Stocks Up Over 10%: Sensex Gains & Top Performers On BSE

Table of Contents

Sensex Gains – A Detailed Analysis

Magnitude of the Surge

The Sensex experienced a breathtaking increase, closing at [Insert Closing Value]—a gain of [Insert Exact Percentage Gain]%. This represents a significant jump compared to the previous day's close, the previous week's performance, and even surpasses the average monthly gains seen in recent times.

- Exact percentage gain: [Insert Exact Percentage Gain]%

- Closing value: [Insert Closing Value]

- Comparison to previous day: [Insert Percentage Change compared to previous day]

- Comparison to previous week: [Insert Percentage Change compared to previous week]

- Market volume: [Insert data on overall market volume and trading activity]

This substantial increase showcases a strong bullish sentiment within the Indian stock market.

Contributing Factors

Several factors likely contributed to this significant Sensex increase. A confluence of positive global and domestic influences fueled this remarkable rally.

- Positive global market trends: Positive cues from global markets, particularly in the US and Europe, influenced investor confidence. [Mention specific global market events that could have contributed]

- Positive economic indicators: Recent positive economic indicators, such as [Mention specific data points like GDP growth figures, inflation reports, or positive industrial production data], boosted investor optimism about the Indian economy's prospects.

- Specific company announcements: Strong quarterly earnings reports from major companies across various sectors further contributed to the positive market sentiment. [Mention examples if any].

- Government policies: Supportive government policies and announcements, aimed at boosting economic growth, instilled confidence among investors. [Mention examples if any].

Investor Sentiment

The prevailing mood among investors is decidedly bullish. The significant Sensex gains reflect a surge in investor confidence.

- Increased investor confidence: Positive economic data and corporate performance have fueled a strong belief in the future performance of the Indian stock market.

- Bullish sentiment: The market is currently characterized by a strong bullish sentiment, leading to increased buying activity.

- Foreign Institutional Investment (FII) flows: Positive FII flows have also contributed significantly to the Sensex surge. [Mention any data regarding FII inflow].

Top Performing Stocks on BSE

Sector-wise Analysis

Several sectors showcased exceptional performance, driving the overall Sensex surge.

- IT Sector: [List top 3 performing IT stocks, their percentage gains, and brief reasons]. Example: Infosys (+X%), TCS (+Y%), Wipro (+Z%). Strong quarterly earnings and positive outlook drove gains.

- Banking Sector: [List top 3 performing Banking stocks, their percentage gains, and brief reasons]. Example: HDFC Bank (+X%), SBI (+Y%), ICICI Bank (+Z%). Improved credit growth and positive economic outlook boosted investor confidence.

- Pharma Sector: [List top 3 performing Pharma stocks, their percentage gains, and brief reasons]. Example: Sun Pharma (+X%), Cipla (+Y%), Dr Reddy's (+Z%). Strong export demand and new product launches fueled growth.

Individual Stock Deep Dive (Top 3)

Let's take a closer look at the three best-performing stocks:

- [Stock Name 1]: Sector: [Sector]; Percentage Gain: [Percentage]; Reasons: [Reasons for strong performance].

- [Stock Name 2]: Sector: [Sector]; Percentage Gain: [Percentage]; Reasons: [Reasons for strong performance].

- [Stock Name 3]: Sector: [Sector]; Percentage Gain: [Percentage]; Reasons: [Reasons for strong performance].

Potential Risks and Future Outlook

While the current market sentiment is positive, investors should exercise caution. Market fluctuations are inherent, and this rally might not sustain indefinitely. Potential risks include global economic uncertainty and shifts in investor sentiment. A balanced and diversified portfolio remains crucial for mitigating risk.

Impact on Investors and the Broader Economy

Implications for Investors

The Sensex gains present both opportunities and challenges for investors.

- Opportunities for profit-booking: Investors with short-term investment horizons might consider booking profits.

- Potential risks associated with high gains: The current market rally might be unsustainable, and investors need to manage their risk accordingly.

- Recommendations for portfolio management: A diversified portfolio, incorporating stocks across various sectors, is essential for managing risk.

Macroeconomic Impact

The market surge positively impacts the broader economy.

- Positive sentiment on GDP growth: The strong market performance reflects positive expectations for future economic growth.

- Increased consumer confidence: A rising stock market often boosts consumer confidence, leading to increased spending and economic activity.

- Potential for job creation: Increased business activity and investment fueled by market gains can potentially lead to job creation.

Conclusion

The Sensex's remarkable surge exceeding 10%, highlighted by the impressive performance of several BSE stocks across various sectors, is a significant event in the Indian stock market. This rally reflects a confluence of positive global and domestic factors, resulting in increased investor confidence and a strong bullish sentiment. Understanding Sensex gains and identifying top BSE performers is crucial for smart investment strategies. However, investors should always maintain a balanced approach, aware of potential risks. Stay updated on future Sensex gains and top BSE performers by subscribing to our newsletter! Learn more about maximizing your returns from stocks up over 10% by exploring our resources.

Featured Posts

-

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Events This Fall

May 15, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Events This Fall

May 15, 2025 -

Npo Medewerkers Getuigen Over Angstcultuur Onder Leeflang

May 15, 2025

Npo Medewerkers Getuigen Over Angstcultuur Onder Leeflang

May 15, 2025 -

Ind As 117 And The Future Of Insurance In India Opportunities And Challenges

May 15, 2025

Ind As 117 And The Future Of Insurance In India Opportunities And Challenges

May 15, 2025 -

Euphoria Season 3 First Look At Cassies Wedding In Set Photos

May 15, 2025

Euphoria Season 3 First Look At Cassies Wedding In Set Photos

May 15, 2025 -

The 2026 Bmw I X A Detailed Examination Of Its Potential As A Leading Electric Vehicle

May 15, 2025

The 2026 Bmw I X A Detailed Examination Of Its Potential As A Leading Electric Vehicle

May 15, 2025

Latest Posts

-

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

May 15, 2025

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

May 15, 2025 -

Jimmy Butler Picks Rockets Vs Warriors Game 6 Predictions And Best Bets

May 15, 2025

Jimmy Butler Picks Rockets Vs Warriors Game 6 Predictions And Best Bets

May 15, 2025 -

1 050 V Mware Price Increase At And T Details Broadcoms Proposed Hike

May 15, 2025

1 050 V Mware Price Increase At And T Details Broadcoms Proposed Hike

May 15, 2025 -

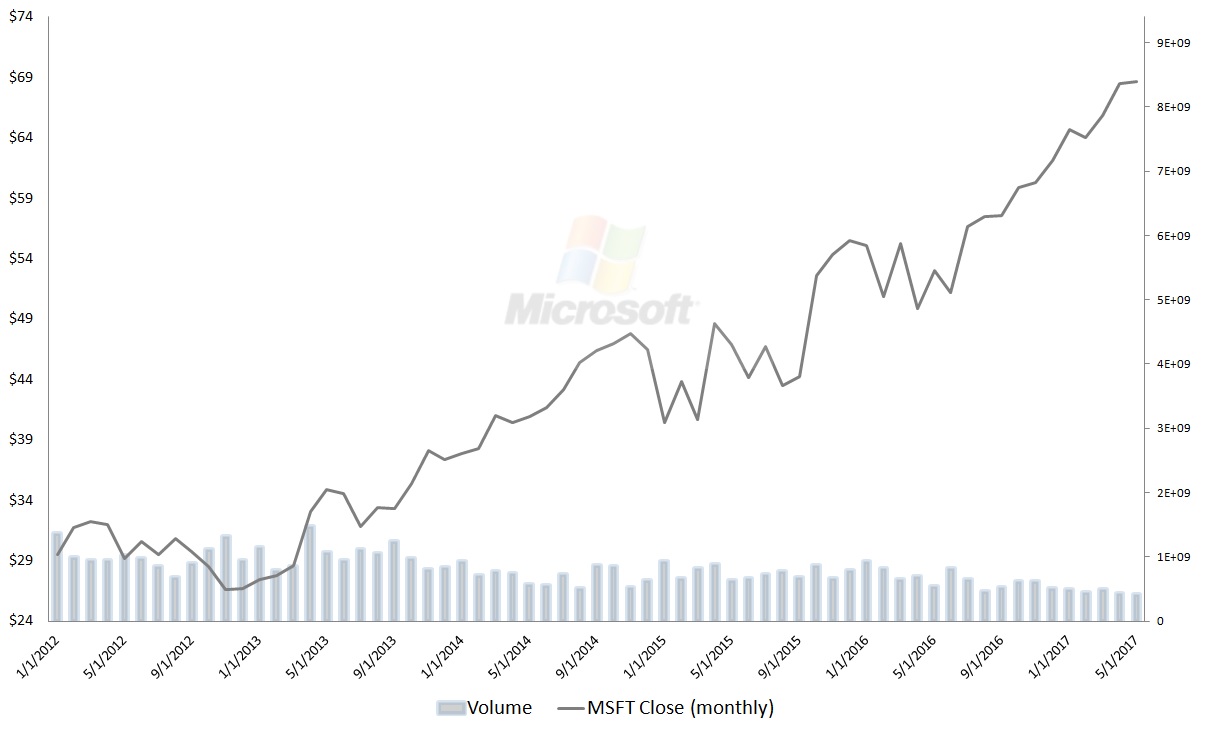

Why Microsoft Stock Stands Out During Trade Conflicts

May 15, 2025

Why Microsoft Stock Stands Out During Trade Conflicts

May 15, 2025 -

The Safe Harbor Of Microsoft Stock In A Volatile Market

May 15, 2025

The Safe Harbor Of Microsoft Stock In A Volatile Market

May 15, 2025