Stock Market Valuation Concerns: BofA's Insights And Recommendations

Table of Contents

BofA's Assessment of Current Market Valuation

High Valuations Across Sectors

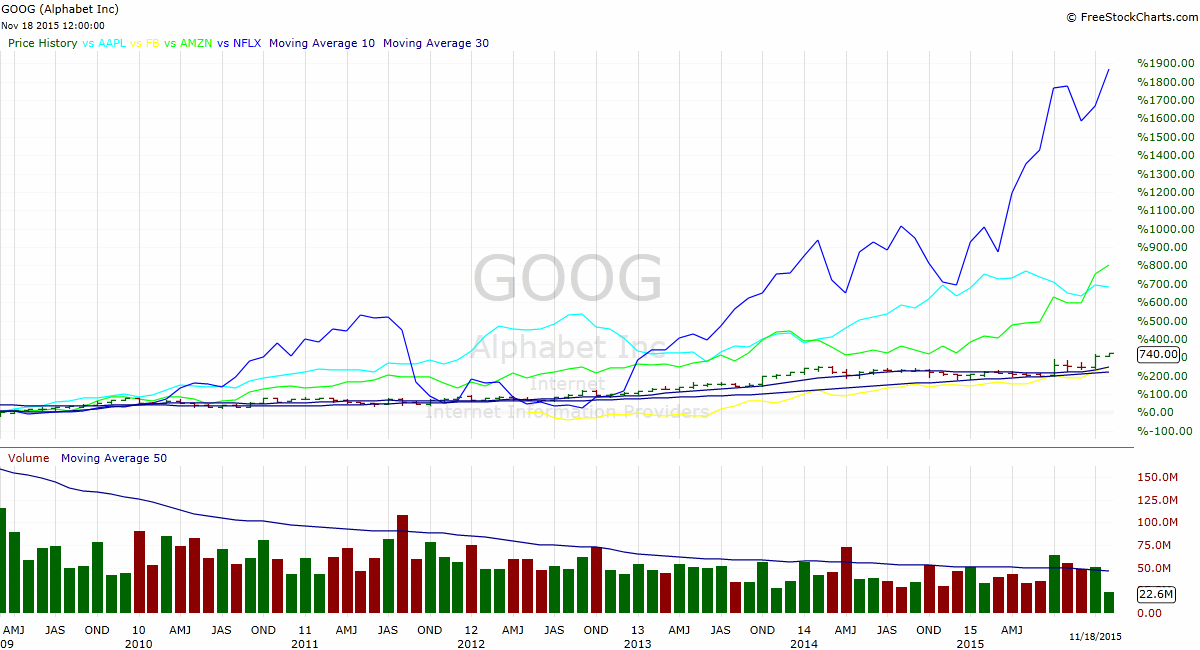

BofA's recent reports indicate high valuations across several sectors. Their analysis utilizes key metrics like Price-to-Earnings (P/E) ratios and Price-to-Sales (P/S) ratios to gauge market valuation against historical benchmarks. They find that many sectors are trading at premiums compared to their historical averages.

- Specific sectors BofA identifies as overvalued: Technology and Consumer Discretionary are frequently cited as examples of sectors exhibiting high valuations. However, it's crucial to remember that these are broad generalizations, and individual companies within these sectors may present varied valuation characteristics.

- Key metrics used by BofA to determine valuation: BofA employs a multi-faceted approach, considering not only P/E and P/S ratios but also factors like dividend yields, growth prospects, and interest rate sensitivity. A detailed understanding of these metrics is crucial for a thorough valuation assessment.

- Comparison to historical valuations: BofA's analysis often compares current valuations to historical data, highlighting deviations from long-term averages. This helps contextualize current valuations within a broader historical perspective. For instance, they may highlight how current P/E ratios compare to averages from the past 10 or 20 years.

Impact of Interest Rate Hikes

Rising interest rates significantly impact stock market valuations. Higher rates increase borrowing costs for companies, reducing profitability and potentially slowing down economic growth. This inverse relationship between interest rates and stock prices is a key consideration in BofA's analysis.

- Explanation of the inverse relationship between interest rates and stock valuations: When interest rates rise, the cost of capital for businesses increases. This can lead to lower profits and reduced investment, putting downward pressure on stock prices. Conversely, lower interest rates stimulate economic activity and generally boost stock valuations.

- BofA's projections for future interest rate movements: BofA's economists regularly publish forecasts for interest rate changes, influencing their valuation assessments. These projections are crucial for investors to understand the potential future impact on stock market prices. These projections should however be treated as one factor among many in investment decisions.

- How these projections impact their valuation concerns: BofA's projections on interest rate hikes are directly integrated into their valuation models. Higher projected rates often translate to lower predicted stock prices, increasing their concerns about current valuations.

BofA's Recommendations for Investors

Diversification Strategies

BofA strongly advocates for diversification to mitigate risks associated with high valuations. This involves spreading investments across various asset classes and sectors, reducing the overall portfolio's vulnerability to market fluctuations.

- Recommended asset allocation strategies: The optimal asset allocation depends on individual investor risk tolerance and financial goals. BofA may recommend a balanced portfolio that includes stocks, bonds, real estate, and other alternative investments.

- Emphasis on diversifying across sectors and asset classes: To reduce concentration risk, BofA recommends diversifying across multiple sectors, not just focusing on high-growth areas.

- Importance of risk tolerance assessment: Investors should accurately assess their risk tolerance before making investment decisions. A comprehensive financial plan should integrate risk tolerance with investment goals and time horizons.

Selective Stock Picking

BofA also emphasizes the importance of selective stock picking. Instead of blindly investing in the overall market, they advise focusing on fundamentally strong companies with sustainable growth prospects, potentially less susceptible to valuation concerns.

- Criteria BofA uses for stock selection: BofA's analysts utilize a rigorous process, looking at factors such as revenue growth, profit margins, debt levels, and competitive advantages. They prioritize companies with a solid track record and a clear path to future growth.

- Examples of stocks BofA might recommend (mentioning specific examples cautiously and responsibly, citing sources): While we can't provide specific stock recommendations here, reports from BofA can be consulted to identify their current top picks. Always conduct your own thorough due diligence before investing.

- Importance of fundamental analysis in mitigating valuation risks: BofA stresses the importance of fundamental analysis, which involves evaluating a company's intrinsic value rather than solely relying on market sentiment.

Potential Risks and Opportunities

Recessionary Concerns

BofA acknowledges the possibility of an economic recession and its potential impact on stock market valuations. A recession would likely lead to lower corporate profits and potentially a significant market correction.

- BofA's probability assessment of a recession: BofA's economists regularly publish their probability assessments for a recession, providing investors with valuable insight into the potential risks.

- How a recession might affect different sectors: The impact of a recession can vary across sectors. Some sectors may be more resilient than others, making diversification and sector selection even more crucial.

- Strategies to protect portfolios during a potential downturn: Strategies to consider during a recession include increasing cash holdings, shifting to more defensive investments like government bonds, and focusing on companies with strong balance sheets.

Long-Term Growth Potential

Despite current stock market valuation concerns, BofA maintains a generally positive outlook on long-term growth. They identify sectors with strong long-term potential, suggesting investors maintain a long-term perspective.

- Sectors BofA sees as having strong long-term growth potential: Sectors like healthcare, renewable energy, and technology (with a focus on specific, undervalued companies) are frequently cited as having significant long-term growth potential.

- Strategies for long-term investing in the face of valuation concerns: Long-term investors may employ strategies such as dollar-cost averaging to reduce the impact of short-term market volatility.

- Importance of patience and a long-term investment horizon: Navigating short-term market fluctuations requires patience and discipline. A long-term investment horizon allows investors to ride out market corrections and benefit from the long-term growth potential of the economy.

Conclusion

BofA's analysis underscores significant stock market valuation concerns, requiring investors to adopt a cautious yet strategic approach. By diversifying portfolios, employing selective stock picking, and understanding the impact of economic factors like interest rates and potential recessions, investors can navigate these challenges effectively. Remember to conduct thorough research and, if needed, seek professional financial advice before making any investment decisions. Stay informed about evolving stock market valuation concerns and adapt your strategy accordingly to mitigate risks and maximize long-term returns.

Featured Posts

-

Broadways Photo 51 Mia Farrow Supports Sadie Sink

May 25, 2025

Broadways Photo 51 Mia Farrow Supports Sadie Sink

May 25, 2025 -

Nicki Chapmans Chiswick Garden A Bespoke Escape

May 25, 2025

Nicki Chapmans Chiswick Garden A Bespoke Escape

May 25, 2025 -

Vervolg Snelle Marktdraai Europese Aandelen Tegenover Wall Street

May 25, 2025

Vervolg Snelle Marktdraai Europese Aandelen Tegenover Wall Street

May 25, 2025 -

Analysis Of Apple Stock Aapl Important Price Levels And Trends

May 25, 2025

Analysis Of Apple Stock Aapl Important Price Levels And Trends

May 25, 2025 -

Tisice Prepustenych Kriza Zasiahla Najvaecsie Nemecke Spolocnosti

May 25, 2025

Tisice Prepustenych Kriza Zasiahla Najvaecsie Nemecke Spolocnosti

May 25, 2025

Latest Posts

-

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025

George L Russell Jr Maryland Legal Giant And Progressive Icon Passes Away

May 25, 2025 -

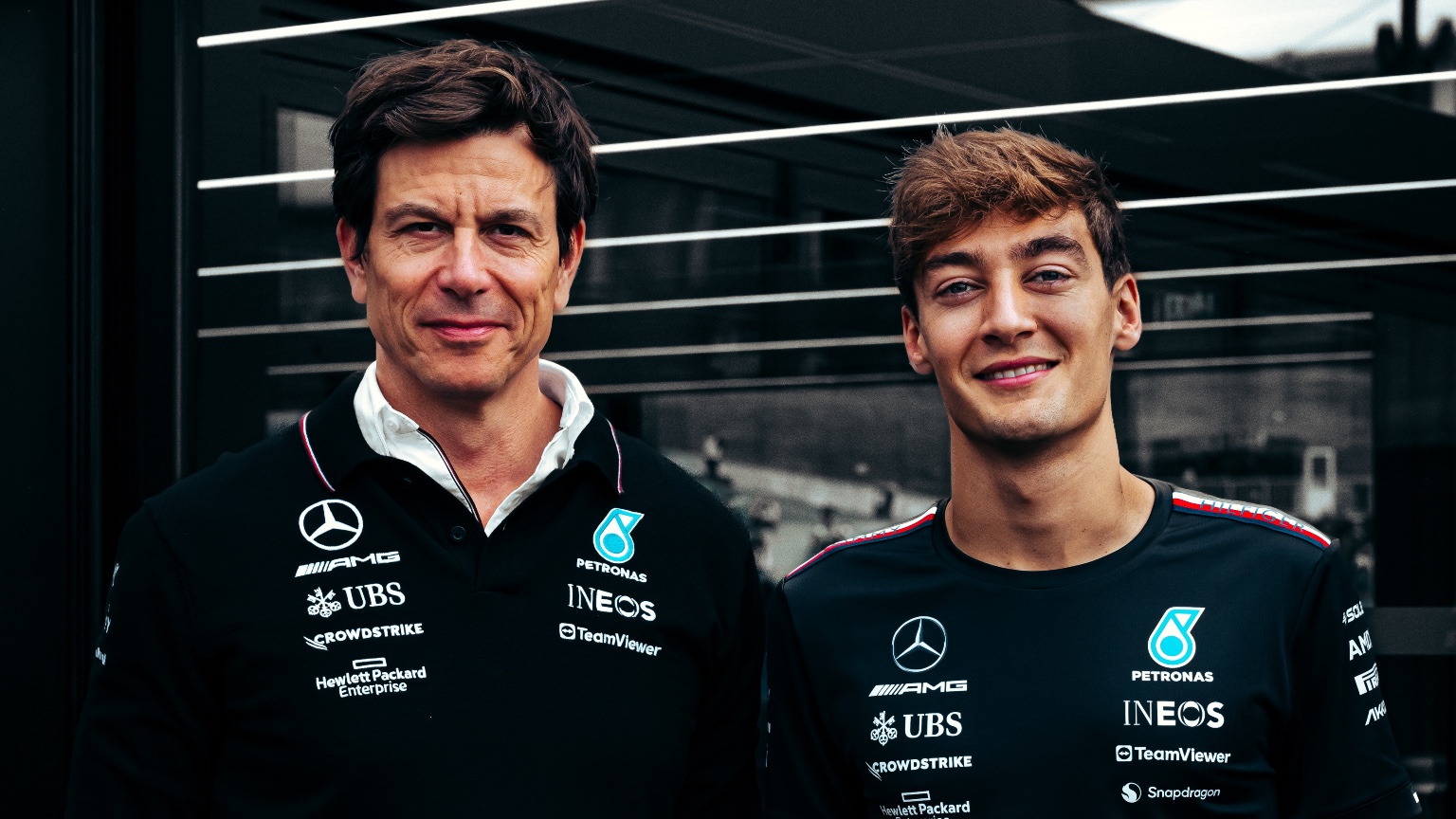

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025

Mercedes F1 Wolffs New Hints On Russells Contract Status

May 25, 2025 -

The George Russell Contract Why Mercedes Must Act

May 25, 2025

The George Russell Contract Why Mercedes Must Act

May 25, 2025 -

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025

Will Mercedes Re Sign George Russell The Key Factor

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Contract

May 25, 2025