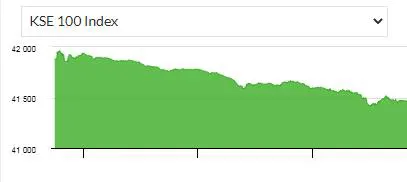

Pakistan Stock Exchange Outage Amidst Market Volatility

Table of Contents

Causes of the PSX Outage

The precise cause of the PSX outage may not be immediately clear, but several factors could have contributed to the system failure. Investigating these potential causes is essential for implementing effective preventative measures.

Technical Glitches

Technical glitches are a common cause of stock exchange outages worldwide. The PSX, like any complex system, is susceptible to various technical issues.

- Server failures: A primary server malfunction could have cascaded into a complete system shutdown.

- Software bugs: Unforeseen errors in the trading platform's software could have disrupted normal operations.

- Network problems: Issues with network connectivity, either internal or external, could have prevented smooth data transmission.

- Previous instances: While specific details may not be publicly available, analyzing past PSX incidents might reveal patterns or weaknesses in its infrastructure.

The PSX's existing infrastructure and its capacity to handle peak trading volumes are key considerations in understanding the vulnerability to technical failures. A thorough review of the infrastructure is necessary to identify and address potential weaknesses.

Cybersecurity Threats

The possibility of a cyberattack or data breach cannot be ruled out. Financial institutions are increasingly targeted by sophisticated cybercriminals.

- Increasing cyber threats: The global rise in cyberattacks targeting financial institutions highlights the vulnerability of such systems.

- Data breach implications: A successful cyberattack could compromise sensitive investor data and disrupt trading activities.

- Robust cybersecurity crucial: The PSX needs to invest in and maintain robust cybersecurity measures, including firewalls, intrusion detection systems, and regular security audits.

Overload Due to Market Volatility

The heightened market volatility preceding the outage may have placed an extraordinary strain on the PSX's systems.

- Correlation between volatility and system strain: Periods of intense market activity, often characterized by rapid price fluctuations and high trading volumes, can overwhelm even the most resilient systems.

- Trading volume data: Analyzing trading volumes during the period leading up to the outage can reveal if system capacity was exceeded. This data should be publicly available for transparency and accountability.

- System capacity planning: The PSX's ability to handle increased trading volume during volatile periods needs to be reassessed and potentially increased.

Impact of the Outage on Investors and the Market

The PSX outage had far-reaching consequences for investors and the overall market.

Trading Halts and Lost Opportunities

The unexpected halt in trading deprived investors of the ability to buy or sell assets, leading to potential losses.

- Stocks affected: Identifying which stocks were impacted and the magnitude of potential losses is crucial for assessing the overall effect.

- Missed opportunities: Investors may have missed opportunities for profit or been forced to hold losing positions due to the inability to trade.

- Psychological impact: The uncertainty caused by the outage also significantly impacted investor confidence.

Market Sentiment and Volatility

The outage further exacerbated existing market volatility, contributing to a negative market sentiment.

- Index fluctuations: Key indices likely experienced significant swings during and after the outage, reflecting investor anxiety.

- Investor reactions: Investor reactions ranged from frustration and anger to concerns about the PSX's reliability.

- Expert opinions: Financial experts and analysts offer insight into the broader impact of the outage on market sentiment and investor confidence.

Regulatory Response and Investigation

Regulatory bodies are likely investigating the cause of the outage and will implement measures to prevent future incidents.

- Regulatory bodies involved: The Securities and Exchange Commission of Pakistan (SECP) and other relevant bodies will play a crucial role in the investigation.

- Potential penalties or reforms: Depending on the findings, the PSX may face penalties, and regulatory reforms may be implemented.

- Official statements: Statements released by regulatory authorities provide insight into the ongoing investigation and planned actions.

Preventing Future PSX Outages

Preventing future outages requires a multi-faceted approach focusing on infrastructure, cybersecurity, and risk management.

Investing in Infrastructure

Upgrading the PSX's infrastructure is crucial to enhance its resilience and reliability.

- Infrastructure upgrades: Investment in redundant systems, improved hardware, and advanced software is essential.

- Disaster recovery plans: Comprehensive disaster recovery plans should be in place to minimize disruption in case of unforeseen events.

- Best practices from other exchanges: Learning from the experiences and best practices of other major stock exchanges can help inform the PSX's upgrade strategy.

Enhanced Cybersecurity Measures

Strengthening cybersecurity defenses is paramount to protecting the PSX from cyberattacks.

- Specific cybersecurity measures: Implementing advanced threat detection, multi-factor authentication, and regular penetration testing is critical.

- Regular security audits: Conducting periodic security audits will help identify vulnerabilities and ensure the effectiveness of existing security measures.

- Employee training: Educating employees on cybersecurity best practices will reduce the risk of human error and social engineering attacks.

Improved Risk Management

A robust risk management strategy is vital for mitigating the impact of future market volatilities.

- Stress testing: Regular stress tests can simulate high-volume trading scenarios to identify potential bottlenecks and vulnerabilities.

- Contingency plans: Well-defined contingency plans should be developed to handle various scenarios, including system failures and cyberattacks.

- Early warning systems: Implementing early warning systems can help detect potential issues before they escalate into major disruptions.

- Transparency and communication: Open and transparent communication with investors and stakeholders is crucial for building confidence and trust.

Conclusion

The Pakistan Stock Exchange outage underscores the critical need for robust infrastructure, enhanced cybersecurity, and comprehensive risk management strategies. The impact on investors and market sentiment highlights the severe consequences of such disruptions. Addressing these issues requires a concerted effort from the PSX, regulatory bodies, and all stakeholders. Investing in technological upgrades, implementing advanced cybersecurity protocols, and developing comprehensive risk mitigation strategies are crucial steps towards ensuring the stability and reliability of the Pakistan Stock Exchange. Stay informed about the Pakistan Stock Exchange and its ongoing improvements to mitigate future outages and maintain market stability.

Featured Posts

-

The Value Of Middle Managers Bridging The Gap Between Leadership And Workforce

May 10, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Workforce

May 10, 2025 -

Is Putins Victory Day Ceasefire A Genuine Peace Offering

May 10, 2025

Is Putins Victory Day Ceasefire A Genuine Peace Offering

May 10, 2025 -

Stephen King In 2025 The Monkey Movies Potential Impact On The Authors Year

May 10, 2025

Stephen King In 2025 The Monkey Movies Potential Impact On The Authors Year

May 10, 2025 -

Elon Musk Wealth Increase Billions Added After Tesla Rally Dogecoin Step Back

May 10, 2025

Elon Musk Wealth Increase Billions Added After Tesla Rally Dogecoin Step Back

May 10, 2025 -

Unlocking The Nyt Crossword Strands Puzzle April 12 2025

May 10, 2025

Unlocking The Nyt Crossword Strands Puzzle April 12 2025

May 10, 2025