5 Dos And Don'ts: Your Guide To A Private Credit Career

Table of Contents

Embarking on a private credit career can be both exciting and challenging. This dynamic field offers lucrative opportunities but requires a strategic approach. This guide outlines five essential dos and don'ts to help you navigate this path successfully and build a thriving career in private credit. The private credit market is competitive, but with the right preparation and strategy, you can achieve your career goals.

<h2>Do: Network Strategically to Build Your Private Credit Career</h2>

Networking is crucial for success in any finance career, but it's particularly important in the relatively close-knit world of private credit. Building strong relationships can open doors to opportunities you might not find otherwise.

<h3>Target Key Industry Events and Conferences</h3>

- Attend relevant conferences and workshops focusing on private credit, alternative investments, and related finance areas like leveraged finance and distressed debt. Look for events hosted by organizations like the Institutional Limited Partners Association (ILPA) or the American Investment Council (AIC).

- Actively participate in networking events and sessions. Don't just attend; engage in conversations, ask insightful questions, and share your own experiences.

- Follow up with new contacts promptly after meeting them. Send a personalized email referencing your conversation and expressing your continued interest in their work and the private credit industry.

<h3>Leverage LinkedIn for Professional Connections</h3>

- Create a strong LinkedIn profile showcasing your experience and skills in finance, specifically highlighting any relevant experience in areas like credit analysis, financial modeling, or portfolio management.

- Join relevant groups and engage in discussions. Participate thoughtfully in conversations, sharing your insights and perspectives to establish yourself as a knowledgeable professional.

- Connect with professionals working in private credit firms. Research firms that interest you and connect with individuals in relevant roles. Personalize your connection requests to show you’ve done your research.

<h3>Informational Interviews are Invaluable</h3>

- Reach out to people working in private credit for informational interviews. These conversations can provide invaluable insights into the day-to-day realities of a private credit career.

- Prepare insightful questions about their career path and the industry. Demonstrate your genuine interest in learning about their experiences and the challenges they’ve faced.

- Show genuine interest in learning from their experience. Listen attentively, ask follow-up questions, and express your gratitude for their time.

<h2>Don't: Underestimate the Importance of Financial Modeling Skills</h2>

Private credit professionals spend a significant amount of time analyzing financial data and creating complex models. Strong financial modeling skills are essential for success.

<h3>Master Essential Financial Modeling Tools</h3>

- Develop proficiency in Excel, including advanced functions like VBA, data manipulation, and shortcut keys. This is foundational for all financial modeling.

- Learn to use financial modeling software such as Bloomberg Terminal or Argus. These platforms are industry standards and provide crucial data and analytical tools.

- Practice building complex financial models for various scenarios. The more you practice, the more proficient you’ll become at building accurate and reliable models.

<h3>Neglect Understanding of Financial Statements</h3>

- Gain a solid understanding of balance sheets, income statements, and cash flow statements. This is the bedrock of financial analysis in private credit.

- Learn to analyze financial statements to assess the creditworthiness of borrowers. This involves understanding key ratios, trends, and potential risks.

- Develop the ability to spot red flags and assess risk accurately. Identifying potential problems early on is critical in private credit lending.

<h2>Do: Specialize in a Niche Within Private Credit</h2>

While a broad understanding of private credit is beneficial, specializing in a niche can significantly enhance your career prospects.

<h3>Explore Specific Sectors</h3>

- Focus on a specific industry sector, such as real estate private equity, infrastructure finance, or healthcare financing. Developing expertise in a specific sector makes you a more valuable asset.

- Develop deep expertise in the chosen sector’s financing structures and risk profiles. Understand the unique challenges and opportunities within that sector.

- This specialized knowledge will make you a more valuable asset to potential employers. Employers are always looking for individuals with niche expertise.

<h3>Develop Expertise in Specific Credit Strategies</h3>

- Learn the intricacies of different private credit strategies such as direct lending, mezzanine financing, or distressed debt. Each strategy has its own nuances and risk profiles.

- Gain practical experience through internships or entry-level positions. Real-world experience is invaluable.

- This specialized knowledge will set you apart from other candidates. Demonstrating specialized knowledge is crucial in a competitive market.

<h2>Don't: Neglect Soft Skills in a Private Credit Career</h2>

While technical skills are essential, soft skills are equally important for success in a private credit career.

<h3>Develop Strong Communication Skills</h3>

- Practice clearly and concisely communicating complex financial information. You need to be able to explain complex concepts to both financial and non-financial audiences.

- Build strong presentation skills to confidently present your analysis. You'll frequently need to present your findings to colleagues, clients, and senior management.

- Develop active listening skills to effectively engage with clients and colleagues. Effective communication is a two-way street.

<h3>Underestimate the Importance of Teamwork</h3>

- Private credit often involves collaboration with various teams and professionals, including legal, accounting, and underwriting teams.

- Develop strong teamwork skills and an ability to work collaboratively. Being a team player is crucial in a collaborative environment.

- Learn to effectively contribute to a team's success. Your contributions should enhance the overall performance of your team.

<h2>Do: Continuously Learn and Stay Updated</h2>

The private credit market is constantly evolving, requiring continuous learning and adaptation.

<h3>Pursue Relevant Certifications</h3>

- Consider pursuing relevant certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst). These credentials demonstrate a high level of competency.

- Stay informed about industry changes through professional development courses and training. Continuously updating your skills is crucial.

- These credentials enhance your credibility and marketability. They signal your commitment to professional development.

<h3>Keep Abreast of Market Trends</h3>

- Stay informed on current economic conditions, interest rate fluctuations, and industry-specific news. Understanding market dynamics is critical for success.

- Follow leading publications and industry experts to keep your knowledge current. Stay up-to-date on the latest developments and trends.

- Continuous learning is crucial for success in the dynamic private credit market. The private credit landscape is constantly shifting, so continuous learning is essential.

<h2>Conclusion</h2>

Building a successful private credit career requires a multifaceted approach. By following these five dos and don'ts—from strategically networking and mastering financial modeling to specializing in a niche and continuously learning—you can significantly increase your chances of thriving in this competitive field. Remember, a dedicated pursuit of knowledge, combined with strong soft skills and networking, will propel your private credit career forward. Start building your dream private credit career today!

Wwii Sunken Warship Yields Unexpected Discovery A Car Found Intact

Wwii Sunken Warship Yields Unexpected Discovery A Car Found Intact

Europa League Preview Brobbeys Power A Key Factor For Ajax

Europa League Preview Brobbeys Power A Key Factor For Ajax

Philippine Bank Ceo Warns Of Economic Hardship Amid Tariff War

Philippine Bank Ceo Warns Of Economic Hardship Amid Tariff War

18 Prix D Excellence Cecobois 2025 Projets De Bois Et De Bois D Uvre Canadiens Francais

18 Prix D Excellence Cecobois 2025 Projets De Bois Et De Bois D Uvre Canadiens Francais

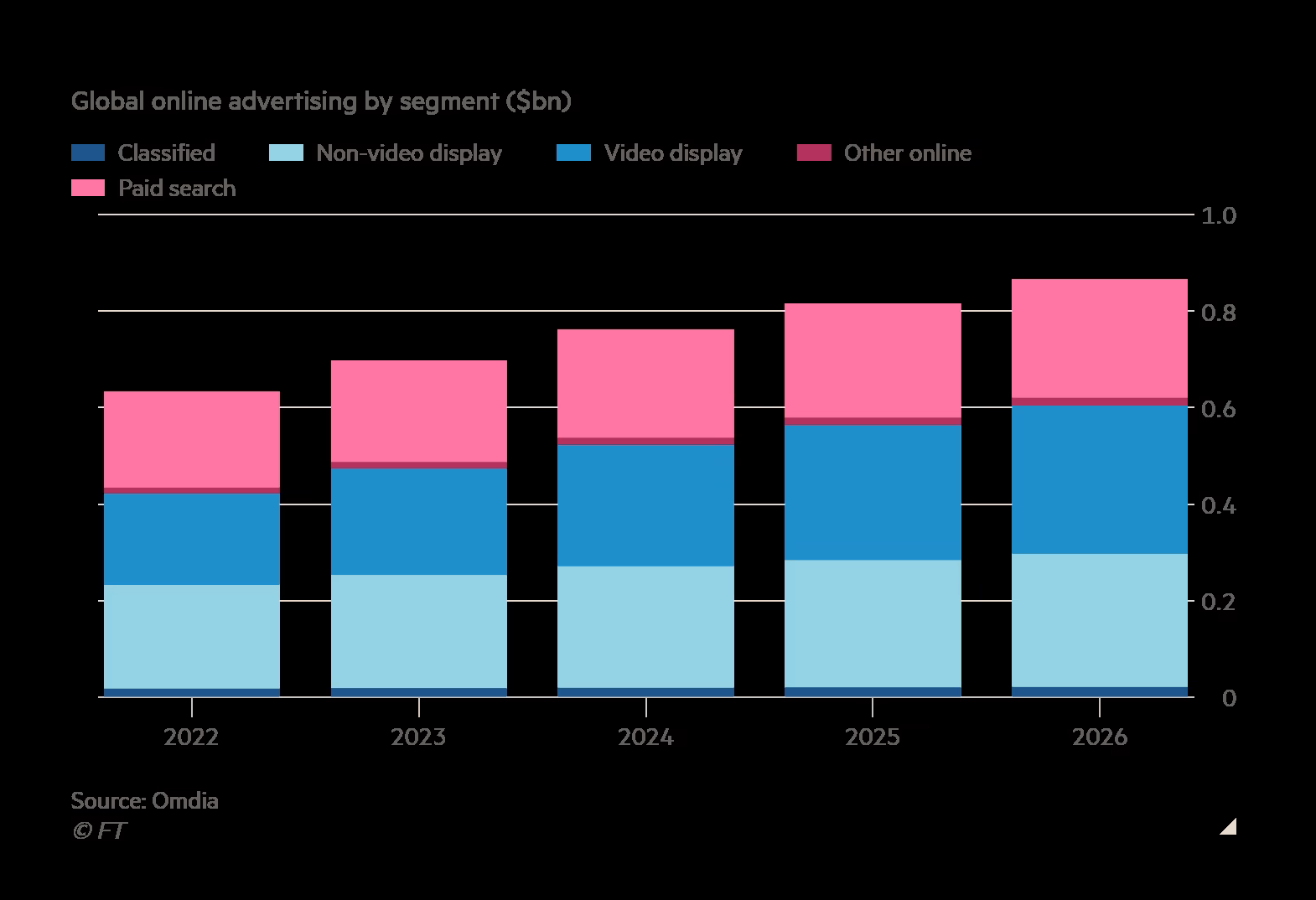

Big Tech Anticipates Advertising Revenue Dip Due To Tariffs

Big Tech Anticipates Advertising Revenue Dip Due To Tariffs

Haaland Tynnplate As Sikrer Seg Gigantisk Kontrakt Innen Forsvarsindustrien

Haaland Tynnplate As Sikrer Seg Gigantisk Kontrakt Innen Forsvarsindustrien

Bekker Forsoplet Naboers Innsats Mot Soppel

Bekker Forsoplet Naboers Innsats Mot Soppel

Jon Almaas Og Erling Haalands Uventede Vennskap

Jon Almaas Og Erling Haalands Uventede Vennskap

Stor Kontrakt For Haaland Tynnplate As Levering Til Verdens Forsvarsindustri

Stor Kontrakt For Haaland Tynnplate As Levering Til Verdens Forsvarsindustri

Handlekraftige Naboer Bekjemper Forsopling Soppelberg Fjernet Fra Bekk

Handlekraftige Naboer Bekjemper Forsopling Soppelberg Fjernet Fra Bekk