This AI Quantum Computing Stock: A Dip Buying Opportunity Based On One Key Metric

Understanding the AI Quantum Computing Market

The intersection of artificial intelligence and quantum computing represents one of the most exciting frontiers in technological advancement. This rapidly evolving market promises transformative solutions across various sectors, from drug discovery and materials science to financial modeling and cybersecurity. However, it's crucial to acknowledge the inherent risks associated with investing in such an early-stage market.

- High growth potential: Advancements in both AI and quantum computing are fueling exponential growth projections for this sector. The convergence of these two powerful technologies unlocks unprecedented computational power, paving the way for innovations previously deemed impossible.

- Early-stage market with inherent volatility: As with any nascent technology, the AI quantum computing market is characterized by significant volatility. Stock prices can fluctuate dramatically based on technological breakthroughs, regulatory changes, and market sentiment.

- Significant long-term investment potential: Despite the risks, the long-term potential for early adopters in this field is substantial. Companies that successfully navigate the challenges and establish market leadership stand to reap enormous rewards.

Key players in this space include IBM, Google, and Microsoft, but smaller companies like IonQ are making significant strides and attracting considerable investor interest. The race to develop commercially viable quantum computers is fierce, creating a dynamic and competitive environment.

Introducing IonQ (IONQ): A Detailed Analysis

IonQ is a leading player in the trapped-ion quantum computing space. Their business model centers around providing access to their quantum computers through cloud-based platforms, enabling researchers and developers to explore the potential of quantum computing. They boast a robust technology platform and a strong team of scientists and engineers.

- Company background and key achievements: IonQ has achieved several key milestones, including demonstrating high-fidelity quantum gates and achieving record qubit numbers. Their focus on trapped-ion technology is considered a promising approach to building scalable and fault-tolerant quantum computers.

- Recent stock performance and volatility: Like many AI quantum computing stocks, IONQ has experienced significant price fluctuations. Recent dips present a potential entry point for astute investors, but careful analysis is crucial.

- Potential catalysts for future growth: Future growth catalysts for IonQ include securing strategic partnerships, achieving further technological breakthroughs, and expanding their customer base. Government funding initiatives and increasing industry interest also contribute to the positive outlook.

The Key Metric: Patent Portfolio and its Significance

For IonQ, a key metric indicative of its long-term prospects is its growing patent portfolio. A strong patent portfolio signifies a significant competitive advantage and intellectual property protection, crucial in the highly innovative quantum computing landscape. It demonstrates IonQ's commitment to research and development, its technological leadership, and its potential for future innovation.

- Detailed explanation of the metric and its relevance: A robust patent portfolio safeguards IonQ's unique technologies, preventing competitors from replicating their innovations. It also serves as a valuable asset for future licensing agreements and collaborations.

- Presentation of data and its interpretation: IonQ's patent portfolio has been steadily expanding, indicating a strong commitment to innovation and a focus on protecting their intellectual property. This sustained growth is a positive indicator of the company's long-term viability.

- Comparison with industry benchmarks: While precise comparisons across all competitors are challenging due to varying disclosure practices, IonQ’s patent portfolio compares favorably to other publicly traded quantum computing companies.

Evaluating the Dip Buying Opportunity

Based on the analysis of IonQ's expanding patent portfolio and its overall technological advancements, the recent dip in its stock price could present a compelling buying opportunity for long-term investors. However, it's vital to acknowledge the associated risks.

- Risk assessment: Potential downsides include the inherent volatility of the quantum computing market, competition from larger players, and challenges in scaling quantum computing technology to commercial applications.

- Reward potential: The potential upside is significant, considering IonQ's pioneering technology, its growing patent portfolio, and the immense long-term potential of the AI quantum computing market.

- Recommendation based on the analysis: Considering the potential for growth and the relative strength of its patent position, we believe IonQ warrants consideration as a potential addition to a diversified portfolio.

Conclusion: Is This AI Quantum Computing Stock Right for Your Portfolio?

This analysis suggests that IonQ's strong patent portfolio, coupled with its technological advancements, makes it a potentially attractive AI quantum computing stock during a price dip. The key metric analyzed — the patent portfolio — provides strong evidence of the company’s long-term commitment to innovation and its potential for future growth. However, remember this is a high-risk, high-reward investment. Before investing in any AI quantum computing stock, including IonQ, thorough due diligence and careful consideration of your risk tolerance are paramount. Consider adding this promising AI quantum computing stock to your portfolio, but remember to conduct thorough due diligence before making any investment decisions. This analysis serves as a starting point for your own research and should not be considered financial advice.

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

Amazon Warehouse Closures In Quebec Union Challenges Before Labour Tribunal

Amazon Warehouse Closures In Quebec Union Challenges Before Labour Tribunal

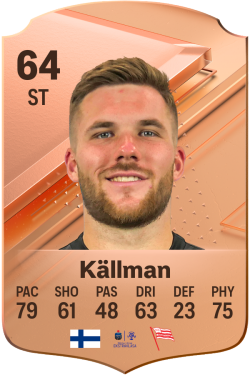

Benjamin Kaellman Huuhkajien Uusi Taehti

Benjamin Kaellman Huuhkajien Uusi Taehti

Addressing The Rise In Femicide Prevention And Intervention Strategies

Addressing The Rise In Femicide Prevention And Intervention Strategies

L Affaire Jaminet Reglee Le Joueur Rembourse Le Stade Toulousain

L Affaire Jaminet Reglee Le Joueur Rembourse Le Stade Toulousain