Student Loan Delinquency: The Effect On Your Credit Score

Table of Contents

Understanding Student Loan Delinquency

Student loan delinquency refers to missing payments on your student loans. The severity of the delinquency is typically categorized by the number of days past due: 30 days, 60 days, and 90 days or more. Each stage carries increasing consequences.

-

Federal Student Loans: These loans are offered by the U.S. government and are often seen as more lenient initially, but serious delinquency can lead to wage garnishment, tax refund offset, and even damage to your credit report.

-

Private Student Loans: These loans are provided by banks and other private lenders. Delinquency on private loans can lead to more aggressive collection practices and faster negative impacts on your credit score than federal loans.

-

Contributing Factors: Several factors contribute to student loan delinquency, including unexpected job loss, medical emergencies, reduced income, and simply a lack of proper financial planning.

-

Stages of Delinquency:

- 30-59 Days Late: Your lender will likely contact you, potentially offering options like forbearance or deferment.

- 60-89 Days Late: Negative information is typically reported to credit bureaus.

- 90+ Days Late: Your loan may be considered seriously delinquent, leading to more severe consequences including potential legal action.

The Impact of Delinquency on Your Credit Score

Late student loan payments are meticulously reported to the three major credit bureaus: Equifax, Experian, and TransUnion. This negative information remains on your credit report for seven years, significantly impacting your credit score.

-

Credit Score Reduction: A single delinquent student loan payment can lead to a substantial drop in your credit score, potentially hundreds of points. The more payments you miss, the worse the impact.

-

Long-Term Effects: A low credit score due to student loan delinquency can make it incredibly difficult to secure future loans, mortgages, or even rent an apartment. You'll likely face higher interest rates on any credit you do obtain, increasing the overall cost of borrowing.

-

Negative Consequences:

- Difficulty securing loans (auto, mortgage, personal)

- Higher interest rates on future loans

- Rejection for credit cards or other financial products

- Damage to your financial reputation

Preventing Student Loan Delinquency

Proactive planning and responsible financial management are crucial to avoiding student loan delinquency.

-

Effective Repayment Planning: Create a realistic budget that prioritizes your student loan payments. Explore different repayment plans offered by your lender to find one that aligns with your income.

-

Proactive Communication: If you anticipate difficulties making your payments, contact your lender immediately. They may offer options such as deferment (temporarily postponing payments) or forbearance (reducing or suspending payments).

-

Income-Driven Repayment Plans (IDRs): These plans base your monthly payments on your income and family size, making them more manageable for borrowers with lower incomes.

-

Practical Steps:

- Create a detailed budget and track your expenses.

- Automate your student loan payments to avoid missed payments.

- Set up reminders for upcoming payments.

- Regularly review your loan terms and repayment options.

Recovering from Student Loan Delinquency

If you're already dealing with student loan delinquency, taking swift action is paramount.

-

Contact Your Lender: Reach out to your lender and explain your situation. Explore options for repayment plans or debt consolidation.

-

Credit Repair Strategies: Once you've addressed the delinquency, focus on rebuilding your credit. This includes disputing any inaccuracies on your credit report and demonstrating responsible credit behavior moving forward.

-

Time to Recover: Recovering from student loan delinquency takes time and consistent effort. It could take several years to significantly improve your credit score.

-

Steps to Improve Credit:

- Pay all bills on time.

- Keep credit utilization low.

- Consider a secured credit card.

- Monitor your credit reports regularly.

Conclusion

Student loan delinquency has severe and long-lasting consequences, significantly impacting your credit score and future financial opportunities. Understanding the stages of delinquency, its impact on your creditworthiness, and proactive strategies for prevention and recovery are vital to maintaining good financial health. Don't let student loan delinquency damage your financial future. Take control of your student loans today by exploring different repayment options and communicating with your lender. With responsible financial planning and proactive management, you can overcome past challenges and build a strong credit foundation. Remember, it's possible to recover from delinquency and achieve long-term financial success.

Featured Posts

-

Haly Wwd Astar Tam Krwz Ke Jwte Pr Mdah Ka Waqeh Mkml Tfsylat

May 17, 2025

Haly Wwd Astar Tam Krwz Ke Jwte Pr Mdah Ka Waqeh Mkml Tfsylat

May 17, 2025 -

St Johns Basketball Tom Thibodeau Of The New York Knicks Offers High Praise

May 17, 2025

St Johns Basketball Tom Thibodeau Of The New York Knicks Offers High Praise

May 17, 2025 -

Stem Scholarships Supporting Local Students Future In Science And Technology

May 17, 2025

Stem Scholarships Supporting Local Students Future In Science And Technology

May 17, 2025 -

Todays Mlb Game Yankees Vs Mariners Prediction And Betting Odds

May 17, 2025

Todays Mlb Game Yankees Vs Mariners Prediction And Betting Odds

May 17, 2025 -

Anchor Brewing Company Shuttering After 127 Years Of Brewing History

May 17, 2025

Anchor Brewing Company Shuttering After 127 Years Of Brewing History

May 17, 2025

Latest Posts

-

Laporan Keuangan Manfaat Dan Implementasinya Bagi Pertumbuhan Bisnis

May 17, 2025

Laporan Keuangan Manfaat Dan Implementasinya Bagi Pertumbuhan Bisnis

May 17, 2025 -

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025

Analisis Laporan Keuangan Kunci Sukses Bisnis Anda

May 17, 2025 -

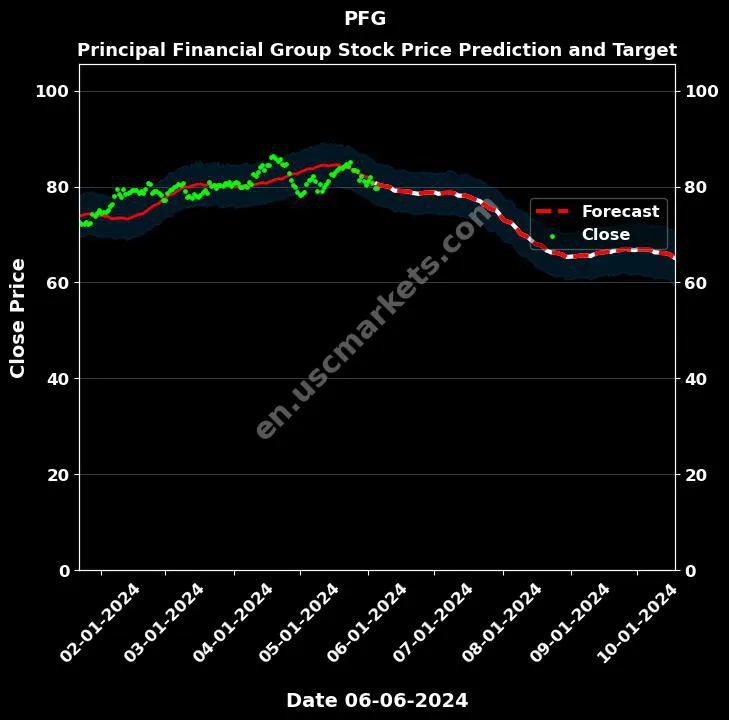

Principal Financial Group Pfg Stock A Comprehensive Review Of 13 Analyst Assessments

May 17, 2025

Principal Financial Group Pfg Stock A Comprehensive Review Of 13 Analyst Assessments

May 17, 2025 -

Panduan Lengkap Memahami Dan Menggunakan Laporan Keuangan Bisnis

May 17, 2025

Panduan Lengkap Memahami Dan Menggunakan Laporan Keuangan Bisnis

May 17, 2025 -

Understanding Principal Financial Group Pfg An Analysis Of 13 Analyst Ratings

May 17, 2025

Understanding Principal Financial Group Pfg An Analysis Of 13 Analyst Ratings

May 17, 2025