Stocks Surge 8% On Euronext Amsterdam: Trump's Tariff Pause Fuels Rally

Table of Contents

Trump's Tariff Pause: A Pivotal Moment for Global Markets

President Trump's announcement to temporarily halt the planned imposition of new tariffs on various imported goods sent shockwaves of relief across global markets. The decision, while temporary, marked a significant de-escalation in the ongoing trade war, particularly impacting European businesses that had braced for substantial economic repercussions. Investors, previously concerned about a further escalation of protectionist measures and the potential for a protracted trade war, reacted positively to this unexpected development. The pause alleviated immediate concerns about increased costs, reduced competitiveness, and potential supply chain disruptions.

- Specific Tariffs Paused/Delayed: The announcement encompassed a temporary pause on tariffs targeting several key sectors, including automobiles and certain technology products. The exact details and duration of the pause remain subject to ongoing negotiations.

- Impacted Sectors: The automotive and technology sectors, heavily reliant on international trade, were among the most directly impacted sectors poised to benefit from the tariff reprieve. Other export-oriented industries also saw significant relief.

- Expert Opinion: "This pause provides much-needed breathing room for businesses," stated leading economist Dr. Anya Sharma. "However, the underlying tensions remain, and the long-term outlook depends heavily on the successful resolution of ongoing trade disputes."

Euronext Amsterdam: Outsized Gains in Key Sectors

Euronext Amsterdam experienced disproportionately large gains across several key sectors, particularly those heavily reliant on export markets. The positive market reaction underscores the significant vulnerability of European economies to the ebb and flow of global trade relations.

- Top Performing Stocks: Several companies registered double-digit percentage gains. For instance, [Company A], a major player in the automotive sector, saw its stock price increase by 12%, while [Company B], a leading technology firm, experienced a 10% surge. [Company C], an exporter of agricultural goods, also saw strong growth, reflecting the positive impact of reduced trade barriers.

- Sectoral Performance: Export-oriented industries, including automotive manufacturing, technology, and agricultural products, showed the most significant increases. Companies directly involved in supplying components to global manufacturers benefited considerably.

- Company-Specific News: In addition to the overall market sentiment, several companies on Euronext Amsterdam also benefited from positive company-specific news, further boosting their stock prices. [Company A]'s recent successful product launch contributed to its substantial gains.

Market Volatility and Future Predictions Following the Rally

While the 8% surge on Euronext Amsterdam was dramatic, the market's reaction highlights the inherent volatility of the current global financial landscape. Prior to the tariff announcement, significant uncertainty and market fluctuations were evident. The rally, though substantial, requires careful consideration of its sustainability.

- Potential Risks: The truce is temporary, and the possibility of renewed tariff threats remains a significant risk. Geopolitical uncertainties and potential future protectionist measures could trigger further market volatility.

- Future Scenarios: Several scenarios are possible. A complete resolution of trade disputes could lead to sustained market growth. However, renewed tensions could trigger a sharp market correction.

- Expert Predictions: Analysts predict a period of continued volatility in the short-term. The long-term outlook hinges on the outcome of ongoing negotiations and the overall stability of the global trade environment. Many are urging caution, advising investors to closely monitor developments and adjust their investment strategies accordingly.

Conclusion: Navigating the Post-Tariff Rally on Euronext Amsterdam

The 8% surge on Euronext Amsterdam following Trump's tariff pause underscores the profound impact of global political events on stock markets. This significant rally, concentrated in export-oriented sectors, highlights the interconnected nature of the global economy and the immediate response to shifts in trade policy. Understanding the intricacies of global political developments and their potential impact is crucial for navigating the complexities of the Euronext Amsterdam stock market and global investment strategies. While the rally offers a moment of optimism, investors should remain vigilant and prepared for potential future volatility. Analyze market trends carefully and consider the implications of this temporary reprieve for your long-term investment strategies. Stay informed about the evolving situation on the Euronext Amsterdam stock market and effectively manage your portfolio in this dynamic environment. Use tools to effectively analyze market trends and make informed investment decisions concerning the Euronext Amsterdam stock market, considering the impact of ongoing trade wars on stocks.

Featured Posts

-

Your Dream Country Escape Making The Move A Reality

May 24, 2025

Your Dream Country Escape Making The Move A Reality

May 24, 2025 -

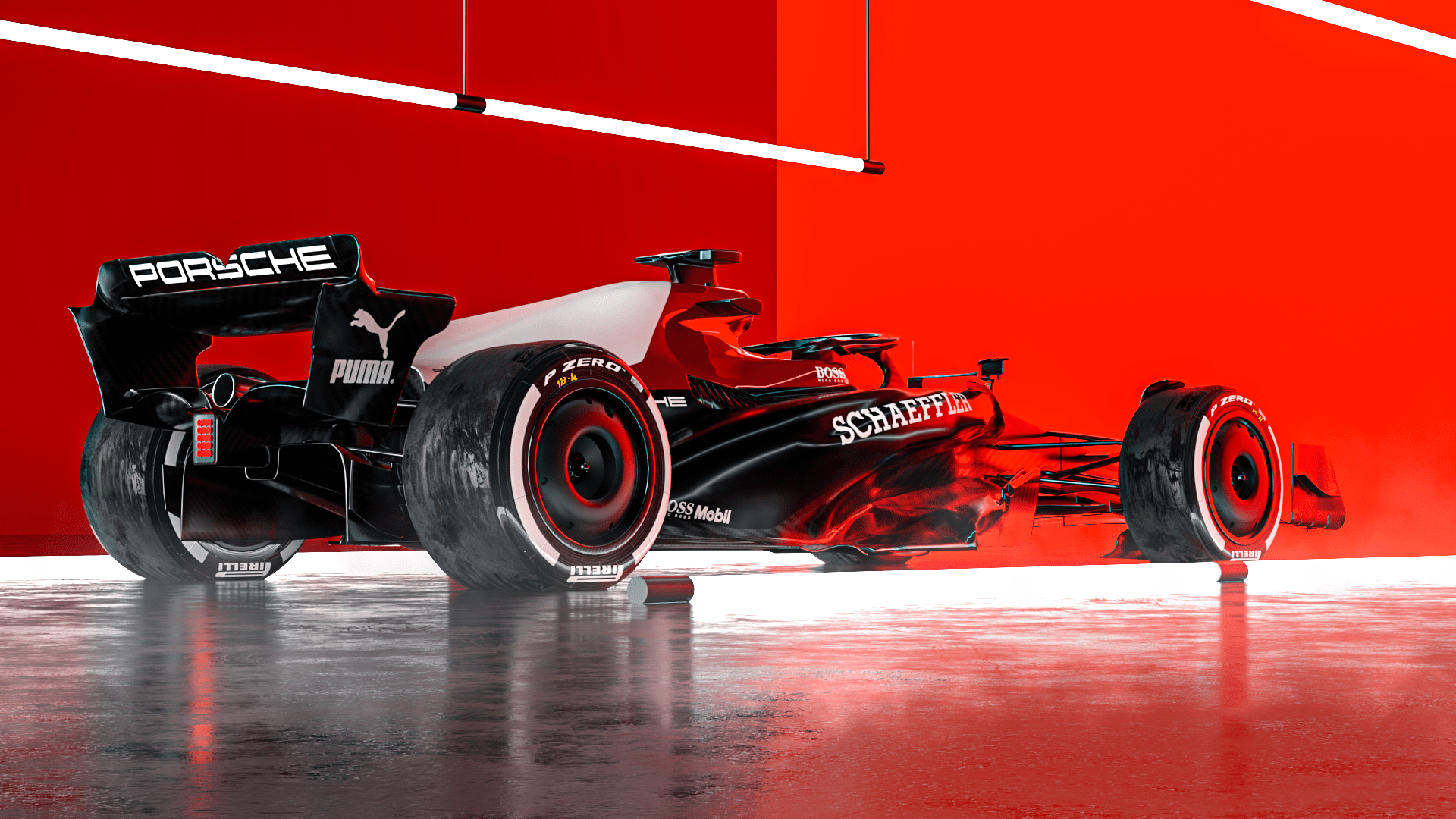

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025 -

Nightcliff Robbery Teenager Arrested Following Fatal Stabbing Of Shop Owner In Darwin

May 24, 2025

Nightcliff Robbery Teenager Arrested Following Fatal Stabbing Of Shop Owner In Darwin

May 24, 2025 -

Severe M56 Crash Causes Significant Traffic Disruption

May 24, 2025

Severe M56 Crash Causes Significant Traffic Disruption

May 24, 2025 -

England Airpark And Alexandria International Airport Partner For Ae Xplore A Focus On Local And Global Flight

May 24, 2025

England Airpark And Alexandria International Airport Partner For Ae Xplore A Focus On Local And Global Flight

May 24, 2025

Latest Posts

-

House Tax Bill Passes Triggering Bond Sell Off Stock Market Live Updates

May 24, 2025

House Tax Bill Passes Triggering Bond Sell Off Stock Market Live Updates

May 24, 2025 -

Stock Market Today Bonds Tumble Dow Futures Uncertain Bitcoin Surges Live Updates

May 24, 2025

Stock Market Today Bonds Tumble Dow Futures Uncertain Bitcoin Surges Live Updates

May 24, 2025 -

The Untold Story Sam Altman Jony Ive And A Top Secret Gadget

May 24, 2025

The Untold Story Sam Altman Jony Ive And A Top Secret Gadget

May 24, 2025 -

Theme Park Wars Universals 7 Billion Investment Challenges Disneys Dominance

May 24, 2025

Theme Park Wars Universals 7 Billion Investment Challenges Disneys Dominance

May 24, 2025 -

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025