected by the Tariffs

Several prominent business figures with close ties to President Trump operated in sectors potentially vulnerable to the Liberation Day tariffs. Identifying these Trump's business connections and analyzing their financial interests is crucial to understanding the overall impact. These influential figures and key stakeholders represent a cross-section of industries, including real estate, steel, and manufacturing.

- Example: [Associate Name 1] – Real Estate Development – Experienced increased construction costs due to tariffs on imported steel and building materials, potentially leading to reduced profit margins on projects.

- Example: [Associate Name 2] – Steel Manufacturing – Initially benefited from increased domestic demand due to tariffs, but later faced challenges from retaliatory tariffs imposed by other countries.

- Example: [Associate Name 3] – Apparel Manufacturing – Suffered significant losses due to increased costs of imported fabrics and components, impacting production and employment.

Analyzing the Direct Financial Impact of the Tariffs

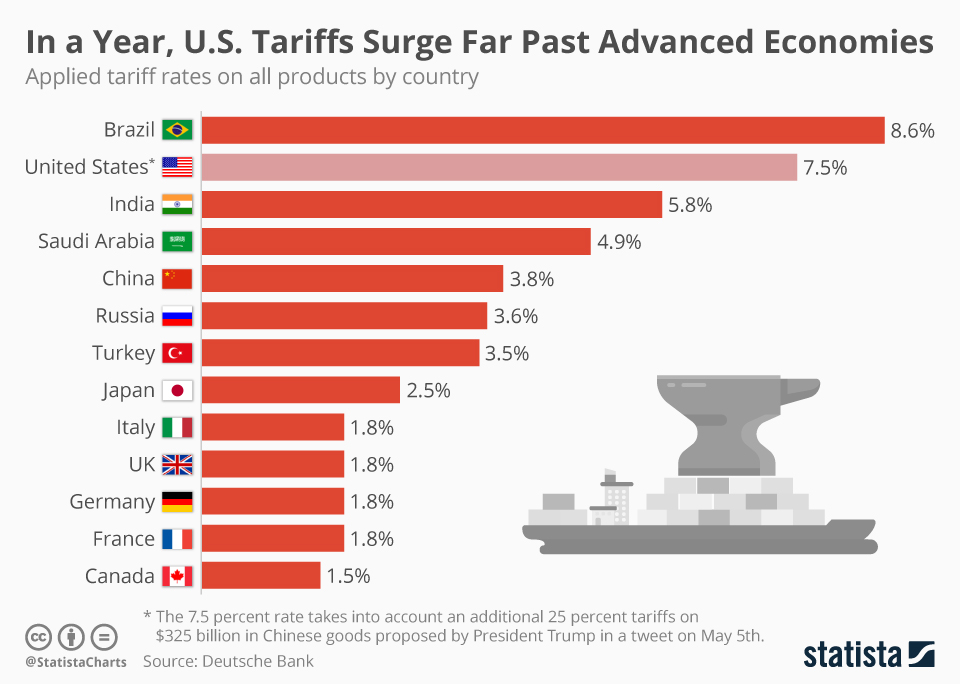

The Liberation Day tariffs had a demonstrably direct impact on the financial well-being of several associates. This analysis focuses on the economic consequences, examining financial losses, profit margins, investment losses, and market volatility.

- [Associate Name 1] reportedly experienced a 5% decrease in profit margins on several major real estate projects due to increased material costs caused by the tariffs. This financial losses impacted the overall return on investments for that year.

- [Associate Name 2] saw a temporary surge in domestic steel sales, leading to an initial increase in profits. However, subsequent retaliatory tariffs from trading partners resulted in a net loss of 10% in annual revenue, highlighting the complex market volatility triggered by the trade war. This demonstrates the limitations of relying on short term profit margins increases to evaluate the overall economic consequences of such policies.

- [Associate Name 3]'s apparel manufacturing business faced significant challenges and recorded an estimated 15% decrease in profits. This was attributable to higher costs of imported materials and decreased competitiveness in the global market. The inability to effectively offset the investment losses through price increases or altered supply chains was critical to their financial downfall.

Examining Indirect Impacts and Political Ramifications

Beyond the direct financial implications, the Liberation Day tariffs triggered a cascade of indirect effects. This includes political fallout, shifts in public opinion, and alterations in business strategies. Analysis considers regulatory challenges, reputational risk, and lobbying efforts.

- Several associates reportedly engaged in intense lobbying efforts, attempting to influence the administration's trade policies and mitigate the negative impacts on their businesses.

- The tariffs also sparked several legal challenges, with some businesses arguing that the measures were unfair or violated international trade agreements. These regulatory challenges required extensive financial and legal resources.

- The overall impact on public opinion towards the Trump administration was mixed. While some viewed the tariffs as a necessary measure to protect American jobs, others criticized them for harming businesses and consumers. This reputational risk had long-term implications.

Comparing the Impact on Wealthy Associates vs. Other Businesses

The Liberation Day tariffs disproportionately affected various businesses. Comparing the impact on Trump's wealthy associates to the consequences experienced by smaller businesses reveals a considerable disparity of impact. While some wealthy associates could absorb losses or adjust strategies, smaller businesses often lacked the resources to navigate the economic turbulence and faced significant job losses. This disparity contributes to the complex issues of economic inequality and economic recovery following such economic upheavals. Analyzing the small business impact is critical to fully grasp the wide range of consequences.

Conclusion: Liberation Day Tariffs and the Long-Term Consequences for Trump's Network

The Liberation Day tariffs demonstrably impacted President Trump's wealthy associates, resulting in a mixture of direct financial consequences and indirect political ramifications. While some benefited initially, many eventually experienced significant losses or negative repercussions. The study of Trump’s trade policy impact on his personal connections underscores the complex interplay between trade policy, economic realities, and political connections.

The long-term consequences of these tariffs remain a topic of ongoing analysis. To better understand the lasting effects of this controversial trade policy, further research is needed. We encourage readers to conduct in-depth Liberation Day tariffs analysis and investigate the effects of tariffs on a broader spectrum of businesses and individuals within the U.S. economy. This deep dive will allow for a more complete understanding of the far-reaching consequences of such policy decisions.

Featured Posts

-

Ray Epps Sues Fox News For Defamation Over January 6th Allegations

May 10, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Allegations

May 10, 2025 -

Pakistan Stock Exchange Outage Amidst Market Volatility

May 10, 2025

Pakistan Stock Exchange Outage Amidst Market Volatility

May 10, 2025 -

The Intriguing Theory Of Davids High Potential And Morgans Vulnerability

May 10, 2025

The Intriguing Theory Of Davids High Potential And Morgans Vulnerability

May 10, 2025 -

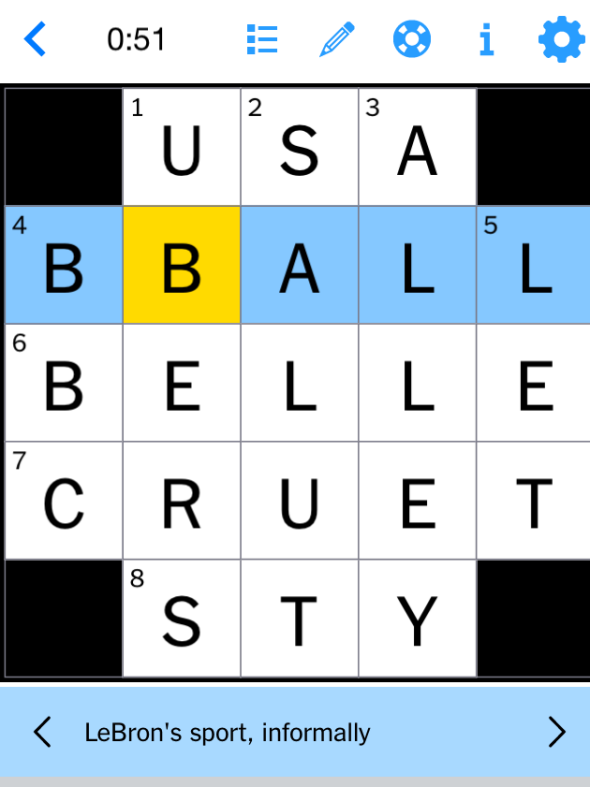

Nyt Crossword April 6 2025 Clues Hints And Spangram Help

May 10, 2025

Nyt Crossword April 6 2025 Clues Hints And Spangram Help

May 10, 2025 -

Is Chris Martin Influencing Dakota Johnsons Career Decisions

May 10, 2025

Is Chris Martin Influencing Dakota Johnsons Career Decisions

May 10, 2025