Strong Earnings Boost Vodacom (VOD) Payout Beyond Forecasts

Table of Contents

Exceptional Earnings Growth Fuels Higher Dividend

Vodacom's impressive earnings growth is the driving force behind the increased dividend payout. The company reported a substantial increase in earnings, exceeding both year-over-year and quarter-over-quarter expectations. This robust performance is reflected in several key financial metrics:

- Significant Earnings Increase: Earnings grew by X% compared to the previous year and Y% compared to the previous quarter. (Replace X and Y with actual figures from Vodacom's financial reports). This represents a substantial improvement in the company's financial health and profitability.

- Key Drivers of Growth: This impressive growth is attributable to several factors, including a larger subscriber base, increased average revenue per user (ARPU), and the successful launch of new data and financial services products. The expansion into new markets also contributed significantly to overall revenue growth.

- Dividend Payout Surpasses Forecasts: The actual dividend payout amounts to Z rand per share (replace Z with the actual figure), exceeding the forecasted amount by W% (replace W with the percentage increase). This generous dividend reflects Vodacom's confidence in its future prospects and its commitment to rewarding shareholders.

- Improved Profit Margins: The increased profit margins, driven by operational efficiencies and strategic cost management, played a crucial role in funding the higher dividend payout. This demonstrates the company's ability to generate substantial profits even amidst challenging market conditions.

The factors behind this strong earnings growth are multifaceted and point towards the sustainability of this positive trend. A detailed analysis of Vodacom's financial statements reveals a healthy balance sheet and robust cash flow, suggesting that this impressive performance is not merely a one-off event.

Strong Performance Across Key Operational Areas

Vodacom's success isn't confined to a single area; rather, it reflects strong performance across its key operational areas.

- Vodacom South Africa Dominates: Vodacom South Africa continues to be a major contributor to overall revenue, demonstrating strong growth in data revenue and mobile financial services. Market share gains in key segments highlight the company's competitive advantage.

- International Operations Expand: Vodacom's international operations are also contributing significantly to the company's overall growth, showcasing the success of its expansion strategy into new and emerging markets. This diversification mitigates risk and provides opportunities for future expansion.

- Data Revenue Drives Growth: The continued growth in data revenue underscores the increasing demand for mobile data services and Vodacom’s ability to capitalize on this trend. Investments in network infrastructure have directly supported this growth.

- Mobile Money a Key Growth Engine: Mobile money services, such as M-Pesa, continue to be a significant driver of revenue and profit, demonstrating the potential of financial services within the telecoms sector. This successful integration of financial services positions Vodacom for continued growth in this lucrative market.

Vodacom's strategic investments in its network infrastructure have significantly improved its service offerings and contributed to enhanced customer satisfaction and increased revenue. The company's ongoing expansion plans and potential strategic acquisitions further promise continued growth in the future.

Investor and Market Reaction to Vodacom's Results

The market reacted positively to Vodacom's impressive financial results.

- Stock Price Surge: Following the announcement, Vodacom's stock price experienced a significant increase, reflecting investor enthusiasm. This increase demonstrates confidence in the company's future growth trajectory.

- Increased Trading Volume: The trading volume of VOD shares also increased dramatically, indicating heightened investor interest and activity in the market.

- Positive Analyst Ratings: Analysts have largely issued positive ratings for Vodacom, citing the strong earnings and increased dividend as key factors. This positive outlook reinforces the market's confidence in the company.

- Market Capitalization Increase: Vodacom's market capitalization saw a significant increase, reflecting the enhanced value attributed to the company by investors.

The strong positive response from the market underscores the significance of Vodacom's financial performance and the confidence investors have in its future prospects. This reaction validates the company's strategic decisions and its ability to deliver strong financial returns.

Long-Term Implications for Vodacom Investors

Vodacom's strong earnings and increased dividend payout have significant long-term implications for investors.

- Continued Growth Potential: The company's robust financial position and strategic initiatives suggest significant potential for continued growth in the coming years.

- Risk Assessment: While the outlook is positive, investors should carefully consider the inherent risks associated with any investment, including market fluctuations and competitive pressures.

- Attractive Long-Term Investment: Vodacom presents itself as an attractive long-term investment opportunity for investors seeking consistent dividend payouts and potential capital appreciation.

- Dividend Reinvestment Plan (DRIP): Utilizing a DRIP can enhance returns by automatically reinvesting dividend payments to purchase additional shares.

Considering both the opportunities and challenges, Vodacom's future outlook appears promising, making it a potentially attractive addition to a diversified investment portfolio.

Conclusion

Vodacom's (VOD) unexpectedly strong earnings have resulted in a significantly higher-than-anticipated dividend payout, bolstering investor confidence. This performance highlights the company's resilience and growth potential across its diverse operational segments. The exceptional results paint a strong financial outlook for Vodacom.

Call to Action: Are you seeking strong dividend-paying stocks with significant growth potential? Consider adding Vodacom (VOD) to your investment portfolio. Thoroughly research Vodacom's financial statements and consult with a financial advisor before making any investment decisions. Learn more about Vodacom's investment opportunities and future growth prospects to make informed decisions.

Featured Posts

-

Gina Schumacher A Nascut O Fetita Michael Schumacher Este Bunic

May 20, 2025

Gina Schumacher A Nascut O Fetita Michael Schumacher Este Bunic

May 20, 2025 -

Analyzing Tariff Volatility Insights From Fp Videos Domestic And International Coverage

May 20, 2025

Analyzing Tariff Volatility Insights From Fp Videos Domestic And International Coverage

May 20, 2025 -

Exploring Agatha Christies Poirot His Cases Methods And Enduring Legacy

May 20, 2025

Exploring Agatha Christies Poirot His Cases Methods And Enduring Legacy

May 20, 2025 -

Understanding Hmrcs Nudge Letters For Online Sellers E Bay Vinted Depop

May 20, 2025

Understanding Hmrcs Nudge Letters For Online Sellers E Bay Vinted Depop

May 20, 2025 -

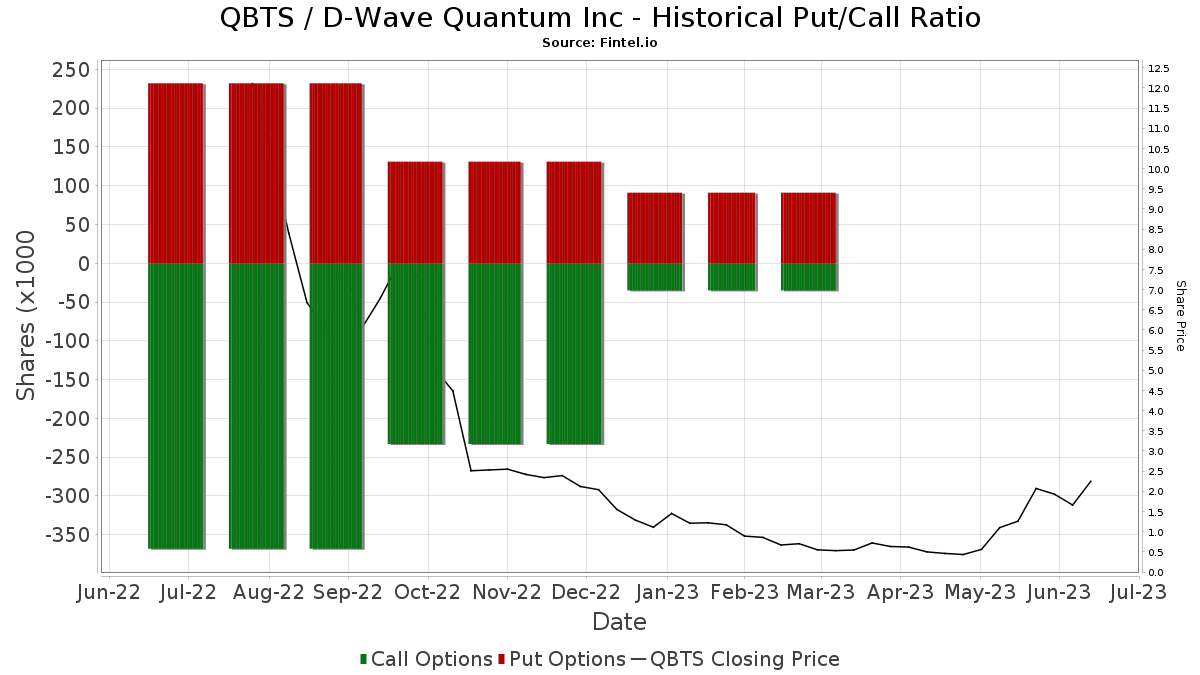

Analyzing The Recent Price Increase Of D Wave Quantum Inc Qbts Stock

May 20, 2025

Analyzing The Recent Price Increase Of D Wave Quantum Inc Qbts Stock

May 20, 2025

Latest Posts

-

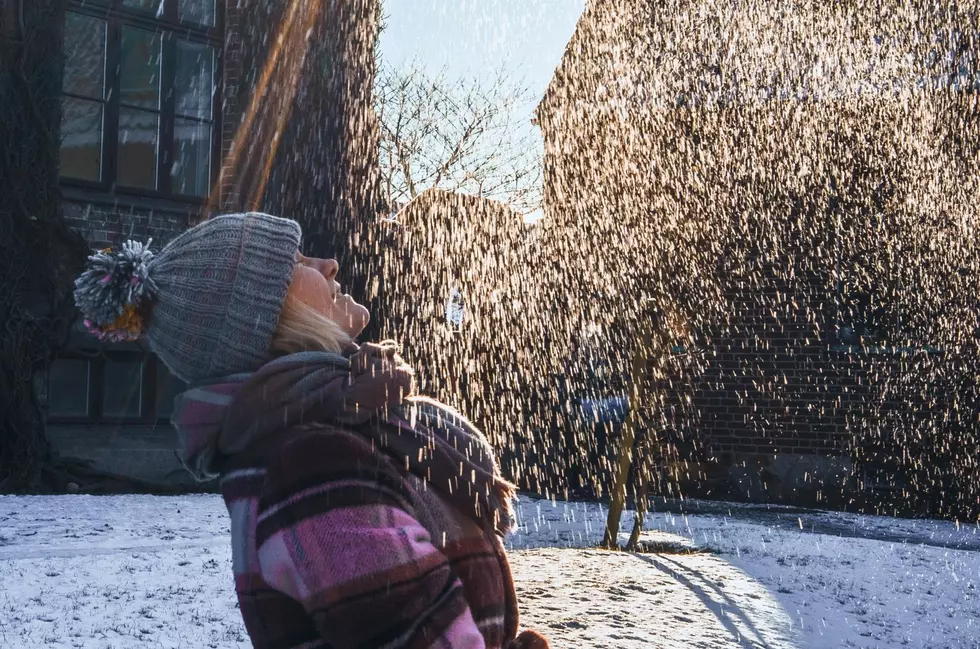

Winter Weather Advisory Impact On School Schedules And Transportation

May 20, 2025

Winter Weather Advisory Impact On School Schedules And Transportation

May 20, 2025 -

Investing In Ai Quantum Computing One Reason To Consider This Stock Now

May 20, 2025

Investing In Ai Quantum Computing One Reason To Consider This Stock Now

May 20, 2025 -

Staying Safe During Winter Weather School Delays And Preparedness

May 20, 2025

Staying Safe During Winter Weather School Delays And Preparedness

May 20, 2025 -

This Ai Quantum Computing Stock A Dip Buying Opportunity Based On One Key Metric

May 20, 2025

This Ai Quantum Computing Stock A Dip Buying Opportunity Based On One Key Metric

May 20, 2025 -

School Delays And Winter Weather Advisories What You Need To Know

May 20, 2025

School Delays And Winter Weather Advisories What You Need To Know

May 20, 2025