House Tax Bill Passes, Triggering Bond Sell-Off: Stock Market Live Updates

Table of Contents

The House Tax Bill: Key Provisions and Market Impact

The newly passed House tax bill contains several provisions with significant implications for the market. While the specifics are complex, some key elements directly impacting market reactions include changes to corporate tax rates and potential effects on government spending. These alterations significantly influence corporate profitability, investor confidence, and inflationary expectations.

- Impact on Corporate Profitability: Lower corporate tax rates, a central feature of the bill, are expected to boost corporate earnings. This could lead to increased stock valuations and potentially higher dividends. However, the long-term effect depends on how companies utilize these additional profits – reinvestment, share buybacks, or increased executive compensation.

- Effect on Investor Confidence: The passage itself, regardless of the specific provisions, can impact investor confidence. A sense of clarity following a period of uncertainty can be positive; however, concerns about increased national debt could counter this.

- Changes in Expected Inflation Rates: The bill's potential impact on government spending and the national debt could influence inflation expectations. Increased government borrowing might push up interest rates, impacting inflation and investment strategies.

- Potential Shifts in Investment Strategies: Investors may adjust their portfolios in response to the altered tax landscape. This may involve reallocating assets from one sector to another, seeking out opportunities or hedging against potential risks. Keywords: Tax reform, corporate tax rate, individual income tax, fiscal policy, government spending.

Bond Market Sell-Off: Analysis and Implications

The House tax bill's passage triggered a significant sell-off in the bond market. This is primarily due to the anticipated rise in interest rates. As the government borrows more to finance the tax cuts, the increased demand for funds pushes interest rates higher. Since bond prices and interest rates have an inverse relationship, rising interest rates lead to falling bond prices.

- Impact on Fixed-Income Investors: Fixed-income investors holding bonds are experiencing losses as bond prices decline. This impacts returns and creates uncertainty for those relying on fixed-income investments for retirement or other financial goals.

- Potential Ripple Effects on Other Asset Classes: The bond market sell-off can have ripple effects throughout the financial markets. It can influence the performance of other asset classes, impacting overall portfolio performance.

- Changes to Borrowing Costs for Businesses and Consumers: Higher interest rates increase borrowing costs for businesses and consumers. This could dampen economic growth by discouraging investment and consumer spending. Keywords: Bond yields, interest rates, fixed income, bond market, treasury bonds, credit risk.

Stock Market Reactions: Sectoral Analysis and Live Updates

The stock market's initial reaction to the House tax bill was mixed. While some sectors benefited from the anticipated increase in corporate profits, others experienced declines due to concerns about inflation or increased interest rates.

- Major Indices Performance: (Insert live data feed for Dow Jones, S&P 500, and Nasdaq here. This section requires real-time data integration for optimal SEO and user engagement.)

- Trading Volume and Volatility: (Insert live data feed showing trading volume and volatility here. High volume and volatility indicate increased market uncertainty).

- Key Sector Performance: (Analyze performance of technology, energy, financials, and other key sectors. Explain reasons behind performance fluctuations). Keywords: Stock market index, Dow Jones, S&P 500, Nasdaq, stock market volatility, sector performance, trading volume.

Expert Opinions and Future Outlook

Financial experts offer varying perspectives on the long-term implications of the House tax bill. Some believe the tax cuts will stimulate economic growth, while others express concerns about increased national debt and inflationary pressures.

- Short-Term Market Forecasts: (Summarize short-term predictions from various experts. Use cautious language and avoid definitive statements).

- Long-Term Economic Impact: (Discuss potential long-term impacts on economic growth, inflation, and government debt).

- Potential Policy Responses: (Analyze possible future policy responses from the government or the Federal Reserve). Keywords: Financial expert, market forecast, economic outlook, investment strategy, risk assessment.

Conclusion: Navigating the Post-Tax Bill Market

The House tax bill's passage has created significant uncertainty in the bond and stock markets. The ensuing bond sell-off and mixed stock market reactions highlight the complexity of the situation. Staying informed about live updates and market fluctuations is crucial for investors. Diversification and a well-defined risk management strategy are essential to navigating this volatile environment. Stay updated on the latest stock market and bond market news regarding the House tax bill by following reputable financial news sources and consulting with a financial advisor.

Featured Posts

-

Game Industry Cuts Accessibility Takes The Hit

May 24, 2025

Game Industry Cuts Accessibility Takes The Hit

May 24, 2025 -

Reopening The Dreyfus Case A Parliamentary Push For Recognition

May 24, 2025

Reopening The Dreyfus Case A Parliamentary Push For Recognition

May 24, 2025 -

Nimi Muistiin Ferrarin Uusi 13 Vuotias Taehti

May 24, 2025

Nimi Muistiin Ferrarin Uusi 13 Vuotias Taehti

May 24, 2025 -

M56 Road Closure Cheshire Deeside Area Facing Traffic Congestion

May 24, 2025

M56 Road Closure Cheshire Deeside Area Facing Traffic Congestion

May 24, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarindaki Etki Ve Analiz

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarindaki Etki Ve Analiz

May 24, 2025

Latest Posts

-

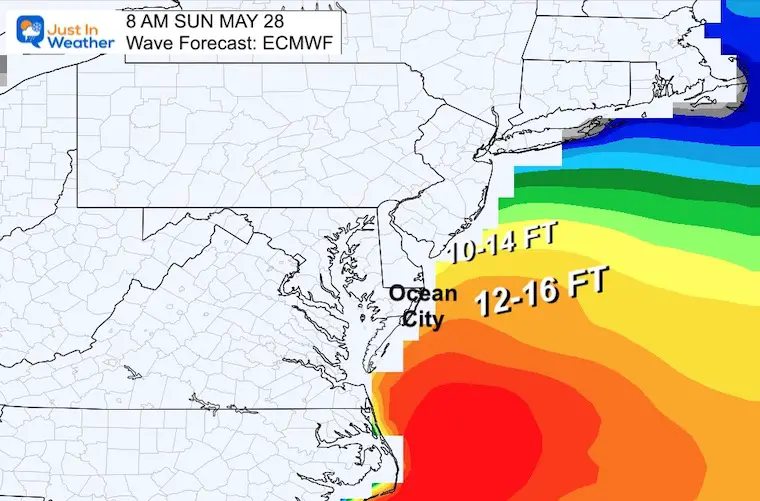

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 24, 2025 -

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025

Kazakhstans Billie Jean King Cup Win Over Australia A Full Report

May 24, 2025 -

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025

Commencement Address A Celebrated Amphibian At University Of Maryland

May 24, 2025 -

Internet Reacts Kermit The Frog As Umds 2025 Commencement Speaker

May 24, 2025

Internet Reacts Kermit The Frog As Umds 2025 Commencement Speaker

May 24, 2025