Stock Market Valuations: BofA's Reassuring Take For Investors

Table of Contents

BofA's Key Arguments for Moderate Valuations

BofA's assessment of stock market valuations rests on several pillars, providing a more nuanced perspective than simply declaring the market over- or undervalued.

Considering the Impact of Interest Rates

BofA's analysis acknowledges the impact of rising interest rates on stock valuations. Higher rates increase the discount rate used in present value calculations, theoretically reducing the value of future earnings.

- BofA projects interest rate increases to peak at X% by Y date (replace X and Y with actual data if available). This projection is factored into their valuation models.

- Increased interest rates make bonds more attractive, potentially drawing investment away from equities. BofA's models account for this shift in investor sentiment.

- The relationship between interest rates and present value is inverse: higher rates lead to lower present values of future cash flows, impacting stock valuations.

The Role of Earnings Growth

BofA emphasizes the importance of future earnings growth in justifying current stock market valuations. Their analysis suggests that robust earnings growth can offset the negative impact of higher interest rates.

- Sectors expected to show strong earnings growth include: (list specific sectors mentioned by BofA, e.g., technology, healthcare).

- BofA's analysis utilizes forward P/E ratios, focusing on projected earnings rather than trailing earnings, to provide a more forward-looking assessment of valuations.

- Companies demonstrating consistent revenue and earnings growth are seen as better positioned to withstand interest rate increases.

Addressing Concerns About Inflation

Inflation is a significant concern affecting stock market valuations. BofA acknowledges this but presents a measured view of its impact.

- BofA predicts inflation to moderate to Z% by the end of the year (replace Z with actual data if available). This prediction underpins their analysis.

- While inflation can erode corporate profits, BofA anticipates that many companies will successfully pass increased costs onto consumers, mitigating the negative impact.

- Their valuation models incorporate inflation expectations and their potential effects on both revenue and costs.

Alternative Perspectives and Counterarguments

While BofA presents a relatively optimistic view, it's crucial to consider alternative perspectives.

Bearish Views on Stock Market Valuations

Several analysts hold a bearish outlook on stock market valuations, citing several indicators:

- High Shiller P/E ratio: This metric suggests that the market is significantly overvalued compared to its historical average.

- High market cap-to-GDP ratio: This ratio indicates a potentially unsustainable level of market capitalization relative to the overall economy.

- Concerns about potential corporate profit declines: Some analysts believe that the current level of corporate profits is unsustainable in the face of economic headwinds.

BofA's Rebuttal to Bearish Arguments

BofA addresses these concerns by highlighting several points:

- BofA argues that the Shiller P/E ratio is less relevant in a low-interest-rate environment. The methodology of this ratio may not perfectly capture the current macroeconomic context.

- They acknowledge the high market cap-to-GDP ratio but emphasize the potential for continued earnings growth. This growth, they argue, can justify the current market capitalization.

- Their analysis incorporates a detailed assessment of potential profit declines, adjusting their valuations accordingly. They disagree with the extent of the predicted decline.

Investment Strategies Based on BofA's Analysis

BofA's analysis offers insights into potential investment strategies, but it's crucial to approach them with caution.

Opportunities for Selective Investment

Based on BofA's assessment, several investment opportunities may exist:

- Specific sectors identified as undervalued or poised for growth: (List specific sectors mentioned by BofA).

- Companies with strong balance sheets and consistent earnings growth: These companies are better equipped to weather economic uncertainty.

- Diversification across various asset classes: This strategy helps mitigate risk and reduce exposure to potential market downturns.

Risk Management Considerations

Investing based on any single analysis carries inherent risks:

- Economic forecasts are inherently uncertain: BofA's projections may not materialize as anticipated.

- Unexpected events can significantly impact market valuations: Geopolitical risks, unforeseen regulatory changes, or unexpected economic shocks can negatively impact even the most carefully selected investments.

- Always conduct thorough due diligence: Before making any investment decision, conduct your own research and assess the risks involved.

Stock Market Valuations: A Cautious Optimism

BofA's analysis presents a more optimistic perspective on current stock market valuations than some bearish predictions. They emphasize the role of earnings growth in offsetting the impact of higher interest rates and moderate inflation. However, it's crucial to acknowledge opposing viewpoints and to approach any investment strategy with a thorough understanding of the risks involved. The key takeaway is the importance of understanding stock market valuations through careful analysis and consideration of various perspectives. To assess your investment portfolio and learn more about BofA's insights on stock market valuations, conduct further research and develop informed investment strategies based on your own due diligence.

Featured Posts

-

The Rise Of Wildfire Betting Los Angeles And Beyond

Apr 26, 2025

The Rise Of Wildfire Betting Los Angeles And Beyond

Apr 26, 2025 -

5 Dos And Don Ts Your Guide To A Private Credit Career

Apr 26, 2025

5 Dos And Don Ts Your Guide To A Private Credit Career

Apr 26, 2025 -

Wwii Sunken Warship Yields Unexpected Discovery A Car Found Intact

Apr 26, 2025

Wwii Sunken Warship Yields Unexpected Discovery A Car Found Intact

Apr 26, 2025 -

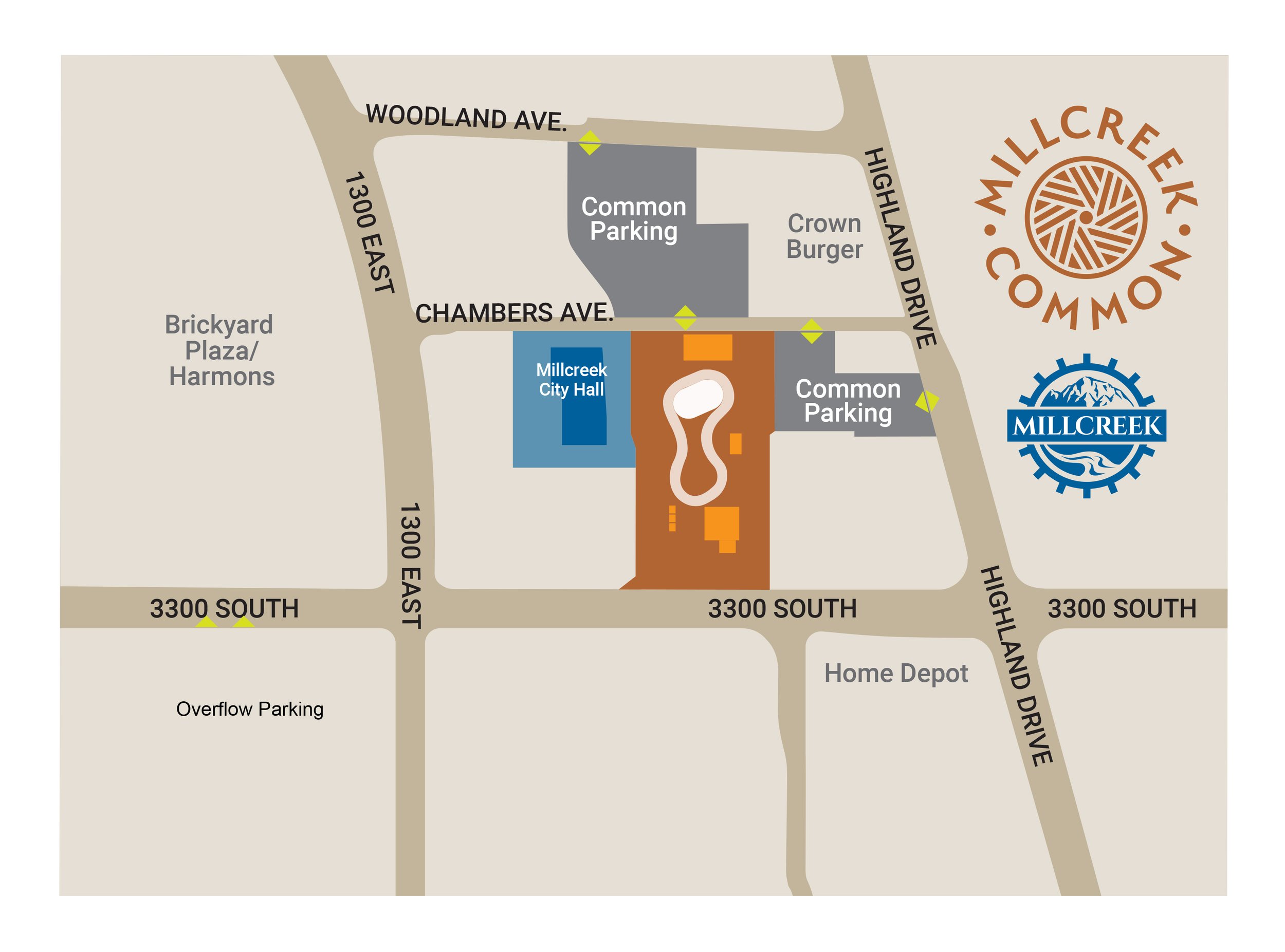

King Day In Millcreek Common A Taste Of Dutch Street Party Culture

Apr 26, 2025

King Day In Millcreek Common A Taste Of Dutch Street Party Culture

Apr 26, 2025 -

Justice Department Recommends 7 Year Sentence In George Santos Case

Apr 26, 2025

Justice Department Recommends 7 Year Sentence In George Santos Case

Apr 26, 2025

Latest Posts

-

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Connection

Apr 27, 2025 -

Public Health Concerns Evaluating The Credentials Of The Cdcs New Vaccine Study Hire

Apr 27, 2025

Public Health Concerns Evaluating The Credentials Of The Cdcs New Vaccine Study Hire

Apr 27, 2025